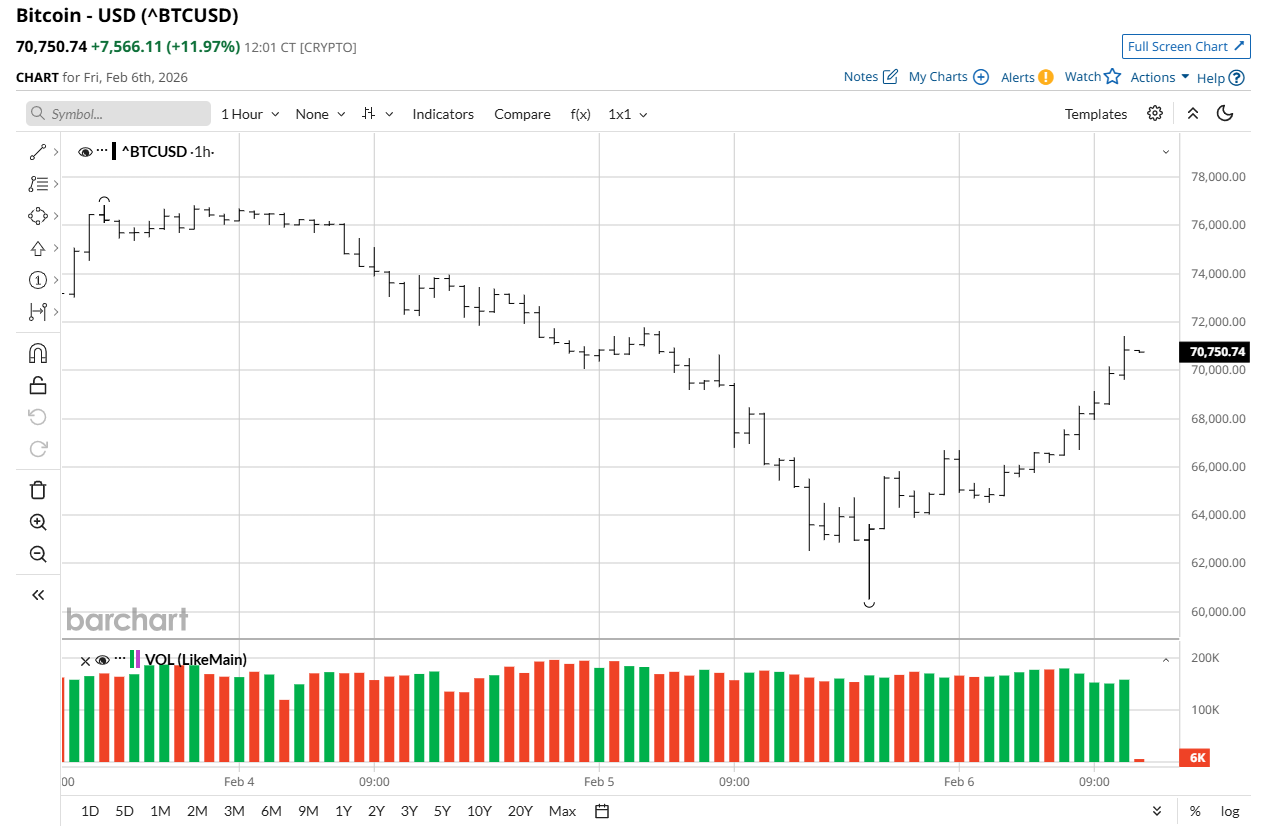

Bitcoin (BTCUSD) is extending losses today, crashing to a near two-year low of about $60,000 this morning, as a perfect storm of macroeconomic, political, and technical factors continued to pressure the world’s largest cryptocurrency by market cap.

At one point on Feb. 6, Bitcoin’s relative strength index (RSI) was seen at a historic low of 16, indicating its most oversold level since November 2018.

While BTC has reversed some of the loss in recent hours, it remains down nearly 30% versus its year-to-date high.

Tom Lee Believes Bitcoin Has Bottomed Now

Fundstrat’s head of research and long-term crypto bull Tom Lee believes “all pieces are in place for Bitcoin to bottom here.”

He has identified a rare time-and-price alignment that historically signals trend exhaustion. Plus, the market is "clean" following deleveraging that removed speculative froth in October, Lee told CNBC.

Fundstrat’s senior expert also cited “parabolic” network utility and institutional tokenization as catalysts that will eventually force a sharp mean reversion in BTC price.

Put together with extremely oversold RSI, Bitcoin appears at the cusp of a sustainable recovery in February.

Michael Saylor Remains Bullish on BTC

The massive selloff in Bitcoin that has it trading more than 50% below its all-time high has failed to deter Michael Saylor, chairman of MicroStrategy (MSTR), as well.

On the company’s conference call this week, Saylor maintained his unwavering support for BTC, saying its institutional foundation remains stronger than ever given President Donald Trump's administration’s pro-crypto agenda.

According to Saylor, the current volatility is merely a “transfer of wealth” from short-term speculators to long-term institutional entities.

Note that Bitcoin has a history of closing both February and March in green, a seasonal pattern that makes it all the more attractive in the near term.

Does the ‘Warsh’ Effect Warrant Caution?

Kevin Warsh’s nomination as the next chairman of the Federal Reserve remains an overhang for BTC, given his advocacy for hard money, higher real interest rates, and a smaller Fed balance sheet.

Still, exchange-traded funds (ETFs) are now seeing a deceleration in outflows, which may provide the structural support required to reclaim the $90,000 level over the next few weeks.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)