The software sector just took a harder hit than at any point in its history, creating opportunities for investors willing to look past the panic. Jefferies recently noted that roughly 73% of software stocks now screen as oversold, the highest reading on record. Even the broader tech universe isn't far behind, with about 45% of names hitting oversold territory.

But here's the thing: three names stand out from the carnage with something most beaten-down stocks don't have. DocuSign (DOCU), Intuit (INTU), and Atlassian (TEAM) all show oversold conditions on their RSI indicators while maintaining perfect 100% Barchart opinion scores.

That's a rare combination, suggesting Wall Street analysts still believe in the fundamentals even as traders hammer the stocks.

Let's break down why each deserves a closer look.

DocuSign: Agreement Management Is the Real Story

DocuSign's stock has taken a beating alongside the broader software selloff, but CFO Blake Grayson made a compelling case at the Nasdaq investor conference in December that most people are missing the bigger picture.

The company is building what Grayson called Intelligent Agreement Management, or IAM, which addresses everything from preparing agreements to managing them after signature. It crossed 25,000 IAM customers in the most recent quarter, up from just 10,000 in April. That's serious momentum for a product that launched in mid-2025.

Grayson explained that the company already has 150 million consented agreements on the IAM platform, providing a significant data advantage. When DocuSign benchmarked queries on public contract data versus their own consented corpus, they achieved a 15-percentage-point improvement in recall precision.

"If you go to ChatGPT and use these LLMs, they're partially accurate," Grayson told the conference. "A 15-point improvement is super valuable, and it provides even more to the trust component that our customers get from using DocuSign."

The company now has nearly 1.8 million customers and relationships with about 275,000 direct sales customers. Most importantly, customers using IAM are using more e-signature volume, creating a flywheel effect that strengthens both businesses.

DocuSign raised its dollar net retention from a low of 98% roughly two years ago to 102% currently, driven primarily by retention gains since IAM remains too small to drive meaningful expansion yet.

Management sees a clear path to high-single-digit or even double-digit growth as IAM scales and churn continues to improve.

