How Delta Helps You Make Better Options Trading Decisions

How well do you really understand Delta in options trading? Let’s put your skills to the test.

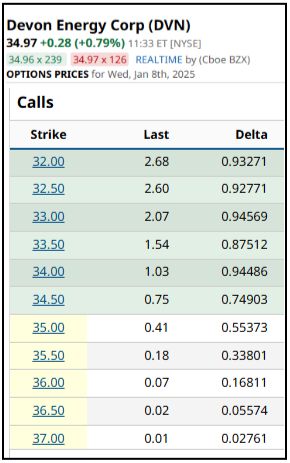

You're looking at Devon Energy trading at $34.97 and confident the stock is headed higher. Based on your account size, you’re willing to risk around $100—but how do you choose the right option for maximum impact?

Here's the call option chain you’re working with:

You can buy the $34 call option, which would cost you $103 (since each option contract controls 100 shares).

Or, you could buy five $35.50 call options for $90.

Now, let’s say Devon’s stock rises $1 right after you buy the option. Here’s the big question: How much would you profit on each trade?

If you’re familiar with Delta, you’ll get the answer in seconds—but don’t worry if you’re not there yet. Let’s break it down.

- The $34 call option would net a profit of ~$95, giving you a 92% return

- Five $35.50 call options would net a profit of $169, giving you a 188% return

While the $35.50 options offer a higher percentage return, they also come with a lower Delta, meaning their price is less sensitive to small stock moves than the $34 call.

Understanding Delta isn’t just about calculating quick profits—it’s a powerful tool that guides every aspect of options trading, from selecting the right strike to managing risk and maximizing returns.

In this article, we’ll explore:

- What Delta tells you about an option’s price sensitivity and its probability of expiring in-the-money.

- How Delta changes over time with stock price movements, expiration, and implied volatility.

- How to select the right option using Delta, tailored to your goals and trading style.

- Common mistakes traders make with Delta and actionable strategies to avoid them.

- How to use Barchart’s tools to analyze Delta and monitor your trades.

By the end, you’ll understand how to use Delta to make better trading decisions and how to leverage tools like Barchart’s option chain and Greeks calculators to stay ahead in the market. Let’s dive in!

Understanding Option Delta: Your Market Exposure Guide

Delta is one of the most critical metrics in options trading. Understanding it can make the difference between consistently profitable trades and confusion over why your options aren’t performing as expected.

At its core, Delta tells you two important things about your position:

How much the option’s price will move in response to a $1 change in the underlying stock price:

A call option with a Delta of 0.50 will increase by $0.50 for every $1 rise in the stock price.

For a put option, Delta is negative, meaning the option price drops by $0.50 for every $1 rise in the stock.

Since each option controls 100 shares, that $0.50 change translates to $50 in profit or loss.

The probability of the option expiring in the money (ITM).

Delta can also provide a rough approximation of the likelihood that an option will finish ITM at expiration. For example, an option with a Delta of 0.30 has about a 30% chance of expiring in the money.

This dual role makes Delta a cornerstone of options trading, helping traders assess both price sensitivity and likelihood of success for any given position.

Visualizing Delta: The Behavior of Different Options

The chart below illustrates how Delta behaves for options with varying moneyness (ITM, ATM, OTM) and expiration dates for both put and call options.

- For call options (top half of the chart):

- Deep in-the-money calls have Deltas closer to 1, showing a strong link to the stock price.

- Out-of-the-money calls have Deltas closer to 0, as they’re less likely to move in tandem with the stock price.

- At-the-money calls, where the strike price is near the stock price, have a Delta around 0.50, reflecting a balanced sensitivity.

- For put options (bottom half of the chart):

- Deep in-the-money puts have Deltas closer to -1, meaning their value moves inversely to the stock price.

- Out-of-the-money puts have Deltas near 0, reflecting minimal sensitivity.

