/EV%20in%20showroom%20by%20Robert%20Way%20via%20Shutterstock.jpg)

Nio (NIO) shares rallied on Thursday after the Chinese electric vehicle (EV) specialist confirmed it will report its first-ever adjusted profit in the fourth quarter of 2025.

In a press release dated Feb. 5, the automaker said it sees its non-GAAP operating profit falling between RMB 700 million and RMB 1.2 billion – a big improvement from the RMB 5.5 billion loss last year.

Despite today’s surge, Nio stock remains down over 35% versus its October high, which makes it even more attractive as a long-term holding.

Should You Invest in NIO Stock Today?

Nio’s profitability milestone is a feature of growing sales and its commitment to cutting costs. In fact, the EV maker is finding success in lowering manufacturing costs, which may boost its margin over time.

Risk-tolerant long-term investors should consider investing in the NYSE-listed firm today because as a profitable name, it could attract greater institutional interest and push its stock price higher through the remainder of 2026.

Nio shares are worth owning also because they’re trading at a compelling 0.94x sales only. This makes them less expensive to own than Chinese peers like Xpeng (XPEV).

Why Else Are NIO Shares Worth Owning?

NIO’s recent launch of the ONVO and Firefly brands have positioned it well to capture both premium and budget-conscious consumers.

Plus, management’s guidance for an annual growth trajectory of at least 40% makes this EV stock even more attractive to own in 2026.

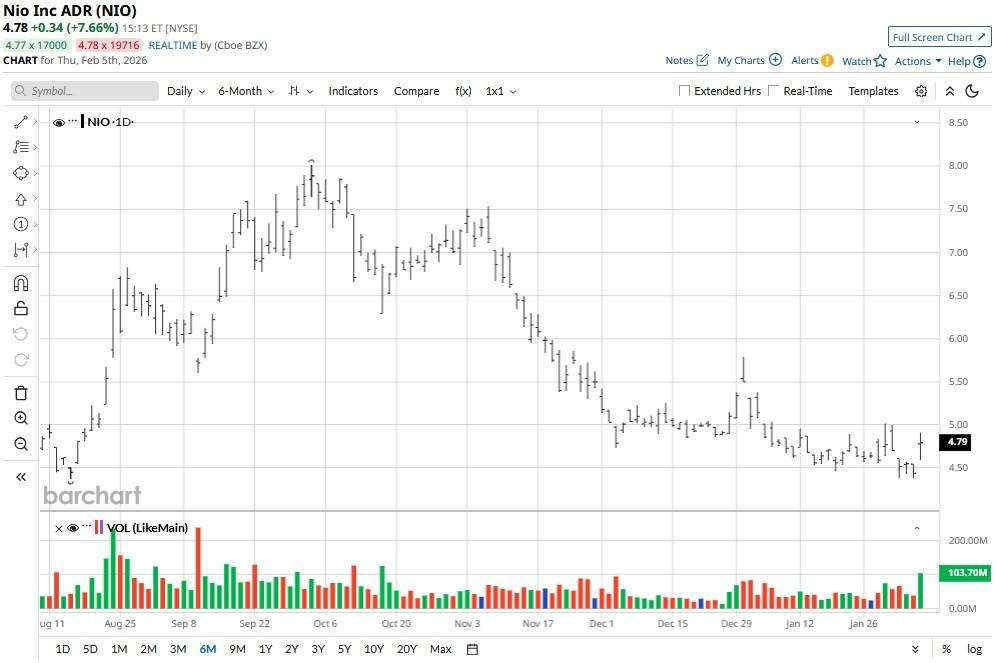

Note that Nio’s stock price rally pushed it well past its 20-day moving average (MA) on Thursday, indicating the near-term trend is turning bullish now.

Investors should also note that the firm’s expanding battery-swapping network recently surpassed 100 million cumulative swaps, providing a distinct competitive moat.

How Wall Street Recommends Playing Nio

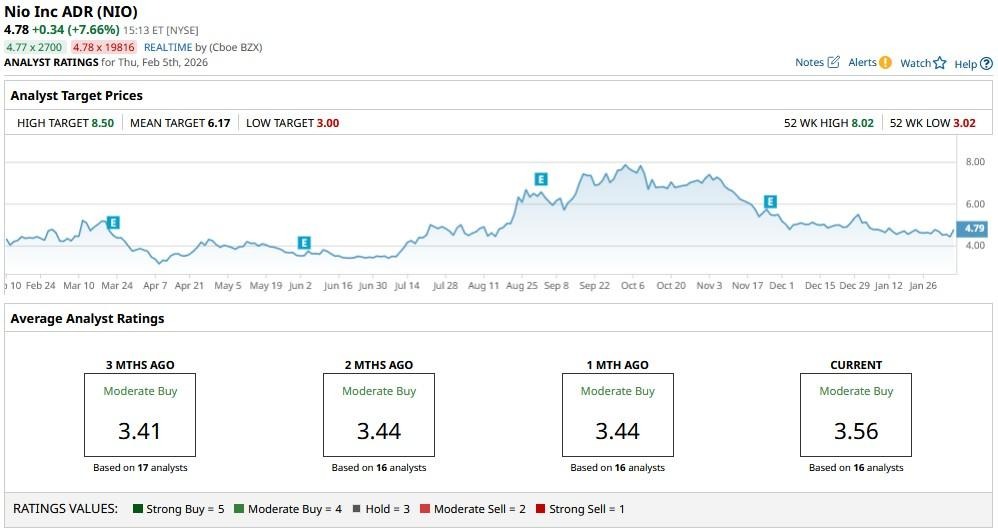

Investors could also take heart in the fact that Wall Street analysts remain significantly bullish on NIO shares for the next 12 months.

According to Barchart, the consensus rating on the Chinese EV maker remains at “Moderate Buy” with the mean target of $6.17 indicating potential upside of more than 25% from current levels.

This article was created with the support of automated content tools from our partners at Sigma.AI. Together, our financial data and AI solutions help us to deliver more informed market headline analysis to readers faster than ever.

On the date of publication, Wajeeh Khan did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)