Apple (AAPL) closed yesterday just above its 52-week low and is showing a Barchart Technical Option Rating of a Strong Sell.

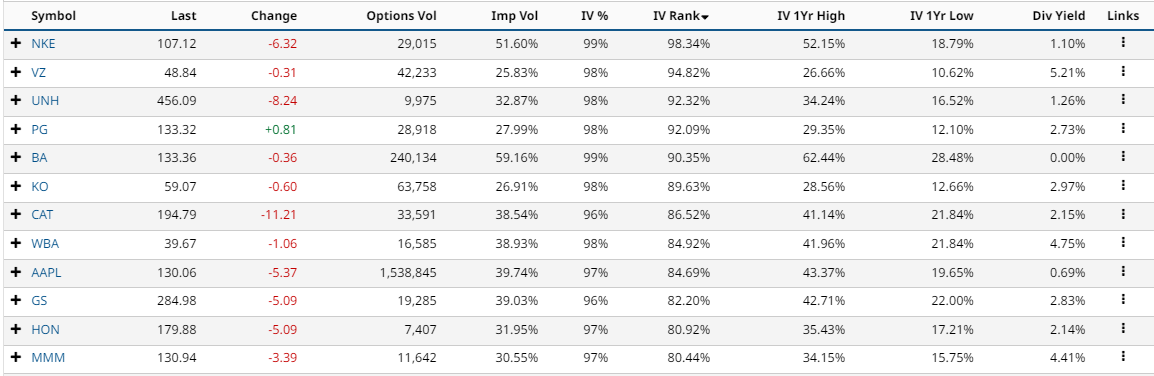

When running a Stock Screen for Dow Industrial stocks we can see that AAPL stock has one of the highest IV Ranks of all Dow stocks.

So, given that AAPL is rated a strong sell and implied volatility is high, what option strategies might be appropriate?

Well, we want to focus on:

- Bearish strategies due to the strong sell recommendation

- Negative vega strategies due to the high implied volatility rank.

Let’s take a look at a few different option ideas on AAPL stock given the above parameters.

Bear Call Spread

The first strategy is a bear call spread. A bear call spread is created through selling a call and then buying a further out-of-the-money call.

A bear call spread is a risk defined trade, so you always know the worst-case scenario. Bear call spreads are negative delta (bearish) and negative vega (benefit from a fall in implied volatility).

Using the July 15 expiry, traders could sell the 140 call and buy the 145 call. That spread could be sold for around $1.00, which means the trader would receive $100 into their account. The maximum risk is $400 for a total profit potential of 22.55%, with a probability of 76.8%.

The breakeven price is 141.00. This can be calculated by taking the short call strike and adding the premium received.

As the spread is $5 wide, the maximum risk in the trade is 5 – 1.00 x 100 = $400.

Let’s take a look at another potential option strategy.

Bearish Butterfly Spread

Assuming a trader had a target price for AAPL of 120, they could set up a bearish butterfly spread centred at that price. For example:

Buy 1 July 15th 130 put @ 5.70

Sell 2 July 15th 120 calls @ 2.45

Buy 1 July 15th 110 call @ 0.95

The total cost of this trade is $175 and that is the maximum loss potential on the trade.

The maximum gain is $825 which is calculated by taking the difference in strike prices less the premium paid ($1,000 less $175).

The breakeven prices are 111.75 and 128.25 (lower strike plus the premium and upper strike minus the premium).

A butterfly options trade, has a tent-like shape with the potential for very large profits around the short strike. It's important to keep in mind that it's unlikely you would ever achieve the maximum profit.

For a trade such as this, I would set a profit target of 30% and a stop loss of 20%.

The final idea we will look at is a long call option trade.

Conclusion

There you have two different bearish, negative vega trade ideas for AAPL stock, but you can use these strategies on any stock with a high IV Rank and a strong sell rating.

Please remember that options are risky, and investors can lose 100% of their investment. This article is for education purposes only and not a trade recommendation. Remember to always do your own due diligence and consult your financial advisor before making any investment decisions.

*Disclaimer: On the date of publication, Steven Baster did not have (either directly or indirectly) any positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. Data as of after-hours, June 16, 2022.

More Options News from Barchart

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)