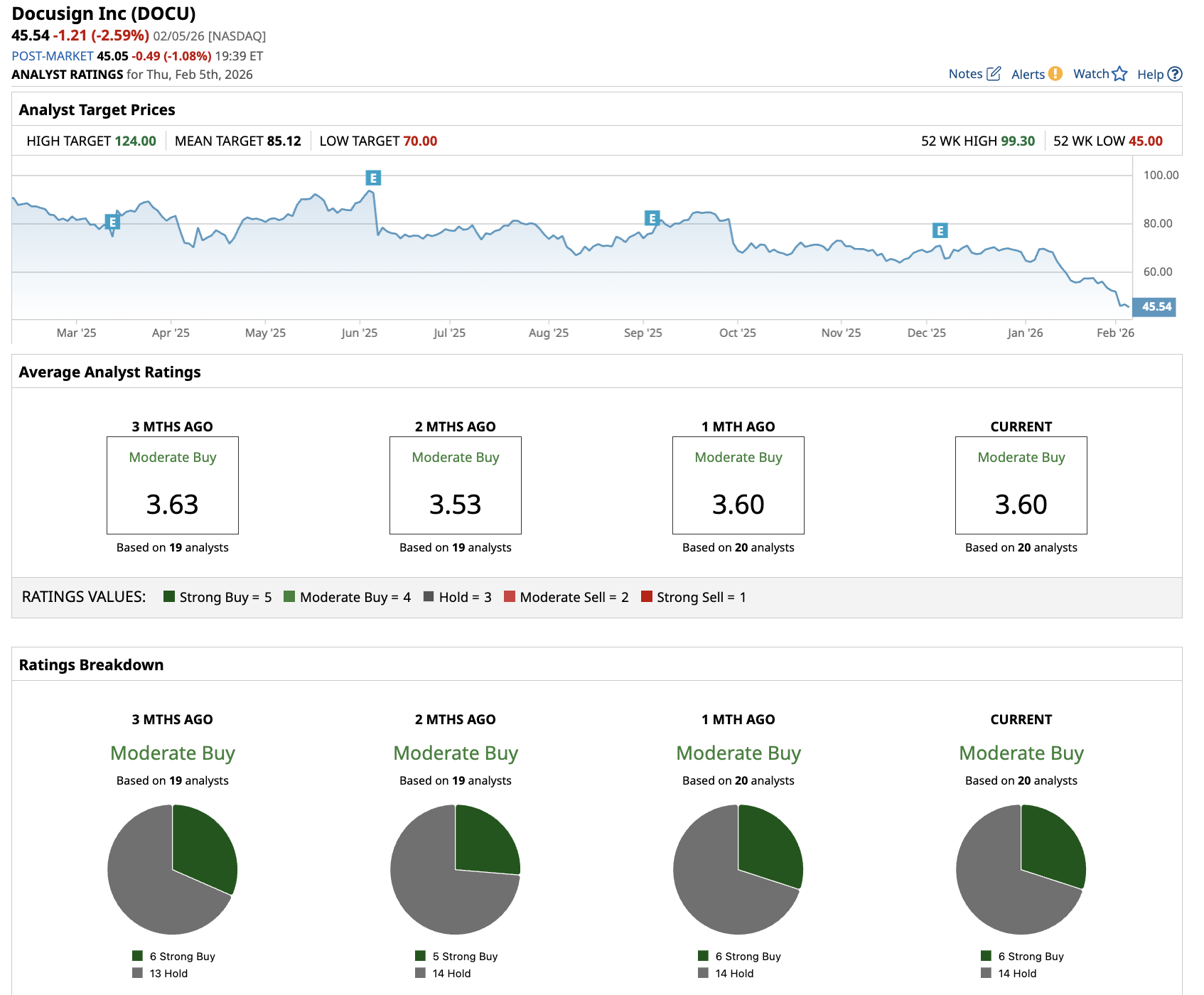

Out of the 20 analysts tracking DOCU stock, six give it a consensus “Strong Buy,” and 14 recommend “Hold.” The average DOCU stock price target is $85.12, above the current price of about $46.

Intuit: AI Is Transforming Tax and Financial Services

Intuit's consumer platform chief, Mark Notarainni, outlined at the Barclays conference how AI is changing TurboTax and Credit Karma, expanding the addressable market. The company declared itself an AI-driven platform seven years ago, well before ChatGPT made headlines. That early investment is paying off now as AI enables true "done-for-you" experiences rather than linear interview processes.

- TurboTax saw a 12% reduction in tax prep time last year by using AI to personalize the experience and only surface relevant questions.

- The company expects additional refinements this tax season as it works toward enabling 90% of its products with human intelligence augmented by AI.

- The assisted tax category represents a massive opportunity.

- About 88 million Americans still file through assisted methods, creating a $37 billion total addressable market.

- AI is enabling Intuit to move upmarket by making its experts more efficient, allowing them to serve more customers without being bogged down in mundane tasks.

- Notarainni said developers are 40% more efficient with AI, enabling the company to build products like business tax much faster than previously possible.

- On the customer success side, Intuit expects $135 million in efficiency opportunities this year, enabling it to serve more customers.

- Credit Karma is deploying a fleet of AI agents, including a refund assistant to help users make smarter decisions with tax refunds, a debt assistant that works in the background year-round, and Credit Spark to help Gen Z users improve their credit scores through spending-habit analysis.

- The platform now has 43 million monthly active users across 140 million members, providing multiple touchpoints to drive engagement beyond the seasonal tax business.

