Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

The Bull Strangle Newsletter, released weekly, shares a trading strategy that has achieved a documented 73%-win rate and outperformed the S&P 500 by 240% since inception. The strategy combines buying stock and simultaneously selling out-of-the-money covered calls and cash-secured puts to generate option premiums and manage risk.

Watch List Overview

Watch list candidates are chosen for their stable price behavior, defined support, and liquid option markets, making them well suited for a long-stock, dual-option selling strategy. Their orderly movement allows the stock to serve as a reliable anchor while both the call and put premiums expand the profit range and reduce dependence on short-term direction.

Past Performance

The Bull Strangle model portfolio is now outperforming the S&P by 2.85:1.

Watch List Favorites

This week the Newsletter contains 22 stocks and ETFs across 8 sectors. 2 of the stocks on the Watch List are detailed below:

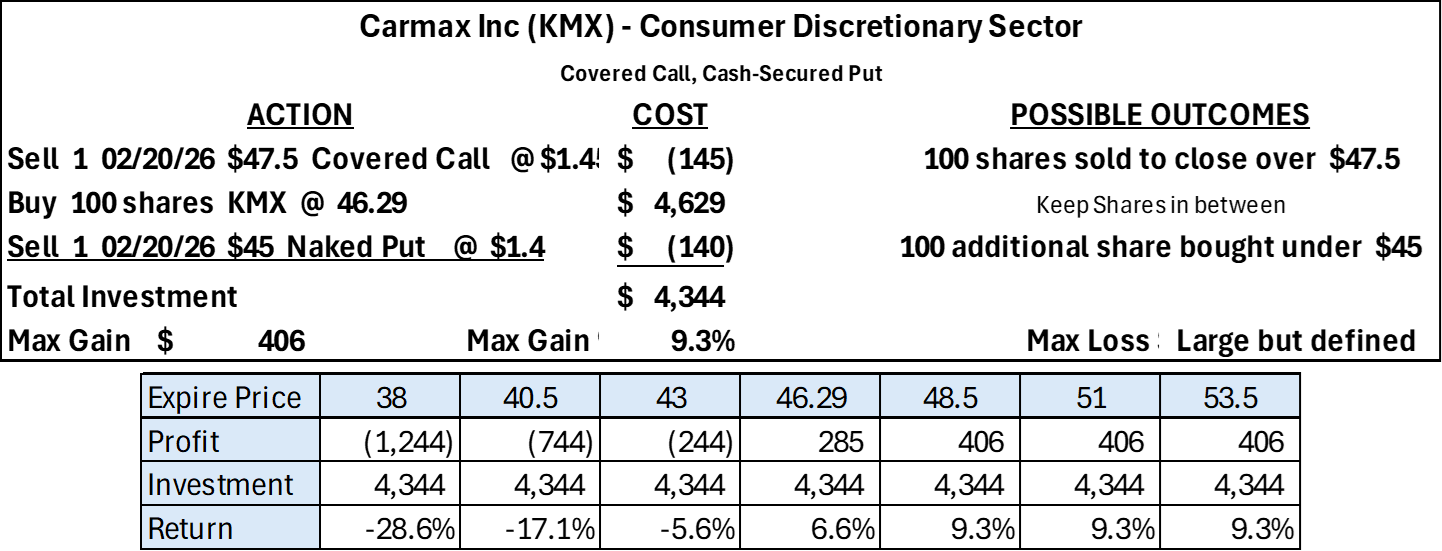

CarMax, Inc., (KMX)

- CarMax, Inc., through its subsidiaries, operates as a retailer of used vehicles and related products in the United States. The company operates in two segments: CarMax Sales Operations and CarMax Auto Finance. The CarMax Sales Operations segment offers customers a range of makes and models of used vehicles, including domestic, imported, and luxury vehicles, as well as hybrid and electric vehicles; used vehicle auctions; extended protection plans to customers at the time of sale; and reconditioning and vehicle repair services.

