/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)

Broadcom (AVGO) shares have retreated sharply in recent months, sliding more than 23% from their 52-week high. The pullback comes despite strong, AI-driven demand and strength in the infrastructure software offerings.

Ongoing geopolitical uncertainty has made investors cautious, while questions around margins have added to the pressure. Together, these factors have weighed on sentiment, even as Broadcom’s end markets remain resilient.

Wall Street, however, remains optimistic on the stock. Analysts expect the company to continue capitalizing on AI-related demand. Further, they see meaningful upside potential for Broadcom stock over the next 12 months.

Solid Demand to Support Recovery in Broadcom’s Stock

Broadcom’s growth outlook remains solid, supported by sustained demand across both AI semiconductors and infrastructure software. Fiscal 2025 marked a record year for the company, with revenue rising 24% year over year (YoY) to $64 billion. Growth was powered by AI and VMware.

AI-related revenue surged 65% to $20 billion, pushing semiconductor revenue to a record $37 billion, while the infrastructure software segment expanded 26% to $27 billion, driven by strong adoption of VMware Cloud Foundation (VCF).

Management expects customer spending on AI to accelerate further in fiscal 2026, supporting its growth, and could lead to a recovery in its share price.

A key driver is Broadcom’s custom accelerator, or XPU, business. These chips are increasingly being adopted by hyperscalers and have wide applications. Importantly, XPUs are not limited to internal workloads. In some cases, its customers are extending them externally to third-party users. Management believes this external scaling opportunity could be significant.

Adding to the positives is AVGO’s order book. Broadcom secured a $10 billion order to supply its latest Ironwood TPU racks to Anthropic, followed by an additional $11 billion order from the same customer for delivery in late 2026. During the fourth quarter, the company also added a fifth XPU customer with a $1 billion order scheduled for late 2026 delivery.

In addition, AI networking demand has been stronger as customers build data center infrastructure. Broadcom’s AI switch backlog now exceeds $10 billion, driven by record bookings for its Tomahawk 6 switches. The company has also logged record orders for DSPs, optical components such as lasers, and PCI Express switches. Notably, Broadcom ended the fourth quarter with more than $73 billion in AI-related orders, nearly half of its total consolidated backlog of $162 billion.

Management expects most of this AI backlog to be delivered over the next 18 months, with AI revenue projected to double YoY to $8.2 billion in the first quarter of fiscal 2026.

Meanwhile, infrastructure software performance remains resilient. Fourth-quarter bookings reached $10.4 billion, up from $8.2 billion a year earlier, lifting software backlog to $73 billion. While renewals are expected to be seasonally softer in the first quarter, management still forecasts low double-digit growth in infrastructure software revenue for fiscal 2026.

Overall, accelerating AI-driven revenue and steady software growth from VMware bode well for continued expansion in 2026. Although margins may face some pressure from product mix, operating leverage should meaningfully support earnings growth and, ultimately, drive recovery in its share price.

Here’s What Analysts Expect for AVGO Stock

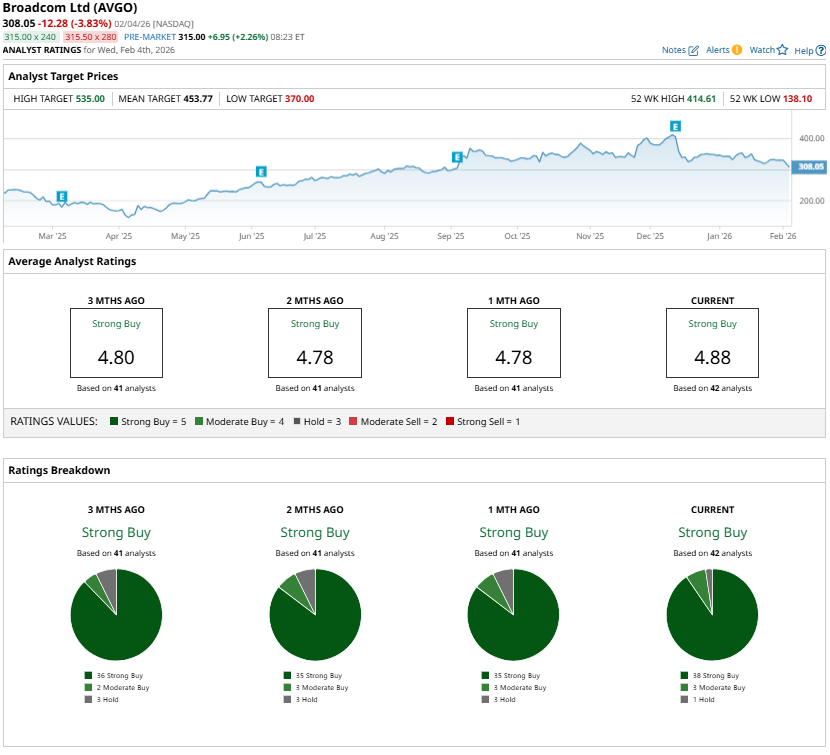

Analysts remain optimistic about AVGO stock and maintain a “Strong Buy” consensus rating. The average price target of $453.77 suggests more than 47% upside from its Feb. 4 closing price of $308.05.

Broadcom’s valuation further strengthens this positive outlook. AVGO stock trades at a forward price-to-earnings multiple of 36.85, which appears attractive given projected earnings growth of 54.4% in fiscal 2026 and an additional 40.7% in 2027. AVGO’s strong growth and a reasonable valuation support analysts’ bullish investment thesis.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

/Tesla%20Inc%20tesla%20by-%20Iv-olga%20via%20Shutterstock.jpg)

/Microsoft%20sign%20at%20the%20headquarters%20by%20VDB%20Photos%20via%20Shutterstock.jpg)