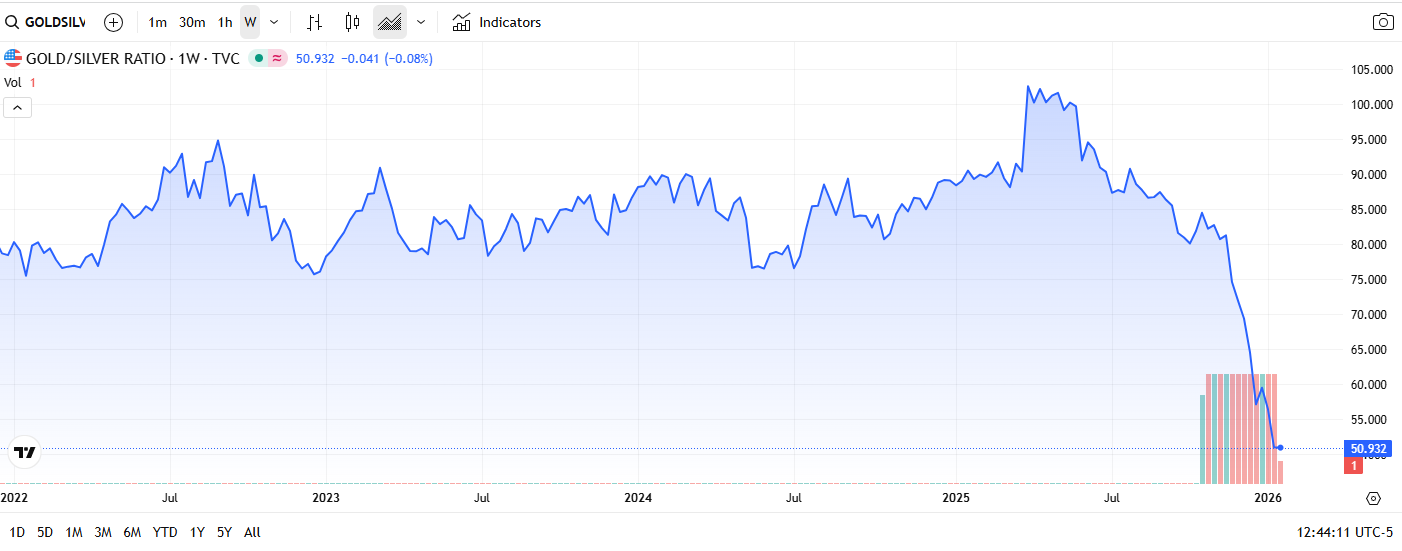

Silver and gold have shown impressive strength, rallying to all-time highs. Analysts’ gold price forecasts for 2026 have already been met or are nearing their targets within just the first month of the year. The rally in the metals has been driven largely by fear. Geopolitical and economic uncertainty, trade policy, a weaker dollar, lower interest rates, government debt, and central bank demand have all contributed to higher prices. As gold and silver prices have increased, the fear of missing out has only added more fuel to these markets. Last Friday’s Commitment of Traders report showed managed money holding a net long 136,548 contracts in gold, after buying 12,292 contracts. Funds were long 15,045 contracts in silver, after selling 2,613 contracts.

Morgan Stanley: $4,800

Goldman Sachs: $4,900 previously, now $5,400

Deutsche Bank: $4,950

Charles Schwab: $5,055

UBS: $5,400

Jefferies Group: $6,600

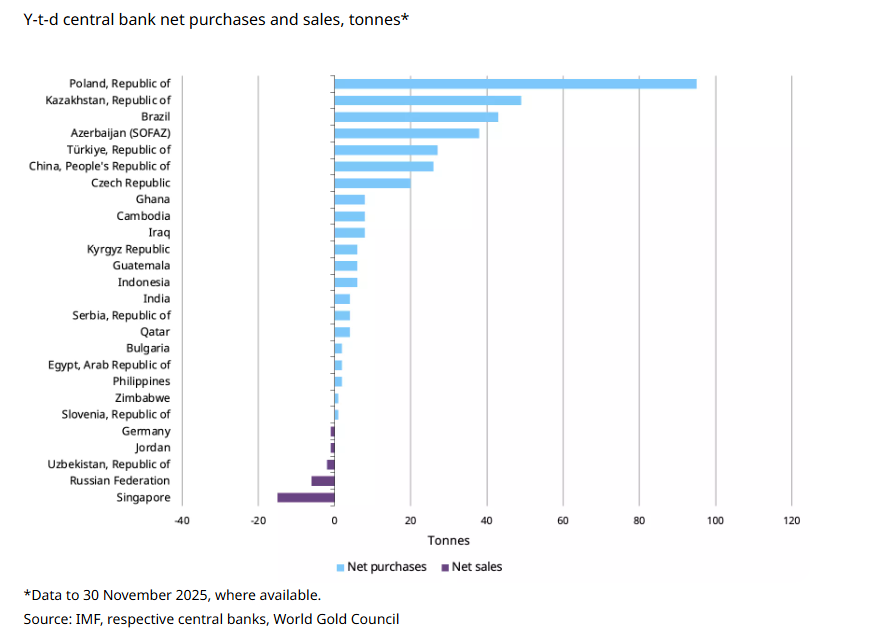

Poland was the top buyer of gold in 2025, and the National Bank of Poland has announced plans to buy an additional 150 metric tons of gold. Central banks are expected to buy an average of 60 metric tons of gold per month in 2026. This compares to central bank buying of approximately 1,000 tons of gold per year between 2022 and 2025, while the previous decade saw buying in the 400-500 ton range. Gold is being used as a hedge for uncertainty, but as conditions change, these hedges can be unwound. I recommend being careful chasing the parabolic move in precious metals. Futures margins in the metals will continue to increase if prices keep moving higher.

