/Oracle%20Corp_%20office%20logo-by%20Mesut%20Dogan%20via%20iStock.jpg)

Oracle (ORCL) shares are positioned for a potential boost as a deal to spin off TikTok's U.S. operations nears completion, with the software giant set to secure a 15% stake in the new American entity.

The Chinese parent company ByteDance struck an agreement on Thursday with a group of non-Chinese investors to create a U.S. TikTok, ending a six-year legal battle that threatened the app's survival in America. The deal addresses national security concerns that Beijing could use the platform to surveil or manipulate its more than 200 million U.S. users.

Oracle will join an investor consortium including MGX, an Emirati investment firm, Silver Lake, and Michael Dell's personal investment entity, which collectively will own more than 80% of the new venture. Adam Presser, TikTok's former head of operations, has been named chief executive of the U.S. entity.

For Oracle, the deal will potentially unlock new revenue streams in cloud infrastructure and data management. Oracle has long served as TikTok's cloud provider, and the equity stake is a natural extension of an existing relationship.

Does Oracle's stake in the newly independent TikTok USA warrant adding the stock to portfolios at current levels?

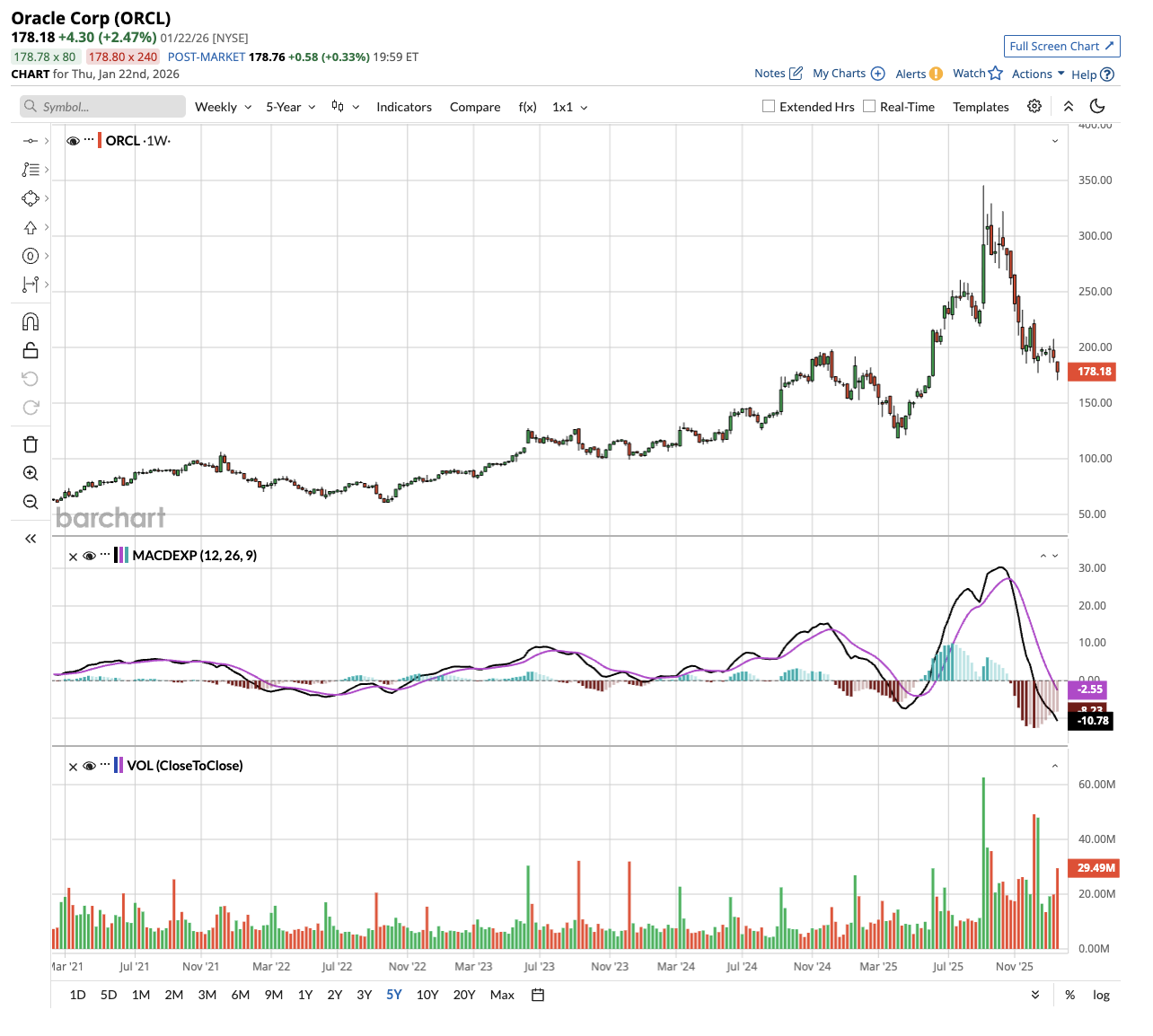

Oracle's Stock is Down Almost 50% From All-Time Highs

Oracle's stock has dropped almost 50% from its September peak amid concerns about the company’s massive capital expenditures. Between fiscal 2026 and fiscal 2028 (ending in May), Oracle is projected to report a cumulative free cash outflow of over $55 billion.

The core concern revolves around Oracle's massive financial commitments to AI. The company raised $18 billion in debt recently to fund data center construction, pushing total debt above $100 billion.

