Russia considers Ukraine Western Russia, while the US and NATO countries believe the country is part of free Eastern Europe. As of the end of last week, over 150,000 Russian troops have amassed along the Ukraine-Russian border. Tensions have risen to the highest level since the end of the Cold War and the Cuban Missile Crisis in the early 1960s. The US and European countries have threatened sanctions against Russia if they attack Ukraine. The dialogue and negotiations are ongoing, but the threat of war remains a clear and present danger.

Russia produces many essential raw materials. A war could have substantial impacts on commodity flows worldwide.

Markets reflect the economic and geopolitical landscapes. Commodities are global assets. The current situation could impact prices and dramatically increase volatility in the commodities asset class when inflation is already pushing prices to multi-year and, in some cases, all-time highs.

Russia’s influence in the crude oil market has increased

In 2016, when the nearby price of NYMEX crude oil dropped to the $26 per barrel level and Brent futures were near $27 per barrel, OPEC, the international oil cartel, turned to Russia for cooperation to stabilize the price and coordinate production policy to push the price higher. President Vladimir Putin saw the call for assistance as another opportunity to broaden his influence in the turbulent Middle East. The Russians had already established relations with the Syrian and Iranian governments, and a relationship with the other Middle Eastern oil-producing countries only enhanced Russia’s position in the region.

Since then, OPEC has not made a significant move in production policy without Russian participation. While Russia has not joined OPEC, the market refers to the cartel as OPEC+, with the plus meaning decisions come from Riyadh, Saudi Arabia, and Moscow.

In early 2021, US energy policy took a dramatic turn as the Biden administration addressed climate change by supporting alternative and renewable energy sources while inhibiting the production and consumption of fossil fuels. After decades of striving to achieve energy independence from the Middle East, the US became the swing producer of crude oil. However, falling inventories and production handed petroleum’s pricing power to the cartel, with Russia playing a leading role. President Putin’s calculated and strategic move to embrace and cooperate with OPEC made Russia an influential force and dominant factor in the energy commodity that powers the world.

Russia is the world’s leading exporter of wheat

While most market participants would select crude oil as the world’s most political commodity, history teaches that wheat is the agricultural product that has caused the most upheaval when the price rises and availabilities become scarce. Wheat is the primary ingredient in bread, a nutritional staple. From the French Revolution to the Arab Spring in 2010, rising wheat prices have caused bread riots that toppled governments.

