A few weeks ago, many NFL fans—fatigued from having to watch the Chiefs in five out of the past six Super Bowls—got their collective wish as Kansas City failed to make the playoffs for the first time since 2014.

But then, a funny thing happened.

The Patriots punched their ticket to the Super Bowl … with a young, up-and-coming quarterback … and a defensive-minded, fundamentals-first coach.

Who knows? Maybe Sam Darnold will exorcise his ghosts once and for all. Maybe the Seahawks will get revenge for their Super Bowl XLIX loss 11 years ago. Maybe we aren’t on the cusp of another New England dynasty that will tire us from the game.

But we’re not here to talk about those storylines.

We’re here, as we are every year, to talk about the Super Bowl Indicator.

First: A Note for Super Bowl Haters

The Super Bowl might not be for you, but it’s for a lot of us.

In 2025, Super Bowl LIX was the most-watched single-network telecast in television history. In the U.S. alone, it averaged 127.7 million viewers and peaked at 137.7 million (during the second quarter). It was also broadcast in 25 languages across 195 countries and territories; while estimates for overseas viewership tend to be more squirrelly, it’s believed that international viewers pushed the overall number to north of 200 million.

Given that Super Bowl LX’s halftime show will feature Bad Bunny—a man who topped Spotify’s global charts in 2020, 2021, 2022, and 2025—there’s every reason to believe this year’s “big game” will crush all previous records.

In other words, if you don't care about the Super Bowl … well, a lot of other people do.

The Super Bowl Indicator

But even if you’re not interested in the sport itself, or the entertainment, or even the ads, there’s still one more reason to watch:

The Super Bowl Indicator.

Investors are commonly on the lookout for market signals that can help them get an edge. Economic data, for instance, or stock charts are two great sources for useful indicators that active investors can put to work.

Young and the Invested Tip: Plan on contributing to a retirement plan in 2026? Here are all the contribution limits and deadlines you should know.

Sometimes, though, market analysts look a little farther afield—OK, a lot farther afield—to figure out what the stock market will do next. In fact, going to a psychic or reading tea leaves would be downright scientific compared to the methods that would-be stock market prognosticators employ to get an investing edge.

Without exaggeration, there are market signals attached to the price of a Big Mac, cardboard-box manufacturing, lipstick, sales of men’s underwear, and the cover of the Sports Illustrated Swimsuit Issue.

But the most famous of these outside-the-box investment cues is the Super Bowl Indicator.

The Super Bowl Indicator goes back nearly half a century, to 1978, when the term was first coined by New York Times sportswriter Leonard Koppett. And it works like this:

- If the Super Bowl's winner comes from the original National Football League (now the National Football Conference, or NFC), stocks will rise for the rest of the year.

- If the Super Bowl's winner comes from the original American Football League (now the American Football Conference, or AFC), stocks will fall for the rest of the year.

Listen, I know. I know!

Maybe I’ve been too deadpan up until now, so let me be clear: I do not actually believe in the predictive powers of the Super Bowl Indicator. I do not believe the Super Bowl has any meaningful effect on the stock market. I do not want anyone to ever invest based on the outcome of a football game.

The Super Bowl Indicator is nothing more than a whimsical bit of nonsense, and while nonsense isn’t necessarily good for the wallet, it does soothe the soul.

All of that said …

I can't blame Koppett too much for giving this idea the time of day. After all, when he identified the signal, it had never been wrong before. As of 1978, the Super Bowl Indicator was flawless.

But fast forward a few decades, and the indicator's track record has become pretty muddy.

What Should Investors Look For at This Year's Super Bowl?

As always, this is the point at which I turn things over to Ryan Detrick, Chief Market Strategist at Carson Group and a pretty good LinkedIn follow for investors.

Detrick has been on the Super Bowl Indicator beat for as long as I can remember (indeed, you can read his annual full take here). And despite what his lifelong fandom of the Cincinnati Bengals would otherwise suggest about his cognitive skills, he at least has enough sense to know it’s all a gag.

