Anyone can look good in a bull market. The challenge is looking like, and being a prime opportunity regardless of economic conditions. There are a few companies like that. But, more often than not, they are the ones you are likely not paying attention to.

Building a bulletproof portfolio isn’t about chasing trends or timing the next move. It is about owning businesses that continue to grow sales, reward shareholders, and stay disciplined regardless of market conditions. These are the companies that keep performing when volatility rises and headlines turn negative.

With that in mind, today, I’ll pull up my list of Dividend Kings - companies with 50 or more years of straight dividend increases. Then, I’ll screen for names with consistent revenue growth, balanced payout ratios, and strong analyst backing.

The result? A short list of companies built for durability, stability, and reliable income over time- perfect for bulletproof portfolios.

How I came up with the following stocks

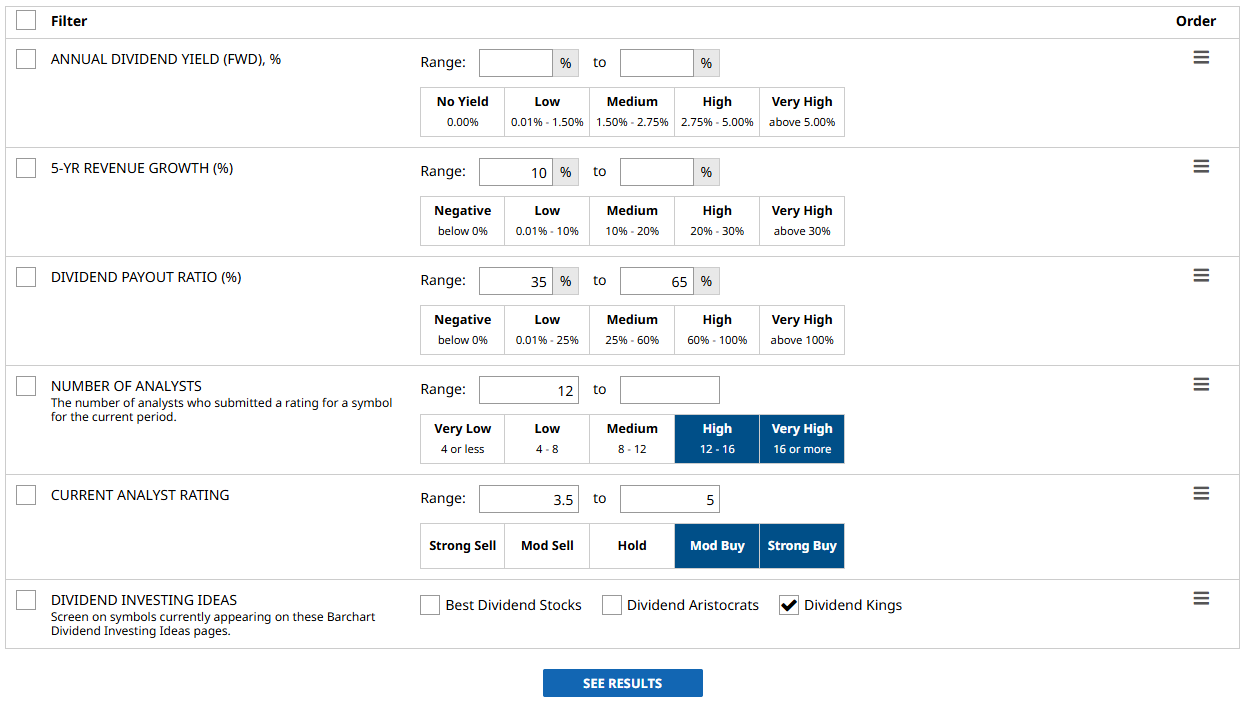

Using Barchart’s Stock Screener, I selected the following filters to get my list:

- Annual Dividend Yield (FWD),%: Left blank so I can sort it later from highest to lowest.

- 5-YR Revenue Growth (%): 10% or higher. I am looking for companies with consistent year-over-year sales growth.

- Dividend Payout Ratio (%): 35-65%. This range is the sweet spot that shows which companies are paying dividends without overextending.

- Number of Analysts: 12 or more. More analysts suggest greater confidence in the rating.

- Current Analyst Rating: 3.5-5. Stocks with Moderate Buy to Strong Buy ratings.

- Dividend Investing Ideas: Dividend Kings

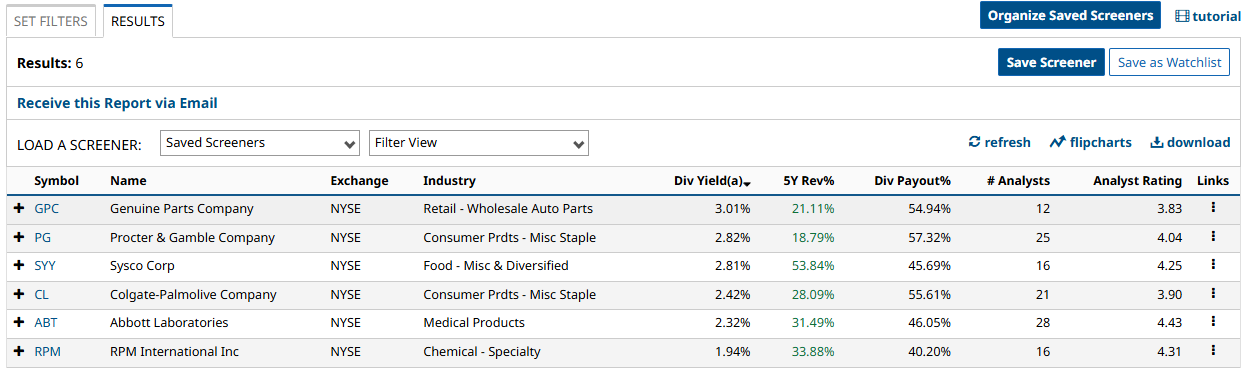

I ran the screen and got 6 results. I will cover three with the highest forward annual dividend yield.

