While the broader market has seen choppy action to start this month, energy stocks have managed to stage a quiet but firm move higher. After a brutal 2025 where crude prices (CBJ26) (CLH26) fell nearly 20%, the sector is seeing a shift in sentiment.

But as I’ve said for decades, there are three certainties in the world: water is wet, the sky is blue, and the price of oil and oil stocks is volatile. So when I view this chart, I think “uh oh, here we go again.”

What do I mean? The issue with owning ETFs that track oil and oil stocks – and there are many – is that we are better off thinking of them as things we rent, not own. The moves are too often unsustainable.

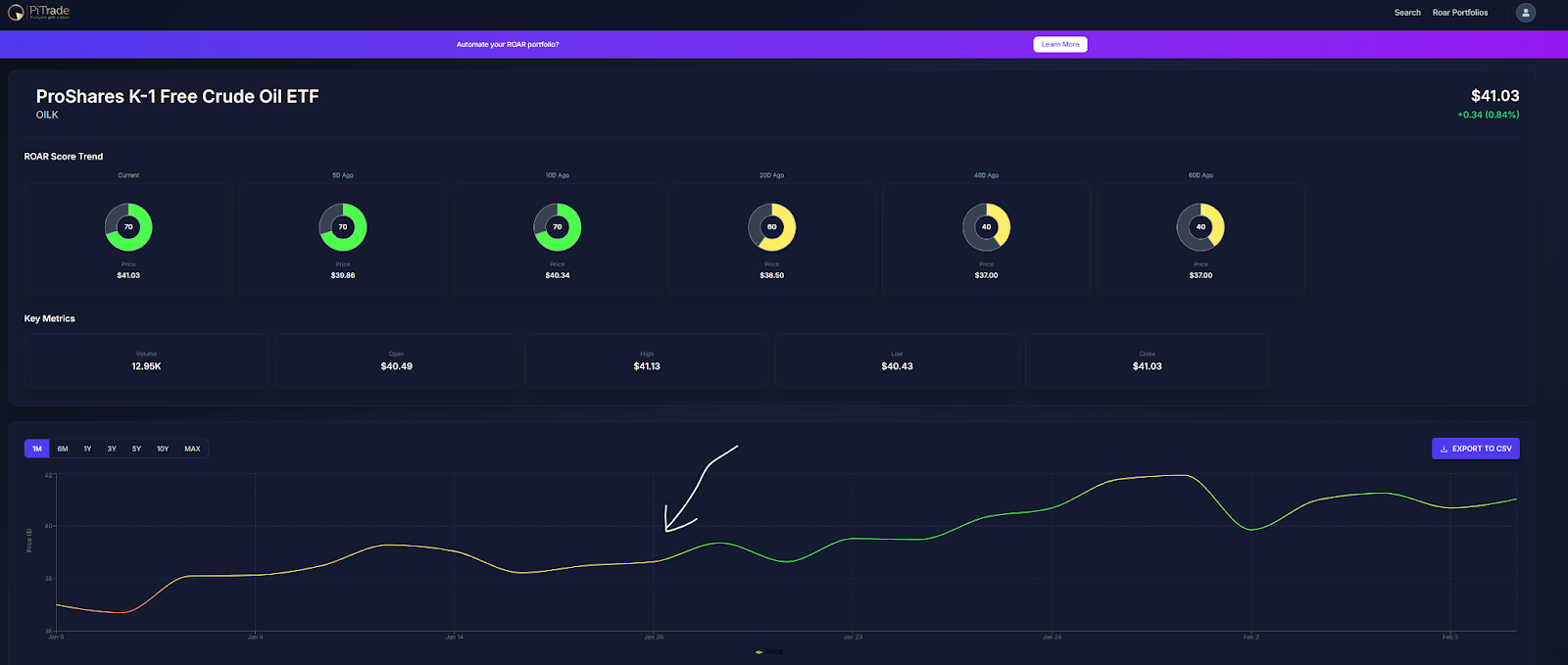

Case in point are the last two big moves, the first seen last April-June, and the second since the start of this year. From $35 on OILK to $44 so quickly is like going from 0 to 60mph in just 5 seconds. That spring move created a top that was a descending pattern which brought OILK right back down to where the serious part of the up move had begun. A good trade, but not a good investment.

Now, look at today’s move. It is similar in shape, trend, and speed. And it is already producing a Percentage Price Oscillator (PPO) indicator that looks exhausted. It has not rolled over yet, but I’m watching it carefully now. I don’t own OILK, but I do own a commodities ETF that is about 50% exposed to oil.

Risk, Opportunity, and Reward in Oil Stocks and ETFs

The heart of oil’s recent move started just about 10 days ago. My proprietary Risk Opportunity and Reward (ROAR) Score, which I recently built into an investor research portal with my friends at PiTrade.com, shows that OILK was poised for a move higher (ROAR Score = 60), then signaled a more devoted move higher around Jan. 21 (when ROAR lifted to 70, the start of the lower-risk zone).

But while any system can help spot changes in risk, the one thing no system can compete with is the ever-skittish nature of energy. The price of oil, stocks of oil drillers, and even MLPs. They tend to move together, especially at extremes.

The Bottom Line on Crude Oil

Trading in oil is about risk management. Otherwise prepare to get crushed eventually.

Investing in oil? In these modern markets, there is too much global and economic tension for me to believe long-term investing in oil could be fruitful.

I’m watching for that PPO to do more than hint at topping. Alternatively, there could be a pause and a retest of the prior high. But with a volatile market segment like this, to expect that as a “Plan A” is asking a lot.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)