SoFi Technologies (SOFI), founded in 2011, has entered earnings season with investors clearly more cautious than enthusiastic. The stock has fallen below $30 and now trades roughly 40.34% under its 52-week high.

The decline followed a predictable sequence. Management’s $1.5 billion capital raise reopened concerns around dilution just as early investors began locking in profits after a strong rally. With valuations already high, the market chose discipline and stepped back rather than pushing prices higher.

But a narrow focus on the stock obscures the larger picture. The underlying business of SoFi is still expanding. Product adoption is consistent, member growth is robust, and engagement metrics don't indicate tiredness.

The notion is supported by investor behavior. The stock climbed 4.9% when the company revealed its earnings schedule on Jan. 2, and it gained an additional 6.6% during the subsequent trading session.

So, let us evaluate what investors might do with SoFi's shares after the earnings, which are set for release on Friday, Jan. 30, before the market opens.

About SoFi Stock

Based in San Francisco, California, SoFi is a member-centric digital financial ecosystem rather than a single-product fintech. With a market cap of around $31.1 billion, it spans lending, banking technology, APIs, investing tools, and cash management under one integrated platform.

Still, the stock’s journey has not been smooth. Over the past 52 weeks, SoFi’s shares gained nearly 58.33%. The strength carried into a 20% rise over six months before plunging 5.95% in the past month as valuation discipline returned.

SoFi stock now trades at 70.95 times forward adjusted earnings and 9.17 times sales. The multiples stand well above industry averages, signaling a meaningful premium and leaving little margin for error as expectations remain elevated.

SoFi Surpasses Q3 Earnings

On Oct. 28, 2025, SoFi delivered a third-quarter fiscal 2025 performance that lifted its stock 5.5% in a single trading session. Revenue surged 37.9% year-over-year (YOY) to $961.6 million, handily beating analyst estimates of $904.4 million. Adjusted EPS rose 120% from the prior year’s quarter to $0.11, topping consensus expectations of $0.08.

Margins expanded in tandem. Adjusted net income climbed 129.5% from the prior-year period to $139.4 million, while adjusted EBITDA jumped 48.7% YOY to $276.9 million. Growth extended well beyond financials. SoFi added a record 905,000 new members, lifting total membership to 12.6 million, a 35% YOY increase.

Product growth followed suit, with 1.4 million new products added, pushing the total to 18.6 million, up 36% annually. Moreover, engagement quality improved meaningfully. Roughly 40% of new products came from existing members, marking the highest cross-buy rate since 2022 and extending a four-quarter upward trend.

Looking forward, management has raised full-year fiscal 2025 guidance accordingly. The company now expects to add approximately 3.5 million members, representing 34% growth, above prior guidance of three million and 30%. Adjusted net revenue is projected at $3.54 billion, implying 36% growth versus the prior 30% outlook.

Management now also forecasts adjusted EBITDA of nearly $1 billion, up from $960 million, representing a 29% margin. Adjusted net income is expected to reach $455 million, above $370 million previously, with adjusted EPS rising to $0.37 from $0.31.

On the other hand, analysts anticipate fourth-quarter fiscal 2025 EPS to grow 140% YOY to $0.12. For full-year fiscal 2025, the bottom line is projected to grow 146.7% to $0.37, followed by another 59.5% increase in fiscal year 2026 to $0.59.

What Do Analysts Expect for SoFi Stock?