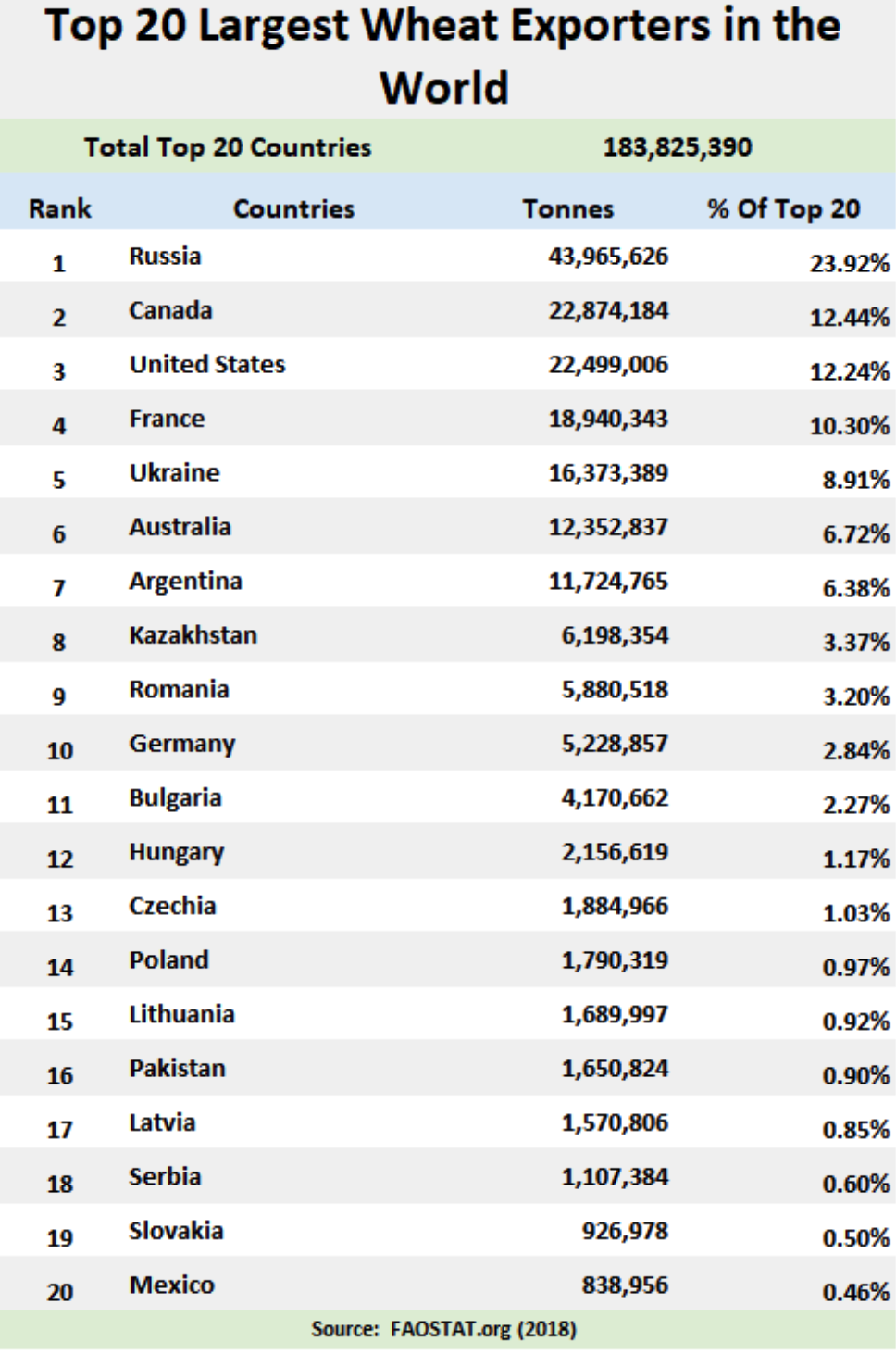

Russia is the world’s top exporter of the grain.

Source: beef2live

As the chart shows, Russian exports account for nearly 24% of the wheat that travels worldwide. Russian exports were almost double that of Canada and the US, the second and third-leading wheat exporting countries. Nearby CBOT soft red winter wheat prices were hovering around the $8 per bushel level on February 18, the highest price in a decade since 2012.

Russia is one of two platinum group metals producing countries

Platinum group metals that cleanse toxins from the environment in automobile catalytic converters come from South Africa and Russia. In Russia, the PGMs are byproducts of Siberian nickel production.

Palladium is the PGM favored by gasoline-powered catalytic converters, and Russia’s Nornickel is the world’s leading palladium producer.

In 2021, palladium rose to an all-time high at the $3,000 per ounce level. At the end of last week, the price was just under $2,300 per ounce.

