/Meta%20Platforms%20by%20Primakov%20via%20Shutterstock.jpg)

Meta Platforms (META), the parent of Facebook, Instagram, WhatsApp, and Threads, has ruled a digital empire built on advertising dollars flowing through its vast social universe. Threads, once a side conversation born within that ecosystem, is now stepping into the spotlight as Meta rolls out ads on Threads globally and officially flips the monetization switch. For the tech giant, it's more than a routine product update. It marks the point of a fast-scaling microblogging platform beginning to carry real economic weight.

With more than 400 million monthly users and daily engagement now rivaling Elon Musk’s X, Threads is quickly growing out of its experimental phase into a revenue engine. Meta is rolling out the same ad tools that have powered Facebook and Instagram for years – carousel ads, rich visuals, Advantage+ features, and easy campaign management across platforms – while adding brand-safety checks to keep advertisers at ease.

For investors, though, Meta has always been a thrilling yet temperamental companion. After a strong run into Q3 2025, the stock gave back gains as Wall Street fixates on Meta’s massive spending plans. A looming CapEx surge, persistent rate worries, and frothy AI valuations have kept sentiment on edge. With Threads emerging as a potential growth catalyst, should investors stay the course with META, trim exposure, or lean in and add the stock to their portfolios?

About Meta Stock

Meta Platforms hardly needs an introduction. Born as Facebook in 2004, the company has evolved far beyond its dorm-room origins into a global digital ecosystem spanning Instagram, WhatsApp, Messenger, and now Threads. What began as a simple newsfeed has steadily transformed into a platform shaping how billions communicate, create, and connect. Today, Meta is leaning hard into artificial intelligence (AI), augmented reality, and its long-term metaverse ambitions, positioning itself as infrastructure for the next wave of digital interaction.

That forward-looking vision is reflected in its stock price performance. After climbing nearly 487% over the past decade, Meta now carries a market capitalization of about $1.66 trillion and sits firmly among the “Magnificent Seven.” Still, recent trading suggests even giants pause to catch their breath.