Oracle also joined the Stargate project with OpenAI and SoftBank (SFTBY), a $500 billion initiative to build AI infrastructure across the United States. These enormous capital requirements have sparked questions about whether the returns will justify the investment.

Oracle management laid out ambitious targets at a recent analyst meeting:

- The company expects revenue to reach $225 billion by fiscal 2030, representing 31% annual growth over five years.

- Earnings per share should reach $21 during the same period, growing at a 28% annual rate.

- To put those numbers in perspective, Oracle would need to roughly quadruple both revenue and profits in just five years.

Oracle secured $65 billion in new infrastructure deals during a single 30-day period last quarter. Its total remaining performance obligations exceed $500 billion, up by more than 200% year over year. Oracle’s strong backlog figures indicate strong demand even as analysts are concerned about the composition of that pipeline.

Reports indicate that a substantial portion of Oracle's contract backlog stems from a single OpenAI agreement, raising concerns about customer concentration risk. Analysts have also questioned whether deals between AI companies, cloud providers, and chip makers represent genuine demand or simply companies trading commitments with each other.

Oracle maintains that its competitive advantage lies in speed and integrated technology.

- The company completed a massive data center in Texas in under a year, which will become the largest supercomputer ever built.

- Oracle can deploy AI infrastructure faster than competitors, which has helped it win customers, including OpenAI and Meta (META).

- Notably, Oracle illustrated that a hypothetical six-year, $60 billion contract would yield 35% gross margins after accounting for startup costs.

- The company also expects its AI database platform to generate $20 billion in annual revenue by fiscal 2030.

What Is the ORCL Stock Price Target?

