KB Home (KBH) stock trades for slightly over 3x earnings and has an attractive 1.82% dividend yield, making it attractive to value investors. The company is still profitable and announced better than expected earnings for its latest quarter ending May 31. In addition, the stock has attractive covered call income plays.

On June 22, KB Home, a Los Angeles-based homebuilder for first-time, first move-up, second move-up, and active adult homebuyers, produced earnings per share (EPS) of $2.32 for its fiscal Q2 ending May 31. That was 28 cents better than analysts expected.

Now, for the year ending Nov. 30, analysts forecast $10.17 EPS, putting the stock, at $32.93 on Aug. 15, at just 3.2x earnings. That is an extremely low multiple, typical only for highly cyclical companies that might be facing a massive drop in profits. But analysts are not that pessimistic and this low valuation seems overdone.

For example, for the year ending Nov. 30, 2023, the average of 16 analysts is only $9.62 EPS, according to a survey by Seeking Alpha. That represents a drop in earnings of just over 5.4%. That does not warrant such a low valuation.

As a result, this presents opportunities for investors to create supplementary income by shorting out-of-the-money calls on a covered basis and puts on a cash-secured basis

Covered Call Play with KBH

The next under table from Barchart shows that the $36 strike price calls that expire on Sept. 16, 32 days from now, have an attractive premium.

The calls trade for 48 cents at the midpoint. Here is what that means. An investor can buy 100 shares of KBH stock for $3,293 and then short the $36 strike calls. They immediately receive $48 per call contract, which represents an immediate monthly return of 1.458%.

If this can be done every month without the stock rising to $36 by the end of the contract period, the total return is 17.5%. That is a very good return on top of the 1.82% dividend yield from the underlying stock or 19.3% in total.

Moreover, even if the stock rises to $36.00 within the month the investor gets to keep the capital gain. That represents another 9.3% appreciation in the investor's portfolio value of KBH stock.

Cash-Secured Put Play

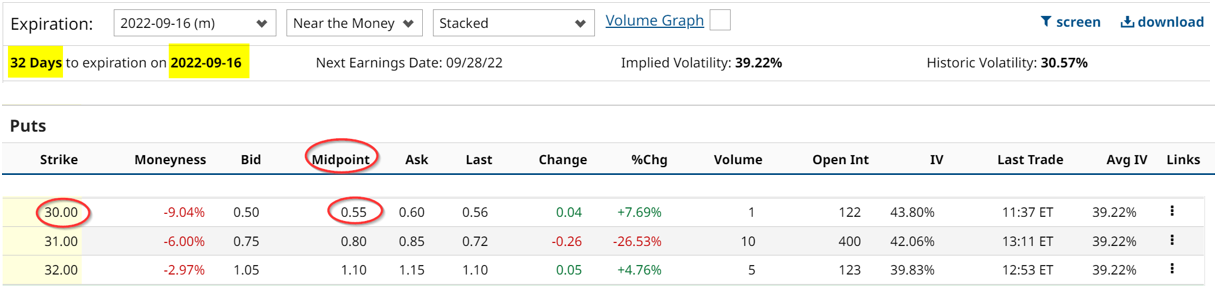

The table below shows that shorting out-of-the-money puts are also very profitable, and in some respects, even more attractive.

For example, the $30 strike price puts (8.9% below today's price), offer premiums of $0.55 per contract. In this situation, the investor has to have $3,000 available to purchase 100 shares at $30.00. Therefore, the potential income yield is 1.83% (i.e., $55/$3,000), assuming the stock falls to $30 or lower. Even if it doesn't the investor has to have cash available to buy the shares. This works out to an annualized return of 22%.

On the other hand, there is no capital gain opportunity as with covered calls, and the investor does not automatically receive the dividend yield. So the potential 19.3% covered call income return is slightly lower than the 22% cash-secured put income play. But, again, this does not include the potential capital gain upside.

On the other hand, the chief advantage of selling the out-of-the-money puts is the ability for an investor to potentially get a much cheaper price to buy the stock. For example, after taking into account the $55 in put income, the net purchase price, if the $30 strike price is exercised, lowers the net buy-in cost to just $2,945 for 100 shares. That is 10.56% lower than the covered call investor has to pay for his 100 shares in order to receive his out-of-the-money income.

So the two plays are probably close, with a slight edge to the cash-secured put play. Either way, KB Home stock is very cheap at these prices. In fact, the truly enterprising investor might consider putting on both of these plays.

More Stock Market News from Barchart

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)