.

If you would like to trade, consider the following opportunities in gold. Note that March 2026 Options trade against the April 2026 Futures contract. If you are interested in trade ideas in any other metals, please contact me or fill out the form below.

APRIL ’26 GOLD 4930.4

MARCH ’26 GOLD

SELL 1 MARCH ’26 4500 PUT 17.8

Price: 17.8 CREDIT Cost: $1,780 CREDIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

MARCH ’26 GOLD OPTIONS EXPIRE 2/24/26 (33 DAYS)

MAXIMUM LOSS: UNLIMITED

.

If you would like to receive more information on the commodity markets, please use this link to join my email list

.

MARCH ’26 GOLD

SELL 1 MARCH ’26 4500 PUT 17.8

BUY 1 MARCH ’26 4350 PUT 8.9

Price: 8.90 CREDIT Cost: $890 CREDIT/TRADE PACKAGE, PLUS FEES AND COMMISSIONS.

MARCH ’26 GOLD OPTIONS EXPIRE 2/24/26 (33 DAYS)

MAXIMUM LOSS: LIMITED

MARCH '26 SILVER

MARCH '26 COPPER

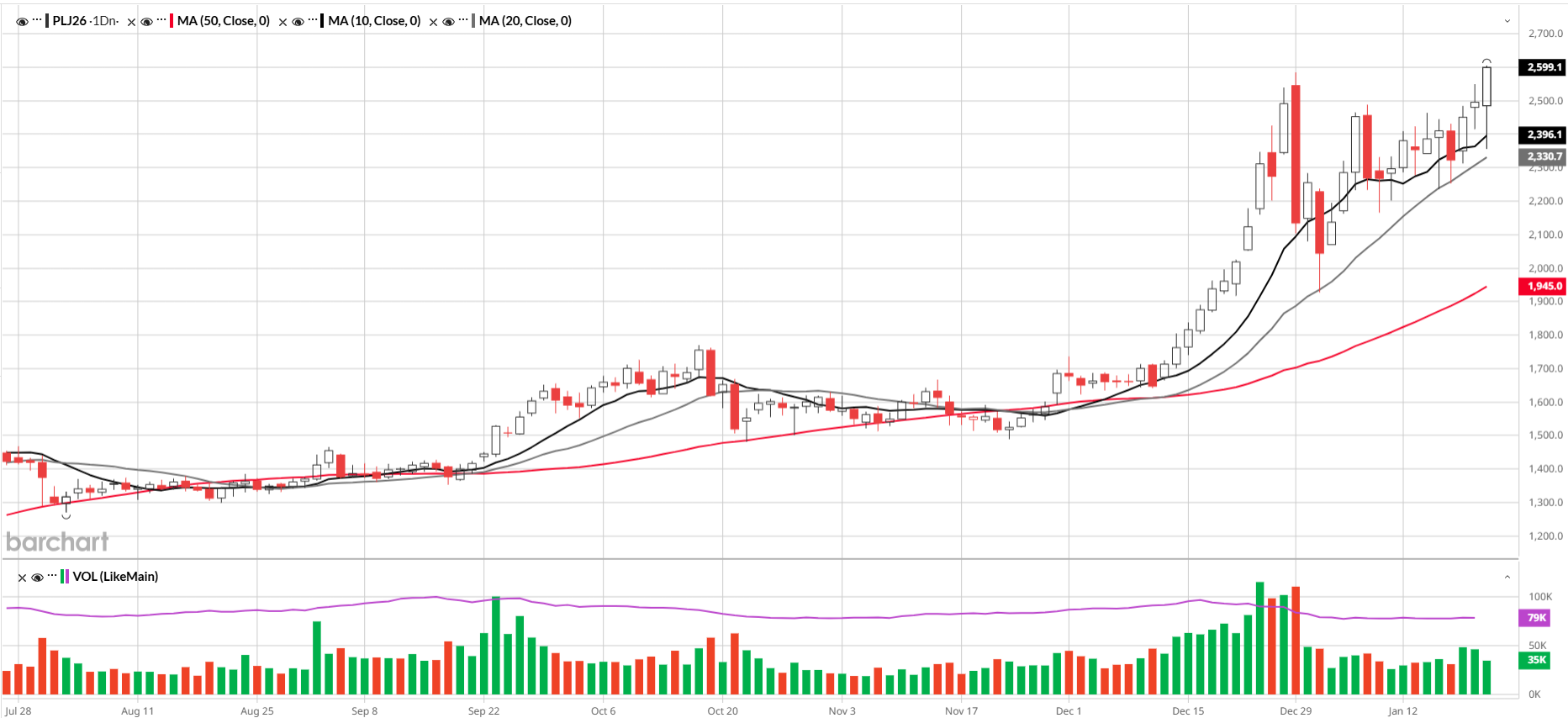

APRIL '26 PLATINUM

If you would like to receive more information on the commodity markets, please use this link to join my email list

