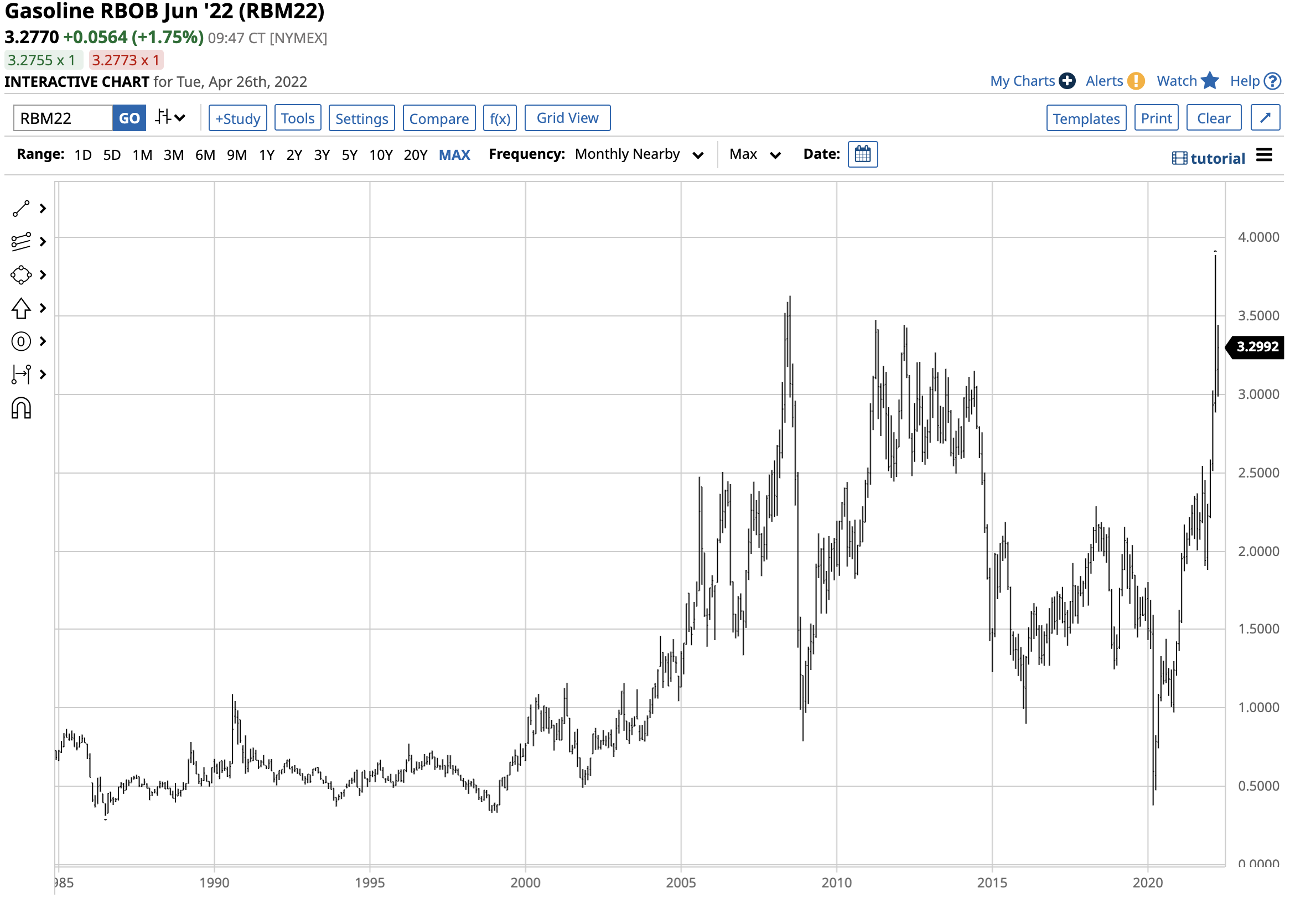

At over the $3.25 per gallon wholesale level, gasoline prices recently traded at the highest price in a decade since 2012. During the week of March 7, nearby NYMEX gasoline futures rose to $3.8904 per gallon, surpassing the 2008 $3.6310 all-time high. While gasoline prices rose to over $4 and $5 throughout the United States, in states like California, local taxes pushed each gallon to between $6 and $8. When inflation pushes all prices higher, the highest gasoline prices in history only exacerbate the economic condition.

