Darling Ingredients has had an impressive run over the past six months as its shares have beaten the S&P 500 by 29.3%. The stock now trades at $45.81, marking a 39% gain. This was partly thanks to its solid quarterly results, and the performance may have investors wondering how to approach the situation.

Is there a buying opportunity in Darling Ingredients, or does it present a risk to your portfolio? Get the full stock story straight from our expert analysts, it’s free.

Why Is Darling Ingredients Not Exciting?

We’re happy investors have made money, but we don't have much confidence in Darling Ingredients. Here are three reasons why DAR doesn't excite us and a stock we'd rather own.

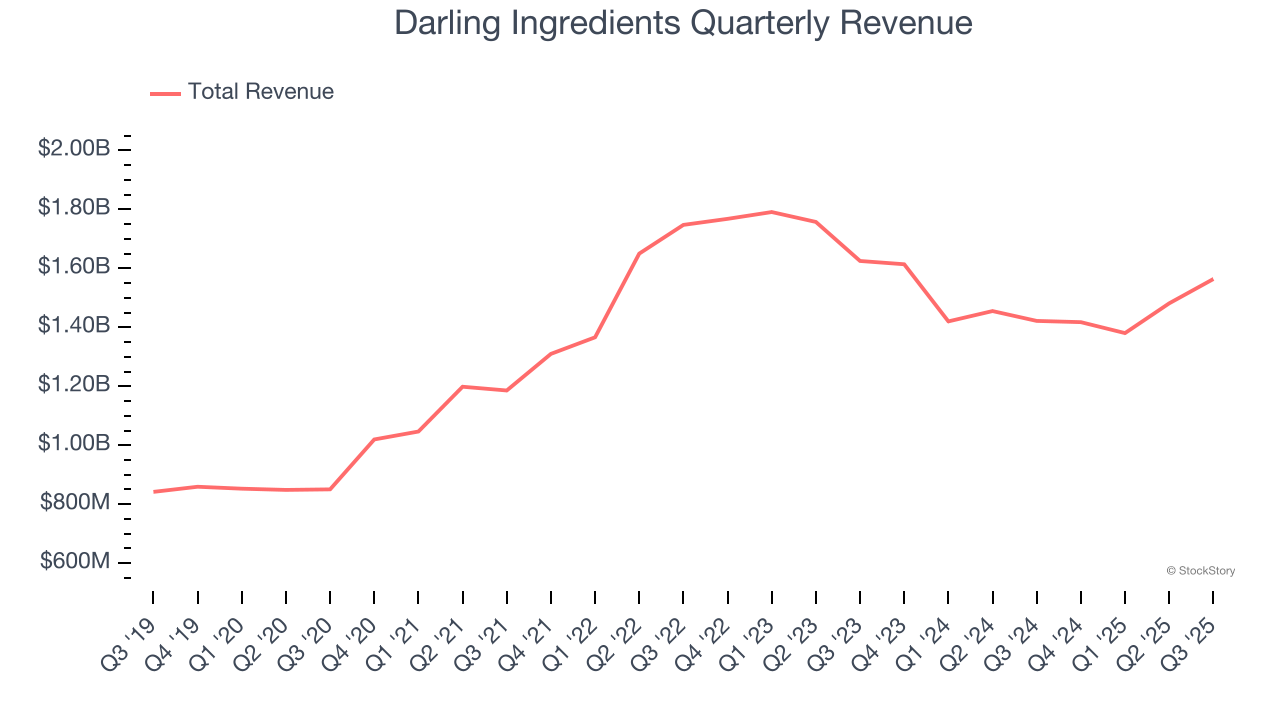

1. Revenue Spiraling Downwards

Examining a company’s long-term performance can provide clues about its quality. Any business can experience short-term success, but top-performing ones enjoy sustained growth for years. Darling Ingredients struggled to consistently generate demand over the last three years as its sales dropped at a 1.3% annual rate. This was below our standards and signals it’s a lower quality business.

