/Intel%20Corp_%20Santa%20Clara%20campus-by%20jejim%20via%20Shutterstock.jpg)

Intel (INTC) shares moved lower after the company reported fourth-quarter earnings, even though the chipmaker beat expectations. The market’s reaction reflects investor concern about management’s first-quarter outlook, which came in below consensus and highlighted near-term operational challenges.

For Q4, Intel posted revenue of $13.7 billion, surpassing both Wall Street estimates and the company’s own guidance. Growth was broad-based across the business, supported by continued investment in AI infrastructure. Demand for AI-enabled PCs, traditional server products, and networking solutions all rose at double-digit rates both sequentially and year-over-year (YOY), underscoring Intel’s improving competitive position in several key end markets.

In addition, profitability presented stronger than expected. Intel reported adjusted earnings per share of $0.15, well above its guidance of $0.08 and ahead of analyst expectations. The upside was driven by higher revenue, improved gross margins, and ongoing cost discipline, signaling progress in management’s efforts to stabilize the business.

Despite the solid quarterly performance, Intel’s near-term outlook weighed on the stock. In the second half of 2025, the company met strong customer demand by leveraging intra-quarter wafer production and existing inventory. However, as Intel enters 2026, that buffer has been largely exhausted. At the same time, a shift in wafer production toward server products that began in the third quarter will not fully flow through manufacturing until late in the first quarter of 2026.

As a result, Intel expects supply constraints to be most pronounced in the first quarter, limiting its ability to fully capitalize on demand and pressuring near-term financial results. For the first quarter, Intel is guiding for revenue of $12.2 billion. Even at the midpoint of this range, the outlook falls short of Wall Street expectations of $12.6 billion, signaling a softer start to the year than investors had anticipated. And, profitability is expected to be subdued, with the company forecasting breakeven results for the quarter, below analysts’ consensus estimates.

While these challenges appear temporary, they introduce uncertainty that investors are factoring into the stock.

What’s Ahead for Intel?

Intel enters 2026 facing near-term pressure, with the first quarter expected to remain challenging. However, the investment outlook for INTC stock improves meaningfully as the year progresses, driven by accelerating AI demand and a steady recovery in manufacturing supply.

Management expects supply constraints, particularly those affecting the Client Computing Group (CCG), to ease beginning in the second quarter, with incremental improvement through the remainder of 2026. In parallel, Intel anticipates a strong growth year in its data center and AI (DCAI) business, reflecting rising demand for server capacity.

The company is posturing itself to capture AI-driven growth across its portfolio. Intel is strengthening its client computing franchise and expanding its data center and AI accelerator offerings. Moreover, its X86 architecture franchise positions it well to capitalize on AI-driven demand as it remains the most widely deployed compute platform globally.

In CCG, Intel has strengthened its stance in both consumer and enterprise notebooks with the launch of Core Ultra Series 3, built on the advanced Intel 18A manufacturing process. Further, the planned launch of Nova Lake in late 2026 strengthens its role as the leading AI PC platform.

In addition, PCs are becoming a critical component of AI infrastructure. This dynamic is likely to drive a larger installed base and faster PC refresh cycles, supporting Intel’s growth.

Demand within the DCAI segment for traditional servers remains exceptionally strong, and the company is scaling available capacity to meet demand and deliver solid growth. Furthermore, Intel is partnering with key customers to ensure sufficient capacity well beyond 2026, which reflects the durability of demand. At the same time, the ongoing product ramp to support wide AI workloads augurs well for growth.

Is Intel Stock a Buy Now?

Intel’s post-earnings pullback reflects near-term concerns tied to supply constraints and a cautious first-quarter outlook rather than deterioration in underlying demand. While Q1 may remain under pressure, the company’s stronger-than-expected Q4 execution, easing supply issues as 2026 progresses, and growing exposure to AI-driven PCs and data center workloads point to a more favorable medium-term trajectory.

