Entegris has been on fire lately. In the past six months alone, the company’s stock price has rocketed 55.8%, setting a new 52-week high of $123.63 per share. This performance may have investors wondering how to approach the situation.

Is now the time to buy Entegris, or should you be careful about including it in your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Do We Think Entegris Will Underperform?

We’re glad investors have benefited from the price increase, but we're cautious about Entegris. Here are three reasons you should be careful with ENTG and a stock we'd rather own.

1. Revenue Tumbling Downwards

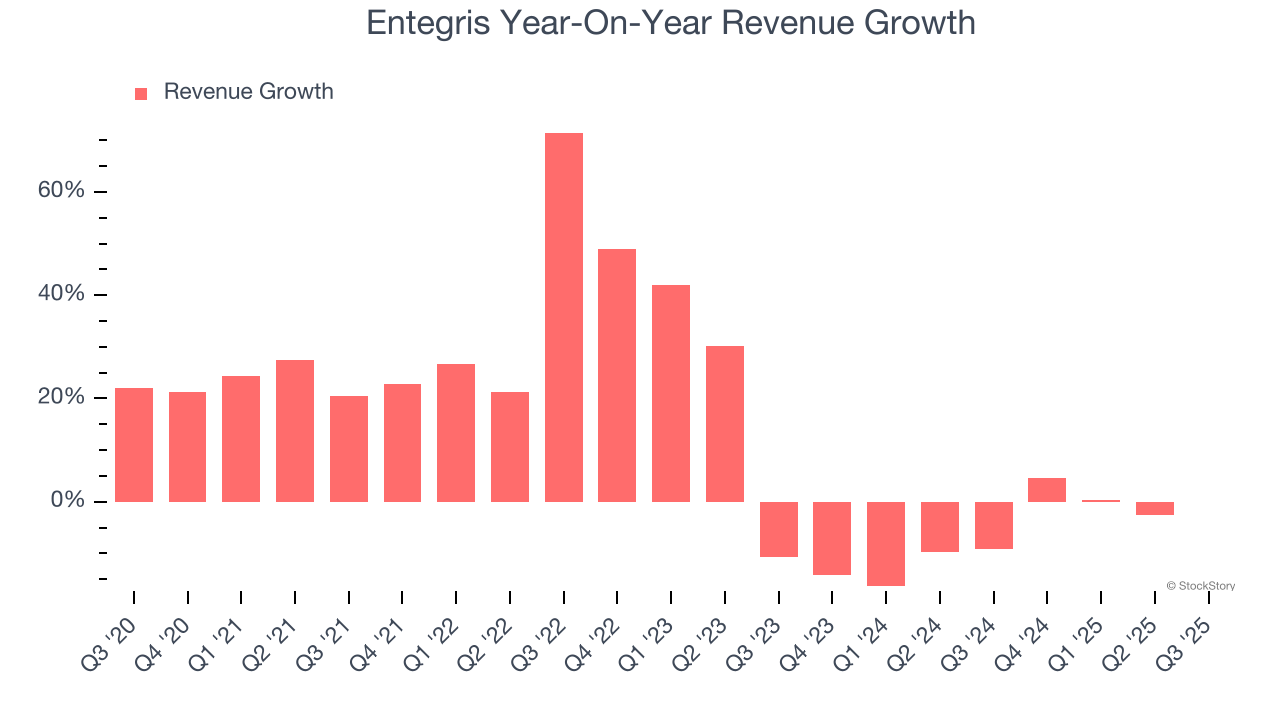

We at StockStory place the most emphasis on long-term growth, but within semiconductors, a stretched historical view may miss new demand cycles or industry trends like AI. Entegris’s recent performance marks a sharp pivot from its five-year trend as its revenue has shown annualized declines of 6.1% over the last two years.

2. Projected Revenue Growth Is Slim

Forecasted revenues by Wall Street analysts signal a company’s potential. Predictions may not always be accurate, but accelerating growth typically boosts valuation multiples and stock prices while slowing growth does the opposite.

Over the next 12 months, sell-side analysts expect Entegris’s revenue to rise by 2.4%. Although this projection indicates its newer products and services will fuel better top-line performance, it is still below average for the sector.

