/Autodesk%20Inc_%20buy-sell%20ith%20logo-by%20NPS_87%20via%20Shutterstock.jpg)

Design software maker Autodesk (ADSK) is back again in the spotlight as it has rolled out a restructuring plan that will eliminate approximately 1,000 roles, or about 7% of its workforce, as management reallocates spending toward cloud platforms and artificial intelligence (AI).

The reductions will largely affect customer-facing sales teams, aligning with Autodesk’s evolving operating model. Investors responded favorably to this news, pushing shares up 4.8% on Thursday, Jan. 22. The reaction came after a stagnant performance last year and a difficult start to 2026, with the stock down 9.5% year-to-date (YTD).

Autodesk continues to shift from a traditional channel-centric sales approach to a subscription- and usage-based transaction model. The transition aims to deepen customer relationships, improve pricing control, and create more predictable sales streams.

Reflecting that progress, management now expects billings, revenue, adjusted operating margin, adjusted EPS, and free cash flow for both fiscal Q4 2026 and the full year to exceed the top end of prior forecasts.

The company estimates total pre-tax restructuring charges of $135 million to $160 million, primarily tied to employee termination benefits, according to regulatory filings. All being said, the company plans to complete the restructuring by the end of fiscal Q4 2027.

With this backdrop in place, the focus now shifts to evaluating the appropriate course of action for ADSK shares.

About Autodesk Stock

Headquartered in San Francisco, California, Autodesk stands at the forefront of 3D design, engineering, and entertainment software. With a market cap close to $57 billion, it empowers architects, manufacturers, and media creators through industry-standard tools, including AutoCAD, Revit, Inventor, Fusion 360, and Maya.

Yet market performance has lagged operational strength. Over the past 52 weeks, ADSK stock declined 11%. Selling pressure intensified recently, with the stock down 14% over the past three months and another 10% in just the last month.

Coming to valuation, ADSK stock is currently trading at 25.15 times forward adjusted earnings and 7.6 times sales, a premium to peers. However, relative to its own five-year averages, the stock sits at a discount. The divergence suggests the market may be undervaluing Autodesk’s durable franchise, presenting a potentially attractive entry point.

Autodesk Surpasses Q3 Earnings

On Nov. 25, 2025, Autodesk reported Q3 fiscal 2026 results that comfortably exceeded expectations. Revenue rose 18% year-over-year (YoY) to $1.9 billion, topping Street estimates of $1.8 billion. EPS increased 26% from the prior year to $1.60, beating consensus expectations of $2.49 and reinforcing operating momentum.

Profitability also strengthened meaningfully. Income from operations climbed 35.8% YoY to $470 million, while net income rose 24.7% from the year-ago period to $343 million. Investors responded quickly. Autodesk shares gained 1.6% on the day of the release and added another 2.4% in the following session, reflecting renewed confidence in execution.

The company’s emphasis on cloud-based platforms and AI continues to translate into tangible financial gains. Billings reached $1.9 billion, while free cash flow totaled $430 million for the quarter.

To that, management has raised fiscal 2026 full-year revenue guidance to $7.15 billion–$7.165 billion and lifted billings expectations to $7.465 billion–$7.525 billion. The company also now targets annual non-GAAP EPS of $10.18–$10.25.

Analysts reinforce the optimism with forward projections. They expect Q4 fiscal 2026 EPS to rise 22.2% YoY to $1.93. For full-year fiscal 2026, estimates call for 23.4% earnings growth to $7.23, followed by another 16.5% increase in fiscal year 2027 to $8.42.

What Do Analysts Expect for ADSK Stock?

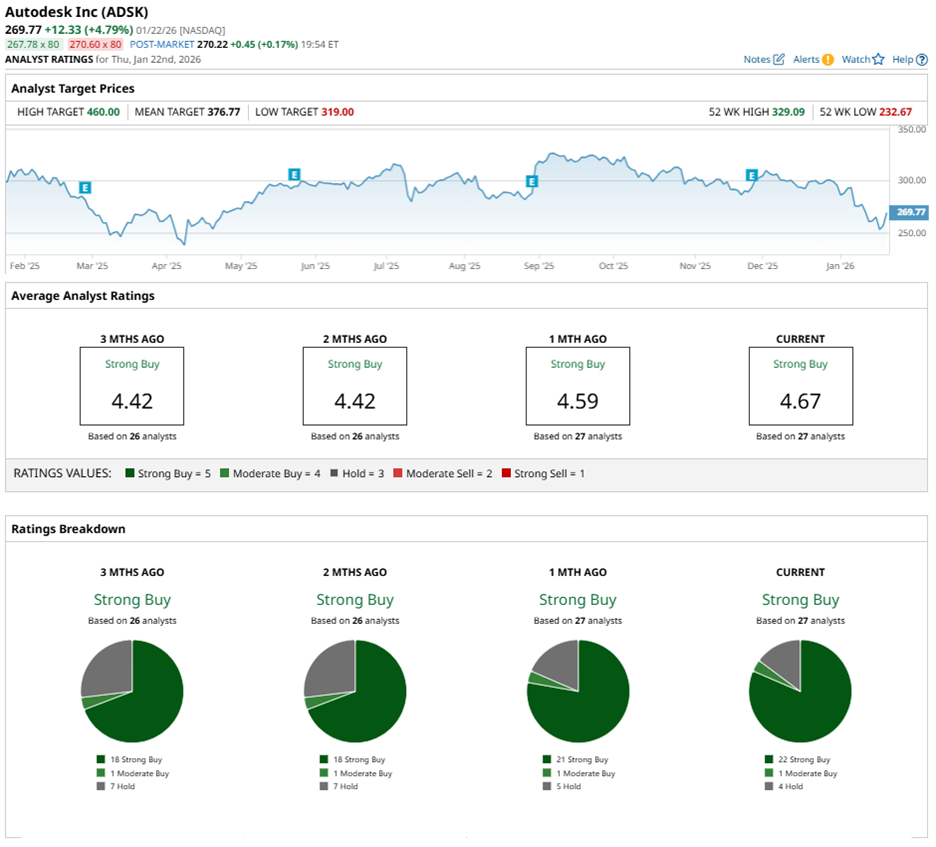

Wall Street continues to back Autodesk’s outlook with conviction. ADSK stock carries a “Strong Buy” consensus rating, supported by 22 of 27 analysts issuing “Strong Buy” ratings. One analyst recommends a “Moderate Buy,” while four advise “Hold.”

Analysts also see notable upside potential. The average price target of $376.77 implies a gain of 40% from current levels. More optimistically, the Street-high target of $460 suggests nearly 70% upside, reinforcing expectations for sustained growth and long-term value creation.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/NVIDIA%20Corp%20logo%20on%20phone-by%20Evolf%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_%20logo%20on%20building-by%20vzphotos%20vis%20iStock.jpg)

/A%20Palantir%20office%20building%20in%20Tokyo_%20Image%20by%20Hiroshi-Mori-Stock%20via%20Shutterstock_.jpg)