Howdy market watchers!

The deep freeze is here! After much anticipation, arctic air will be covering a large part of the country from the Southwest to the Northeast extending into early next week. Snow totals are increasing with ice possible in many areas with more of the same expected next weekend. Thousands of flights have been cancelled along with everyone’s weekend plans, I suspect. It will be a weekend to enjoy indoors around the fire as we all had hoped to do during the Christmas holidays when it was unseasonably warm.

The flip flop couldn’t have been more extreme as one can see from the ‘widow-making’ natural gas futures contract. What a week it has been in that market! After plunging to near $3.00 on the front-month February contract last week, natural gas surged to a high of $5.65 by Thursday with extreme short covering ahead of the polar plunge! This is the largest, fastest surge in the history of the natural gas futures contract. Unbelievable! So much for cheaper nitrogen fertilizer prices…

With moderate crude oil prices, this opportunity to lock in higher natural gas prices will be welcome news for oil companies as the Trump Administration continues to work towards lower energy prices for consumers. However, with rising tensions surrounding protests in Iran, the American military is increasing its presence in the region with escalation possible at any time that is adding some risk premium to the oil market. Stay tuned as this situation has the potential to spike at anytime and create volatility across markets.

President Trump was in Davos, Switzerland, this week for the World Economic Forum where he continued to make a full court press for the US acquisition of Greenland from Denmark. Threatened tariffs on opposing European countries were dropped as there is apparently a ‘framework’ for a deal now in place. Who knows what that actually means as this pursuit is now in full forward motion with President Trump unlikely to settle for even a lease.

Trump also held a signing ceremony for his ‘Board of Peace’ that is seen as an alternative to the United Nations. Link to announcement: President Trump Ratifies Board of Peace in Historic Ceremony, Opening Path to Hope and Dignity for Gazans – The White House. The US also announced this week the withdrawal from the World Health Organization.