“Don’t ever invest based on who wins the Super Bowl,” he says. “Or what will happen at halftime, or the coin toss, or how bad the refs will be.”

Anyways, take it away, Ryan!

The AFC/NFC Breakdown Looks Much Different Now

Detrick, ironically enough, tosses out the history books when looking at the historical record of the Super Bowl Indicator. That is: He simply looks at “when the NFC wins” versus “when the AFC wins,” ignoring the “original conference” aspect of the indicator.

I’d normally be more precious about purity, but the Super Bowl Indicator stopped being perfect long ago anyways.

And again: None of this is real.

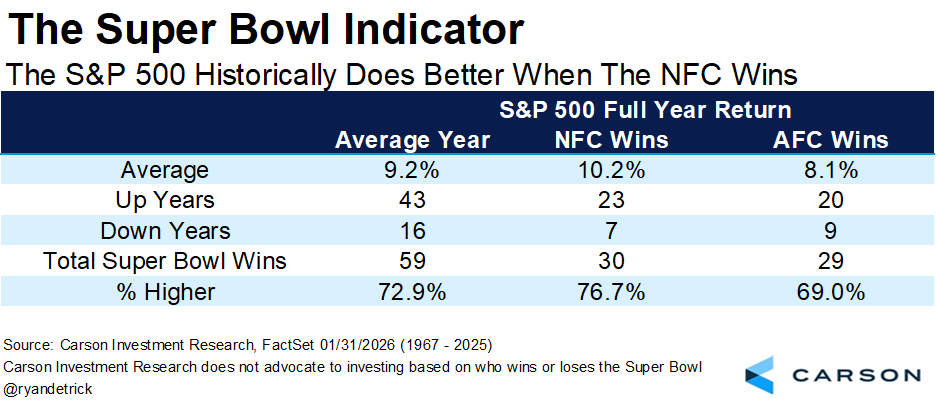

"As our first table shows, the S&P 500 gained 10.2% on average during the full year when an NFC team has won versus 8.1% when an AFC team has won,” Detrick says. "Interestingly, after the Eagles victory over the Chiefs last year, the NFC now has 30 Super Bowl wins compared with 29 from the AFC.” In other words: We have a pretty even batch of data to work with.

OK. So, while stocks clearly don’t uniformly tank after an AFC win anymore, the NFC still enjoys a significant performance edge.

But don’t sign up to be a “12th Man” yet.

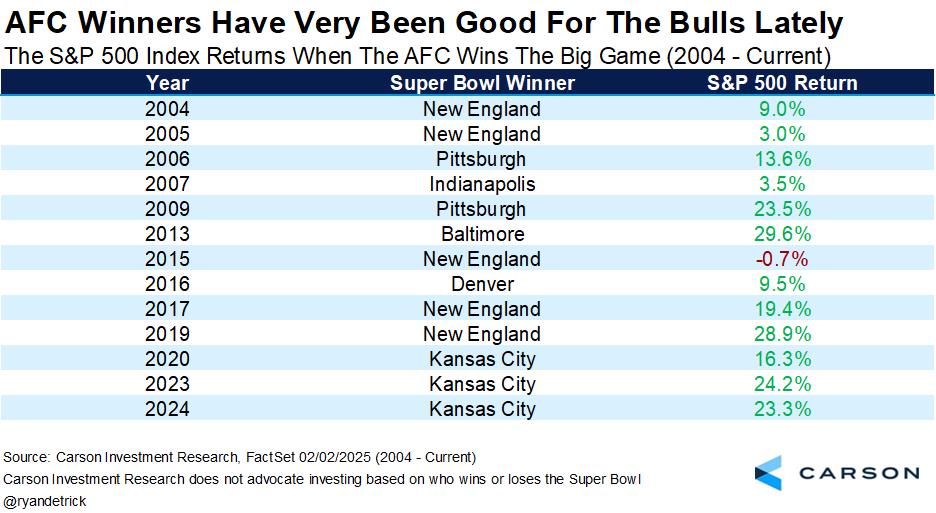

More recent history shows extremely favorable outcomes when the AFC brings home the Vince Lombardi Trophy. Specifically, stocks have gained across the full year in 12 of the past 13 times a team from the AFC won the Super Bowl. That one down year? 2015, and we're talking a 0.7% decline. That's effectively flat.