3. Mediocre Free Cash Flow Margin Limits Reinvestment Potential

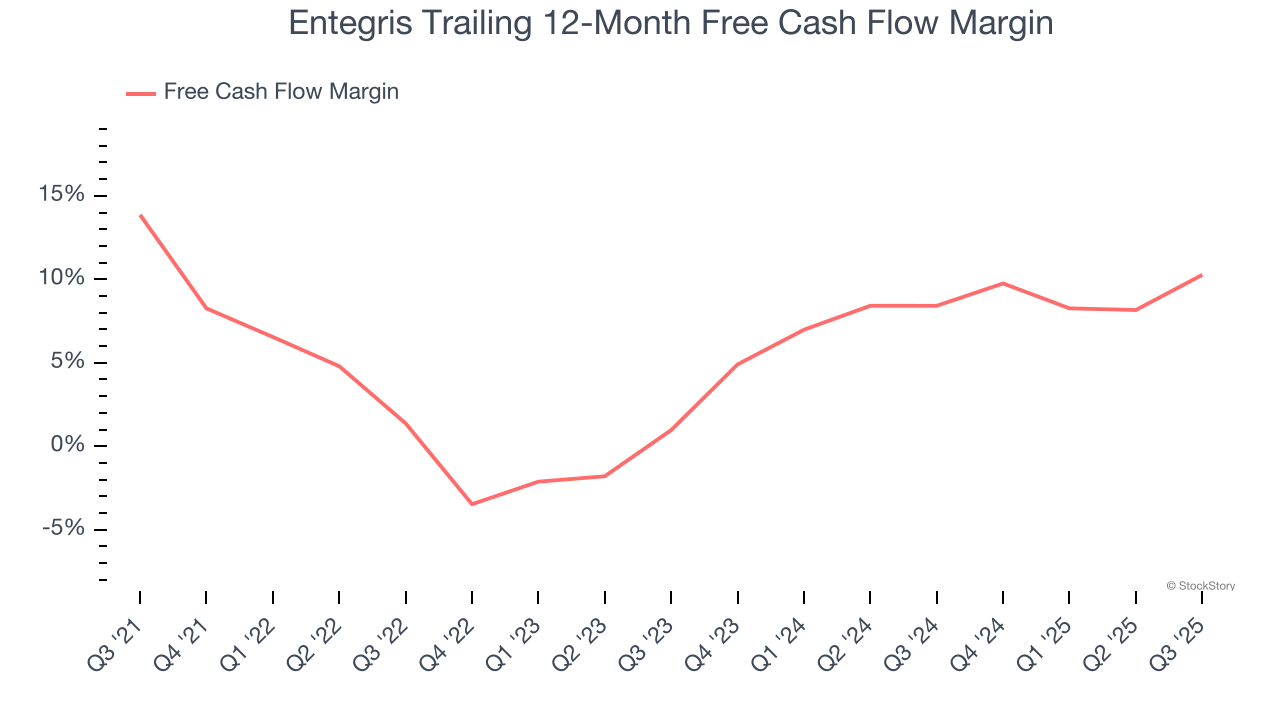

Free cash flow isn't a prominently featured metric in company financials and earnings releases, but we think it's telling because it accounts for all operating and capital expenses, making it tough to manipulate. Cash is king.

Entegris has shown poor cash profitability over the last two years, giving the company limited opportunities to return capital to shareholders. Its free cash flow margin averaged 9.3%, lousy for a semiconductor business.

Final Judgment

Entegris falls short of our quality standards. Following the recent rally, the stock trades at 41.4× forward P/E (or $123.63 per share). At this valuation, there’s a lot of good news priced in - we think there are better opportunities elsewhere. Let us point you toward a fast-growing restaurant franchise with an A+ ranch dressing sauce.

High-Quality Stocks for All Market Conditions

The market’s up big this year - but there’s a catch. Just 4 stocks account for half the S&P 500’s entire gain. That kind of concentration makes investors nervous, and for good reason. While everyone piles into the same crowded names, smart investors are hunting quality where no one’s looking - and paying a fraction of the price. Check out the high-quality names we’ve flagged in our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

/Palantir%20(PLTR)%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)