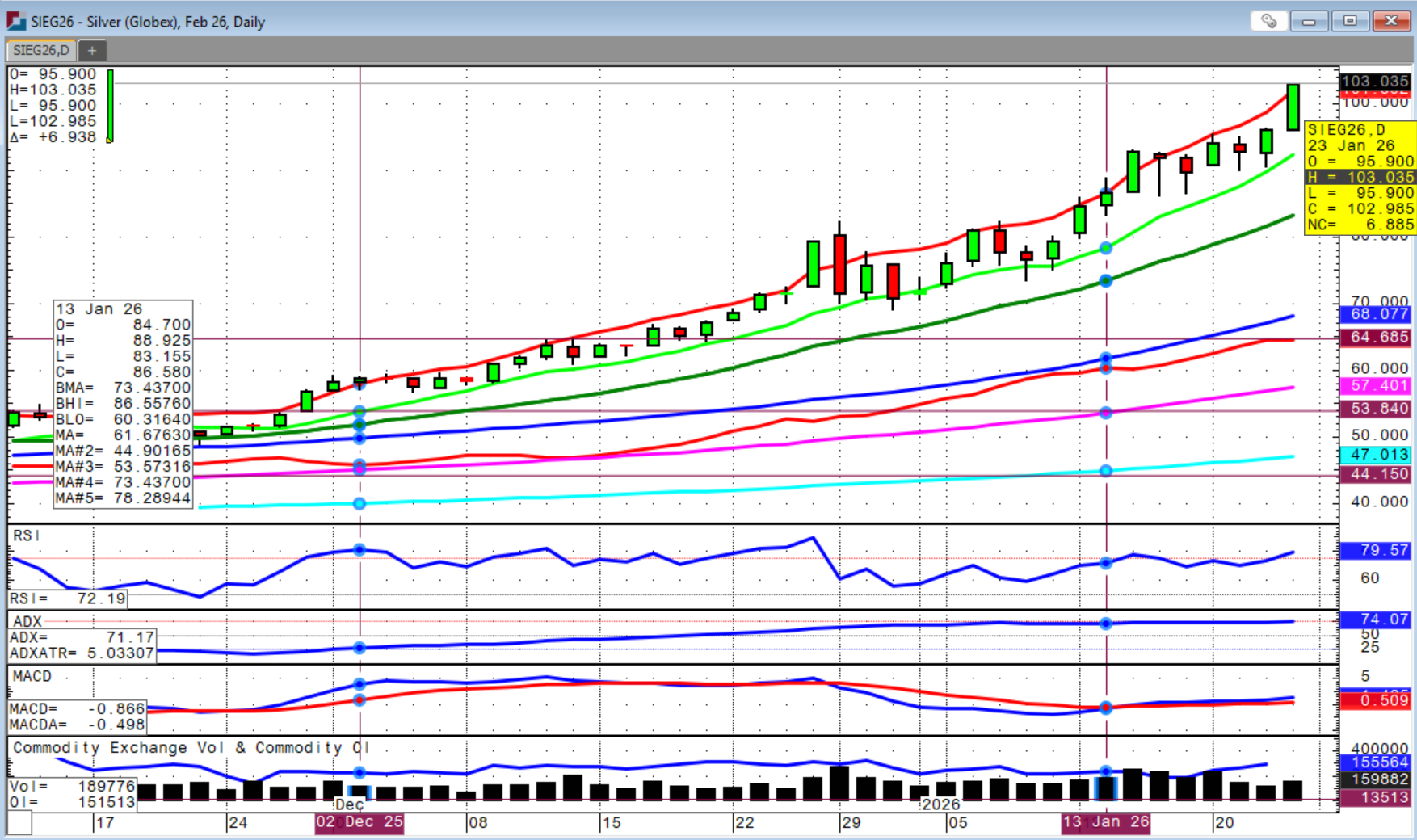

These anxieties have played into the precious metals with silver exploding above $100 per ounce and then some. The COMEX silver contract was up over six percent on Friday alone. Where and when is this going to end. Analysts are expecting silver to reach $130 and gold to top $5,000 this year and it could be well above that.

The US dollar plunged this week with the largest drop on Friday breaking below the late December lows at 97.500. Such move supported commodities from metals to energy to agriculture commodities.

