Long Call Diagonal Option Strategy

Hi, and welcome to the Options Learning Center. I'm excited to discuss long call diagonal spread and how to use Barchart to get the most out of the strategy.

What Is A Long Call Diagonal Spread?

A long call diagonal spread, also known by many other names like bull call diagonal, bullish diagonal spread or a poor man's covered call, is a horizontal options strategy that involves two call options. The investor first buys a long-dated, at-the-money or slightly in-the-money call option and then sells a shorter-term call at a higher strike price - at the same time. The goal is for the underlying asset's trading price to increase over time, and for the short option to expire worthless.

The maximum profit on a long call diagonal is the difference between the two strike prices minus the net debit paid to establish the trade. And you'll hit maximum profit when the underlying asset trades exactly at the short call's strike at its expiration.

While hitting the exact short strike at expiration is unlikely, the trade can still be profitable as long as the underlying price ends higher when the short call expires.

Long Call Diagonal Options Strategy

- Combines Two Call Options

- Buy One Call ATM or ITM (lower strike price)

- Sell One Call OTM (higher strike price)

- Different Expirations

- Max Profit: Price at Short Strike Near Expiration

With this strategy, the trader offsets the price of the long call by collecting premium from the sale of the short call.

The maximum loss of a long call diagonal spread is limited to the net debit paid at the beginning of the trade. The condition happens when the underlying asset trades below the long call's strike at its expiration. If this happens, both options expire worthless and unassigned.

Trade Examples

Long call diagonals are a bit more complicated than your average options trade. Thanks to Barchart's screening tools, you can get potential trades in just a few seconds. Let me show you how.

Screening The Market For Long Call Diagonal Trades

To access the Long Call Diagonal screener, go to Barchart.com, click on the Options tab, and then click on Long Call Diagonal Screener.

After clicking that, you'll be brought to a results screen. These trades represent results based on a default filter that gives you decent results while balancing risk and reward. It's a great starting point for most investors.

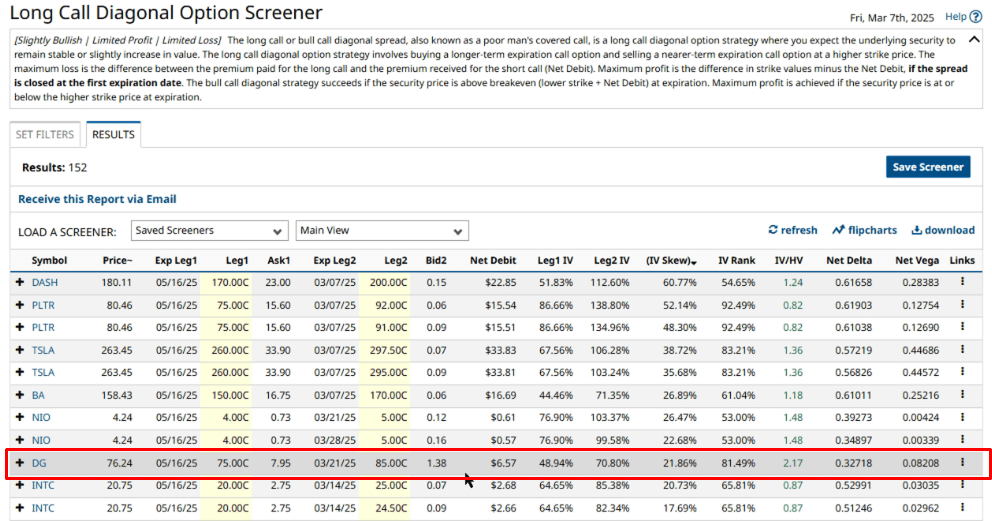

The results screen includes important details like the stock symbol, expiration dates, strike prices, net debit, and other values that traders will find useful.

Now, while the default results are an excellent starting point, you may want to further refine the search. So, to customize the results, you can click on Set Filters at the top of the results window, and you'll be brought to the Screener page.

On the screener page, we have all our defaults right here. You can add your own filter by typing something in the “Add Filter” field and click “Add.” I'll add analyst ratings. If you're unsure what to add, you can open the dropdown to select an option. Available filters include stock and options data, such as options analysis, underlying prices, trade details, company earnings, and technicals—everything you need to refine your trade is right there.

For now, I'll keep the defaults, but I'll set Analyst ratings to hold to moderate buy, because remember, we don't want the stock price to go up - at least not too much. I'll also click on ETF on the security type to include them on the list, then change the expirations of leg 1 (the long call) to between 60 to 100 days, then leg 2 expiration to less than 60 days.