CarMax Inc (KMX) has staged a sharp rebound from its November lows, rallying strongly through December and early January as momentum carried the stock back above its short- and intermediate-term moving averages. That advance recently stalled near the declining long-term downtrend line and the 100-day moving average, where sellers stepped back in. The latest pullback suggests near-term consolidation or digestion of gains, with price now testing whether former breakout levels can hold as support.

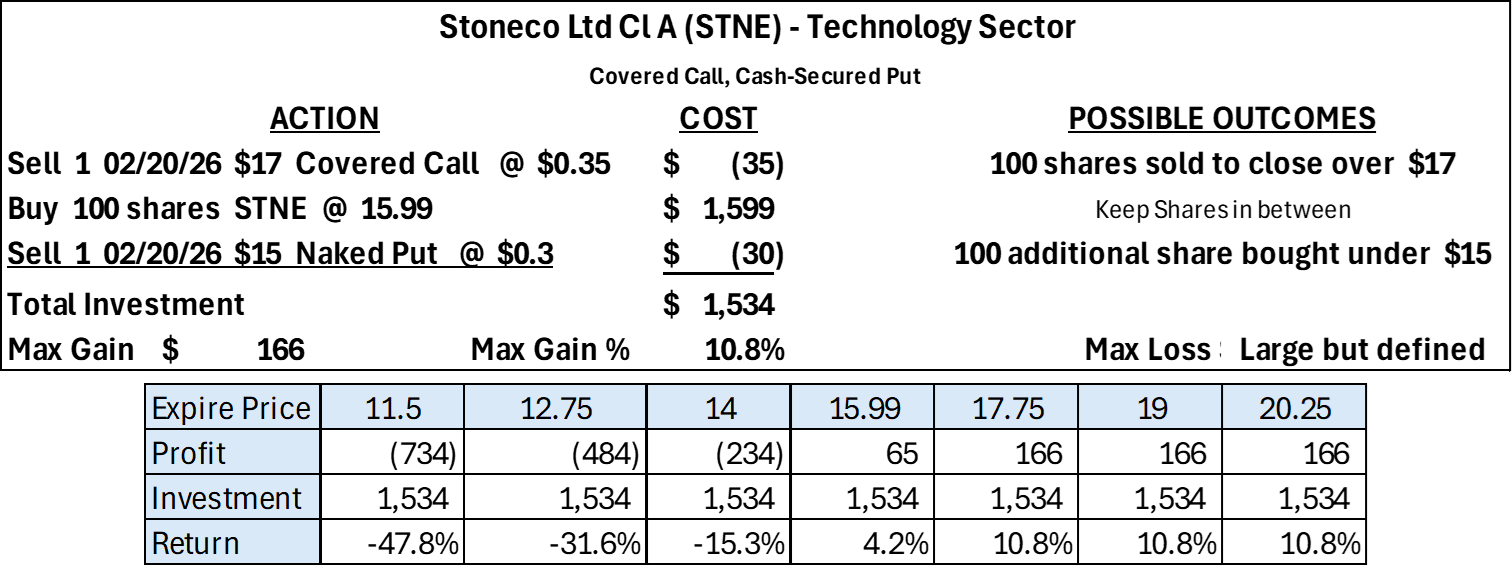

StoneCo Ltd (STNE)

- StoneCo Ltd. provides financial technology and software solutions to merchants and integrated partners to conduct electronic commerce across in-store, online, and mobile channels in Brazil. The company offers financial services, including payment, prepayment, digital banking, and credit solutions. It distributes its solutions, principally through proprietary and franchised Stone Hubs, which offer hyper-local sales and services; and sells solutions to brick-and-mortar and digital merchants through sales team.

StoneCo Ltd (STNE) has recently broken above a well-defined short-term downtrend, signaling a potential shift in momentum after several weeks of consolidation. The stock reclaimed its 20- and 50-day moving averages and pushed back toward the mid-$16 area, while the rising 200-day moving average remains longer-term support. This move suggests improving near-term sentiment.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)