Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 73%-win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Watch List Overview

Watch list candidates are chosen for their stable price behavior, defined support, and liquid option markets, making them well suited for a long-stock, dual-option selling strategy. Their orderly movement allows the stock to serve as a reliable anchor while both the call and put premiums expand the profit range and reduce dependence on short-term direction.

Past Performance

The Bull Strangle model portfolio is now outperforming the S&P by 2.88:1.

Watch List Favorites

This week the Newsletter contains 22 stocks and ETFs across 8 sectors. 2 of the stocks on the Watch List are detailed below:

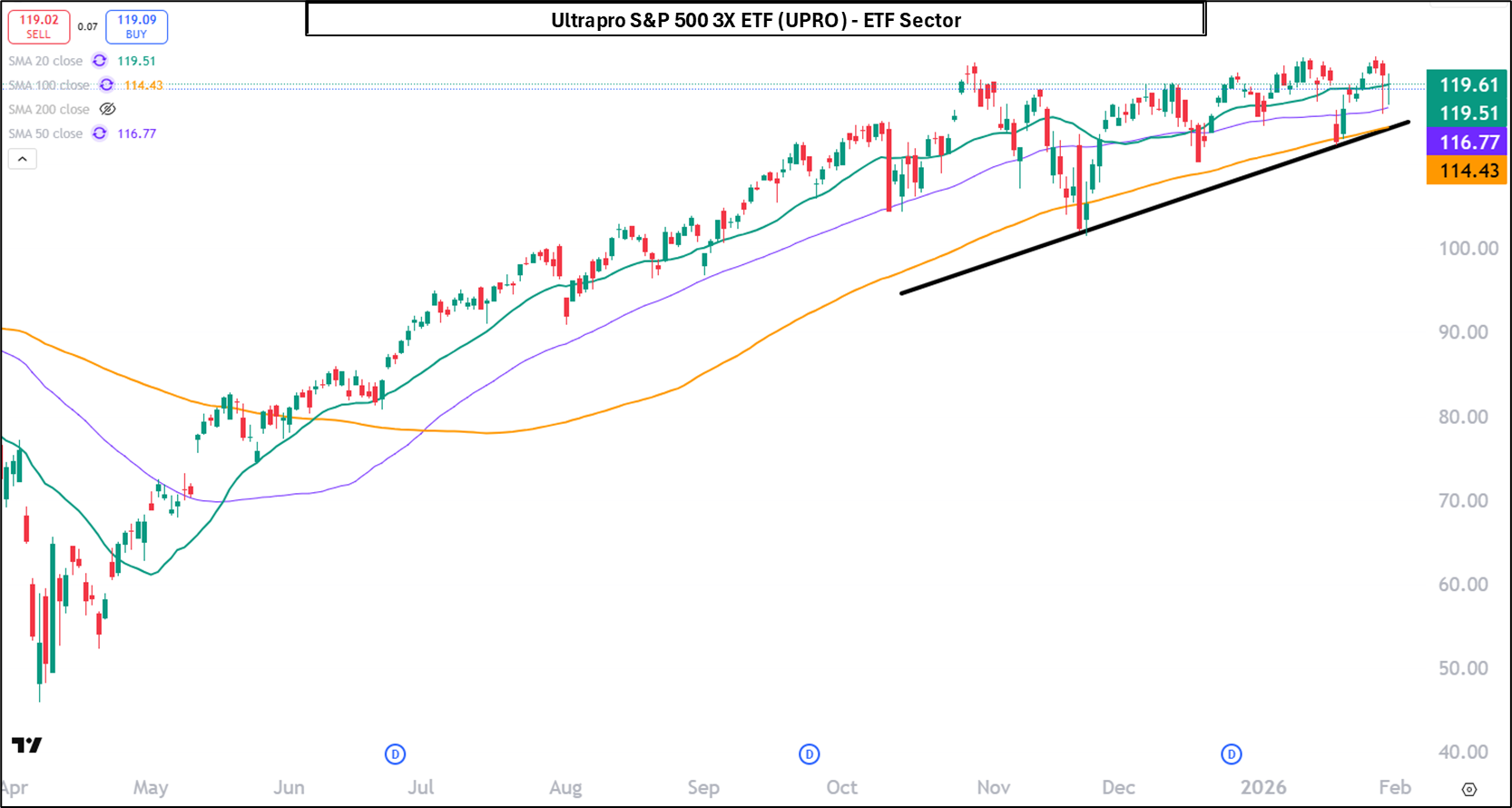

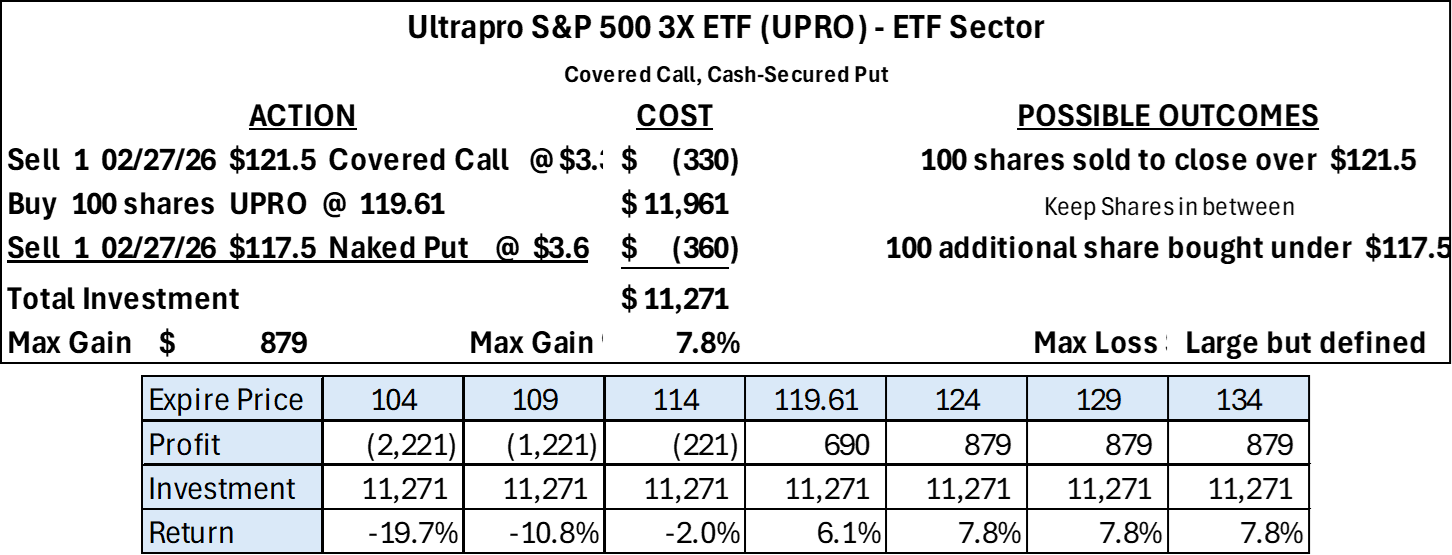

ProShares UltraPro S&P500 ETF (UPRO)

- ProShares UltraPro S&P500 ETF is a leveraged exchange-traded fund designed to amplify the daily performance of the U.S. stock market’s broad large-cap benchmark. Specifically, UPRO seeks to deliver approximately three times (3×) the daily return of the S&P 500® Index before fees and expenses. It achieves this exposure through the use of financial derivatives such as futures, swaps, and other instruments rather than by holding the underlying stocks directly.

UPRO continues to trade in a strong uptrend, consolidating recent gains after a powerful multi-month advance. Price has held above the rising 50-day and 100-day moving averages, while repeated pullbacks have found support along the upward trendline and near the 200-day moving average, reinforcing the bullish structure. Recent action shows higher lows and tight consolidation near prior highs, suggesting the ETF is digesting gains rather than rolling over. As long as UPRO remains above trendline support and the 50-day average, the intermediate trend remains constructive, with upside momentum intact despite normal volatility.

