If you look at the chart for the iShares U.S. Medical Devices ETF (IHI) lately, you might think the sector is flatlining. After a decade of being the steady pulse of a healthcare portfolio, medical device stocks have entered 2026 in what can only be described as a state of cardiac arrest.

Between the rising GLP-1 fever and a new wave of tariff-induced margin pressure, the sector is currently waiting for a jolt of electricity to bring it back to life.

What Are Medical Device Stocks?

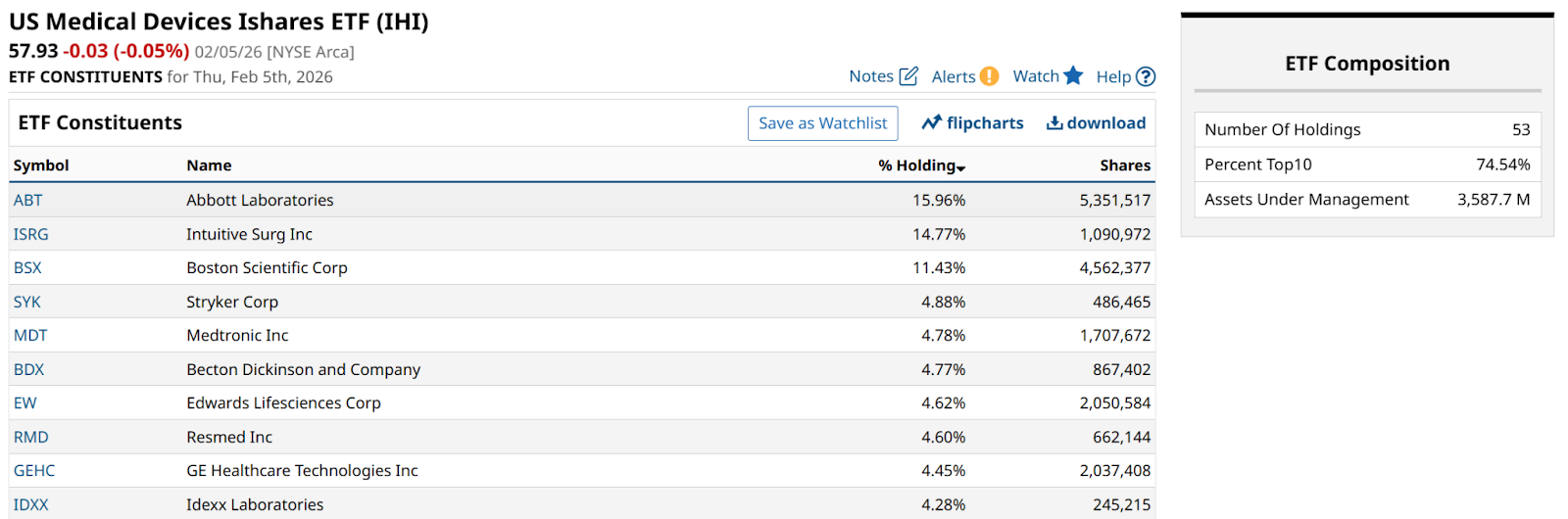

Here are IHI’s top 10, which make up nearly three-quarters of the entire exchange-traded fund (ETF). A mix of household names to consumers and familiar names to professional investors.

