- Commodity markets can basically be broken into tow categories: storable and non storable (excluding Treasuries, stock index futures, etc., a discussion for another day).

- Futures spreads are useful tool for understanding real market fundamentals of both categories, we just have to adjust the analysis accordingly.

- We had a good idea of what last Friday's Cattle on Feed (as well as Hogs and Pigs) report would show based on what occurred in live cattle futures spreads during November.

I had the opportunity to visit with a good friend this morning about futures spreads. What a shock, I know, but it is a subject I find fascinating given it all it tells us about fundamentals. In this case it had to do with live cattle, and what we knew ahead of last Friday’s Cattle on Feed report. Let’s set that aside for a moment and talk about some of the key differences in understanding futures spreads of the various commodity market sectors.

As you know, for many of the grain and oilseed markets we can look at the difference in futures prices and see one of two possibilities:

- If there is a carry (contango) in spreads, we can measure the bullishness or bearishness of the underlying fundamentals by dividing the carry in the spreads by calculated full commercial carry (total storage and interest costs to hold bushels in a commercial facility). A long time ago in a galaxy far, far away I came up with simply breaking the reading into thirds: 33% or less is bullish, 34% to 66% is varying degrees of neutral, and 67% or more is bearish.

- If a spread (or spreads) is inverted (in backwardation) then it is bullish. End of story. And as Horton the Elephant taught us so long ago, “An inverse is an inverse no matter how small.”

These same truths can also be applied to energies, metals, and softs, though we don’t always know (at least I don’t know) what daily storage rates are. This means we have to view a carry/contango situation a bit differently and use historic comparisons as a guide. But again, inverses mean bullish fundamentals.

But then there’s livestock where we can forget about everything we want to apply regarding carry and inverses. In fact, we need to throw those concepts out completely and simply look at spreads in terms of (+) or (-), and how they relate to historic spread levels. Why? Because livestock are not storable commodities (setting aside arguments about Cold Storage reports and holding live cattle back for the time being). Given this, a (+) spread, or one that would be considered inverted in the other sectors, can be bearish while a (-) spread (one that is showing a strong carry/contango) can be bullish. Let’s look at a couple examples:

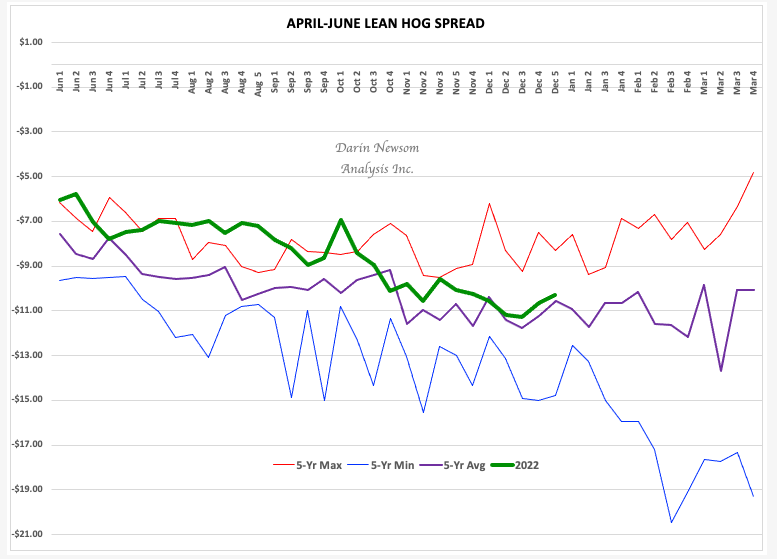

- The April-June lean hog spread is sitting at (-$10.275) midday Monday. Applying the rules of storable commodities, this would be considered an incredibly bearish supply and demand situation. However, the previous 5-year average weekly close for this week is (-$10.575) with the previous 5-year high weekly close (-$8.30), meaning the 2022 spread is actually indicating neutral-to-bullish fundamentals. Note the trendline of the previous 5-year highs is deep in (-) territory for the life of the spread.

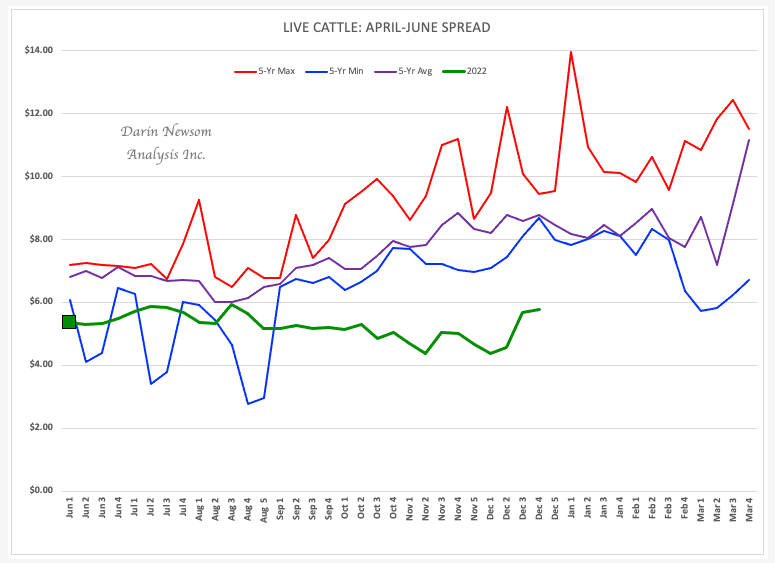

- The April-June live cattle futures spread (+$5.775) midday Monday. Again, first glance would say “Inverted, then bullish.” But live cattle are not storable, and the trendline for the previous 5-year low weekly closes comes in this week at (+$8.675). The 2022 spread is $3 below that, indicating a long-term bearish supply and demand situation that fit the latest Cattle on Feed report that showed large placement of lightweight cattle during November.

I’ll say it again, in the grand scheme of things we do not need USDA reports and their imaginary world of supply and demand numbers. We can read fundamentals every day, all day in futures spreads. If we know how.

And don’t get me started on those “analysts” that rate these silly reports as “friendly” or “unfriendly”.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Businessman%20touching%20the%20brain%20working%20of%20Artificial%20Intelligence%20(AI)%20Automation%20by%20Suttiphong%20Chandaeng%20via%20Shutterstock.jpg)