On March 23, 2022, the euro currency was at just below the $1.10 level versus the US dollar. In an article on Barchart, I wrote that the euro was “teetering on the border” and “the euro currency is literally teetering on the brink of a move to parity against the dollar.”

Over the past two months, the currency relationship between the dollar and the euro has continued the same bearish path. If the rate of decline continues, we should expect to see parity before the end of 2022.

All markets reflect the economic and geopolitical landscapes, which is even more of a factor for the value of one currency versus another. The dollar and the euro are the world’s top reserve currencies because of the market’s perception of economic and political stability in the United States and the European Union. Meanwhile, interest rate differentials are a substantial factor in the currency relationship. The dollar and the euro have been losing purchasing power, but the euro’s decline has been far faster.

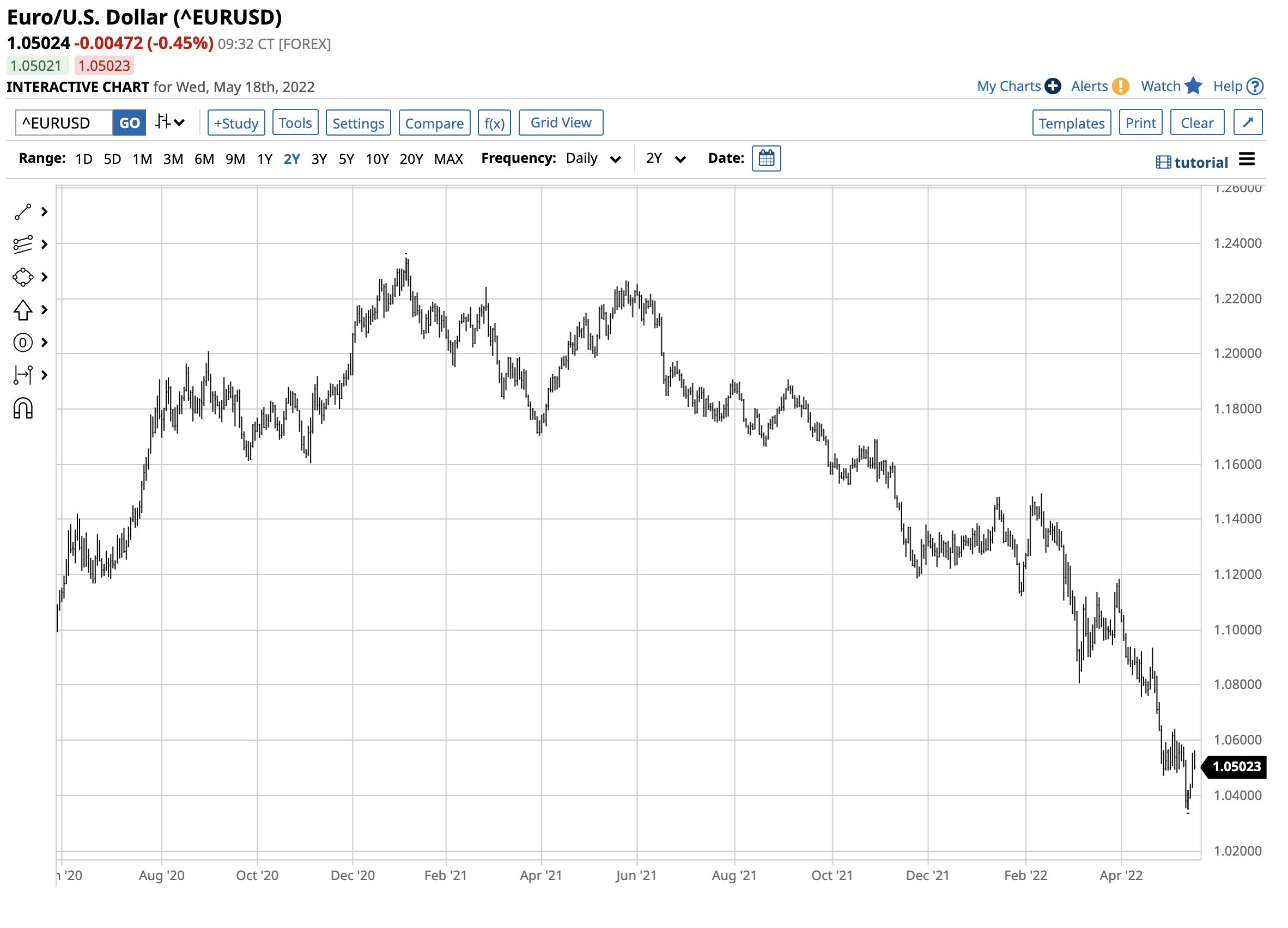

The bearish trend in the euro continues

Since early 2021, it has been all downhill for the euro versus the US dollar currency relationship.

