The Intercontinental Exchange (ICE) offers financially settled futures contracts based on the price of coal loaded at the Newcastle Coal Terminal in Australia. The contract is cash settled against the global COAL Monthly NEWC Index. Each contract contains 1,000 metric tons of thermal coal, and the minimum tick is five cents per ton. Before 2021, the highest price of the ICE Newcastle Coal futures was $139.05 per ton in January 2011. In 2022, the price rose to over three times that level and remains near the high on August 15.

Over the past years, coal became a four-letter word as environmentalists encouraged the world to shun the polluting energy commodity. However, events in 2022 have created a massive rally in coal prices as the demand has surged and supplies declined.

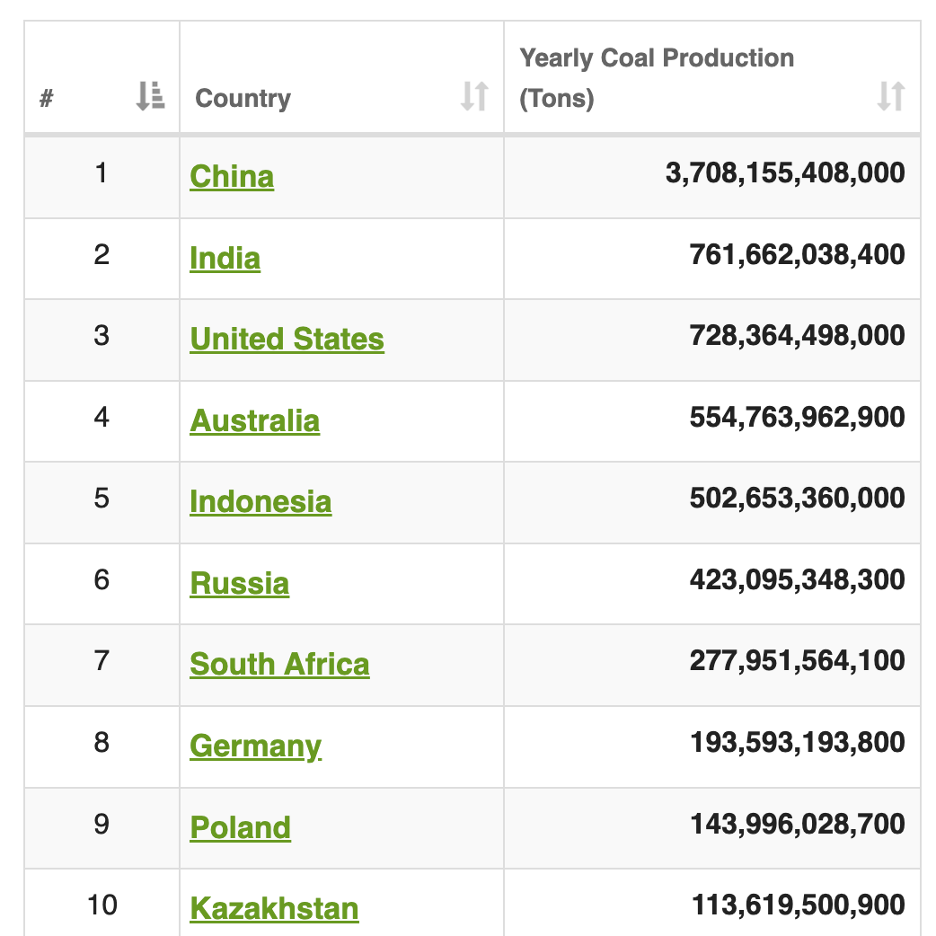

The top ten coal-producing nations

The world’s leading coal-producing countries are:

Source: worldmeters.info

China is by far the world’s top coal producer. India is second, and the US is a close third. Australia rounds out the top four.

