Entertainment giant Disney's (DIS) shares fell more than 7% in yesterday's trading session, even after reporting results that exceeded Street expectations and an optimistic tone from outgoing CEO Bob Iger about the business. The reason was the citation of “international visitation headwinds.” To put it simply, the company sounded a note of caution about foreign visits to its theme parks.

Ironically, the theme park business drove the bulk of the positive results for the company in the quarter, with its head, Josh D'Amaro, also being one of the frontrunners to succeed Iger. The company had earlier clarified that it would name Iger's successor during this quarter.

Overall, the $201.4 billion company's stock has been a laggard for a long time, declining by almost 10% over the past year and by 38% over the past five years. Considering this, is the time right to be a contrarian and add the stock, or is it wise to wait until clarity emerges, until the impending upheaval at the top of the management clears out? Let's find out.

Q1 Beat (But Nothing More)

Disney's results for the first quarter of fiscal 2026 reported a beat on both the revenue and earnings fronts. That is the good news. The bad news is that growth continues to elude the company.

For instance, revenues grew by just 5% from the previous year to $26 billion, whereas earnings actually declined 7.4% from the prior year to $1.63 per share, marking the second consecutive quarter of yearly earnings fall. Although the company has done well to beat Street estimates for nine quarters straight, the reality is that expectations from the “House of Mouse” have been low.

The much-touted experiences division, which includes the theme parks, resorts, and cruise ships, among others, saw record revenues of $10 billion. Yet, it was up by just 6% on a year-over-year (YoY) basis as consumers remain starved of cash to spend on such discretionary items. While its biggest division of entertainment saw an annual growth of 7% to $11.6 billion, thanks to box office hits such as Zootopia 2 and Avatar: Fire and Ash, heightened competition in the sports segment led to a dismal 1% growth in the same period to $4.9 billion.

Additionally, the situation in terms of cash flow also saw an ugly turn, wherein net cash flow from operations slipped to just $735 million for the quarter ended Dec. 27, 2025. This marked a whopping drop of 77% from the previous year, turning the company's free cash flow negative to the tune of $2.3 billion (vs. +$735 million in the year-ago period). The last time this happened was in Q1 FY 2023. Overall, the company closed the quarter with a cash balance of $5.7 billion, lower than its short-term debt levels of $10.8 billion.

Notably, dividend is also not an attractive point for the stock anymore, as its dividend yield of 1.34% remains below the sector median of 1.55%. The payout ratio at about 26% gives the company room for growth in its dividends, yet, amid dwindling profits, I reckon that is a step the company will not take now.

On the other hand, in terms of valuation, the DIS stock continues to trade at elevated levels. This is despite a downturn in the stock over the past year. Its forward P/E, P/S, and P/CF at 17.08, 2, and 13.60 are all above the sector medians of 16.38, 1.29, and 7.83, respectively.

What Is The Cause For Optimism?

The financial situation looks a bit topsy-turvy for Disney right now. Yet there is still a clear thread of optimism among investors, rooted in several deliberate strategic moves that, if executed well, could help the stock regain its footing.

One of the most important among them is the aggressive push to expand internationally, which has taken on added urgency after earlier caution about weaker foreign tourist flows into U.S. parks. Disney has committed to a $60 billion, 10-year capital plan focused squarely on elevating the experiences segment. A standout element is the upcoming launch of Disney Adventure next month. Rather than relying on long-haul travel from Asia to U.S. destinations, the company is bringing a park-like experience closer to the customer. The vessel will accommodate roughly 6,700 guests and function as a floating theme park, targeting the fast-growing middle-class consumer base in Southeast Asia.

Additionally, in the region, Zootopia land at Shanghai Disneyland continues to post record attendance levels, while the recently opened World of Frozen has helped stabilize profitability at the historically challenged Hong Kong resort.

In Europe, Disneyland Paris is in the midst of its most substantial redevelopment since opening. The transformation nearly doubles the size of the second park, now rebranded as Disney Adventure World, aiming to convert it into a genuine multi-day destination that lifts per-guest spending significantly.

Disney is also borrowing proven tactics from other digital platforms. It is introducing gamification features on Disney+ in partnership with Epic Games, while adding deeper commerce capabilities to its direct-to-consumer offering, drawing inspiration from Roku's (ROKU) model. These steps are intended to deepen user engagement and open new monetization avenues. Moreover, the full consolidation of Hulu ownership has removed a major hurdle to a single, streamlined streaming app experience in the United States. Management expects complete unification of the platforms domestically by 2026. Combining the services into one interface should sharpen competitive positioning and reduce operational complexity for subscribers.

