/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

In September, Nvidia (NVDA) made headlines when it announced intentions to invest up to $100 billion in OpenAI, the maker of ChatGPT, as part of a deal that would see OpenAI build at least 10 gigawatts of AI data centers with Nvidia systems.

But now there’s a new report that has people’s attention—according to Bloomberg, Nvidia and OpenAI are nearing a deal for a $20 billion investment—not $100 billion—that's close to being completed. Suddenly, there are numerous headlines in the media that the previous OpenAI/Nvidia deal has fallen apart, casting the leading chipmaker in a bad light.

Moreover, The Wall Street Journal reported that Nvidia has doubts about OpenAI’s business model. So, there’s a lot of drama surrounding the companies right now.

But I have another take. Let’s explore what’s really happening.

About Nvidia Stock

First, let’s take a look at Nvidia. The company soared to become the biggest in the world by market capitalization based on its graphics processing units, which can be bundled by the hundreds and work collectively to perform high-performance computing tasks, such as training and running AI programs.

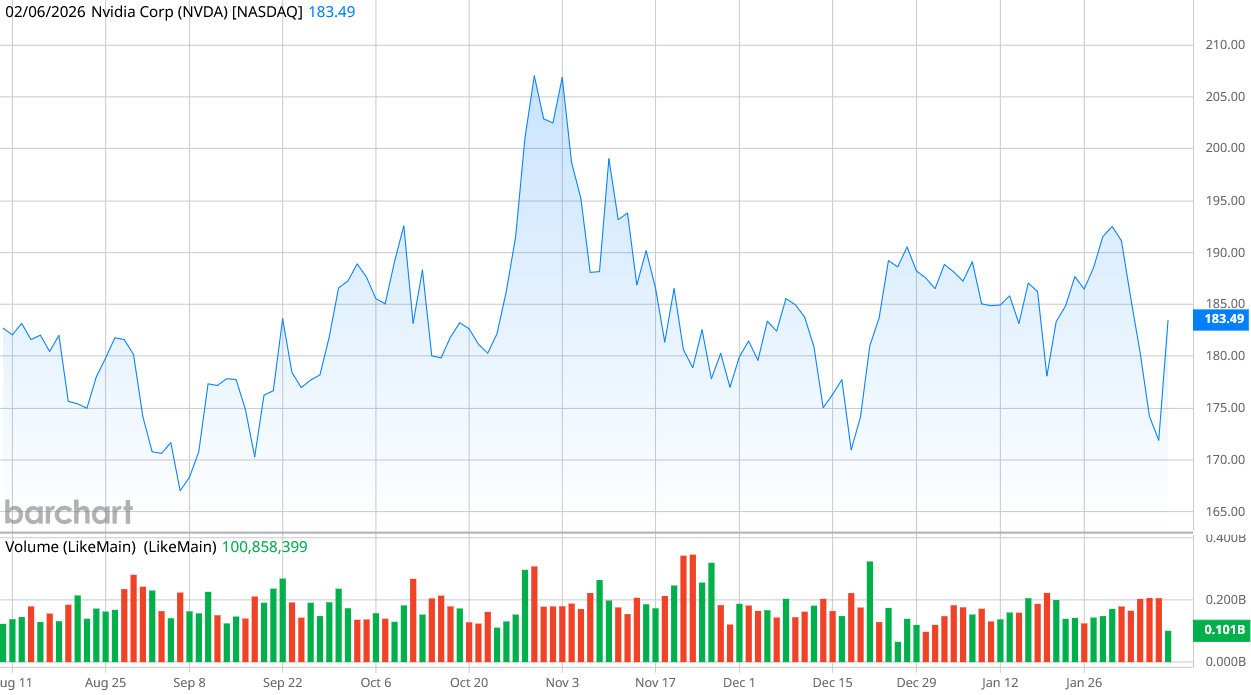

Nvidia’s market capitalization peaked at more than $5 trillion last year, and it’s currently at $4.2 trillion.

Shares are up by 42% in the last year, but that represents a slowdown for NVDA stock, which jumped by more than 700% in the last three years alone. So far in 2026, Nvidia is down 6.6% as the semiconductor sector gathers itself for another upward surge.