So, we have the results ready and arranged according to the highest IV skew. IV Skew is the difference between the short and long call's implied volatility. You want the long call's IV to be lower than the short call to avoid a volatility crush. On the other hand, you do want a volatility crush for the short call, since that will lower its price. So, the higher IV skew, the more chance you end the trade at a profit.

By the way, you can also have Barchart automatically screen the market for your filters, and email you the results every day. To do that, hit the Save Screener button, give it a name then select when you'd like to get the emails.

Let's take this trade here as an example:

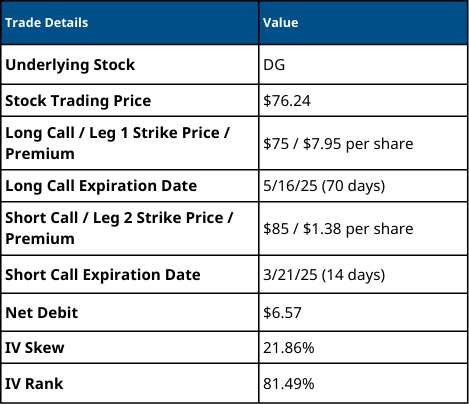

For the purposes of this video, we can pick apart this trade on Dollar General. According to the screener, you can buy a long call diagonal spread on Dollar General stock, which, at the time of recording, is trading at $76.24. The strike price for the long call is $75, which makes it in the money, and you'll pay $7.95. The long call will expire in 70 days on May 16, 2025. Meanwhile, the short call strike will be $85 and will expire in 14 days on March 21, 2025, and you'll receive $1.38 per share for it, which brings your net debit to $6.57.

The trade has an IV skew of 21.86% and an IV rank of 81.49%.

Profit Scenario

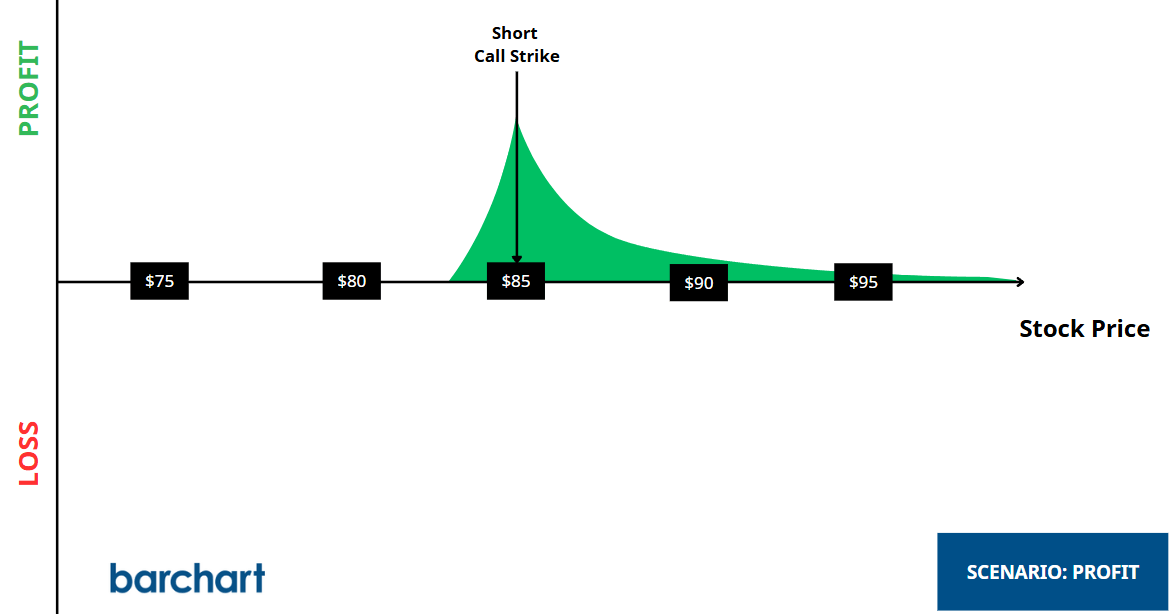

So, let's say for example that DG trades at $85, the short strike, on March 21. That means that the short call will expire worthless and most likely, unassigned.

Meanwhile, the long call has a $10 intrinsic value and has 56 more days till expiration, which means it has time value. So, let's say the $85 strike long call is now trading with a $15 premium. This brings your total profit to $8.43 or $843 total, calculated by subtracting the net debit paid from the long call's present value when you close the trade.