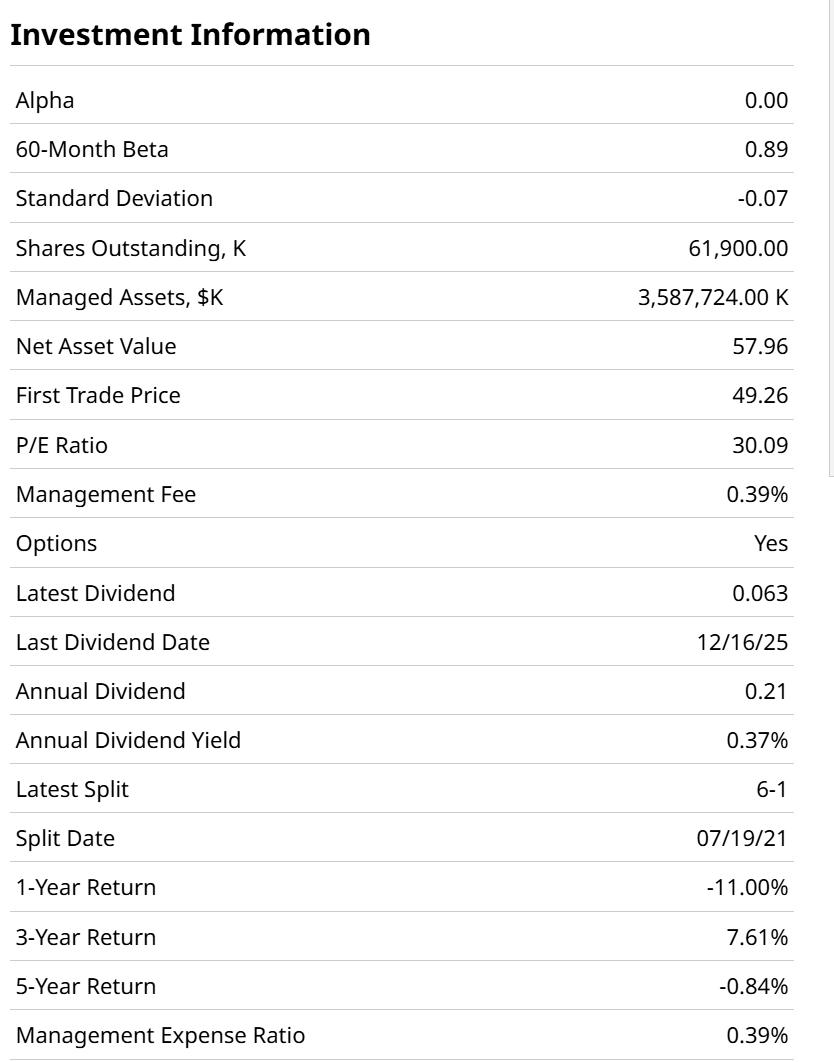

This industry ETF’s stock basket is not cheap at 30x earnings. That’s despite losing money (stock-price-wise) over the past 12 months.