Shares trade at a price-to-earnings ratio of 44.6, which sounds expensive until you realize that in late 2024, the trailing P/E was 62.2. The stock’s forward P/E of 23.5 is surprisingly low, considering the dramatic run that Nvidia’s had in the last several years.

What’s Happening With Nvidia and OpenAI?

When Nvidia announced its partnership with OpenAI in September, it raised plenty of eyebrows. Some criticized it as an example of Nvidia bolstering its own numbers, since its potential $100 billion investment would be in conjunction with OpenAI spending billions on Nvidia’s GPUs.

And I understand that there are naysayers who are looking for a crack in Nvidia’s armor. It’s only human nature to build something up and watch it get torn down again, and I believe there are plenty of people who would gladly line up to take a shot at the world’s leading semiconductor company.

But before you join that line, take another look at that news release from back in September. In it, Nvidia was apparent that it intends to invest in OpenAI “progressively as each gigawatt is deployed.” It also goes on to say that the first gigawatt of Nvidia systems would be deployed in the second half of 2026 on Nvidia’s next-generation Vera Rubin platform.

So, the reality is that Nvidia is close to completing what would be the first segment of that investment—just as the two sides announced nearly six months ago.

We’ll Likely Find Out More Later This Month

Nvidia is scheduled to report its fiscal fourth quarter 2026 earnings results on Feb. 25. And in that report and the subsequent earnings call, CEO Jensen Huang will surely be questioned about the OpenAI deal, as well as Nvidia’s other partnerships.

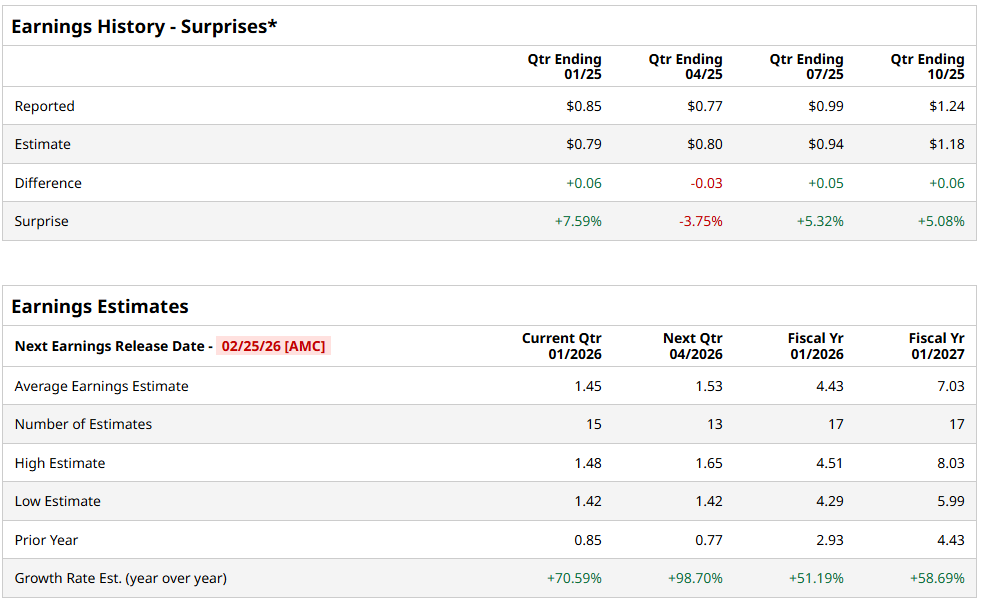

But I believe that the earnings report will also put plenty of concerns that people may have about Nvidia to rest. Nvidia’s Q3 2026 earnings showed record revenue of $57 billion, with $51.2 billion of that coming from the company’s data center segment. Nvidia’s revenue was up 62% from a year ago, and its net income and earnings per share jumped 65% and 67%, respectively.

The consensus estimate by analysts for Nvidia’s Q4 2026 is EPS of $1.45, which would be up more than 70% from a year ago. If Nvidia hits those numbers and shows continued record demand for its Blackwell and Rubin chips—as I expect it will—then you can expect NVDA stock to resume its upward move following that earnings report.

On the date of publication, Patrick Sanders had a position in: NVDA . All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)