The most recent population data for the top four countries are:

China- 1.402 billion

India- 1.380 billion

The United States- 330 million

Australia- 25.7 million

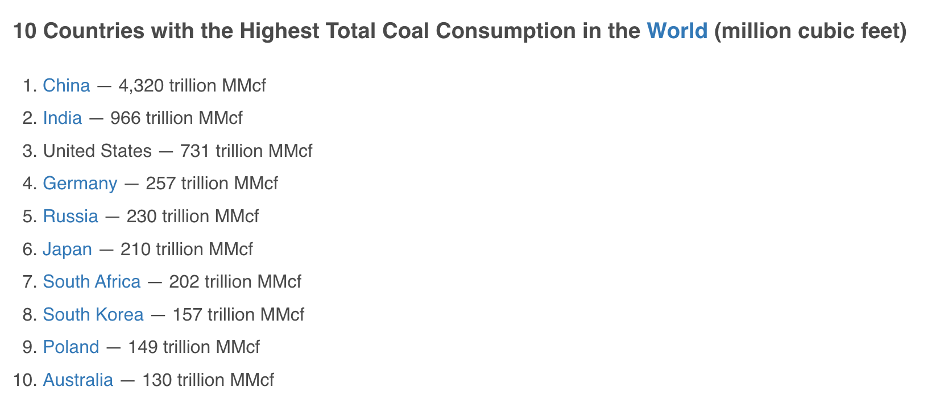

The top coal-consuming countries

The world’s top coal-consuming countries are:

Source: worldpopulationreview.com

China, India, and the US are the leading coal-consuming countries, and Australia is tenth.

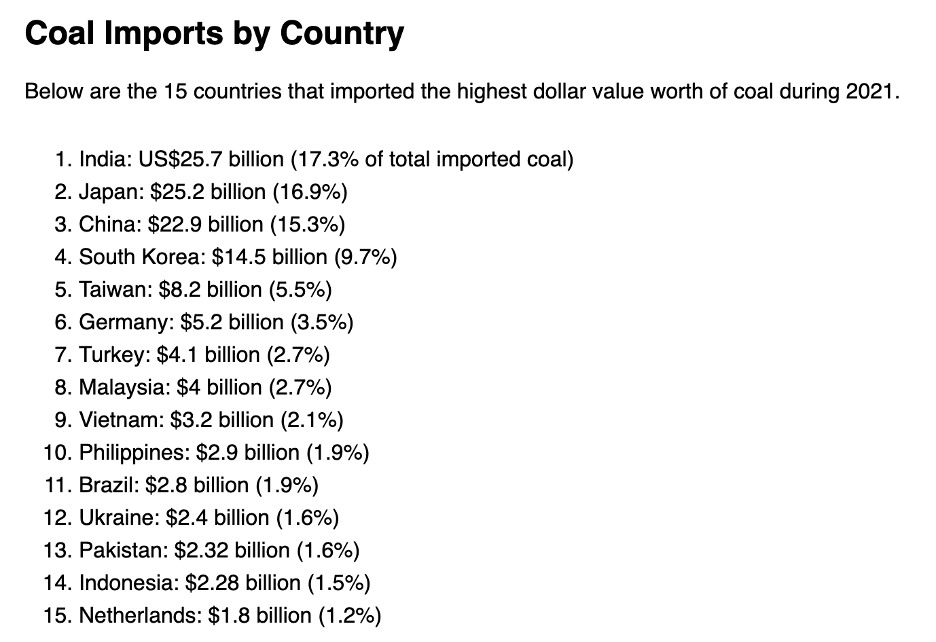

The top coal importing countries are:

Source: worldexports.com

The chart shows that India, Japan, and China are responsible for 49.5% of the world’s annual coal imports.