Russia produces aluminum

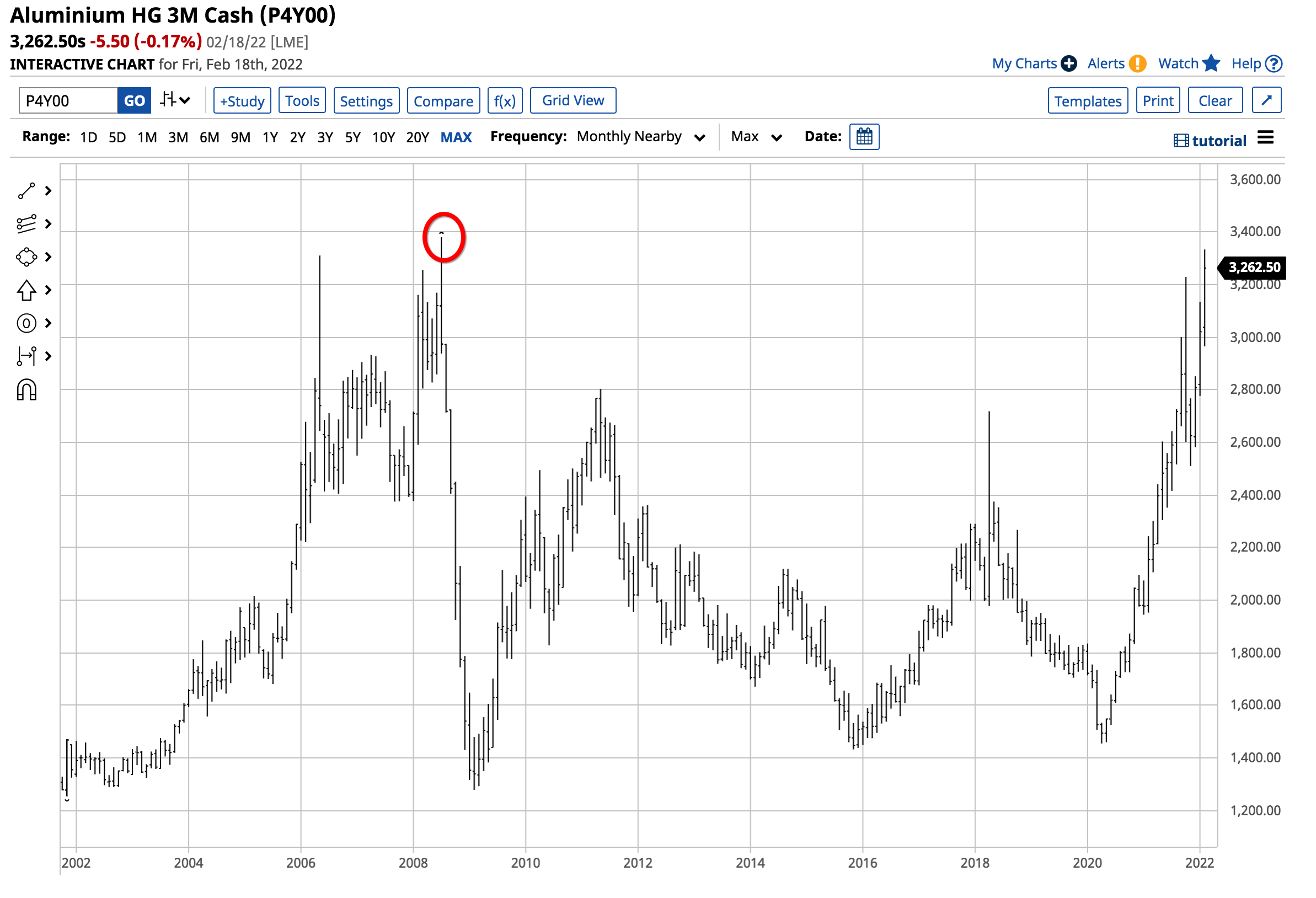

Aluminum is a critical nonferrous metal building block for infrastructure and many products. China is the world’s leading aluminum-producing country, with 37 million metric tons of output in 2020. Russia and India were virtually tied for second place with around 3.6 million metric tons of production.

As the chart highlights, at over $3,260 per ton at the end of last week, three-month LME high-grade aluminum forwards were a stone’s throw from the 2008 all-time $3,380.20 high.

