Marathon Oil and Gas (MRO) reported a record adjusted free cash flow (FCF) for Q2 on Aug. 4. The oil and gas explorer and producer uses most of this cash flow to buy back large amounts of its stock and also pay dividends. This will benefit shareholders in several ways.

On July 27, MRO decided to keep its dividend per share (DPS) level at 8 cents per share (it had been raising it by 1 cent per quarter). This gives the MRO stock a 1.465% dividend yield at $21.84 as of Aug. 8.

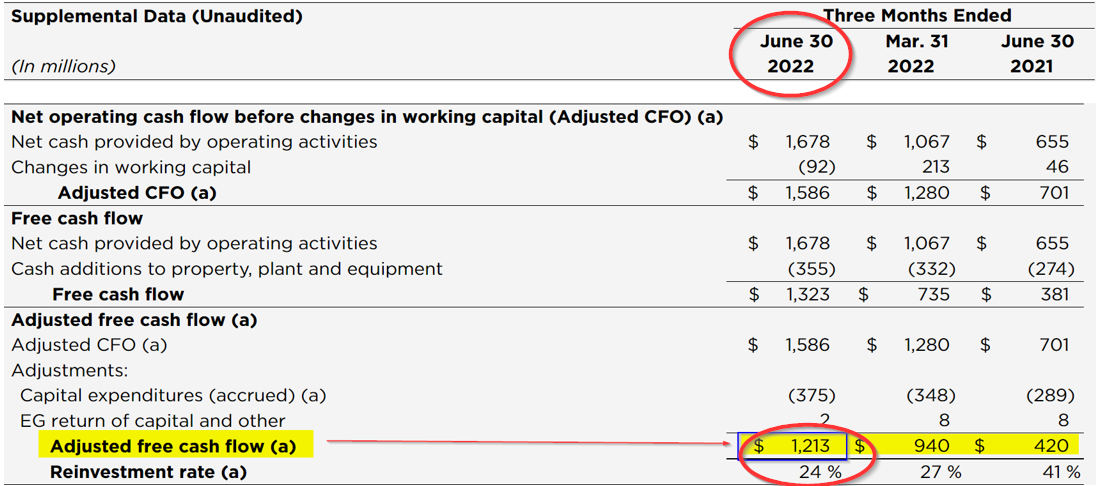

This is the direct result of MRO's massive $1.3 billion in FCF for the quarter. After adjustments to make the number less volatile, adj. FCF was $1.213 billion. This compares with just $940 million in the prior quarter. You can see these adjustments in its Supplemental data snippet below:

This shows that its adjusted FCF includes a very high rate of return (24%) expected on its capex spending. So in addition to getting buybacks and dividends, the company is clearly spending adequately on improving its own operations for future returns. In effect, this is the best of all worlds for investors.

The Impact of Buybacks

The company clearly is using most of its FCF to buy back shares. You can see this in the picture of its 6-month Cash Flow statement below that I have illustrated.

This shows that in the six months ending June 30, the company generated a little over $2 billion in free cash flow (FCF) and used $1.35 billion of that to buy back shares. Moreover, it spent just $108 million in dividends in the first two quarters, paying 8 cents per share.

So, why doesn't Marathon Oil and Gas pay out most of this FCF to shareholders in dividends?

First, take note that since the company reported that its Q2 FCF was $1.323 billion, most of the $2.078 billion in first half 2022 FCF (64%) came during Q2. Q1 FCF was just $755 million. So, its FCF is accelerating. And why not? Its huge investments in capital spending are paying off, along with high oil and gas prices. People think its just a function of prices. That is not completely true - its capex spending pays off too.

Second, by buying back shares, the number of shares outstanding decline. For example in the last year, its share count has fallen from 788.4 million to 677.6 million, a decline of 110.8 million, or 14%. At today's price of $21.92 that is worth $2.428 billion to shareholders.

This is because with a lower share count, the company can raise its dividend without a higher cost to the company. In addition, the earnings per share rise, again with no increase in net income. These two effects help push up the stock price. Moreover, shareholders' stakes in the company rise automatically. These all benefit the long-term shareholder.

In addition, the lower supply of shares and the continuous buying action help push up the stock price as well. This help make the stock a success for the long-term shareholder.

Buybacks Facilitate Covered Calls

Moreover, Investors can also create their own income by selling out-of-the-money covered calls. With a stable share price, this becomes a profitable undertaking.

For example, look at the following Barchart option chain for MRO stock.

It shows that the $24.00 strike price expiring on Sept. 2 offers calls at $0.50 per contract. What does that mean? Investors that buy100 shares of MRO can then sell forward 1 contract that expires in 25 days and immediately receive $50. That represents a 2.29% return on today's price of $21.84 per share, or an investment of $2,184 for 100 shares. Annually, that works out to a 27.4% return on investment. That is a fantastic return. And since the stock has to rise 10% to get to $24.00 in 25 days investors also have very little risk.

This high premium would not be possible if the company was not also buying back huge amounts of its shares. Most companies have 1% covered call option opportunities with no or little buybacks. And with the 10% potential capital gain, if the stock rises to $24.00 by Sept. 2, the total return potential is over 12.2% in one month. That is a very good ROI.

More Stock Market News from Barchart

/Nvidia%20logo%20on%20phone%20screen%20with%20stock%20chart%20by%20xalien%20via%20Shutterstock.jpg)

/Quantum%20Computing/A%20concept%20image%20of%20a%20green%20and%20yellow%20motherboard_%20Image%20by%20Gorodenkoff%20via%20Shutterstock_.jpg)