Let’s start with the first Dividend King:

Genuine Parts Company (GPC)

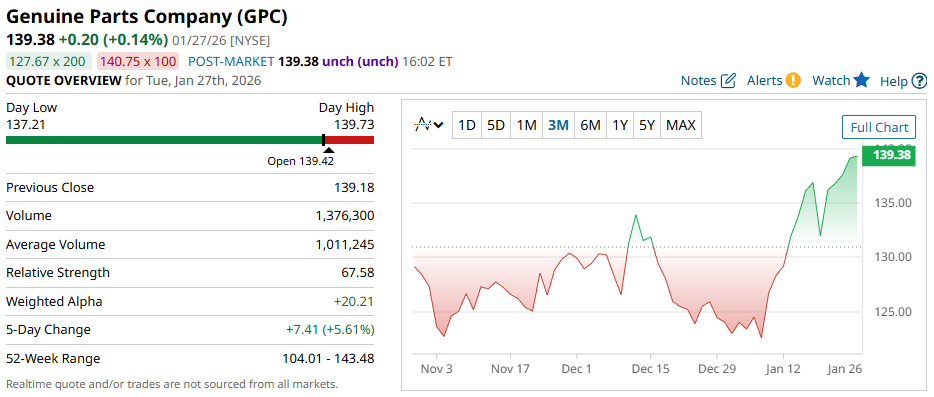

Genuine Parts Company is a global leader in the automobile industry, specializing in the distribution of automotive and industrial replacement parts. It is known for its NAPA Auto Parts, one of the largest automotive aftermarket brands.

In its most recent quarterly financials, sales rose 5% YOY to $6.3 billion, and were up 21.11% over the past five years. Its net income was down 0.2% year over year to $226 million.

Income investors will note that the company raised its dividends for 69 consecutive years. Today, it pays a forward annual dividend of $4.12, yielding around 3%. Meanwhile, it has a dividend payout ratio of 55%, which sits at a balance between shareholder value and company reinvestment, suggesting it is not chasing flashy yields at the expense of long-term stability.

Plus, a consensus among 12 analysts rates the stock a “Moderate Buy” with approximately 36% upside if GPC stock reaches its $190 high target.

Procter & Gamble Company (PG)

The next Dividend King on my List is Procter & Gamble, a company I've often covered, so we’ll keep the introductions brief. It specializes in manufacturing and distributing everyday essentials, such as household and personal care products. Its wide-portfolio includes Tide, Pampers, and more.

In its most recent financials, the company reported sales were up 3% YOY to $22.4 billion, and over the past five years, they're up 18.79%. Net income also rose 20% year-over-year to $4.8 billion.

Procter & Gamble has increased its dividends for 69 consecutive years, and today pays a forward annual dividend of $4.23, translating to a yield of approximately 2.9%. With a 58% dividend payout ratio, I think it is one of the safest income stocks around with lots of runway for dividend growth.

Not only that, but a consensus among 25 analysts rates the stock a “Moderate Buy”, with a high target price of $181, which suggests as much as 22% upside if the stock hits its target.

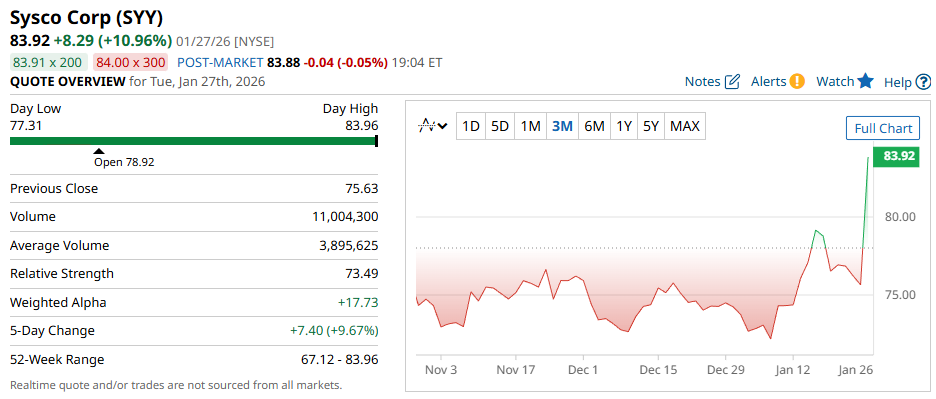

Sysco Corp (SYY)

The last and final Dividend King on my list is Sysco Corp, one of the key companies behind the marketing and distribution of food products, equipment, and related supplies to commercial businesses.

In its recent quarterly financials, the company reported that sales grew 3.2% YOY to $21.1 billion, and they were up 53.84% over the past five years, the best growth rate on the list. However, this past year, costs were up, resulting in net income down 3% year over year to $476 million.

That said, Sysco has increased its dividend for over 50 consecutive years, and today pays a forward annual dividend of $2.16, translating to a yield of approximately 2.6%. It has a modest dividend payout ratio of 46%, which makes it even more compelling, as the company still has plenty of earnings to reinvest and grow its payouts over time.

Speaking of upside, there could be as much as 22% upside if the stock achieves the projected high of $102. Finally, 16 analysts are in consensus, rating the stock a “Moderate Buy”.

Final Thoughts

More than flashy yields, these three Dividend Kings stocks offer what most cannot: stability. These companies have shown resilience and customer value, consistently raising their dividends for more than 50 years, without forcing unsustainable payouts. Today, they maintain strong fundamentals, prioritizing long-term business health while rewarding shareholders.

On the date of publication, Rick Orford did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)