The Market Doesn’t Like the Pats as Much … But the Seahawks’ Sample Size Is Small

You’ll notice the table above shows a lot of green during years in which the Patriots have won the Super Bowl. But once you toss in data from the Pats’ sixth Super Bowl victory, you find that stocks only average a modest 6% gain in years that Bostonians celebrate.

That's a little more than half the 11.4% average annual returns enjoyed when the Seahawks have won it all ... but they've only won it all once.

The Best Bet for the S&P 500? A Beatdown.

If your team isn't playing in the Super Bowl (and if you're a Browns fan like me, that's every year since they started playing the Super Bowl), your response to “who do you want to win?” will likely be “I really don’t care; I just want to see an entertaining game.”

But if you care about your portfolio first and foremost, you’d better be crossing your fingers for a boat race.

Young and the Invested Tip: If you're saving for the very long term (read: retirement), get our weekly insights on investing, Medicare, taxes, and more in our weekly letter, "Retire With Riley."

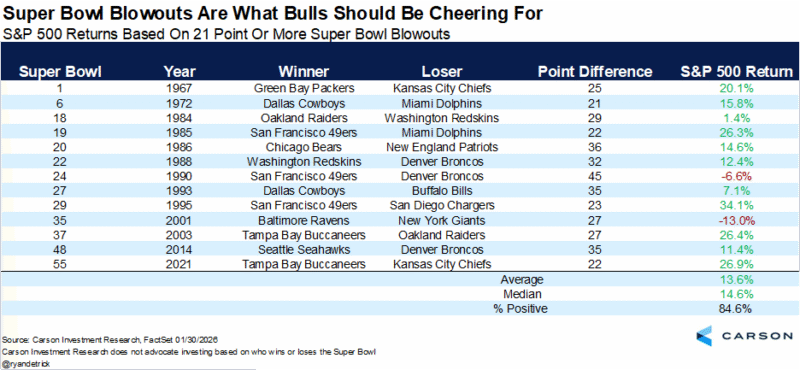

“The larger the size of the win, the better stocks do,” Detrick says, adding another disclosure that “nearly everything I’m saying here isn’t in any way, shape, or form related to what stocks actually do.”

The numbers:

- In years during which the Super Bowl is won by single digits, the S&P 500 gains 6.5% on average and 62.5% of the time.

- In years during which the Super Bowl is won by double digits, the S&P 500 gains 11% on average and 80% of the time.

- In years during which the Super Bowl is won by three touchdowns (21 points)* or more, the S&P 500 gains 13.6% on average and 84.6% of the time.

* Detrick assumes a successful extra-point kick with each touchdown even though the analytics clearly say they should go for two.

Yes, It Was Holding.

That’s it for the Super Bowl Indicator, but I’d like to jot down one last note.

In his endnotes section, Detrick shakes his fist at Super Bowl LVI, complaining that “four years ago, my Bengals were hosed with a horrific holding call in the endzone at the end of the game to literally hand the Rams the game.”

I acknowledge that no one likes “the refs cost us the game” guys. But not only is Detrick correct—this is not holding!—but the play should’ve been whistled from the get-go.

Rams RT Rob Havenstein jumped early.

Riley & Kyle

Like what you're reading but not yet a subscriber? Get our weekly financial insights and updates delivered to your inbox every Saturday morning by signing up for The Weekend Tea today! You can also follow us on Flipboard for more great advice and insights.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Jen-Hsun%20Huan%20NVIDIA's%20Founder%2C%20President%20and%20CEO%20by%20jamesonwu1972%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)