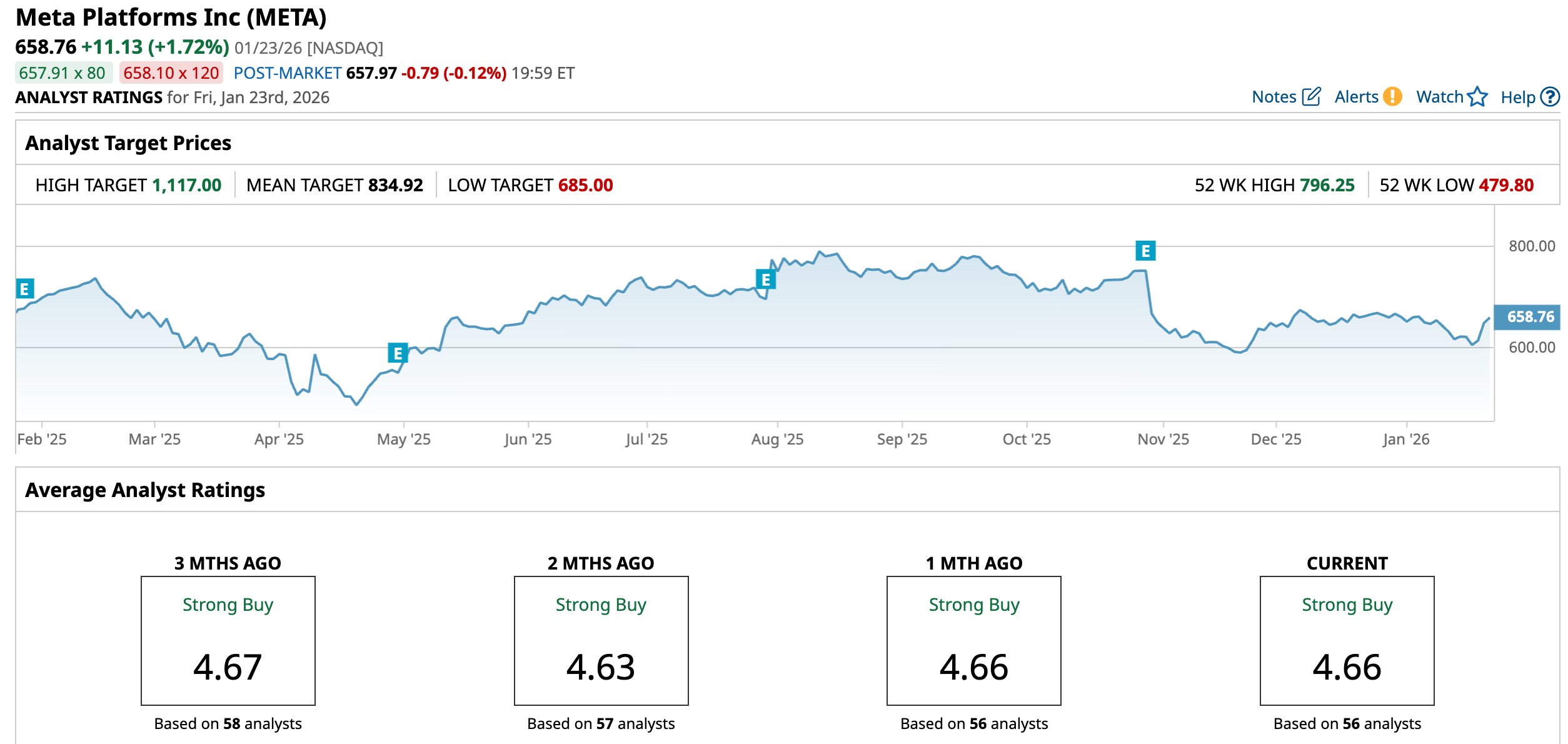

META has stumbled into the new year on shaky footing. With just days left for January to end, shares are a mere +0.32% year-to-date (YTD), reflecting a selloff that’s been building for months. The pressure intensified after Meta’s Q3 2025 earnings on Oct. 30, when the stock plunged 11.3% in a single session. That drop proved to be more than a knee-jerk reaction. Over the past three months, META has slid roughly 9.78%, leaving the stock nearly 20.4% below its 52-week high of $796.25.

At the core of META’s slide is a familiar worry loop. Investors are uneasy about ad demand durability, ballooning AI-related spending, and the lack of a stand-alone profit engine to offset those costs. While Wall Street supports AI that strengthens ad tech, enthusiasm fades for consumer-facing assistants with unclear returns.

Yet, the 14-day RSI is 56.28, hovering in neutral to bullish territory. Meanwhile, the MACD oscillator remains firmly bearish, with the MACD line below the signal line and the histogram printing persistent red bars. Together, the indicators point to continued selling pressure, even as the stock searches for a short-term base near recent lows.

In terms of valuation, META looks expensive at first glance, priced at 21.43x forward earnings and 8.32x forward sales. This sits well above sector norms and its own history. Still, that premium reflects scale and ambition. More than just an ad engine, Meta is pushing into AI, robotics, and the metaverse. As AI gains translate into faster revenue and profit growth, today’s multiples could quietly compress.

Investors on the Edge after Meta’s Q3 Report

Meta’s Q3 earnings results, unveiled on Oct. 29, looked like the kind of report that usually sends a stock higher. Revenue jumped 26% year-over-year (YOY) to $51.2 billion, comfortably beating expectations, powered by an advertising engine that keeps finding new gears. AI-driven targeting, stronger Reels traction, healthier ad demand, and rising engagement all did their part. Meta noted that its AI recommendations alone lifted time spent by 5% on Facebook and 10% on Threads – quiet but meaningful gains at massive scale.

Earnings were stronger than they appeared. Adjusting for a deferred tax charge, EPS would have climbed to $7.25 from $6.20, far better than the reported diluted EPS of $1.05.

Ad impressions in Q3 rose 14%, while average ad prices increased 10% YOY, reflecting improved performance and strong advertiser demand. Family daily active people (DAP) grew 8% annually, underscoring how deeply Meta’s platforms remain embedded in everyday digital life.

Despite these numbers, the stock slipped, and it was not about Q3, but was about what comes next. Meta guided to solid Q4 growth, expecting revenue between $56 billion and $59 billion. The real concern was spending. Management laid out a massive jump in capital expenditures for 2025 between $70 billion and $72 billion, nearly doubling from 2024, with even higher spending hinted at for 2026.

That spending already left fingerprints on the quarter. Free cash flow slid to $10.6 billion, costs surged 32% YOY, and R&D alone consumed nearly 30% of revenue. Cash and marketable securities slipped to $44.45 billion, while long-term debt remained steady at $28.83 billion. Still, Mark Zuckerberg sounded unfazed, framing the spending spree as the price of building an AI future that Meta has no intention of arriving late to.

The tech giant is all set to release its fiscal Q4 and full-year 2025 financial results after the market closes on Wednesday, Jan. 28. Analysts monitoring Meta project its Q4 revenue to be around $58.38 billion, and EPS is anticipated to grow by 3.2% YOY to $8.28. Fiscal 2025 EPS is expected to climb to $28.94, up 21.29% annually, before surging by another 4.42% to $30.22.

What Do Analysts Expect for Meta Stock?