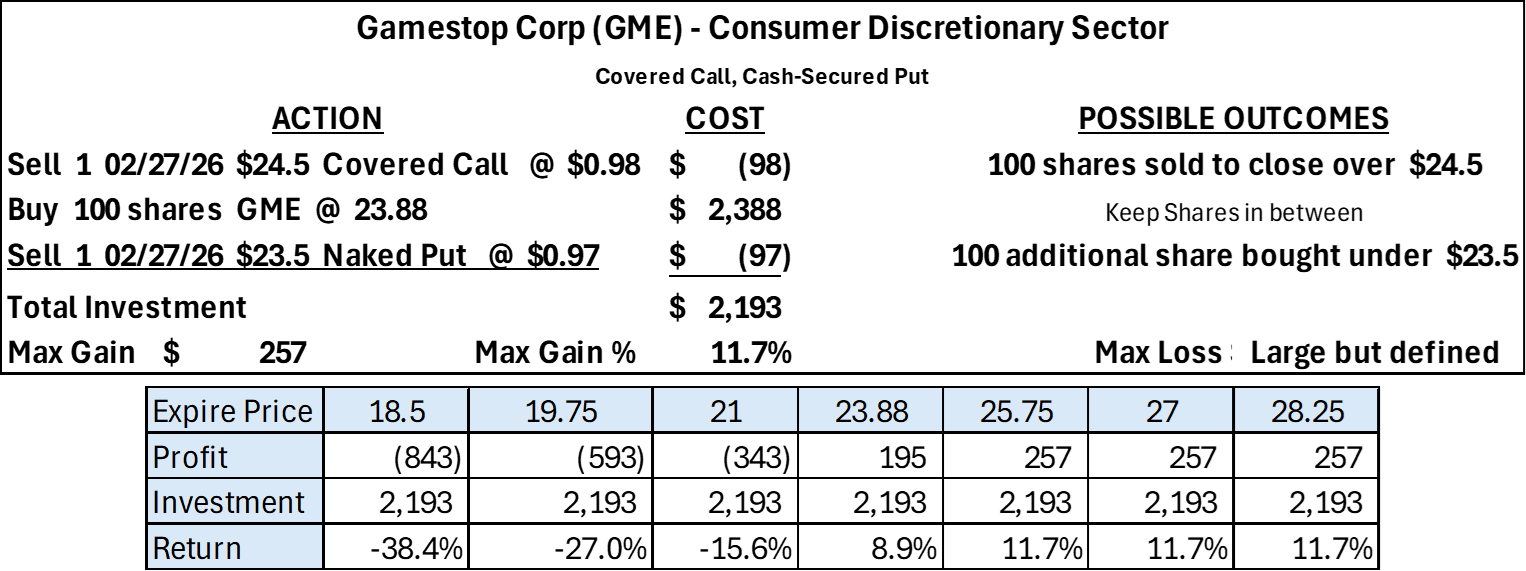

GameStop Corp (GME)

- GameStop Corp., a specialty retailer, provides games and entertainment products through its stores and e-commerce platforms in the United States, Canada, Australia, and Europe. The company sells new and pre-owned gaming platforms; accessories, such as controllers, and gaming headsets; new and pre-owned gaming software; and in-game digital currency, digital downloadable content, and full-game downloads. It sells collectibles comprising apparel, toys, trading cards, gadgets, and other retail products for pop culture and technology enthusiasts.

GameStop has recently shown signs of stabilization following a prolonged downtrend. The stock broke above its descending trendline and reclaimed the 50-day moving average, signaling a potential shift in short-term momentum. Price has also pushed back toward the 100-day moving average, suggesting improving participation after months of lower highs and lower lows. While the longer-term trend remains mixed, recent higher lows and improving moving-average alignment point to a developing recovery phase rather than continued deterioration.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/Microsoft%20Corporation%20logo%20on%20sign-by%20Jean-Luc%20Ichard%20via%20iStock.jpg)

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)