- At-the-money puts have Deltas around -0.50, reflecting moderate price sensitivity

Expiration plays a significant role here. Time decay causes shorter-term options to experience more dramatic shifts in Delta as expiration approaches. Thus, options with longer expirations (e.g., three months) have smoother Delta curves, while shorter expirations (e.g., one week) show sharper changes.

Understanding this graph allows you to visualize how Delta evolves depending on both moneyness and time to expiration.

For example, if you’re trading an option with one week until expiration, its Delta will change more abruptly as it moves ITM or OTM compared to an option with three months to go.

Common Misunderstandings About Delta

While Delta is a powerful metric, many traders assume it doesn’t change - that it’s a fixed value. In reality, Delta is dynamic and influenced by several key factors:

- Stock Price Movement: Delta increases as an option moves deeper ITM and decreases as it moves further OTM. For instance, a Delta of 0.30 can climb to 0.60 if the stock price rises, reflecting the option’s growing sensitivity.

- Time to Expiration: As expiration approaches, Delta for ITM options moves closer to 1 (or -1 for puts), while Delta for OTM options drifts toward 0. This behavior is why short-dated options often require more precise timing than long-dated options.

- Implied Volatility (IV): Higher implied volatility flattens Delta, reducing its sensitivity, while lower volatility sharpens it. This effect is particularly important around earnings or other high-impact events.

Understanding these nuances allows you to better anticipate how your options will behave under different market conditions, enabling smarter adjustments to your positions.

Using Barchart's Option Chain to Read Delta

To make informed decisions, traders can use Barchart’s option chain to easily analyze Delta values across different strike prices and expiration dates. Let’s take Devon Energy as an example:

- Pull up Devon Energy’s option chain in Barchart’s tools, and you’ll see a column labeled Delta. \

- Compare the Delta for the $34 strike call (closer to 0.70) with the $35.50 strike call (closer to 0.30).

By understanding these values, you can decide whether you want higher Delta for greater sensitivity or lower Delta for a more speculative position.

So, how do you figure out which option Delta is right for you?

Selecting the Right Option Using Delta

Choosing the right option isn’t just about picking the cheapest one or the one with the highest potential return—it’s about finding a balance between risk, reward, and probability.

Delta is your guide to making that choice. By understanding how Delta ranges impact an option’s behavior, you can tailor your trades to match your goals, risk tolerance, and market outlook.

Delta Ranges and Their Uses

Options are often categorized by their Delta, with each range serving a specific purpose in trading strategies. Let’s break them down:

High Delta (0.70+):

High Delta options behave similarly to the underlying stock. These are deep in-the-money (ITM) options, meaning they already have significant intrinsic value. They are ideal for stock replacement strategies, offering a lower capital outlay while closely mimicking the stock’s price movements.

In the Devon Energy Option chain, these are the call strike prices well below the stock’s current price of $34.97, such as the $32 strike.

- Advantages:

- Higher probability of expiring in-the-money.

- Minimal impact from time decay (Theta).

- Moves closely with the stock, providing predictable performance.

- Disadvantages:

- Higher upfront cost due to substantial intrinsic value.

- Limited upside potential compared to lower-Delta options (less leverage).

- Smaller percentage returns, making them less attractive for speculative trades.

- Best for: Traders with strong conviction in the stock’s direction who want lower risk and more consistency in returns.

Medium Delta (0.40–0.60):

Medium Delta options offer a balance of risk and reward. These are typically at-the-money (ATM) or slightly in-the-money options. They provide a good mix of sensitivity to stock price movements and affordability.

Going back to the Devon Energy Option chain, these are the call strike prices right around the stock’s current price of $34.97, such as the $35 strike.

- Advantages:

- Moderate probability of expiring ITM (~50%).

- Significant leverage with a reasonable cost.

- Balanced sensitivity to stock movements without extreme risk.

- Disadvantages:

- Time decay still has a noticeable impact, especially near expiration.

- Requires the stock to move meaningfully in the right direction to offset the cost.

- Less predictable than high-Delta options but also not as explosive as low-Delta options.