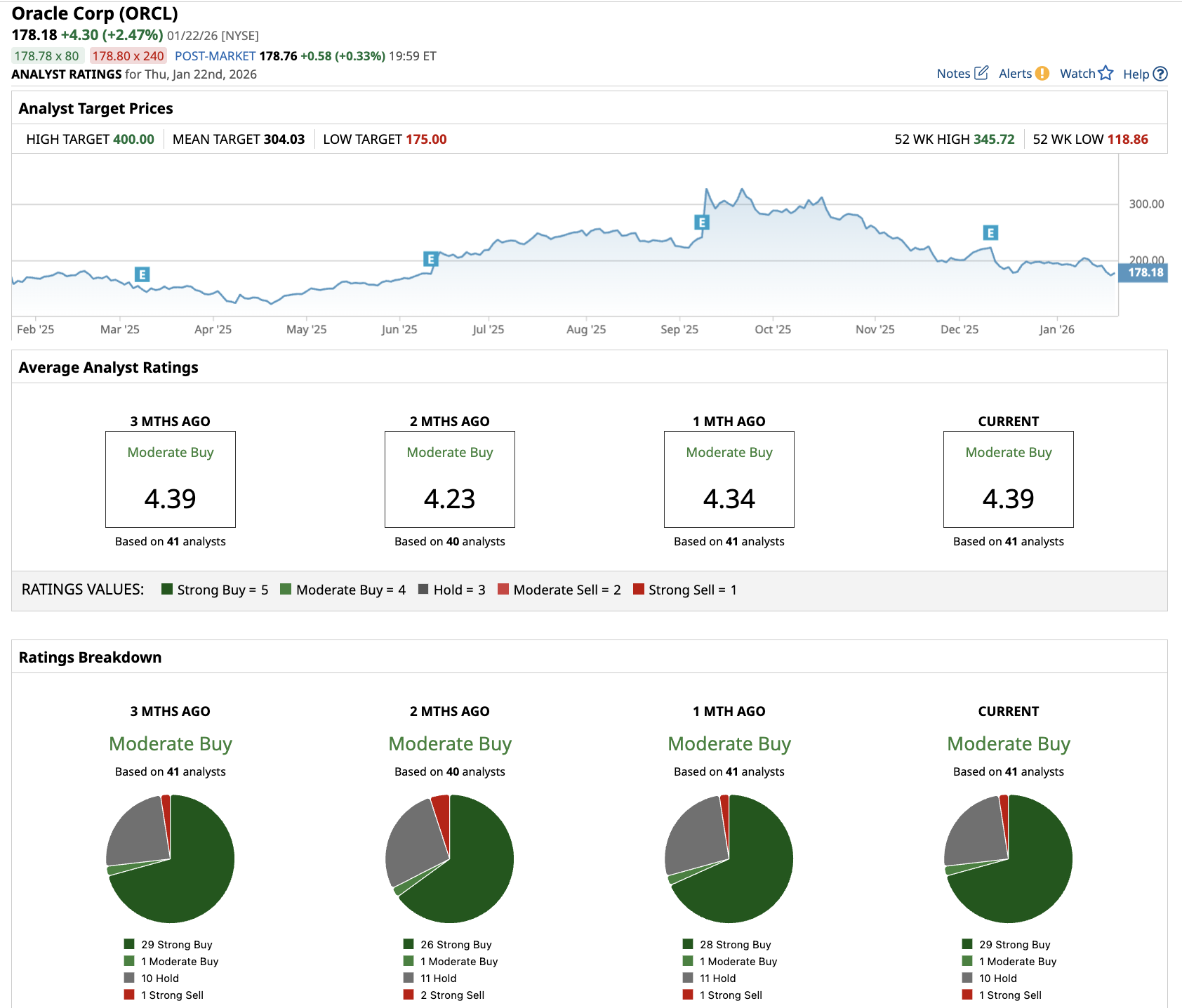

Analysts tracking ORCL stock forecast revenue to increase from $57.4 billion in fiscal 2025 to $227 billion in fiscal 2030. In this period, adjusted earnings per share are estimated to expand from $6.03 to $20.50. If ORCL stock is priced at 20 times earnings, it could more than double over the next three years.

Out of the 41 analysts covering ORCL stock, 29 recommend “Strong Buy,” one recommends “Moderate Buy,” 10 recommend “Hold,” and one recommends “Strong Sell.” The average ORCL stock price target is $304, above the current price of $178.

On the date of publication, Aditya Raghunath did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Chipset%20held%20over%20rush%20hour%20traffic%20by%20Jae%20Young%20Ju%20via%20iStock.jpg)