Finally, after a strong 2025 box office performance, the 2026 slate carries considerable anticipation. Key theatrical releases include The Devil Wears Prada 2, Toy Story 5, Avengers: Doomsday, The Mandalorian & Grogu, and a live-action Moana. On the series side, several high-profile returning series, among them Daredevil: Born Again (Season 2), X-Men ’97 (Season 2), and Shōgun (Season 2), are expected to draw strong viewership. Collectively, these initiatives reflect a multi-front effort to strengthen revenue stability, expand addressable markets, and improve per-customer economics, factors that could support a more constructive long-term outlook for the shares if execution remains consistent.

Analyst Opinion on DIS Stock

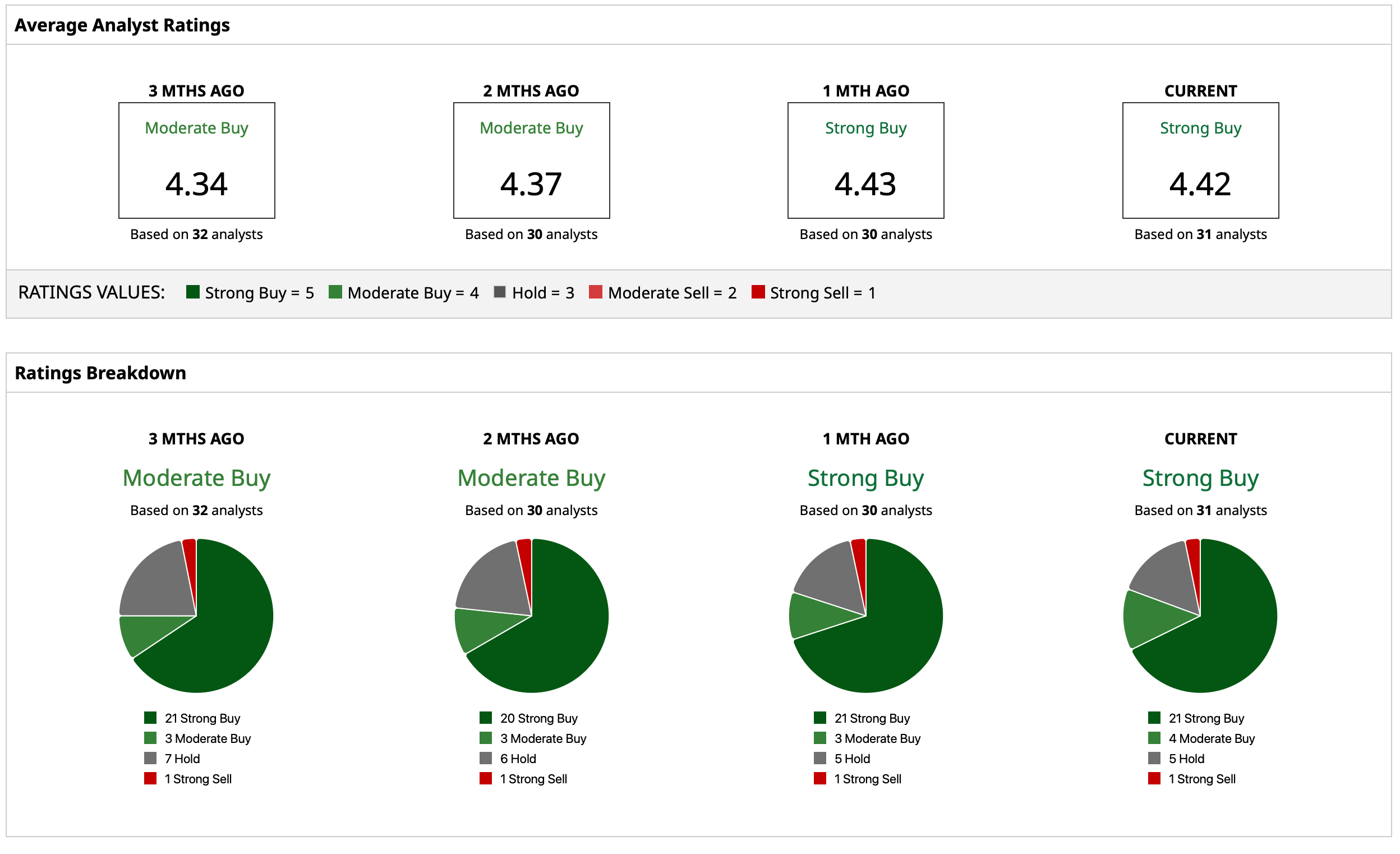

Analysts on Wall Street have deemed the DIS stock to be a consensus “Strong Buy,” with a mean target price of $134.89. This denotes an upside potential of about 29% from current levels. Out of 31 analysts covering the stock, 21 have a “Strong Buy” rating, four have a “Moderate Buy” rating, five have a “Hold” rating, and one has a “Strong Sell” rating.

On the date of publication, Pathikrit Bose did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20phone-by%20rafapress%20via%20Shuterstock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20office%20sign-by%20Poetra_RH%20via%20Shutterstock.jpg)