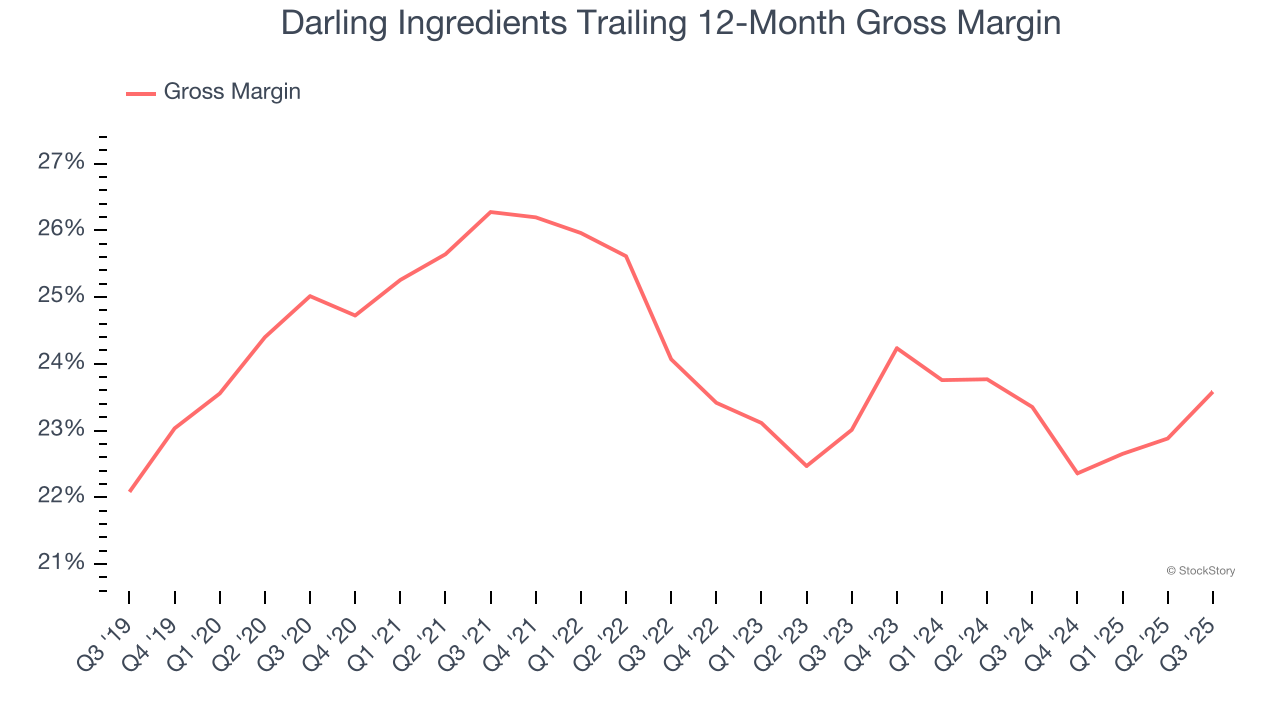

2. Low Gross Margin Reveals Weak Structural Profitability

At StockStory, we prefer high gross margin businesses because they indicate pricing power or differentiated products, giving the company a chance to generate higher operating profits.

Darling Ingredients has bad unit economics for a consumer staples company, giving it less room to reinvest and develop new products. As you can see below, it averaged a 23.5% gross margin over the last two years. That means Darling Ingredients paid its suppliers a lot of money ($76.53 for every $100 in revenue) to run its business.

