/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

SoFi (SOFI) once again delivered an impressive quarterly performance in Q4. It is one of the faster-growing players in the fintech space and added a record 1 million new members during the quarter, bringing its total membership base to 13.7 million. That represents a strong 35% increase compared with the prior year. Product growth was equally solid, with SoFi adding a record 1.6 million new products, pushing total products up 37% year-over-year (YoY).

This surge in members and product adoption translated into significant revenue growth. SoFi’s adjusted net revenue hit a quarterly record of more than $1.01 billion, rising 37% from the same period last year. Notably, Q4 marked SoFi’s first-ever $1 billion revenue quarter.

Management also pointed to accelerating cross-buy activity as a key driver of growth. About 40% of new products were opened by existing members, showing that customers are increasingly using SoFi as a one-stop financial platform. Over the past year, the cross-buy rate has climbed by 7 percentage points, reflecting the company’s ability to build a multi-product relationship with customers.

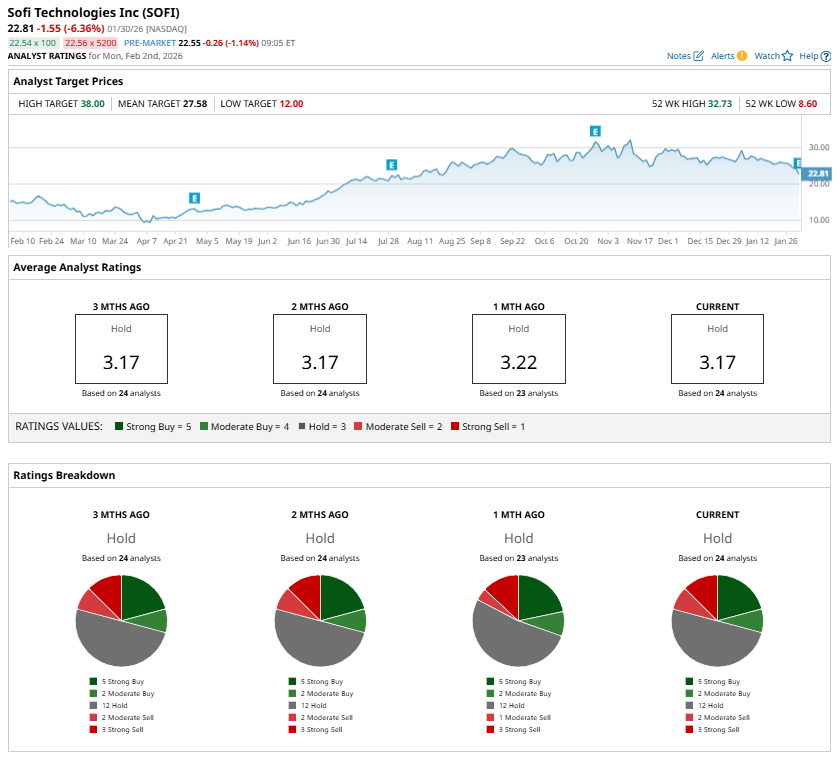

Despite these strong fundamentals, SoFi’s stock has pulled back significantly. Shares closed lower after the report and are now down roughly 30% from their 52-week high of $32.73. Investor concerns around valuation and potential dilution from capital raises have weighed on the stock’s performance.

However, SoFi’s underlying business remains on a solid footing. With strong member growth, expanding product adoption, and revenue momentum, SoFi appears well-positioned to deliver strong earnings over the next several years. Moreover, the decline in SOFI stock may have also eased earlier valuation pressure.

SoFi’s Earnings to Grow at a Solid Pace

SoFi is well-positioned to deliver solid earnings growth in the years ahead, supported by its diversified revenue stream and strong member and product growth. The company’s shift toward a lower-risk, fee-based business model augurs well for long-term growth.

By broadening its financial services platform, SoFi is reducing its reliance on interest-rate-sensitive lending income while also limiting credit risk. This strategic transition is enhancing the company’s balance sheet and building a more durable earnings foundation.

SoFi has significant room to expand across its core markets. At the same time, newer areas such as artificial intelligence, crypto, and business banking offer additional long-term upside. The company’s financial position also remains solid, supported by $3.2 billion in new capital and a growing deposit base. This balance sheet strength provides confidence that SoFi can continue compounding growth over the coming years and potentially deliver strong returns for shareholders.

Looking ahead to 2026, management expects SoFi to sustain its current momentum as demand remains strong from both existing and new partners. For full-year 2026, management forecasts member growth of at least 30%. Adjusted net revenue is expected to reach approximately $4.7 billion, representing about 30% growth. The company also projects adjusted EBITDA of roughly $1.6 billion, implying an EBITDA margin near 34%, up from 29% in 2025. Adjusted EPS is expected to rise to about $0.60, up from $0.39 in 2025.

Beyond 2026, SoFi’s growth trajectory remains solid. Its diversified revenue base, balance sheet strength, and expanding opportunities across both established and emerging business lines will enable SoFi to grow its top line at a CAGR of at least 30% from 2025 through 2028. SoFi’s adjusted EPS is projected to grow at an even faster rate of 38% to 42% over the same period.

Is SOFI Stock a Buy Now?

Wall Street analysts are still cautious on SOFI stock, maintaining a “Hold” consensus rating even after the company’s latest earnings report.

However, SoFi’s growth story remains compelling. The company has transitioned away from reliance on lending alone and has built a diversified business model driven by fee-based financial services. This shift reduces risk and strengthens SoFi’s position as a broader digital finance platform. Moreover, management has outlined strong growth expectations, supported by improving profitability in the medium term. All this suggests SoFi will likely deliver significant growth, implying the dip in its stock price offers an opportunity to buy.

On the date of publication, Sneha Nahata did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/Alphabet%20Inc_%20and%20Google%20logos%20seen%20displayed%20on%20a%20smartphone%20by%20IgorGolovniov%20via%20Shutterstock.jpg)

/Phone%20and%20computer%20internet%20network%20by%20Pinkypills%20via%20iStock.jpg)