The chart shows the decline from $1.2349 on January 6, 2021, to the latest low of $1.03498 on May 13, 2022. The euro dropped 16.2% against the dollar since early 2021, with the euro picking up downside steam in February 2022.

Interest rate differentials are widening, weighing on the euro

The Us Federal Reserve blamed rising US prices on pandemic-inspired supply chain bottlenecks throughout most of 2021, calling inflation a “transitory” event. Meanwhile, the central bank switched gears in late 2021 when CPI and PPI readings rose to the highest level in over four decades. Meanwhile, the US bond market began signaling that inflation was a danger in August 2021, long before the Fed came to the same conclusion.

The chart shows that the US 30-Year Treasury Bond futures began falling from the 167-04 level in July 2021, picking up downside steam when the Fed started tightening credit and making plans to reduce its swollen balance sheet. Rising interest rates increase the yield on US dollar deposits, supporting the dollar versus the euro and other world currencies.

War on Europe’s doorstep is bearish for the euro

In August, US troops made a hasty departure from Afghanistan after years of war, handing the country back to the Taliban. Some countries saw the exit as a sign of weakness by the world’s leading superpower.

The opening ceremonies of the Beijing Winter Olympics were a watershed event having nothing to do with the competitions. Chinese President Xi and Russian President Putin shook hands on a “no limits” alliance and a $117 billion trade agreement. The handshake set the stage for Russia’s February 24 invasion of Ukraine. Russia considers Ukraine western Europe, while the US and Europe believe it is a sovereign country in Eastern Europe. Russia’s aggression launched fierce Ukrainian resistance, igniting the first major European war since WWII. Moreover, it could be a sign that China will move to reunify with Taiwan over the coming months and years.

Meanwhile, war on Western Europe’s doorstep pitting NATO, including the US, against Russia has weighed on the euro currency. Sanctions and Russian retaliation weighs on the European economy that depends on Russian oil and natural gas exports. The euro sunk on the back of the war as it picked up downside steam in February.

New NATO members are increasing risks

Over the past weeks, Finland, Sweden, and even Switzerland are considering joining NATO, where an attack on one member is an attack on all members. Ukraine has also filed a petition to join the alliance. Russia views NATO expansion as an “existential” threat that could lead to a war between nuclear powers, spreading past Ukraine’s borders. Aside from the new potential NATO members, the US and Europe have supplied Ukraine with weapons that have thwarted Russia’s plans to depose the Ukrainian government. Russia and Ukraine are Europe’s breadbasket, providing one-third of the world’s wheat exports. The war has significant ramifications for food and energy supplies and world peace.

Parity could be the first stop for a move to the 2002 low

Markets reflect the economic and geopolitical landscapes. Increasing US interest rates, a rising dollar, and the war on Western Europe’s doorstep create a potent bearish cocktail for the euro currency.

The long-term chart shows the last time the euro and the US dollar traded at parity was in December 2022. At the $1.05 level on May 18, the euro has been on an express train towards the psychological benchmark.

Meanwhile, inflation has been eroding all fiat currency values. While the dollar has risen against the euro and many other world currencies, it has lost purchasing power as the US April consumer price index rose by 8.3%, and the producer price index was 11% higher. The dollar may be the strongest currency, but it is the leader of the foreign exchange instruments that are depreciating as an asset class. The euro has been the weakest link in the currency arena on the other side of the coin.

We will likely see euro-US dollar parity over the coming weeks and months and a continuation of the trend of lower highs and lower lows in the euro currency.

/A%20concept%20image%20of%20space_%20Image%20by%20Canities%20via%20Shutterstock_.jpg)

/A%20concept%20image%20of%20a%20flying%20car_%20Image%20by%20Phonlamai%20Photo%20via%20Shutterstock_.jpg)