Profit: $15 - $6.57 = $8.43 x 100 = $843

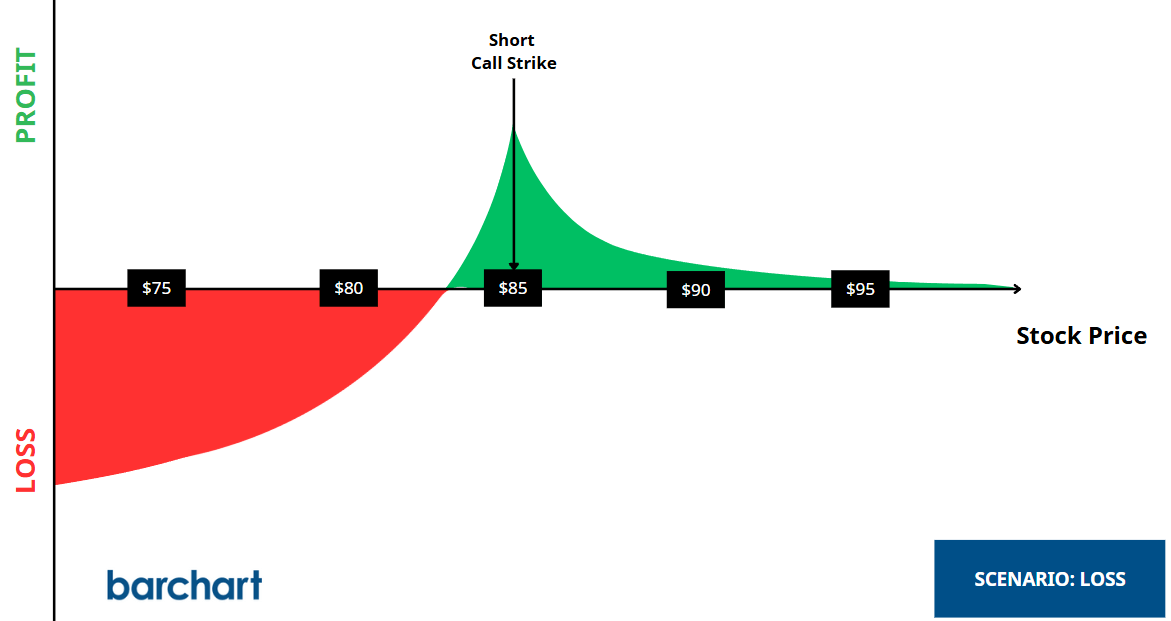

Loss Scenario

On the other hand, if Dollar General's price falls below the long strike at its expiration, your trade will enter its maximum loss condition. For example, let's say the stock price falls to $65.

In that scenario, both calls are out of the money and will have little to no extrinsic value. If there is a little extrinsic value, you can close out the trade with a sell to close order on the long option, and a buy to close on the short call - however, you'll want to be sure the trading fees don't exceed the premiums, as is often the case.

Loss = Net Debit

$7.95 - $1.38 = $6.57 x 100 = $657

Screening For Long Call Diagonal Spreads For Specific Assets

Barchart also allows you to search for long call diagonals for a specific asset. All you need to do is go to the the stock or asset's Price Overview page on Barchart.com. Once there, look for Horizontal Spreads. Then look for the Long Call Diagonal tab. You can change the expiration date in the dropdown, filter using any specific strike price for either trade legs or click the screen button to reach the option screener page for a more granular search.

Closing Your Positions Before Expiration

To avoid assignment risk, it is always a good idea to close your short positions, if they are in the money, right before expiration. For the long call diagonal spread, you have one active short position, the short call, so if it's in the money, I recommend taking whatever profits you have and closing it out to avoid assignment. You can then sell another call - always with an expiry nearer than that of the long call.

- ITM Options Have Assignment Risk

- Strategy Includes One Short Position

Pros and Cons of Long Call Diagonal Spreads

Long call diagonals allow you to buy a long call at a discount, since the short call offsets the cost. The strategy is also flexible in that, as the short calls expire, you can sell more - as long as the long call hasn't expired yet. Lastly, long call diagonal spreads have limited risks.

- Lower Starting Costs

- Potential For Recurring Income

- Limited Risk

On the other hand, a long call diagonal spread's profit potential is limited to the value of the long call, after the short call expires. It is also highly dependent on low volatility, as initiating a trade with a higher IV puts you at risk of a volatility contraction while your trade legs are active. If that happens, your spread will lose value. Finally, this is more complex than most option strategies, and, of course, having a short call means you need to look out for assignment risk.

- Limited Profit Potential

- Requires Low IV During Entry

- Vulnerable To Significant Price Movements

- Complex Strategy

- Risk of Assignment

Conclusion

The long call diagonal spread is best used during neutral or moderately bullish markets and benefits from theta and volatility expansion. However, it is also a complex strategy and requires precise price forecasting to get maximum profit. That's why using any and all resources, including option screeners, will help you get the most out of your trade.

If you need more information, visit the Barchart Options Learning Center where you can find more about long call diagonal spreads, and also find other option trading strategies broken down into their working parts.