/Data%20codes%20through%20eyeglasses%20by%20Kevin%20Ku%20via%20Pexels.jpg)

Palantir Technologies (PLTR) is a stock that seems to polarize investors, but Bank of America's latest conviction list appears to indicate a change in sentiment. Bank of America's updated U.S. 1 list, which is a compilation of the investment bank's best “Buy”-rated stocks, included a reaffirmation of Palantir Technologies as a top pick in 2026, despite a volatile run and high valuation multiples. This is a clear endorsement of the company, which is included in some of the most widely watched stocks in U.S. equity markets.

The request comes as Palantir transforms from an AI narrative stock into one that exhibits operating leverage. Enterprise adoption of its Artificial Intelligence Platform (AIP) continues to gain momentum, government spending on its software appears solid, and Palantir’s profitability metrics are rising at rates that few of its larger-cap software peers can match. In an environment of increasingly selective AI spending, Palantir’s numbers are increasingly speaking louder.

About Palantir Technologies Stock

Founded in 2003 and based in Denver, Colorado, Palantir is a company that specializes in developing software platforms to assist in the integration, analysis, and operation of complex data. Its flagship products, Gotham, Foundry, and AIP, serve various industries, namely government, defense, healthcare, and commercial businesses. With a market capitalization of about $404 billion, it has undoubtedly reached large-cap status in the technology world.

For the past 52 weeks, PLTR has been very volatile, trading between a low of $66.12 per share and a high of $207.52 per share. Though it has pulled back somewhat, it remains substantially higher over the past year, evident by a weighted alpha of +73.7. This far surpasses the rest of the market, even though it has pulled back somewhat since late 2025.

Valuation is the main point of disagreement. The stock has a price-to-forward-earnings ratio of 209 times and trades at more than 110 times revenue. These are high multiples compared to the averages in the software industry. But the multiples are also being validated by the profits. The company has achieved a 33% GAAP operating margin, an adjusted operating margin of 51%, and a profit margin of more than 16%.

In addition, it has no debt. If investors think of the stock as an emerging AI infrastructure play rather than a traditional software company, the premium is viewed as durable.

Palantir Beats on Earnings as AI Adoption Accelerates

In its latest quarter, Palantir’s numbers reinforced Bank of America’s case for being positive on the stock. For instance, in its Q3 2025 quarter, revenue rose by 63% year-over-year (YoY) to $1.18 billion, while U.S. revenue rose by 77% to $883 million. However, the standout figure in the latest numbers is U.S. commercial revenue, which rose by 121% YoY. This is indicative of high adoption rates in enterprises for AIP

Profitability also expanded as growth occurred. Net income under GAAP was $476 million, which equates to a 40% margin, and adjusted free cash flow was $540 million, or 46% of revenue. The Rule of 40 score was 114%, a number rarely seen among larger software companies and which underscores our operating leverage.

In addition to this, contract activity saw significant improvements with Palantir closing $2.76 billion in total contract value in the quarter, increasing by 151% YoY, including a record $1.31 billion in U.S. commercial TCV. Remaining deal value in U.S. commercial rose to $3.63 billion in the quarter.

What Do Analysts Expect for PLTR Stock?

