J.P. Morgan (JPM) is the largest bank in the U.S. (and the world), so investors pay close attention when this megabank loses more than 2% of its value on any given day. J.P. Morgan did just that on Friday, inclusive of its after-hours move.

This decline came as President Donald Trump sued the bank, along with CEO Jamie Dimon, accusing the bank of severing its financial relationship with the previous president following the January 6th insurrection on the U.S. Capitol more than five years ago. The lawsuit was brought about by asserting that J.P. Morgan and Jamie Dimon violated the Unfair and Deceptive Trade Practices Act, with $5 billion in damages sought as a remedy for the “unethical behavior” of the bank, as cited in the complaint.

Aside from other incredibly important news this week, this lawsuit did dominate headlines as investors reassessed their exposure to financial stocks. Let's dive into the potential long-term impact of this lawsuit and what to make of JPM stock in light of this recent news.

Does This Lawsuit Change Anything?

I'd argue that from a fundamental standpoint, there's likely to be little impact on J.P. Morgan over the long term. Regardless of the outcome of this legal action, the reality is that J.P. Morgan earned more than $13 billion this past quarter alone. What that means is that even if this lawsuit does ultimately go President Trump's way, that amounts to roughly one month's worth of earnings for the top U.S. bank.

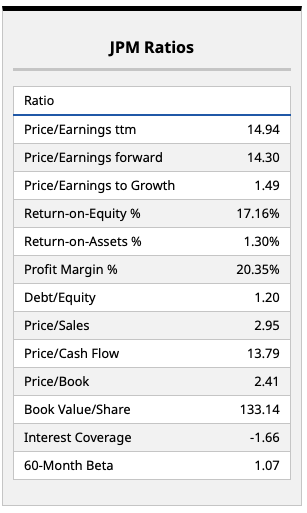

Looking at J.P. Morgan's fundamentals above, it's clear investors have plenty to be excited about. The company's operating margin has surged above 20%, driven by accelerating net interest margins (thanks in part to a steeper yield curve, with short-term interest rates coming down and long-term rates remaining high). That's something President Trump has hoped would change, and we'll see on that front.

The company's return on equity ratio above 17% is enticing, as is the company's price-cash flow ratio at around 13.79 times. That implies a free cash flow yield of more than 7%. In combination with the company's 2% dividend yield, investors can garner a nearly double-digit return in total. That's typically a level at which many bulls will increase exposure to blue-chip stocks.

I think the current macro dynamics at play with a cooling labor market and pressure on central bankers to maintain growth could lead to a further steepening of the yield curve. Such a situation would clearly benefit banks like J.P. Morgan, which have a broad base of businesses, allowing the bank to earn outsized profits in a range of market environments. Accordingly, I'm going to be paying closer attention to J.P. Morgan's upcoming earnings reports than these sorts of headlines, which can muddy the waters for investors considering adding exposure to world-class stocks like J.P. Morgan on daily declines like we saw on Friday.

What Do Wall Street Analysts Think?

For now, commentary from Wall Street analysts on this particular lawsuit remains sparse. That said, the 28 analysts covering JPM stock have placed a healthy price target of more than $336 per share on J.P. Morgan, implying a potential upside of around 13% from current levels.

This upside is more than reasonable in my view over the near term, given J.P. Morgan's performance since April. Macro conditions do affect this bank to a greater degree than most companies in the market. However, these sorts of one-off events are ones I view as potential buying opportunities for those with a long-term investing time horizon.

On the date of publication, Chris MacDonald did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)