/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

After a strong rally, Broadcom (AVGO) stock has come under pressure, dropping 20% from its 52-week high of $414.61. Broadcom is a key supplier of semiconductors, enterprise software, and security solutions, and the company continues to benefit from solid demand tailwinds. In particular, the company's artificial intelligence (AI) focused semiconductor products are seeing significant momentum, while adoption of VMware Cloud Foundation (VCF) has been strengthening its infrastructure software business.

The main concern weighing on AVGO shares is profitability, particularly gross margins. Management recently projected that first-quarter consolidated gross margin could decline by 100 basis points sequentially. This is largely due to a higher mix of AI-related revenue, which carries lower margins compared to Broadcom’s software business.

As AI revenue becomes a larger share of the business, overall gross margins may remain under pressure throughout the fiscal year. The company also noted that margins will continue to fluctuate depending on the balance between infrastructure software and semiconductor sales, as well as the specific product mix within chips.

That said, Broadcom is focusing on improving operating leverage, implying that the company expects higher revenue volumes to translate into stronger operating profit dollars, even if gross margin percentages decline. In other words, Broadcom believes it can offset some margin compression through scale and efficiency.

Looking ahead to the second half of the fiscal year, Broadcom expects to ship more AI systems. This will involve passing through additional component costs that are not manufactured by Broadcom, similar to how memory and other components are bundled into XPU.

As a result, gross margin percentages may fall further because more third-party costs will flow through revenue. However, the company expects total gross margin dollars to rise, even if margins as a percentage of revenue decline. Broadcom believes operating profit dollars should also increase due to leverage, though operating margins could dip slightly as the revenue base expands.

Broadcom to Sustain Solid Growth

Broadcom’s recent stock decline reflects margin concerns rather than softening demand. The company continues to post strong AI revenue growth and is positioned to benefit from both semiconductor demand and higher adoption of VCF.

The company is seeing surging demand for its custom AI accelerators, which it calls XPUs. These chips are increasingly used by major customers to train large language models and to run AI applications. Management highlighted during the Q4 conference call that the same accelerators are also being extended beyond internal use to outside partners, highlighting the scale of opportunity.

Broadcom’s order pipeline also remains solid. In fiscal Q3 2025, Broadcom received a massive $10 billion order for its latest Ironwood TPU racks from Anthropic, followed by another $11 billion commitment for delivery in late 2026. Broadcom also added a fifth XPU customer through a $1 billion order scheduled for late 2026.

Broadcom is also seeing strong growth in AI networking, an essential part of modern data-center buildouts. Customers are investing heavily in infrastructure ahead of deploying AI chips, and Broadcom’s networking products are benefiting directly. The company’s backlog for AI switches is now more than $10 billion, supported by record demand for its Tomahawk 6 switch.

The firm also received “record orders on DSPs, optical components like lasers, and PCI Express switches to be deployed in AI data centers,” per CEO Hock Tan. Overall, Broadcom’s total AI-related backlog now stands at more than $73 billion, nearly half of its $162 billion consolidated backlog. Management expects this AI backlog to be delivered over the next 18 months, and projects that AI revenue will double year-over-year (YOY) to $8.2 billion in Q1 2026.

Meanwhile, Broadcom’s infrastructure software segment will continue to drive its financials. In Q4, software revenue reached $6.9 billion, up 19% YOY. Contract bookings were strong, with total contract value exceeding $10.4 billion, compared with $8.2 billion a year ago. The company “ended the year with $73 billion of infrastructure software backlog,” up sharply from $49 billion in the prior year, supported largely by VCF adoption.

Is Broadcom Stock a Buy on the Dip?

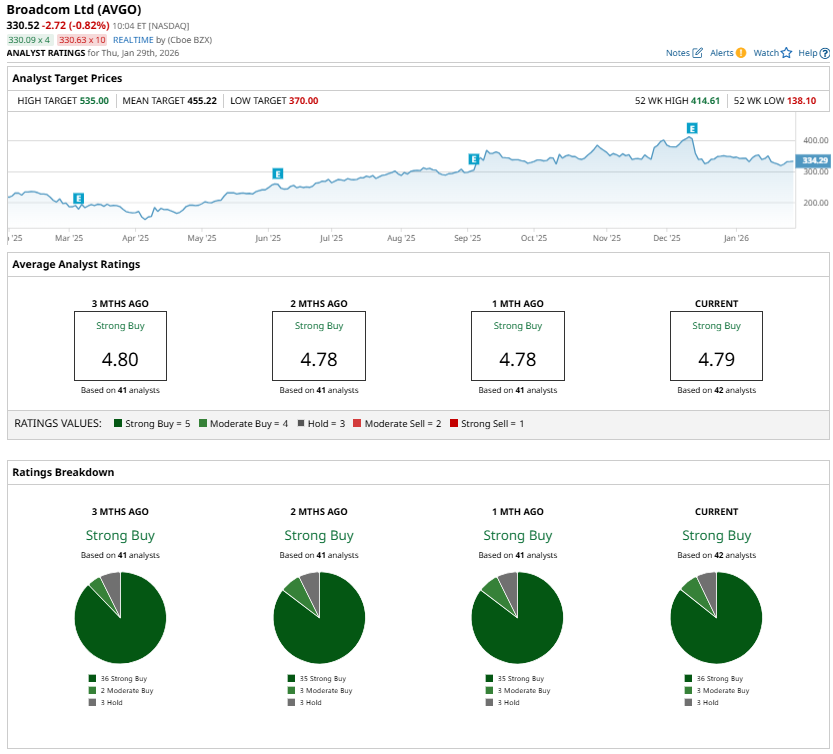

Despite near-term margin headwinds, Wall Street remains optimistic. Analysts continue to rate AVGO stock as a consensus “Strong Buy.” Broadcom will benefit from accelerating AI revenue, a strong backlog, and continued adoption of VMware Cloud Foundation, which will likely support the share price.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)