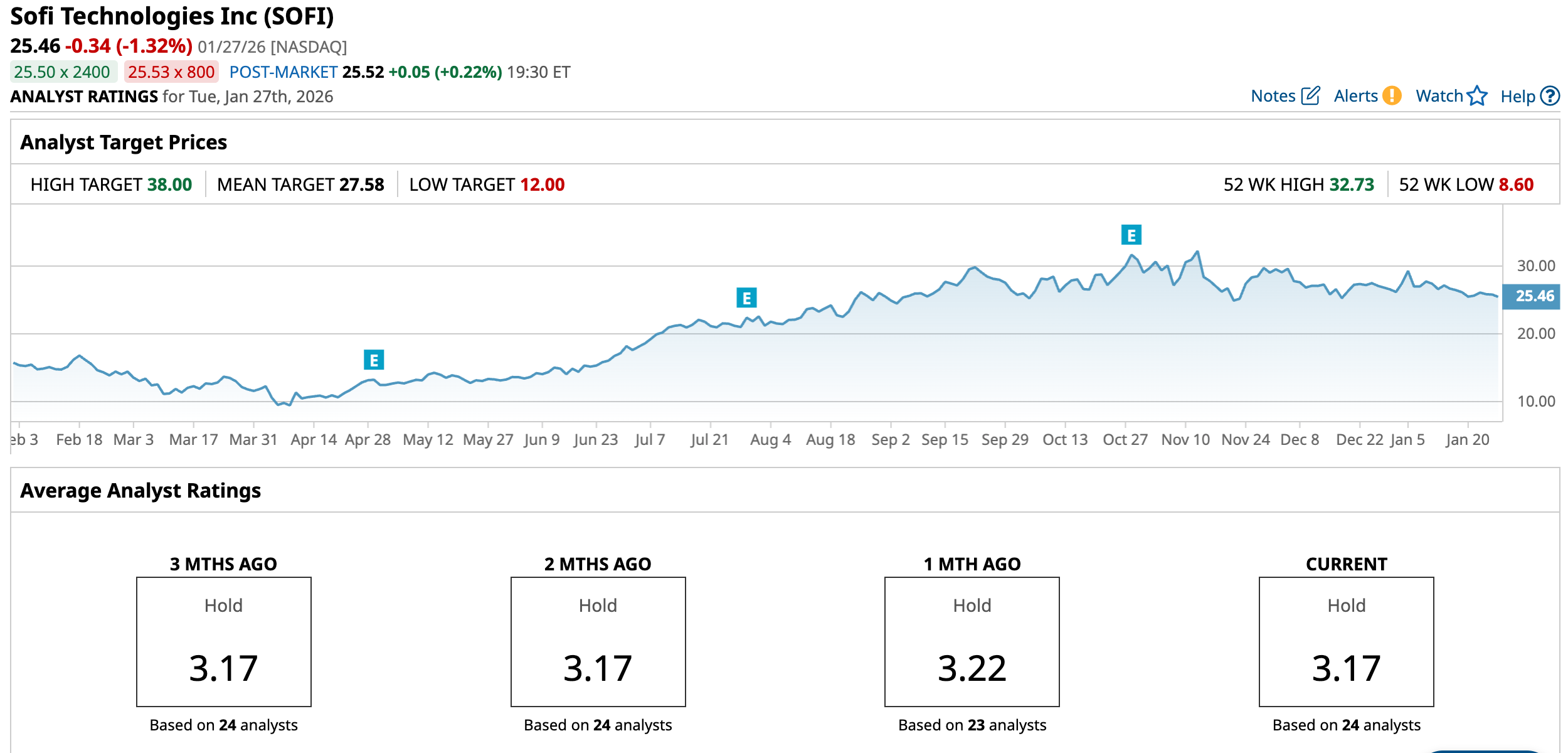

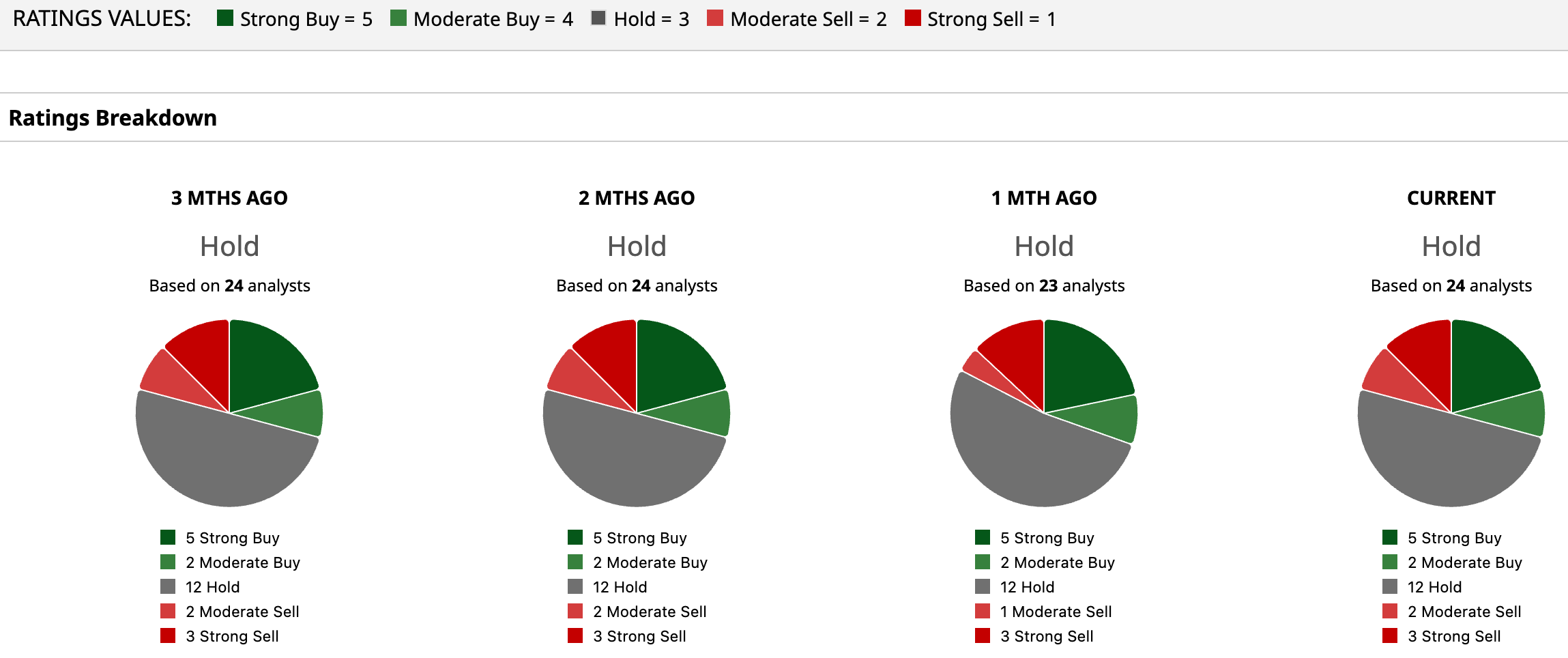

Wall Street, however, remains measured. SOFI stock currently carries an overall rating of “Hold.” Among 24 analysts, five rate it “Strong Buy,” two suggest “Moderate Buy,” 12 recommend “Hold,” two lean toward “Moderate Sell,” and three have assigned a “Strong Sell.”

However, the split reflects tension rather than confusion. SoFi is continuing to scale rapidly, monetize effectively, and deepen engagement. Higher product usage, expanding capital-light businesses, and strong deposits are collectively supporting durable growth.

Nevertheless, the average price target of $27.58 implies a gain of 8.3% from current levels. More optimistically, the Street-high target of $38 suggests nearly 49.3% upside from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)