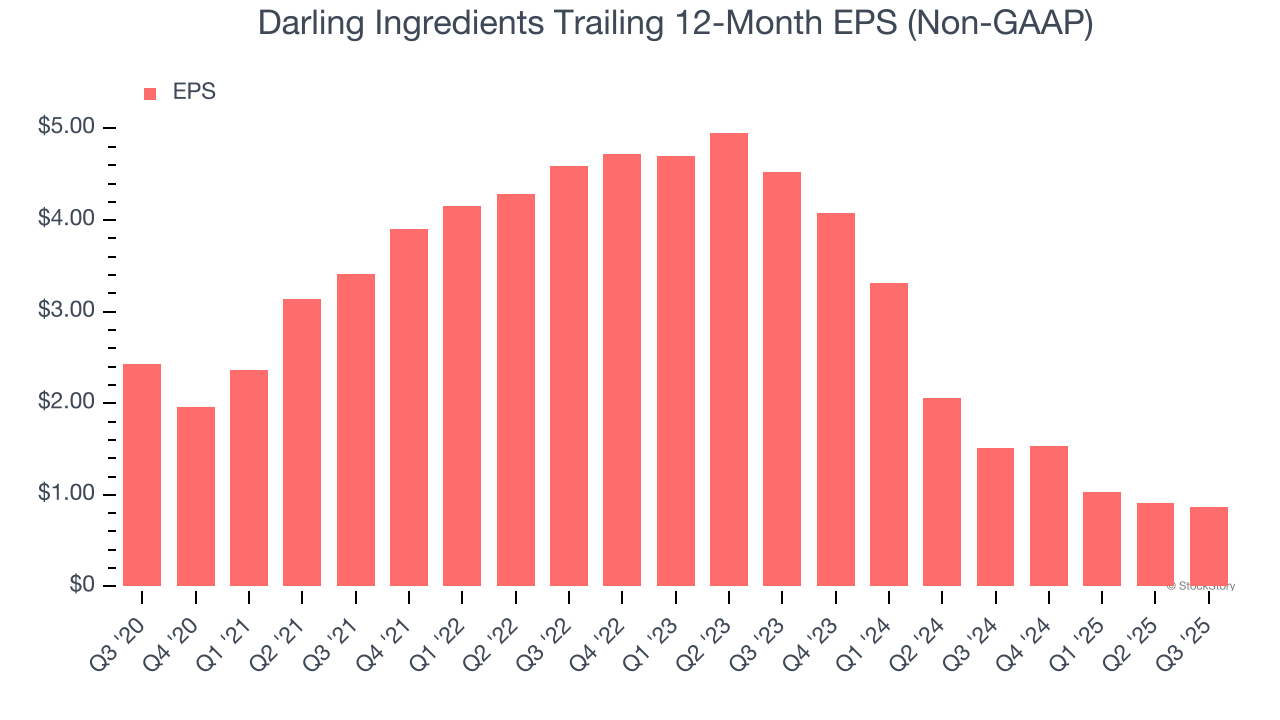

3. EPS Trending Down

We track the long-term change in earnings per share (EPS) because it highlights whether a company’s growth is profitable.

Sadly for Darling Ingredients, its EPS declined by 42.7% annually over the last three years, more than its revenue. This tells us the company struggled because its fixed cost base made it difficult to adjust to shrinking demand.

Final Judgment

Darling Ingredients’s business quality ultimately falls short of our standards. With its shares beating the market recently, the stock trades at 20.9× forward P/E (or $45.81 per share). Beauty is in the eye of the beholder, but we don’t really see a big opportunity at the moment. We're pretty confident there are more exciting stocks to buy at the moment. We’d suggest looking at the Amazon and PayPal of Latin America.

Stocks We Would Buy Instead of Darling Ingredients

If your portfolio success hinges on just 4 stocks, your wealth is built on fragile ground. You have a small window to secure high-quality assets before the market widens and these prices disappear.

Don’t wait for the next volatility shock. Check out our Top 5 Growth Stocks for this month. This is a curated list of our High Quality stocks that have generated a market-beating return of 244% over the last five years (as of June 30, 2025).

Stocks that have made our list include now familiar names such as Nvidia (+1,326% between June 2020 and June 2025) as well as under-the-radar businesses like the once-micro-cap company Tecnoglass (+1,754% five-year return). Find your next big winner with StockStory today.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)