Every few years or so, I come back to Swiss Franc Trust Currencyshares (FXF). And every time, I quickly remember why I returned to it.

Because the U.S. dollar, despite being the go-to currency for decades, has been on a very slippery slope for a long time. And it just got even more slippery. The dollar is sliding, the Japanese yen is waking up, and the FXF, which tracks the standalone currency of the nation famous for neutrality, is surging toward levels we haven't seen in over a decade.

For a do-it-yourself investor, currency trading often feels like a black box, but the current story for the Swiss franc is actually quite simple. It’s a classic case of global investors looking for a vault in which to hide their money during times of political and economic uncertainty.

The Safe-Haven Reputation

When the world gets nervous — whether it’s about trade wars, political shifts in the U.S., or global inflation — money tends to flow into Switzerland. Why? Because Switzerland is essentially the debt-free neighbor on a street full of people with maxed-out credit cards.

The country has low debt, a stable government, and a long history of staying out of global conflicts. In early 2026, as the U.S. dollar loses its shine, the franc is becoming the "gold" of the currency world.

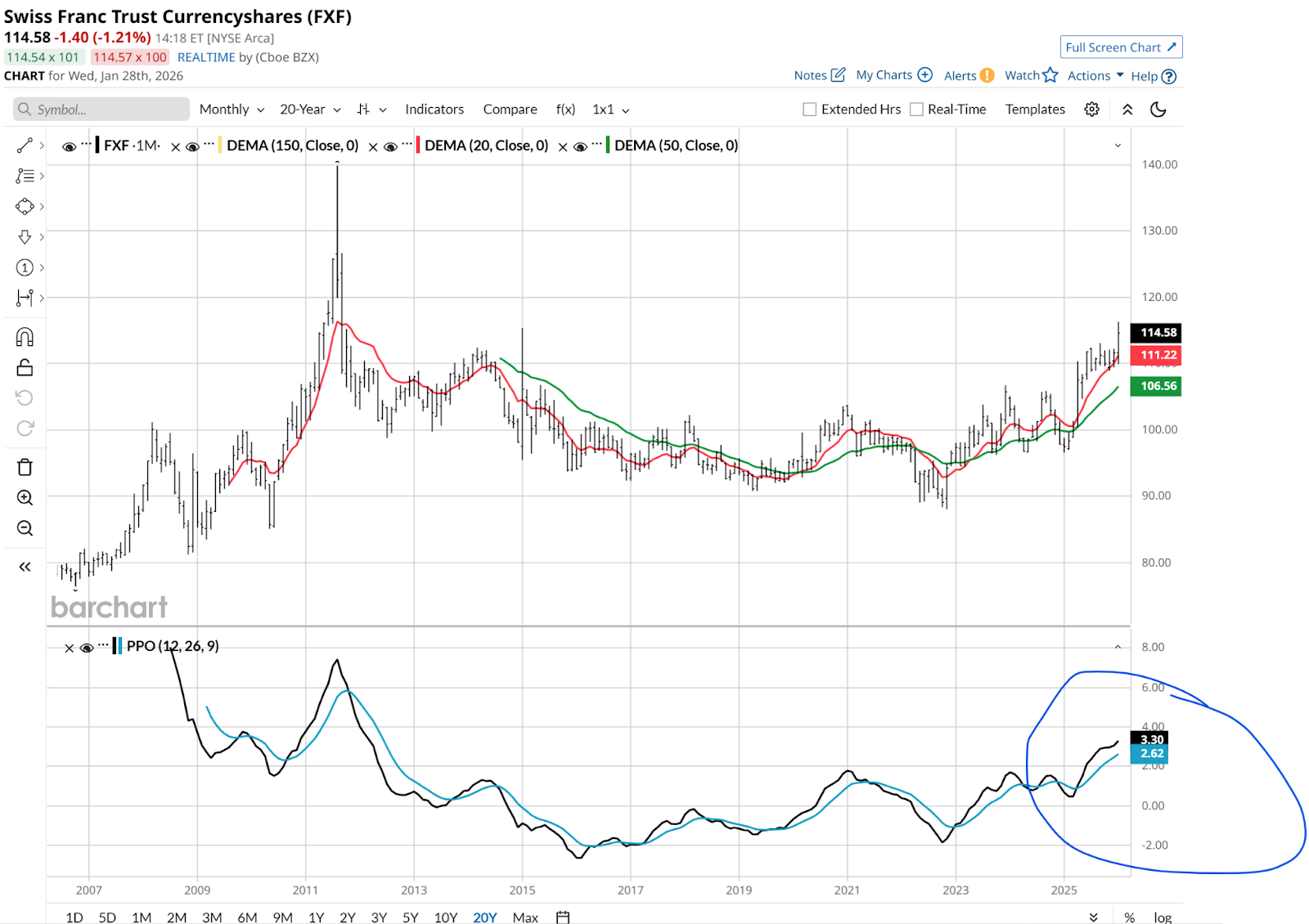

Here’s a monthly chart of FXF, and it looks great to me.

That doesn’t mean it is a bigtime trade currently. It is not bad in a shorter-term time frame. That PPO in the monthly above is encouraging. And the 50-month moving average has started to move higher over the past year.

The daily chart is a bit toppy, so this is a case of different time frames to consider. Still, there’s not a ton of whipsaw in price here, typically.

Stronger Purchasing Power

Because Switzerland has almost no inflation (currently near 0.1%), the franc holds its value better than almost any other currency. While your dollars might buy 3% to 4% less every year due to inflation, a franc stays remarkably stable. This makes it a great hedge — a way to protect your total portfolio if you think your U.S. assets are going to lose value due to rising prices at home. Similar to gold, but with much less volatility and a far smaller speculative crowd pushing it up.

However, it is not all upside. There are risks to FXF, just as with any market-traded asset.

The "too strong" problem is part of it. There is one group of people who may not be in favor of a strong Swiss franc: the Swiss themselves. If the franc gets too expensive, nobody can afford to buy Swiss watches, chocolate, or machinery. This hurts the Swiss economy.

The Swiss National Bank (SNB) is like a referee that can jump onto the field at any time. If they think the franc is rising too fast, they will intervene by selling francs and buying other currencies to push the price back down. It’s similar to the COMEX and margin requirements for silver these days. The threat that always looms.

Also, unlike a stock that pays a dividend or a bond that pays interest, the Swiss Franc pays you nothing to hold it. In 2026, with some international investments paying 4% or 5%, holding a currency that pays 0% is an opportunity cost. You are betting purely on the price going up. If the franc stays flat for two years, you’ve actually lost money compared to what you could have earned elsewhere.

The Bottom Line

The Swiss franc is a solid consideration as an insurance policy for portfolios in 2026. It’s a bet that the U.S. dollar has more room to fall and that global chaos isn't over yet. However, you have to watch the "referee" in Zurich; if the Franc gets too strong, the Swiss National Bank won't hesitate to step in and cool things down.

Rob Isbitts is a semi-retired fiduciary investment advisor and fund manager. Find his investment research at ETFYourself.com. To copy-trade Rob’s portfolios, check out the new PiTrade app. His new blog on racehorse ownership as an alternative asset is at HorseClaiming.com.

On the date of publication, Rob Isbitts did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)