- Best for: Directional traders looking for a compromise between cost and exposure.

Low Delta (<0.30):

Low Delta options are out-of-the-money (OTM) options, meaning they have little to no intrinsic value. These options are highly speculative and require substantial stock price movement to become profitable.

As you probably guessed, with the Devon Energy option chain, these are the options well above the stock’s current price of $34.97, such as the $37 strike.

- Advantages:

- Lower upfront cost, making them accessible for traders with smaller accounts.

- Potential for outsized percentage returns on big stock moves.

- Ideal for high-risk, high-reward scenarios.

- Disadvantages:

- Very low probability of expiring ITM (typically <30%).

- Highly sensitive to time decay, meaning value erodes quickly as expiration nears.

- Strongly impacted by implied volatility—any drop in IV can significantly reduce the option’s price.

- Best for: Traders seeking high-risk, high-reward opportunities, particularly around catalysts like earnings or major news events.

While selecting the right Delta range is crucial, it’s equally important to avoid common mistakes that can undermine your strategy. Let’s explore some of the most frequent missteps traders make when using Delta and how you can steer clear of them.

Avoiding Common Mistakes When Selecting Delta

While Delta is a valuable tool, it’s often misunderstood or misused. Here are some common mistakes to avoid:

- Choosing Cheap Options with Low Delta:

Many traders gravitate toward low-Delta options because they’re inexpensive. However, these options are less likely to expire in-the-money and are more vulnerable to time decay. Without a significant move in the underlying stock, these options often expire worthless. - Ignoring the Impact of Time Decay:

Options with lower Delta tend to lose value faster as they approach expiration, especially if they remain OTM. If you’re holding a low-Delta option and the stock isn’t moving, you’re fighting an uphill battle against time decay. - Overlooking Implied Volatility:

Low-Delta options often have higher extrinsic value, which means their price is more sensitive to changes in implied volatility (IV). If IV drops, the option’s value can decrease even if the stock price rises. - Failing to Match Delta to Your Goals:

Your Delta choice should reflect your trading objective. For example, if you’re aiming for a consistent, stock-like return, a high-Delta option is better suited than a low-Delta option. On the other hand, if you’re targeting a quick, explosive gain, low Delta might align better.

Now that we’ve explored common pitfalls, let’s look at how to align Delta with your specific trading style.

Matching Delta to Your Trading Style

Whether you’re a conservative trader looking for predictable returns or a risk-taker aiming for home runs, Delta helps you find the right option. Pair this analysis with Barchart’s option chain and historical data tools to evaluate past performance and volatility trends.

Let’s explore how Delta changes over time and with stock price movements—and how to adjust your strategy as conditions evolve.

Delta Changes: ITM, ATM, and OTM Options

Delta is dynamic—it evolves based on stock price movement, time decay, and implied volatility (IV). Understanding how these factors affect Delta can help you anticipate changes and make better trading decisions.

In-the-Money (ITM) Options: ITM options already have significant intrinsic value, so their Delta behaves more like the underlying stock.

- Stock Price Movement:

- Delta increases as the option moves deeper ITM, approaching 1 for calls and -1 for puts.

- Example: A $30 call option on a stock trading at $50 might already have a Delta of 0.90, meaning it’s moving almost dollar-for-dollar with the stock.

- Time Decay:

- Time decay has minimal impact on Delta for ITM options, as their value is mostly intrinsic.

- As expiration approaches, Delta stabilizes near 1 (or -1 for puts).

- Implied Volatility:

- Higher IV has a minimal effect on ITM options since their intrinsic value dominates extrinsic value.

- Lower IV similarly has little effect, as ITM options are less dependent on IV for their price.

At-the-Money (ATM) Options: ATM options are highly sensitive to market changes, as their Delta typically hovers around 0.50 for calls and -0.50 for puts.

- Stock Price Movement:

- Delta changes rapidly as the stock price moves closer to ITM or OTM.