Russia produces lots of fertilizers

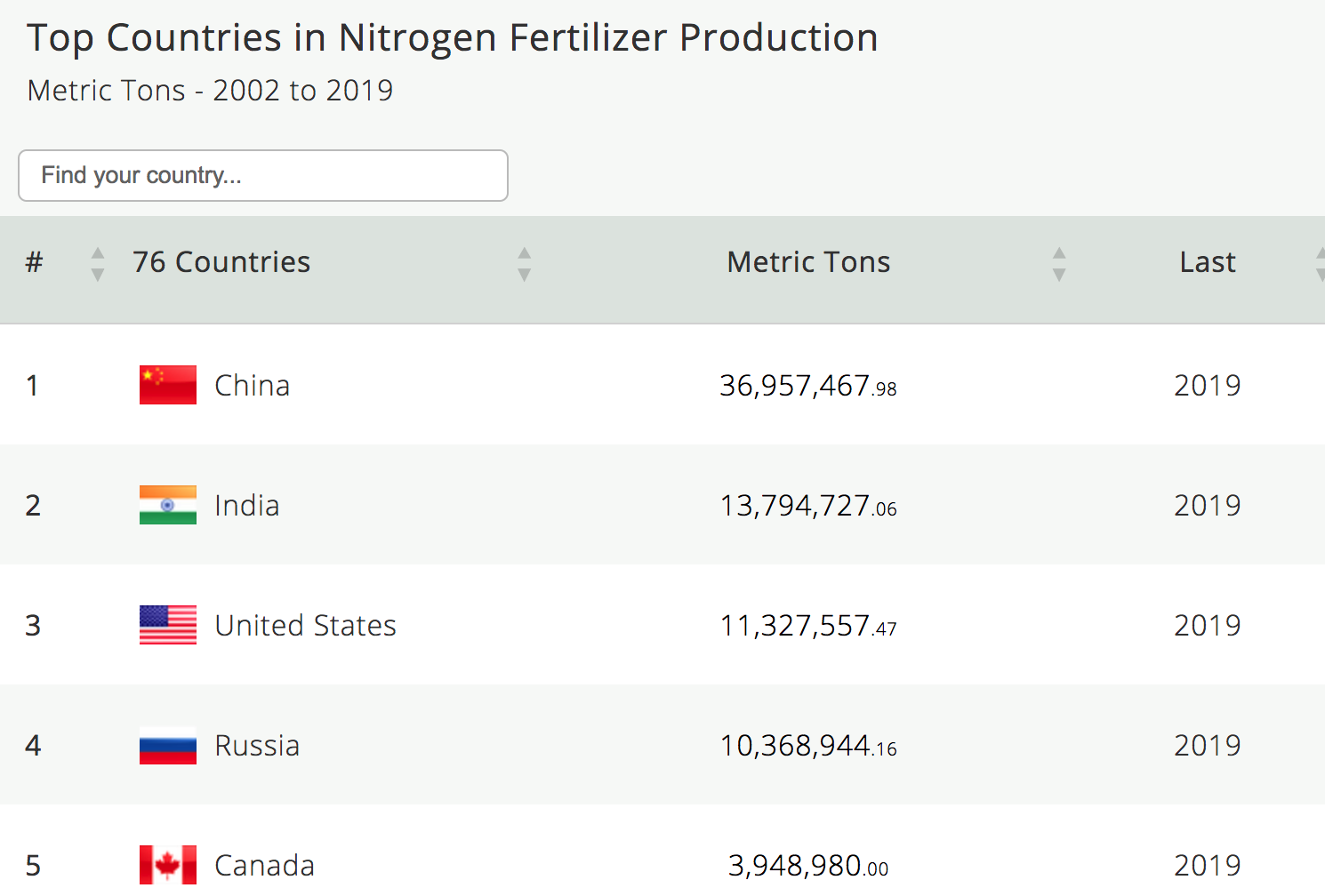

Fertilizer is a critical input for farmers that grow the crops that feed the world. Russia is a leading fertilizer producer.

Source: Nationmaster

The chart shows that in 2019, Russia was the world’s fourth-leading nitrogen fertilizer producer. Russia is second in potash production, and in 2019, Russia led the world in urea output. Over the past months and years, fertilizer prices have soared.

Russia is also a leading producer of iron and steel, gold and other precious metals, and wood. The prices of all commodities have soared since the early 2020 lows.

As the world faces the potential of a Russian incursion into Ukraine, the US and Europe have warned that President Putin and Russia would face severe sanctions if war breaks out. President Putin and China’s President Xi have agreed on a framework that would help Russia avoid some of the ramifications of sanctions. Meanwhile, as tensions remain at the highest level since the Cold War, Russian embargos on many commodities it exports worldwide could wreak havoc with prices as shortages develop and prices soar. Moreover, war will increase logistical issues as shipping lanes could become dangerous. The Black Sea Ports, a main shipping terminal for wheat and other commodities, is surrounded by Romania, Bulgaria, Georgia, Moldova, Turkey, Russia, and Ukraine. War in the region could create wheat shortages over the coming months and years.

A Russian incursion into Ukraine and severe sanctions will have broad-ranging consequences for commodity markets. Crude oil, wheat, aluminum, palladium, fertilizer, and other raw material prices could become very volatile over the coming days, weeks, and months. President Putin’s actions will determine if supply disruptions dominate the price action.

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)