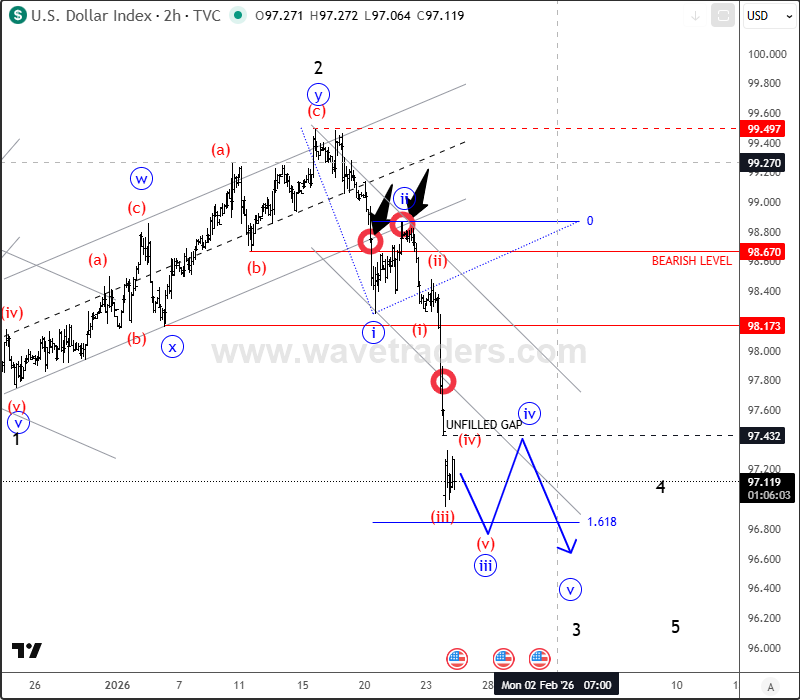

Good morning, traders! We’ve seen huge volatility at the start of the week, so there’s a lot to cover today. Regarding the US dollar, we know where the flow is, so there is still room for further weakness after any pullbacks (watch today’s gaps). Stocks saw an intraday spike lower, which I view as a correction and solid support within the broader uptrend, so risk-on sentiment remains intact for now. Despite the sharp declines on some XXXJPY cross pairs, USDJPY has likely turned bearish, while other XXXJPY crosses may soon stabilize and see more upside. Metals continue to push strongly higher and, in the current risk-on environment, they can remain in a bullish trend—though we should still watch for new corrections. The US Dollar Index (DXY) is coming strongly lower, which looks like subwave (iii) of “iii” within an ongoing five-wave bearish impulse in wave 3. This suggests bearish continuation, but watch for a wave “iv” pullback that could fill the gap.

If you wish to see daily analysis like these, visit us at wavetraders.com - we cover daily Forex, Commodities, Stocks and Crypto

/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)