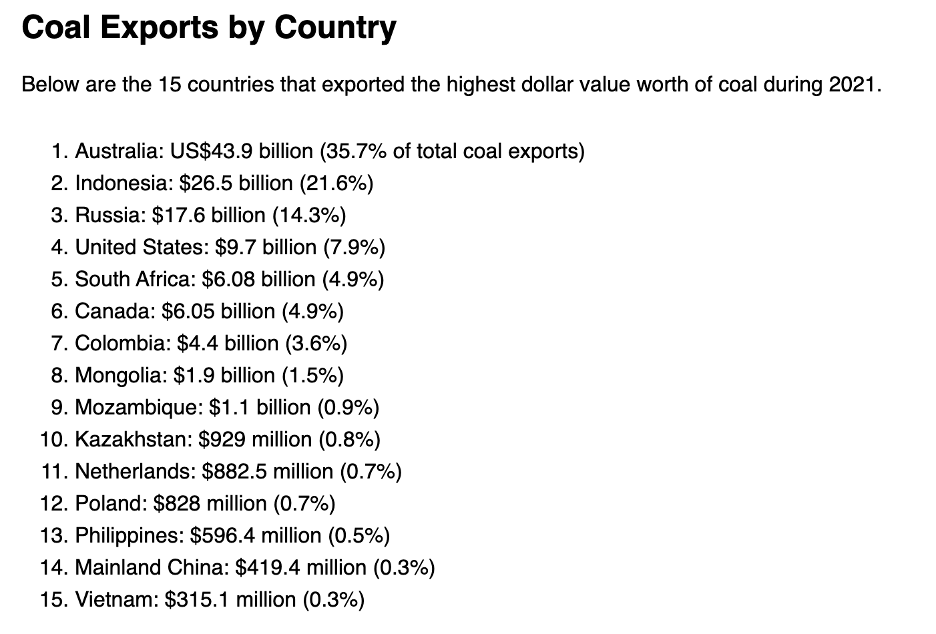

Australia is a critical producer for two reasons

Australia has a unique role in the world’s coal market:

Australia produces far more coal than its domestic requirements. In 2021, Australia was the leading coal exporting country:

Source: worldexports.com

The chart highlights that Australia exported 35.7% of worldwide coal exports in 2021.

Meanwhile, Australia’s location makes logistical exports to Asian countries convenient. The Port of Newcastle, New South Wales, Australia, Port Waratah Coal Services operates the world’s largest and most efficient coal handling operations through its two terminals: Carrington and Kooragang. The ICE Newcastle coal contract reflects the fossil fuel price at the Australian port.

World events have caused coal prices to soar

Russia is a leading fossil fuel producer. In 2022, Russia is third behind the United States and Saudi Arabia, with 10.778 million barrels of output daily. Russia is the second top natural gas producing country behind the United States, and the sixth leading coal producer.

Russia’s invasion of Ukraine, sanctions on Russia, and Russian retaliation have caused supply concerns in the oil, gas, and coal markers, pushing prices higher. Russia has used fossil fuels as an economic weapon against “unfriendly” countries supporting Ukraine.

Meanwhile, China and Russia have a “no-limits” alliance impacting world trade and relations with the US and Europe. Markets reflect the economic and geopolitical landscapes, and fossil fuels are in the eye of the geopolitical storm in 2022.

The long-term chart highlights the explosive move in the ICE Newcastle coal futures contract in 2022 which took the price to a record $440 per ton in March. Meanwhile, prices broke out to the upside in June 2021 when they eclipsed the 2011 $139.05 high.

Carbon emission pledges have reduced supplies- Coal can reach new highs

The war in Ukraine and deteriorating relations with Russia and China have stoked supply concerns in the coal market when worldwide production had declined. With the US, Europe, and other countries worldwide addressing climate change, environmentalist pressure caused coal output to fall. Energy policies have favored alternative and renewable power sources and inhibited oil, gas, and coal production. Many countries and companies have pledged to reduce or eliminate carbon emissions over the coming years.

Oil and gas prices have risen to multi-year highs in 2022, with oil products, gasoline, and distillates reaching record levels. Coal also rallied to an all-time high in 2022. On August 15, the nearby ICE Newcastle Coal futures contract was at the $393.25 level, below the March record peak but over 2.8 times the 2011 high.

As the world moves towards the winter heating season in the northern hemisphere, the demand for thermal coal will increase. Even higher highs could be on the horizon for the coal market over the coming months.

More Energy News from Barchart

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

/PayPal%20Holdings%20Inc%20HQ%20photo-by%20bennymarty%20via%20iStock.jpg)