Gasoline prices were already probing above the $2.50 level in October 2021, the highest level since 2014, as the gasoline market was going into the offseason during the winter months. Russia’s invasion of Ukraine poured fuel on the rally in February and March 2022. The fuel is now heading into the annual driving season, which runs through the spring and summer months. With war raging in Ukraine, sanctions on Russia, and Russian retaliation on “unfriendly” countries, even higher prices could be on the horizon.

An explosive rally since the 2020 low

In March 2020, gasoline traded at its lowest price since 1999, when the nearby futures contract reached 37.6 cents per gallon wholesale.

The chart highlights the explosive rally that took the fuel over ten times higher to $3.8904 in March 2020. As the global pandemic gripped markets and people sheltered at home, the demand evaporated. In commodities, the cure for low prices is low prices. Rising inflation, vaccines, and the shift in US energy policy caused the gasoline price to soar, reaching a record high in March 2022, surpassing the July 2008 $3.6310 per gallon all-time high.

Prices peak during the driving season

Gasoline is a seasonal fuel; the demand tends to decline during the winter months when adverse road conditions cause drivers to put fewer miles on their vehicles. During the spring and summer season, driving increases, peaking during the summer vacation months. Refineries begin producing more gasoline in the late winter, preparing for the driving season surge.

Distillate fuels are less seasonal even though they include heating oil. Jet and diesel fuel demand have a less seasonal influence on prices.

The SPR release is a symbolic and temporary event

The war in Ukraine and sanctions on Russia caused oil and oil product prices to soar in 2022. While crude oil remained below the 2008 all-time high, gasoline and heating oil prices reached record peaks.

The change in US energy policy to support alternative and renewable fuels and inhibit traditional fossil fuels shifted the pricing power back to the international oil cartel and Russia. Russia’s invasion of Ukraine turbocharged the rally in gasoline and other hydrocarbon prices that had begun during the second half of 2020 and throughout 2021. Moreover, rising inflation created an almost perfect bullish storm for energy prices.

As crude oil, gasoline, and distillate fuel prices surged, the Biden administration released thirty million barrels of crude oil from the Strategic Petroleum Reserve. As prices kept rallying, they decided to release another one million barrels per day for one hundred and eighty days, the most substantial SPR release in history.

Since the release, the oil price has stabilized with $100 per barrel as the pivot price over the past weeks.

The chart illustrates that gasoline prices have been trading in a range between $3 and $3.40 per gallon wholesale since mid-March 2022.

The trend remains higher

While gasoline has declined from the early March all-time high, the medium-term bullish trend continues to point to higher lows and higher highs.

The chart shows that while the SPR release may have slowed the ascent of gasoline prices, they are consolidating above the $3 per gallon wholesale level. Before February 2022, the last time prices were above $3 was in 2014.

UGA is the gasoline ETF product

Inflation, sanctions on Russia, the war in Ukraine, seasonal demand, and US energy policy could mean gasoline will challenge the March 2022 highs and move to even higher prices over the coming months. While technical resistance stands at the recent $3.8904 high, the $4 per gallon level is a technical target for the gasoline futures.

The most direct route for a risk position in gasoline is via the futures and futures options on the CME’s NYMEX division. The United States Gasoline ETF product (UGA) is an alternative for those looking for exposure to the gasoline market without venturing into the futures arena.

At around the $58 level on April 26, UGA had over $100.5 million in assets under management. The ETF trades an average of 48,498 shares each day and charges a 1.02% management fee.

The chart demonstrates that UGA rose from $8.19 in March 2020 to a high of $67.34 in March 2022 as the ETF did a reasonable job tracking the gasoline future’s price.

The US SPR release may have slowed the ascent of fossil fuel prices, but previous releases have not always had the desired impact. In almost a perfect bullish storm for gasoline and other oil products, the market could be resting before the next move to an even higher high.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)