/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

Advanced Micro Devices (AMD) recently reported a solid fourth quarter, delivering revenue and earnings that comfortably exceeded Wall Street expectations. The quarterly results confirmed that the company’s operational momentum remains strong, supported by significant demand across key segments.

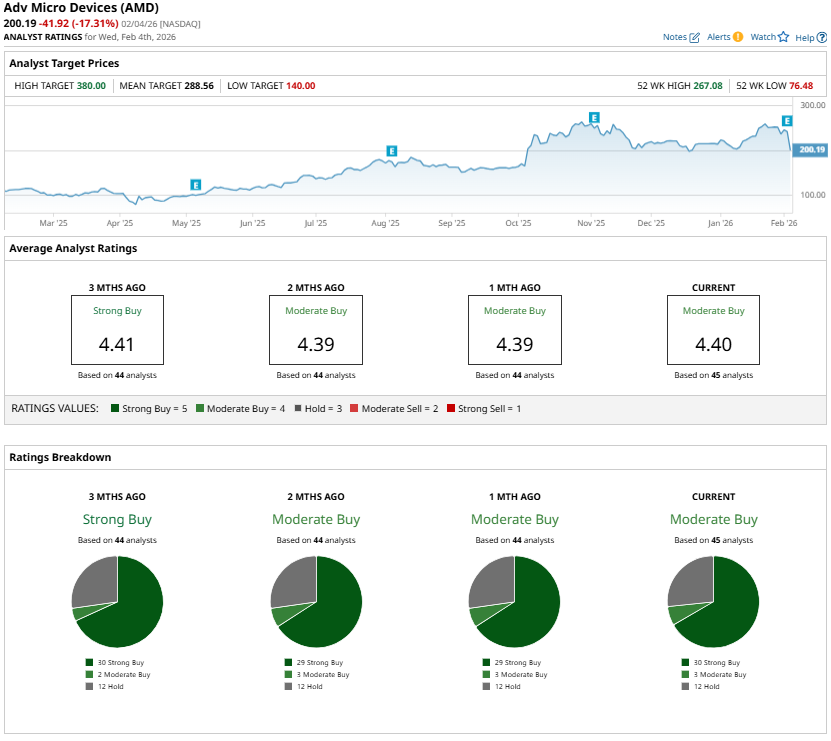

Yet, despite this impressive performance, AMD stock fell sharply, closing more than 17% lower following the earnings release. The decline reflects how elevated investor expectations had become going into the report, with the market hoping for even more aggressive forward guidance from management.

From a fundamental perspective, AMD’s long-term growth prospects remain compelling. The company continues to strengthen its competitive position in high-performance computing, and its data center business in particular is expected to be a major growth engine in 2026 and beyond as enterprise and cloud customers increase spending on advanced chips.

While short-term sentiment can weigh on share prices, AMD’s underlying business trends suggest that the recent selloff offers an attractive entry point. Further, the average price target of $288.56 implies substantial upside from current levels around the $191 mark, with forecasts pointing to roughly 50% potential appreciation over the next 12 months.

Factors Supporting AMD Stock

While AMD stock dropped sharply following Q4 earnings, the company is well-positioned to deliver strong financial performance in 2026, supported by solid revenue growth across its core businesses, particularly high-performance computing and artificial intelligence (AI). One key growth catalyst is AMD’s data center segment, which is expanding rapidly. Revenue is driven by accelerating deployments of the Instinct MI350 Series GPUs and ongoing server market share gains.

Notably, the adoption of AMD’s fifth-generation EPYC processors has ramped meaningfully, and at the same time, its fourth-generation EPYC CPUs continue to sell well.

Looking ahead, demand trends remain favorable across customer segments. Cloud hyperscalers continue to expand capacity to support growing cloud and AI workloads, driving sustained demand for AMD’s server products.

Hyperscalers are scaling infrastructure to meet AI-driven compute needs, while enterprises are modernizing aging data centers. AMD’s upcoming Venice CPU is already generating strong customer interest, with active engagements underway for large-scale cloud deployments and broad OEM platform support expected at launch later this year.

AI represents another growth engine. AMD reported record Instinct GPU revenue in the fourth quarter, driven by the ramp-up of MI350 Series shipments. This marks a new phase in Instinct adoption, as AMD deepens relationships with existing partners while onboarding new customers. The forthcoming MI400 Series further broadens AMD’s AI portfolio, enabling the company to address a full spectrum of cloud, high-performance computing, and enterprise AI workloads.

Based on the strength of its EPYC and Instinct roadmaps, AMD appears well-positioned to grow data center revenue at an annual rate exceeding 60% over the next three to five years. Management’s longer-term ambition to scale the AI business to a multi-billion-dollar business appears within reach.

Beyond data centers, AMD’s client and gaming segment is also contributing to the bullish thesis. Its PC processor business delivered an exceptional performance, and momentum is expected to carry into 2026. Demand for multiple generations of Ryzen desktop and mobile CPUs remains strong, supporting its growth.

Overall, with accelerating momentum in the data-center AI business, server share gains, an expanding product roadmap, and analysts projecting meaningful upside from current levels, the recent selloff presents a compelling buying opportunity for long-term investors.

AMD’s Valuation Suggests a Buy

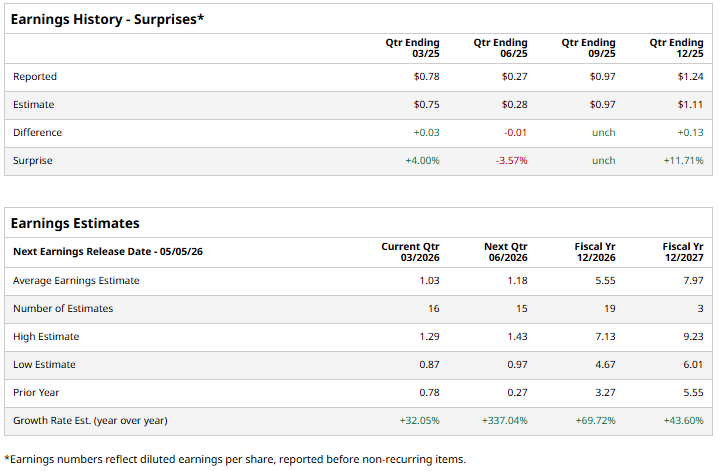

AMD’s current valuation points to a buying opportunity. The company is expected to deliver strong financial performance in 2026, and the recent pullback in its share price has made AMD stock more attractive relative to its earnings growth outlook.

AMD stock trades at a forward price-to-earnings (P/E) ratio of 43.7 times, which is compelling given projected earnings growth of nearly 70% in 2026, followed by another 44% increase in 2027. AMD’s solid growth trajectory and attractive valuation support the bull case.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)