Nearby physical lumber futures settled 2025 at $576 per 1,000 board feet, posting a 4.63% gain for the year that ended on December 31, 2025. I asked whether lumber futures would wait until spring to recover in a November 25, 2026, Barchart article. I concluded with the following:

As the lumber market heads into winter, lower lows are likely. However, the lower prices fall, the greater the odds of a recovery in 2026, as lumber prices could be waiting for spring to soar.

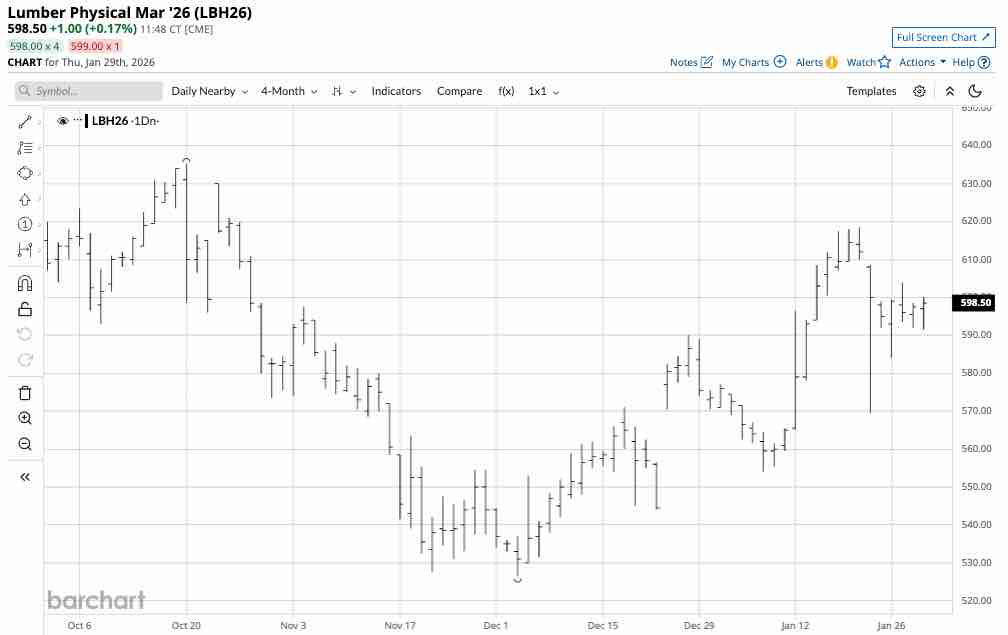

Nearby physical lumber futures prices were higher at just under $600 in late January, as the market moves towards its peak season.

A bullish trend since early December 2025

After reaching a continuous contract low of $526.50 on December 3, 2025, lumber futures have made higher lows and higher highs over the past weeks.

The daily continuous contract shows the rally that took lumber 17.5% higher to a high of $618.50 per 1,000 board feet on January 21, 2026. While the price has pulled back below $600, nearby lumber futures remain in a bullish trend as of late January 2026.

The spring is the construction season

Lumber is a seasonal commodity that tends to reach lows in winter and highs in spring, as the construction season increases demand.

In May 2021, the former random-length lumber futures reached a record high of $1,711.20 per 1,000 board feet. In March 2022, random-length lumber futures reached a lower high of $1,477.40 per 1,000 board feet. Time will tell whether lumber futures head higher over the coming months, but seasonality favors the upside.

Prospects for lower interest rates support higher lumber prices

The U.S. Federal Reserve reduced the short-term Fed Funds Rate by 100 basis points in 2024 and another 75 points in 2025, with the rate sitting at 3.625% in late January 2026. While the central bank controls short-term interest rates as its primary monetary policy tool, market forces set longer-term rates, which in turn drive 30-year fixed-rate mortgages. If short-term rate reductions filter through the yield curve over the coming months, falling mortgage rates could trigger a homebuilding boom, given the pent-up demand for housing and shortage of existing homes. Many homeowners who refinanced their properties when interest rates were below 4% and 3% over the past years are holding onto their homes, causing a shortage of available homes for new buyers. Therefore, lower mortgage rates could cause a sudden increase in demand for new home construction and lumber.

Illiquidity can cause extreme volatility

The lumber market experienced substantial upside price volatility in 2021 and 2022 when mortgage rates fell below 3%. Lumber is an extremely illiquid market, which accounts for its extreme price volatility. The Chicago Mercantile Exchange delisted the random-length lumber futures contract over the past few years and introduced the current physical lumber contract to increase liquidity. Physical lumber futures have a smaller contract size and more flexible delivery requirements to encourage hedging and speculative activity. However, open interest of 7,932 contracts on January 28 and daily trading volumes below 1,500 per day make the lumber futures highly illiquid.

Illiquid futures markets experience high volatility when trends develop as bids to buy disappear during price declines and offers to sell evaporate during rallies.

WOOD, CUT, and WY tend to track lumber prices

While lumber futures provide direct exposure to prices, the illiquidity makes them dangerous for traders, hedgers, and speculators. The three proxies for lumber prices, the WOOD and CUT ETFs, and Weyerhaeuser Company (WY) tend to move higher and lower with lumber prices.

In late November 2025, WOOD traded at $67.74 per share, while the CUT ETF at $27.84 per share. WY was trading at $21.46 per share.

On January 29, 2026, WOOD was trading at $75.24 per share, which was 11.1% higher. CUT at $30.07 per share was 8% higher, and WY at $25.86 per share had rallied by 20.5%. WOOD, CUT, and WY have followed lumber prices higher, and if lumber prices experience a significant seasonal rally this spring, higher highs could be on the horizon. I am bullish on lumber prices as the spring approaches for the following compelling reasons:

- Trade policy between the U.S. and Canada could significantly increase lumber prices, as tariffs are trade barriers that distort prices. Canada is a leading lumber-producing country.

- Falling U.S. interest rates could boost demand for new home construction, driving rising lumber demand and prices.

- The trend in lumber prices since early December is higher, and the trend is always a trader’s or investor’s best friend.

- Seasonality favors the upside over the coming months.

Lumber could rally substantially over the coming weeks and months. Technical resistance is at $618.50, the recent high, $635, the high from October 2025, and just below $700 per 1,000 board feet, the highs from August and March 2025. If lumber prices rise above the $700 technical resistance level, an explosive move could develop, lifting shares of the WOOD and CUT ETFs and WY shares.

On the date of publication, Andrew Hecht did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Advanced%20Micro%20Devices%20Inc_%20logo%20on%20phone%20and%20website-by%20T_Schneider%20via%20Shutterstock.jpg)

/Qualcomm%2C%20Inc_%20logo%20on%20phone-by%20viewimage%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)