/2d%20illustration%20of%20Cloud%20computing%20by%20Blackboard%20via%20Shutterstock.jpg)

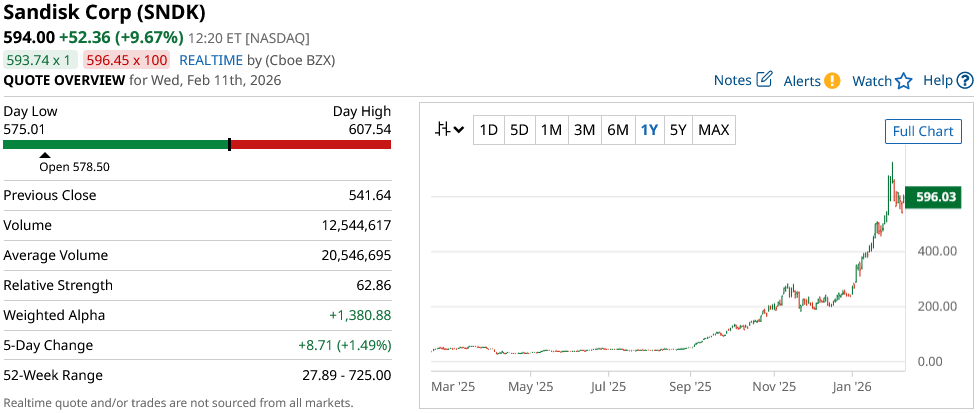

One of the best-performing stocks in the market in recent months, Sandisk (SNDK) has become a go-to investment for those looking to capitalize on surging demand for data storage and NAND flash technology services.

One of the leaders in the memory market, which has been defined recently by shortages in a number of key sub-sectors of the memory market, the artificial intelligence revolution, and the skyrocketing expected future demand for memory and storage, has driven SNDK stock to all-time highs.

Up a whopping 1,500% on a trailing 12-month basis but down 18% from its recent high just a week ago, investors may be on the fence in determining where Sandisk may be headed from here.

Let's dive into what to make of this memory giant's recent move and whether this 18% dip is one worth buying into.

Is Now the Time To Buy the Dip on Sandisk?

It's hard to disagree with the newfound reality the market is coming to grips with. The rise of AI is upon us, and the sheer amount of compute that's going to be needed to power this revolution is incredible. That's a key driver of the impressive moves we've seen in many of the top semiconductor makers in the market.

That's a trend that will likely continue, with data center stocks, hyperscalers, and power companies also benefiting from these robust growth trends.

That said, the memory and storage market is one area of the entire AI ecosystem that I feel investors may not be as closely attuned to. Of course, investors who have stuck with companies like Sandisk during their recent run have been right the whole way. But I have to say, this is one area of the market I, personally, haven't been paying close enough attention to relative to the other tech segments, which have also disproportionately benefited from AI growth tailwinds.

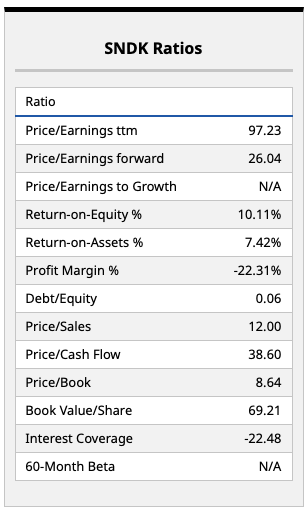

One thing I will say about Sandisk's recent decline is that it has nothing to do with the company's recent growth rate. With net income rising more than 7-fold over the course of the past year, Sandisk's forward price-earnings multiple of just 26-times seems dirt cheap. It goes without saying that this multiple was higher prior to this week's decline, but here we are.

With Sandisk also recently announcing an expansion of its joint venture with a key Japanese memory maker and plenty of additional deals from industry leaders in the AI rollout coming to fruition, this is a stock I think could have meaningful upside. That is, so long as we see the kind of breakneck AI spending continue for at least three to five years.

What Does Wall Street Think of Sandisk?

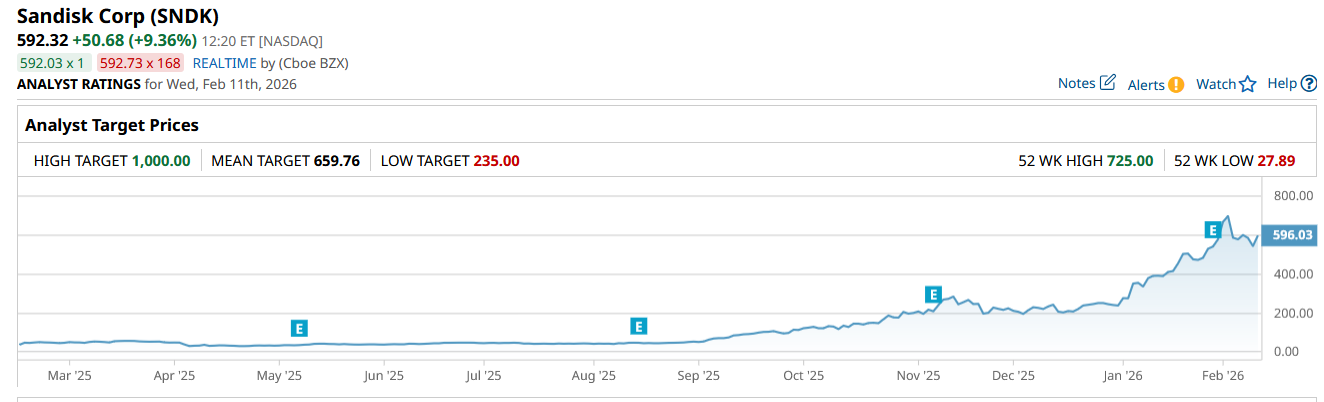

The good news for investors considering a dip-buying opportunity when it comes to SNDK stock is that Wall Street analysts are broadly bullish on this stock. The company's consensus price target currently sits at nearly $660 per share, implying roughly 11% upside from current levels.

In this market, that's the kind of return many investors can get behind. Indeed, given the rather steep declines in a number of leading software names (in part due to the rise of AI), the fact that Sandisk has been able to maintain most of its gains thus far this year is excellent news for investors considering adding a new position or adding to existing positions right now.

In my view, Sandisk is a company with plenty of momentum, and a chart that doesn't look broken (yet). I think the company's upcoming earnings reports should provide some fireworks. For now, I'd take the over on whether this company can blow out earnings expectations in the coming quarters, given the kind of performance we've seen over the past year.

I don't have a crystal ball, but Sandisk is one company that has quietly become one of the stocks I'm watching closely right now. I'd suggest investors with diversified portfolios of tech stocks do the same.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)