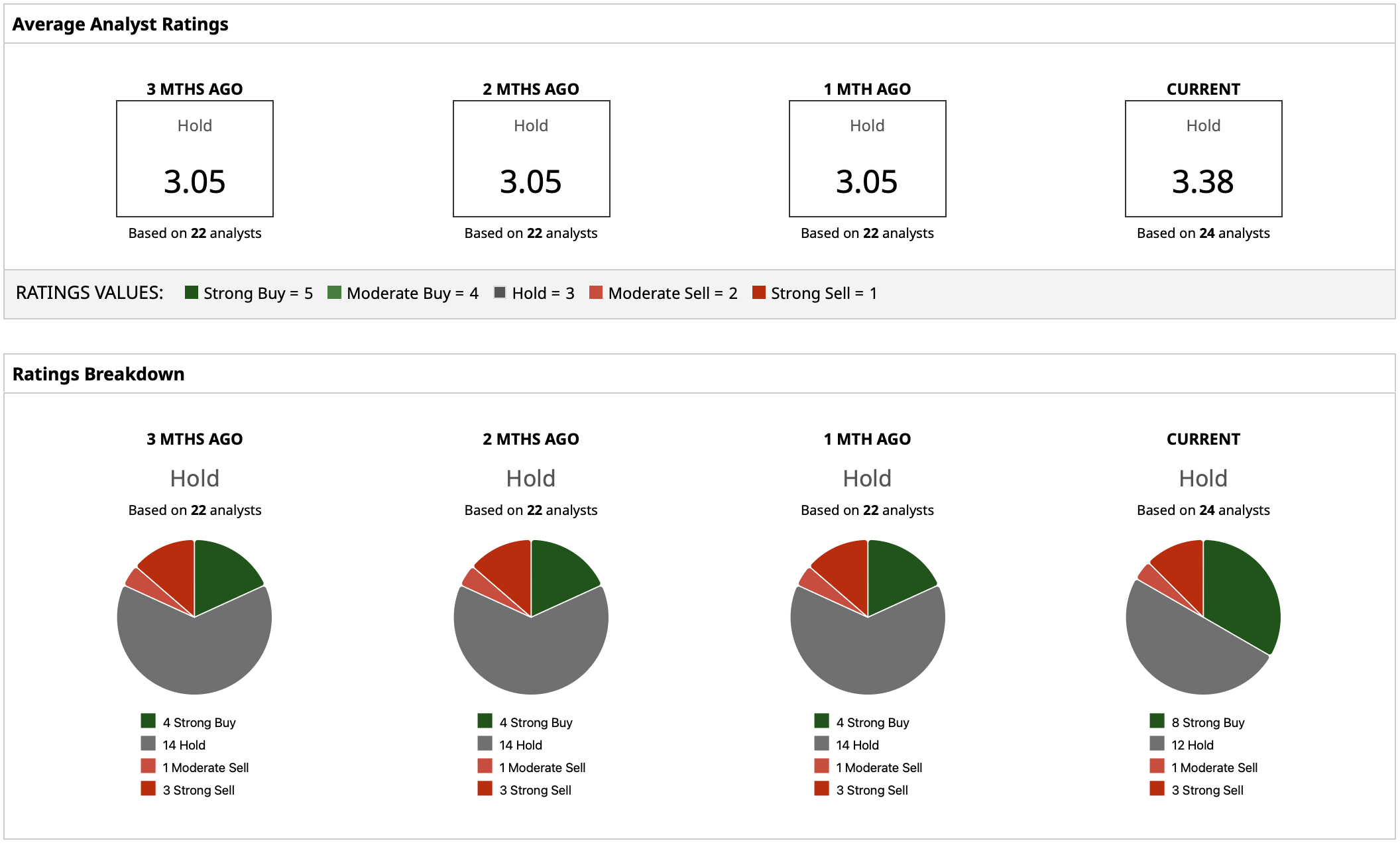

In the Wall Street community, the sentiment for PLTR stock is mixed but leans positive. While it carries a premium valuation, the recent execution has helped increase confidence in the sustainability of the growth and margin story. Bank of America adding the stock to the U.S. 1 stock list, which carries a C-1-9 rating, signifies a “Buy” recommendation with a high level of volatility risk and no dividend, which categorizes the stock as a growth stock investment option for investors.

However, PLTR has a “Hold” rating consensus and the mean analyst price targets for the company sit around $201.52. This means that with the company trading closer to the $170 price level recently, the mean price targets imply a potential upside of about 19%. This may be an indication that the analysts see the company’s continued growth with the help of its artificial intelligence capabilities to warrant its higher price levels well into the next year.

On the date of publication, Yiannis Zourmpanos did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)