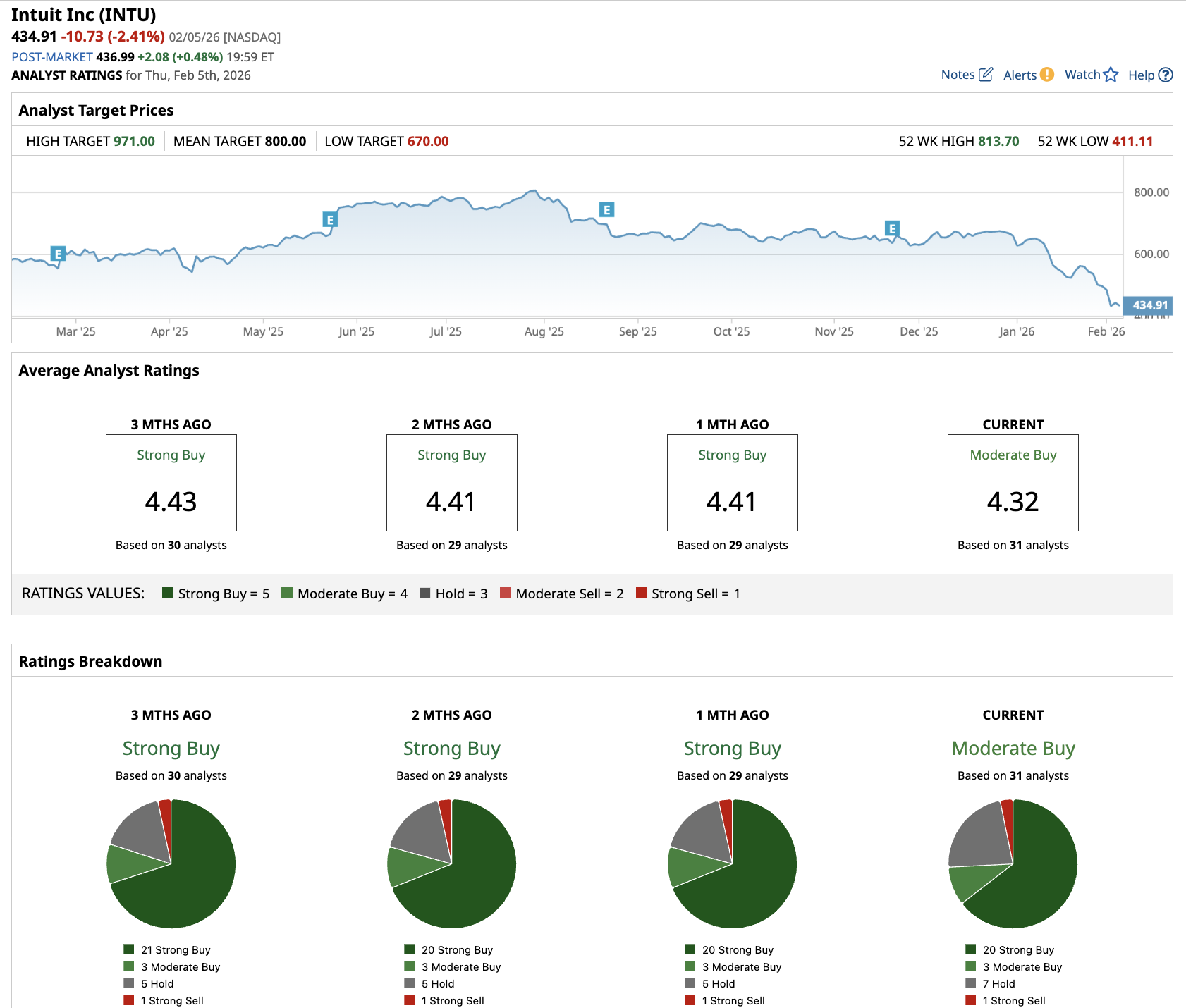

Out of the 31 analysts tracking INTU stock, 20 recommend “Strong Buy,” three recommend “Moderate Buy,” seven recommend “Hold,” and one recommends “Strong Sell.” The average INTU stock price target is $800, above the current price of about $435.

Atlassian: Customers Are Voting With Multiyear Commitments

Atlassian just crossed $6 billion in annual run rate revenue and delivered its first $1 billion cloud revenue quarter, up 26% year-over-year (YoY). But the real signal came from remaining performance obligations, which grew 44% year over year to $3.8 billion.

CEO Mike Cannon-Brookes emphasized on the February earnings call that three consecutive quarters of RPO acceleration indicate customers are making long-term bets on Atlassian's platform, not just buying for 2026.

"Those are tens of thousands of seats signing multiyear deals that are voting on not the platform for 2026 for them in AI, but the platform in '27, '28, and '29," Cannon-Brookes explained.

Atlassian closed a record number of deals greater than $1 million in annual contract value during the second quarter, nearly doubling year-over-year. The company's Rovo AI platform surpassed 5 million monthly active users, with more than 1,000 customers upgrading to the Teamwork Collection and purchasing over 1 million seats.

The data shows AI is actually driving more Jira usage, not replacing it. Software teams using AI code-generation tools create 5% more tasks, have 5% more monthly active users, and expand Jira seats 5% faster than those not using AI code-generation tools. Cloud net revenue retention ticked up to 120% for the third straight quarter, showing existing customers are expanding commitments even in a tough environment.