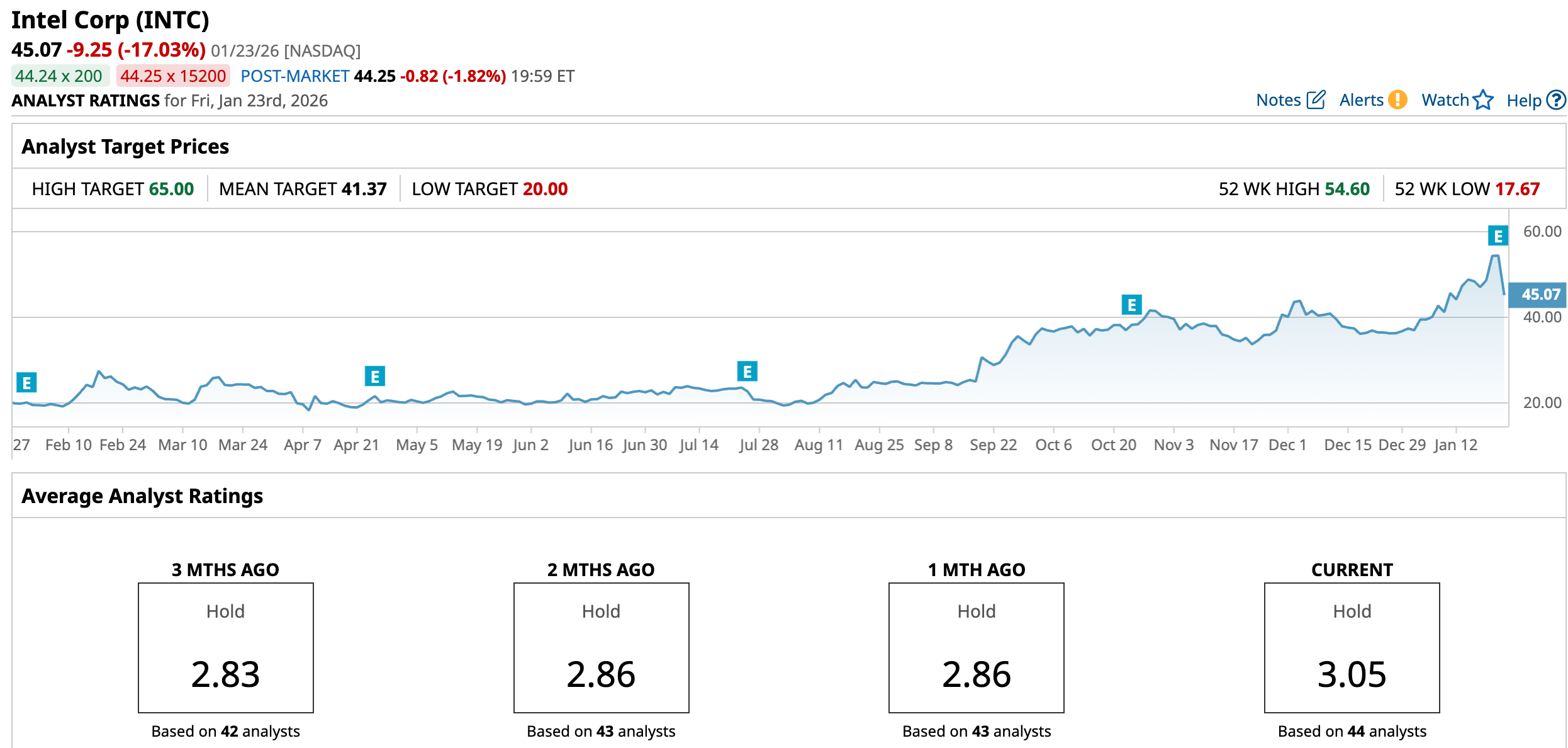

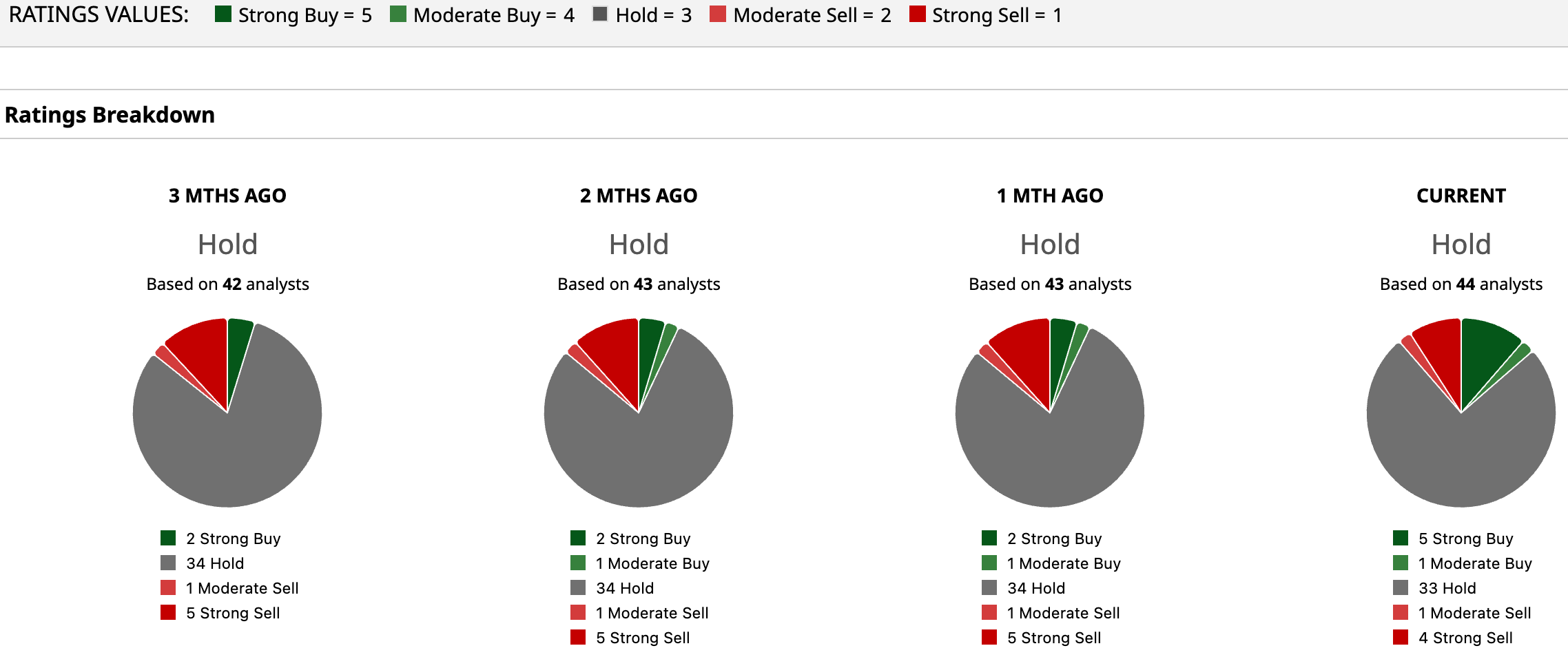

However, Intel stock has already posted a substantial rally over the past six months, suggesting that some of the recovery narrative may be priced in. As a result, analysts remain cautious, with a consensus “Hold” rating on the shares.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)