JPMorgan Chase & Co (JPM) bank stock is now down over 28% YTD and the stock is cheap at just 10x earnings with a 3.45% dividend yield. Value investors like the stock, and related covered call income plays.

JPMorgan Chase is a major money center bank. Its Q2 earnings came in at $2.76 per share. This was 15 cents lower than analysts’ EPS forecasts of $2.91.

Nevertheless, 21 analysts surveyed by Refinitiv have an average forecast EPS of $11.19 for 2022 and $12.57 for 2023. That puts JPM stock on a forward 2022 price-to-earnings (P/E) ratio of 10.3x and 9.1x for 2023.

Moreover, the bank pays a $4.00 annual dividend. That gives it an attractive dividend yield of 3.45%.

The bank is likely to raise that dividend by the end of September. That is because it has now paid the same dividend for the past 4 quarters and usually raises the dividend after the Fed approves its capital return plan.

In addition, its 3.45% yield is higher than its historical 2.76% dividend yield over the last four years. So, for example, if JPM stock now had that yield, its price would be at $144.93 (i.e., $4.00/0.276). That implies a price target 25% higher than today.

We can use that to set a strike price target for a covered call income play.

JPM Covered Call Income Play

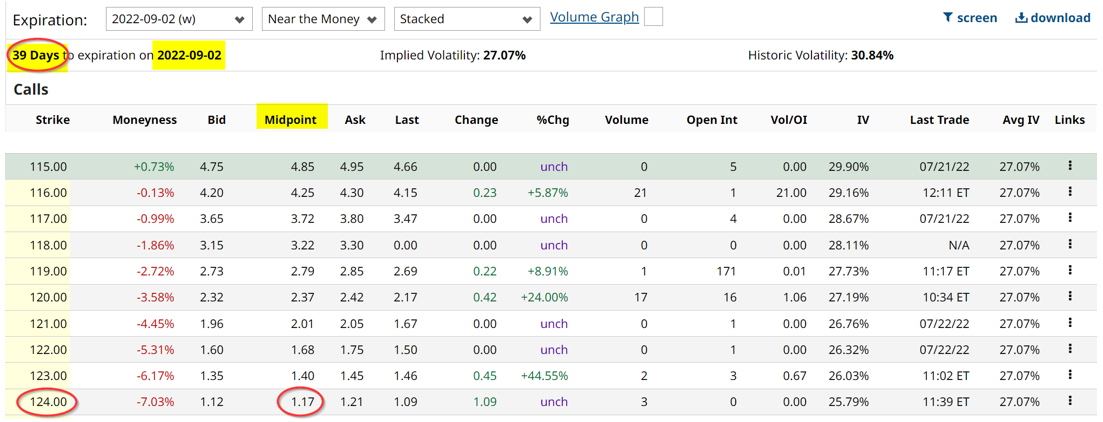

For example, if we look at the Sept. 2 call option chain, investors who sell forward the $124 calls can receive $1.17 per call contract. This can be seen in the Barchart chain below.

This works out to a 1.01% return (i.e., $1.17/$115.73) for just a little over one month and there are 9.36 periods of 39 days in one year. If that can be replicated each month, the annualized return is 9.45% (i.e., 1.01% x 9.36 times per year).

Even if JPM stock rises to the $124 strike price by Sept. 2 close, the investor will make an additional 7.15% in one month. The total return for the 39-day period will be 8.16%.

Moreover, you can clearly see that there are opportunities to make more money by selling at a lower strike price. Obviously, there would be more risk of the covered call shares being called if JPM stock rises to those lower strike prices.

More Stock Market News from Barchart

- Drastic Weather Events Damage Harvests As Recession Looms

- Wall Street Analysts Divided Over Fed Policy

- Stocks Mixed Ahead of Big Tech Earnings and FOMC Meeting

- Stocks Climb Ahead of Mega-Cap Tech Quarterly Earnings

On the date of publication, Mark R. Hake, CFA did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)

/Quantum%20Computing/Image%20by%20Funtap%20via%20Shutterstock.jpg)