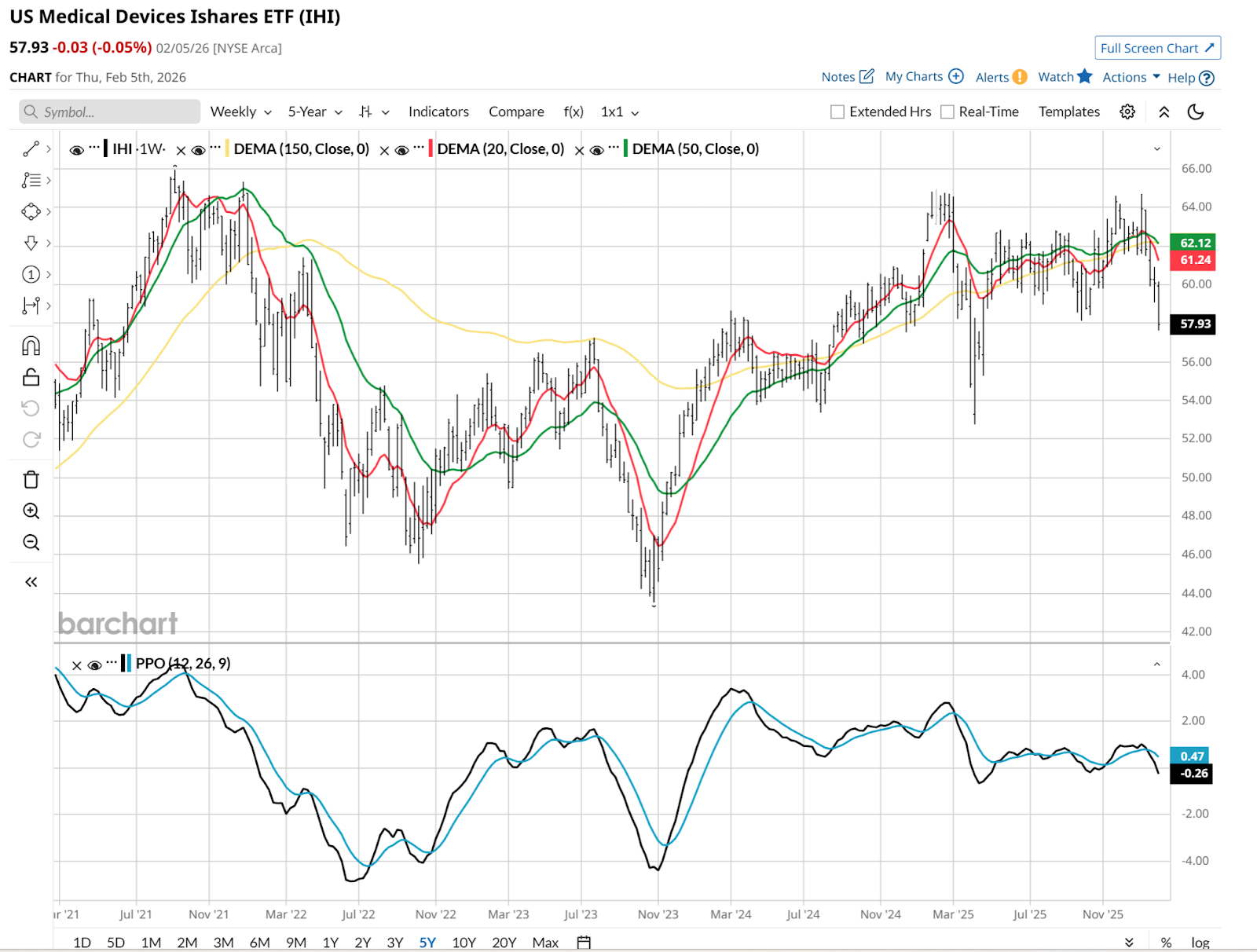

The weekly chart indicates to me that there’s a “look out below” moment possible in the near future. As in $44 if the current selling pressure market-wide continues. That’s 20% or more to the downside. No guarantees there, just a note that risk is high.

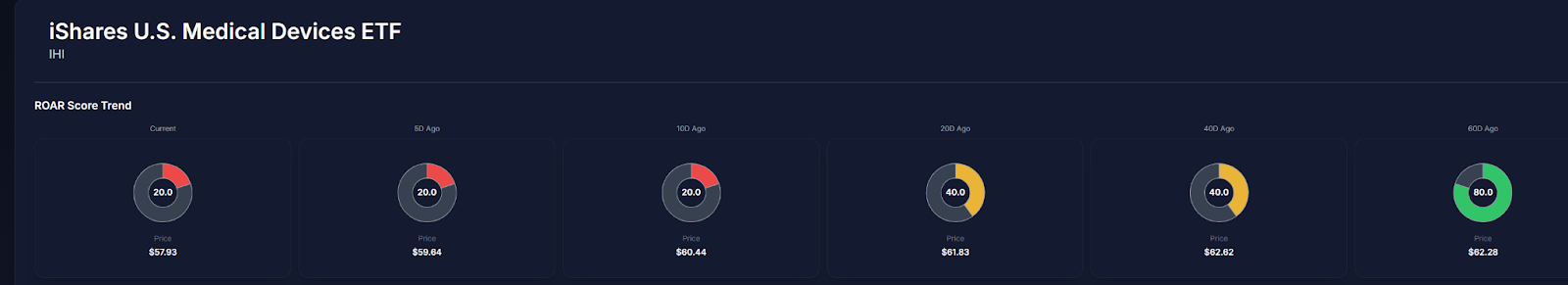

Another way to view this is in the path of its ROAR score, which has declined steadily since peaking at 80 (very low risk) three months ago. As of this writing, IHI’s ROAR score sits down at 20, implying above-average risk of major loss.

Here is the "emergency room" report on why this former high-flyer needs the paddles.

The Snapshot: Why the Sector Is Flatlining

The biggest threat to the medical device business, particularly the old guard within the group, isn't a competitor. It's a syringe. The explosion of GLP-1 weight-loss drugs like Zepbound and Wegovy has fundamentally changed the 2026 outlook for chronic disease management.

Investors are betting that if the world gets thinner, we will need fewer knee replacements, fewer heart valves, and fewer sleep apnea machines. While the actual data on procedure volume remains healthy for now, the fear of a future without chronic obesity is acting like a heavy sedative on these stock prices.

Medical devices are a global business with a massive dependence on international supply chains. The U.S. has ramped up significant tariffs on medical imports from China, Europe, and India. For some of these companies, this is a direct hit to the bottom line. They are facing a double squeeze of rising costs for components and a limited ability to raise prices for hospitals that are already operating on razor-thin margins.

Where the Jolt Could Come From

Despite the grim vital signs, there are signs of life if you know where to look.

Companies integrating artificial intelligence (AI) and digital monitoring are the ones holding the paddles. The U.S. Food and Drug Administration (FDA) has approved more than 100 new AI-enabled radiology applications in the last year alone. Companies that can prove their devices save hospitals money through predictive maintenance or remote monitoring are starting to see their charts turn upward.

The Bottom Line

The medical device sector, tracked by IHI, is currently in a "show me" phase. It has underperformed the broader S&P 500 for a while, and there’s too many headwinds that have to subside before I can see green here again.

Rob Isbitts created the ROAR Score, based on his 40+ years of technical analysis experience. ROAR helps DIY investors manage risk and create their own portfolios. His weekly investor letter can be accessed at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. And, for a change of pace, his new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)