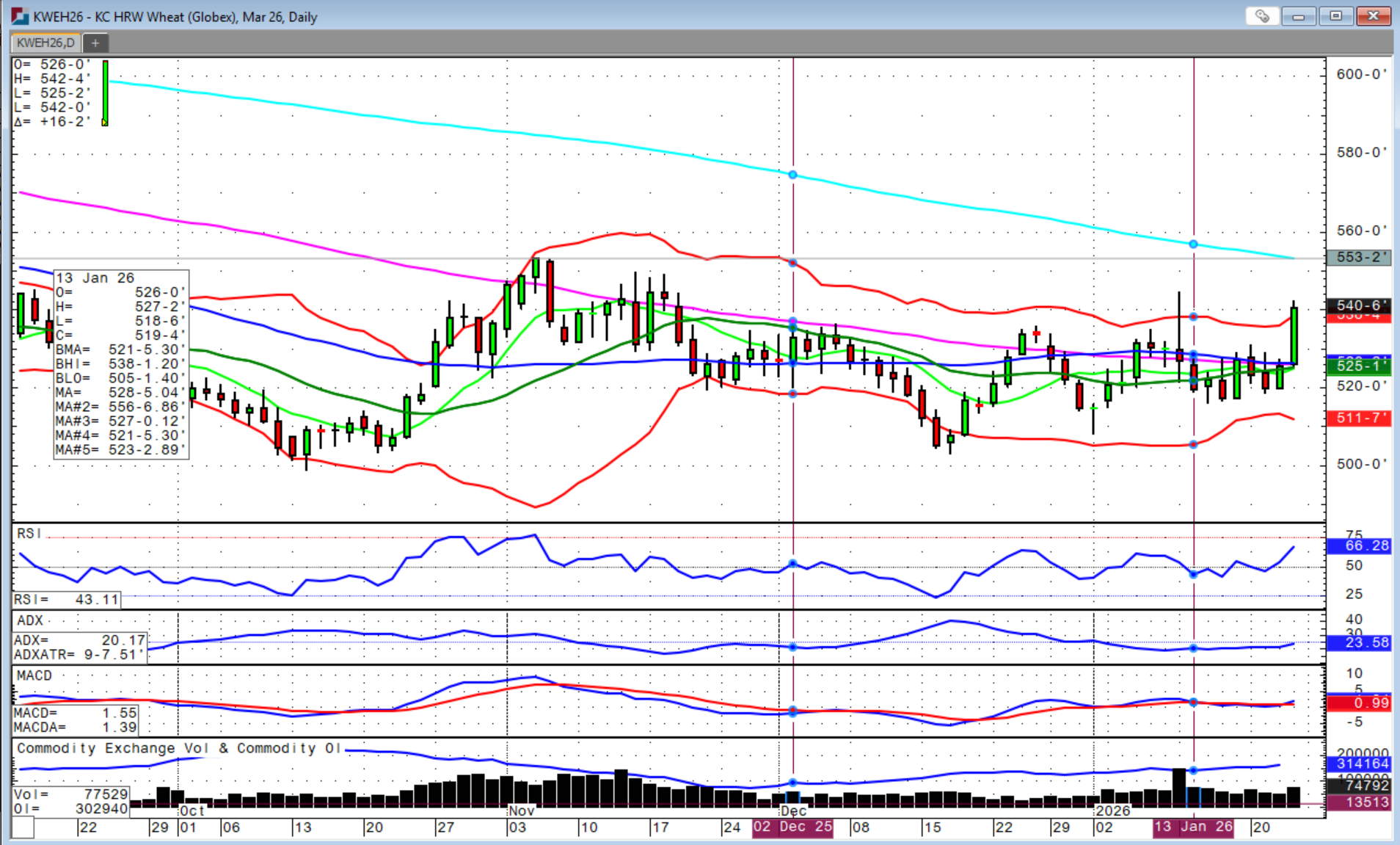

Wheat led the grain and oilseed complex higher on Friday with concerns about winter kill and strong exports. Corn followed with soybeans far behind ending the week with an inside day on charts. Soybeans are at a key decision point with the 12 million metric ton commitment from China now satisfied ahead of the April meeting between Presidents Trump and Xi. US hopes for additional soybean purchases from Beijing are unlikely with buying now turning to Brazil as harvest there progresses.

US farmers desperately need clarity over enhanced biofuel targets to absorb the growing domestic stocks amid an increasingly competitive export environment, particularly for soybeans. With US government funding expiring at the end of January, proposed legislation is being discussed in Congress that lacks additional support for agriculture that the industry was hoping to see. Folks, it is time we begin doing things differently as this is just foreshadowing the future that is getting closer by the day.

We will get an interest rate decision from the Federal Reserve’s FOMC next Wednesday that is likely to result in a pause of the recent cuts. The Personal Consumption Expenditures (PCE) index, the Fed’s preferred inflation gauge, was updated this week and came in at 2.8 percent for December 2025, that continues to remain above the target of 2.0 percent. Personal income increased slightly with consumer spending continuing to show signs of strength. In the Fed’s dual mandate of price stability and full employment, the majority of the FOMC is still likely to lean more towards inflationary concerns, but we will have to see how things develop.

It’s a busy couple of weeks for cattle reports with Friday’s release of the monthly USDA Cattle-on-Feed followed by next Friday’s bi-annual USDA Cattle Inventory report. Fundamentally, expectations continue to point towards a bullish bias in all reports, but the market was patiently waiting for fresh news after an impressive rebound over the past couple of months.

The Cattle-on-Feed report released at 2 PM on Friday did indeed have a bullish bias although placements were slightly higher than expected, but still the lowest in 10 years. January 1st on-feed numbers were as expected and the lowest in 9 years. Marketings came in higher than expected and the highest in 4 years, which indicates bullish demand. With winter weather ahead, I was expecting more strength in Friday’s trade, but we still had a decent close and in fact, an outside reversal higher day on charts after early session selloff down to the 20-day moving average, but a higher high versus the previous session.

Cash fed cattle trade emerged Friday and showed some strength with $236 paid in Texas and Kansas and $236.50 paid in Western Nebraska versus front-month February live cattle futures closing the week near $235. With packer margins negative, these higher cash trade numbers show that demand continues despite the desire of the packers to pay less.

Continued strength in corn may styme significant buying interest in cattle futures next week, but without other headwinds, I believe we could see the stalled cattle rally try to break out above the recent sideways chop.

New World Screw Worm developments will keep volatility a concern with more warnings that a US confirmed case is likely more a matter of when not if. While such news would seem to be bullish due to infected animals not being available, it is difficult to know how consumers will interpret the news. It could be a non-event, but if markets get overbought, even the slightest news of uncertainty can trigger a selloff.

Bottomline, protect your profits as it has been a phenomenal recovery and there may not be another opportunity if the rally stalls here. Reminder, there is no LRP offered on USDA report days.

Sidwell Strategies is the one-stop shop to protect cattle with futures, puts, LRP or a combination of all, which is probably the best strategy overall. If you’re ready to trade commodity markets, give me a call at (580) 232-2272 or stop by my office to get your account set up and discuss risk management and marketing solutions to pursue your objectives. Self-trading accounts are also available. It is never too late to start and there is no operation too small to get a risk management and marketing plan in place.

Wishing everyone a successful trading week! Let us know if you'd like to join our daily market price and commentary text messages to stay informed!

Brady Sidwell is a Series 3 Licensed Commodity Futures Broker and Principal of Sidwell Strategies. He can be reached at (580) 232-2272 or at brady@sidwellstrategies.com. Futures and Options trading involves the risk of loss and may not be suitable for all investors. Review full disclaimer at https://www.sidwellstrategies.com/fccp-disclaimer-21951.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)