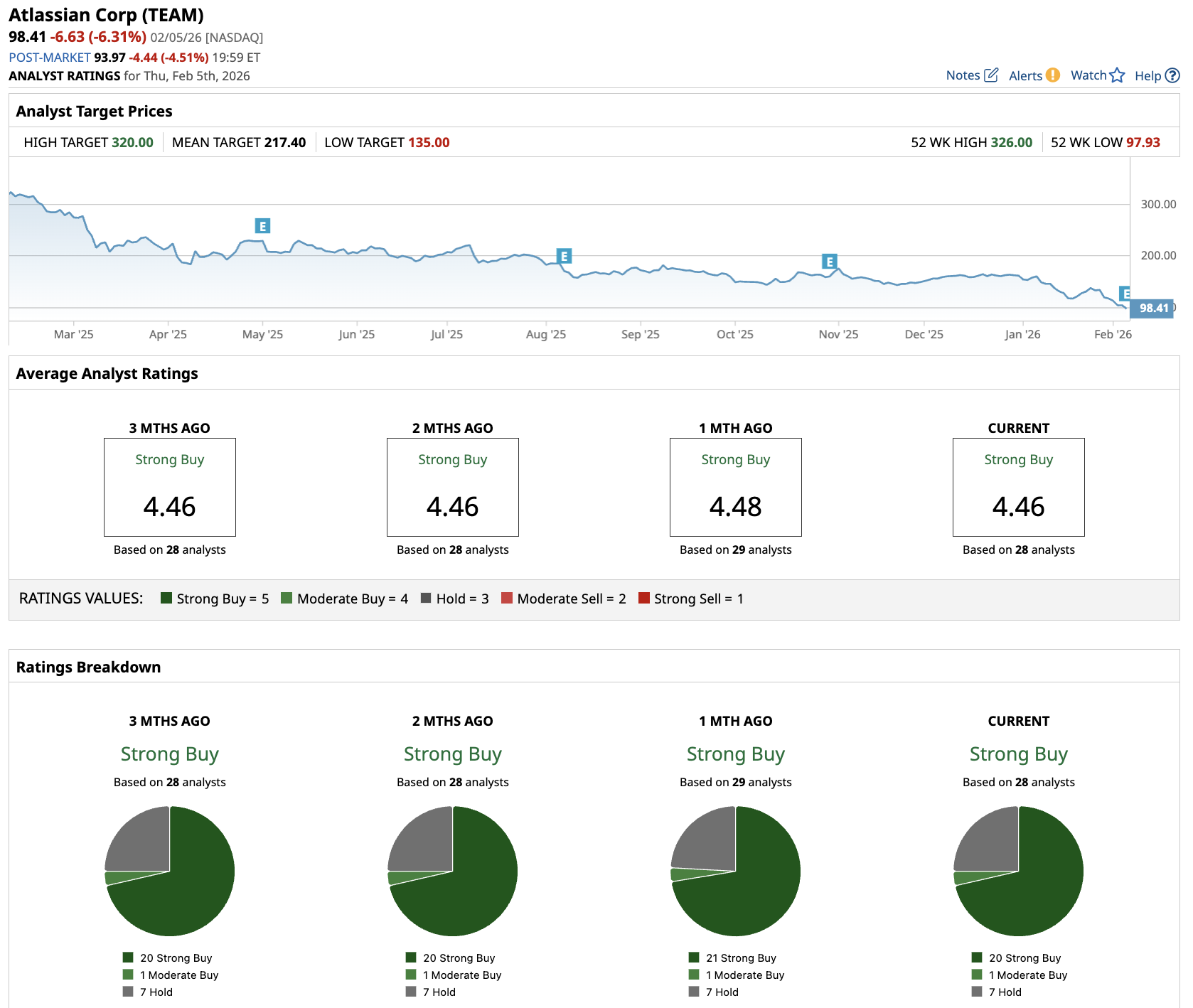

Out of the 28 analysts tracking TEAM stock, 20 recommend “Strong Buy,” one recommends “Moderate Buy,” and seven recommend “Hold.” The average TEAM stock price target is $217.40, above the current price of about $98.

The Bottom Line

Software valuations remain elevated at roughly eight times sales, so this isn't a sector-wide buying opportunity. But these three names combine technical oversold conditions with strong analyst support and improving fundamentals, suggesting the selloff created real value.

The key is distinguishing between stocks that are cheap for a reason and those where fear has disconnected price from business reality.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Tesla%20Inc%20logo%20by-%20baileystock%20via%20iStock.jpg)

/Salesforce%20Inc%20logo%20on%20building-by%20Sundry%20Photography%20via%20Shutterstock.jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)