- Example: If a stock is trading at $50, a $50 call option’s Delta of 0.50 might increase to 0.75 if the stock rises by $1, reflecting its growing likelihood of expiring ITM.

- Time Decay:

- Time decay significantly impacts Delta for ATM options, especially near expiration.

- As expiration nears, ATM options experience the sharpest Delta shifts, as they are highly sensitive to even small stock moves.

- Implied Volatility:

- Higher IV flattens Delta for ATM options as uncertainty spreads the likelihood of movement across a broader range of prices.

- Lower IV sharpens Delta, making ATM options more sensitive to price changes.

Out-of-the-Money (OTM) Options: OTM options have no intrinsic value, making them highly speculative and dependent on extrinsic value.

- Stock Price Movement:

- Delta increases as the stock moves closer to the strike price, but it remains low until the option becomes ATM or ITM.

- Example: A $60 call on a $50 stock might start with a Delta of 0.10, but as the stock climbs to $58, Delta could increase to 0.30.

- Time Decay:

- Time decay has a massive impact on Delta for OTM options, especially close to expiration.

- As expiration approaches, OTM options lose extrinsic value, causing Delta to fall closer to 0.

- Implied Volatility:

- Higher IV significantly increases Delta for OTM options, as higher uncertainty boosts their chance of becoming ITM.

- Lower IV sharply reduces Delta, as lower uncertainty diminishes the probability of expiring ITM.

Conclusion

Delta is one of the most versatile tools in an options trader’s arsenal. It’s not just about measuring how much an option will move with the stock price—it’s about understanding the dynamic relationship between your option, the stock, and the broader market. By mastering Delta, you can make smarter decisions when selecting strikes, managing positions, and adjusting your portfolio as conditions evolve.

Key takeaways from this article include:

- Delta as a Guide to Risk and Reward:Use Delta to assess how sensitive your option is to stock price movements and its probability of expiring in-the-money.

- Selecting the Right Delta for Your Goals: Match your trading style to the appropriate Delta range, balancing cost, risk, and return potential.

- Monitoring Delta Dynamics: Stay alert to how Delta changes with stock price movement, time decay, and implied volatility to make timely adjustments.

With tools like Barchart’s option chain, Greeks columns, and historical data, you have everything you need to track Delta and incorporate it into your trading strategy.

Whether you’re trading short-term or building long-term positions, understanding Delta gives you a significant edge in the options market.

FAQ: Frequently Asked Questions about Delta

What is Delta in options trading?

Delta measures how much an option’s price is expected to change for every $1 move in the underlying stock. For example, a call option with a Delta of 0.50 will gain $0.50 for every $1 rise in the stock price. Delta also gives a rough approximation of the probability that an option will expire in-the-money.

How does Delta differ for calls and puts?

- Call options have positive Delta values (0 to 1), meaning they gain value when the stock price rises.

- Put options have negative Delta values (0 to -1), meaning they gain value when the stock price falls.

Why does Delta change over time?

Delta is dynamic and evolves based on:

- Stock Price Movement: As the stock moves ITM or OTM, Delta increases or decreases.

- Time Decay: As expiration approaches, Delta for ITM options moves closer to 1 (or -1 for puts), while Delta for OTM options moves closer to 0.

- Implied Volatility: Rising IV flattens Delta, while falling IV sharpens it, affecting how sensitive the option is to stock price changes.

- High Delta (0.70+):Deep in-the-money options that behave like the stock and have a high probability of expiring ITM.

- Medium Delta (0.40–0.60): At-the-money options offering a balance of cost, sensitivity, and probability.

- Low Delta (<0.30): Out-of-the-money options with low cost and high potential returns but lower probability of expiring ITM.

How can I use Barchart’s tools to monitor Delta?

Barchart provides multiple features for tracking Delta:

- Option Chains:View Delta for different strikes and expirations.

- Greeks Columns: Analyze Delta alongside other Greeks like Theta and Gamma.

- Historical Data: Examine how Delta and related metrics behave over time to anticipate changes in your options strategy.