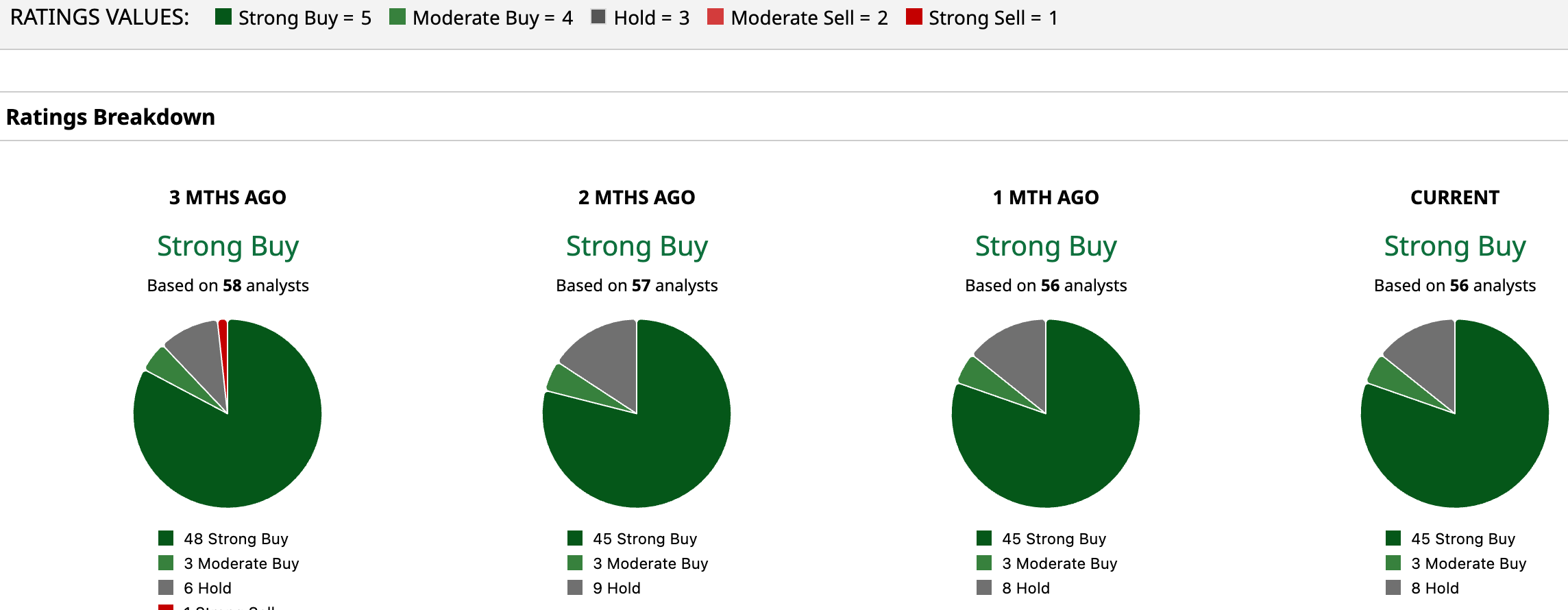

Overall, Wall Street is flashing the green flag for META, with a “Strong Buy” consensus reflecting widespread optimism about the stock’s growth prospects. Of the 56 analysts offering recommendations, 45 are giving it a solid “Strong Buy,” three suggest a “Moderate Buy,” and eight give a “Hold.”

META’s average analyst price target of $834.92 implies a 26.74% upside potential. Meanwhile, Rosenblatt’s Street-high price target of $1,117 suggests that the stock can still rally as much as 69.56% from here.

Final Thoughts on META

Threads ads mark a real turning point for Meta. The platform is losing its ad-free charm, but in return, it is gaining a clear path to becoming a serious business. For Meta, this move strengthens an already dominant ad ecosystem and deepens its competitive moat, even if it comes with short-term growing pains from heavy AI spending.

For investors, the story feels split down the middle. Near-term pressure from costs and shaky sentiment is real, but the long-term case – driven by scale, data, and control over its own AI stack – remains intact. If one believes in Meta’s ability to turn patience into profit, this pullback looks more like a hold-or-add moment than a reason to walk away.

On the date of publication, Sristi Suman Jayaswal did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20badge%20holder-by%20hasrul_rais%20via%20Shutterstock.jpg)

/AI%20(artificial%20intelligence)/Artificial%20intelligence%20and%20machine%20learning%20concept%20-%20by%20amgun%20via%20iStock.jpg)

/AI%20(artificial%20intelligence)/Data%20Center%20by%20Caureem%20via%20Shutterstock%20(2).jpg)

/Nvidia%20logo%20and%20sign%20on%20headquarters%20by%20Michael%20Vi%20via%20Shutterstock.jpg)