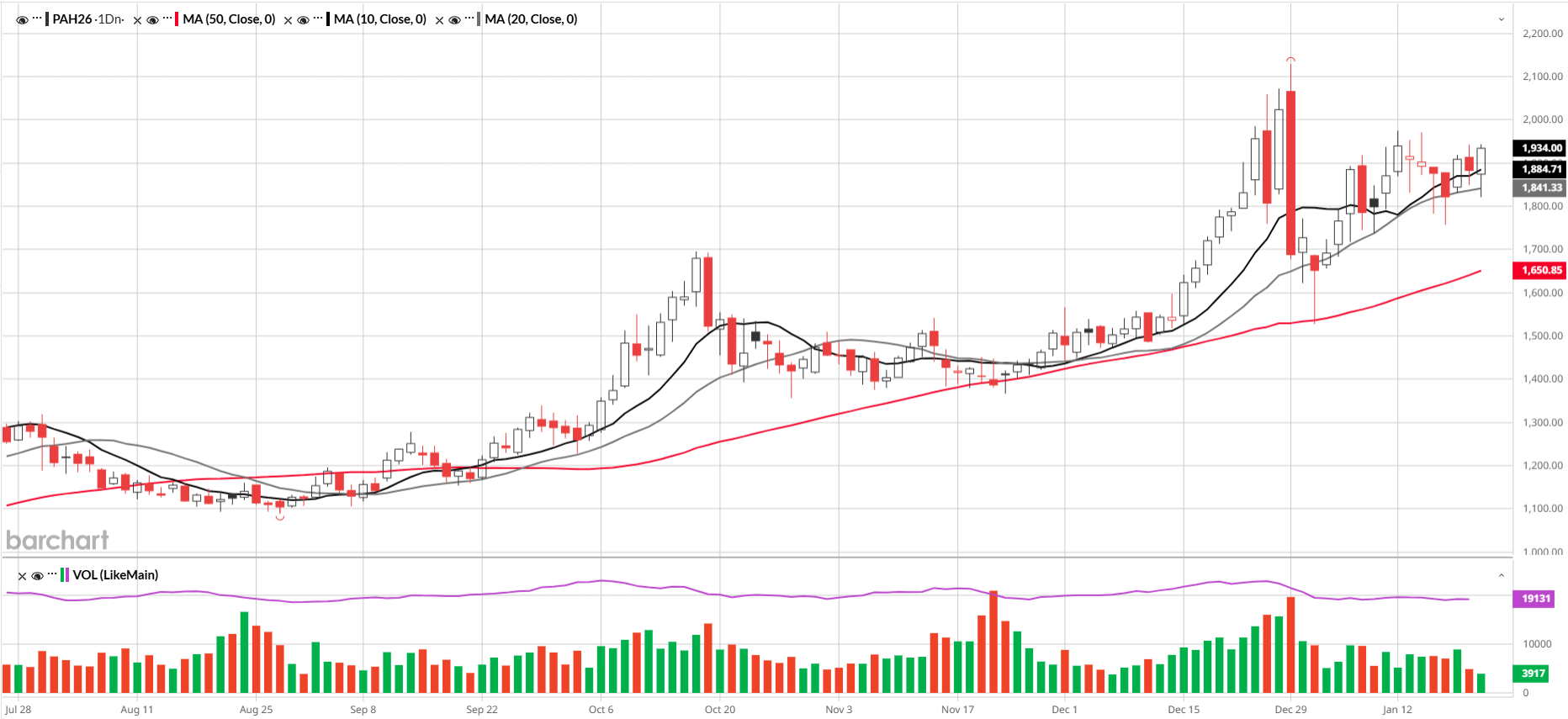

MARCH '26 PALLADIUM

If you would like to receive more information on the commodity markets, please use this link to join my email list

If you don't like the customer service or personal attention you are receiving from your broker, you have options, and you don't have to stay there. I can have your new account open quickly. Call me anytime 312-765-7311.

If you would like to open an account, please use this direct link

.

.

Having a Trading or Hedging Account is essential for your business to be successful. Market volatility has increased across all commodities over the last 12 months, and I expect it to continue to increase in 2026. Opening an account in the future, will definitely not help you if you need access now. To be successful, you need to be able to manage risk in real time. If you are proactive now, you will have the ability to be reactive when you need to be. You can be prepared and patient at the same time. Call me or hit the direct link above.

Hans Schmit

Broker, Pure Hedge Division

312-765-7311

hschmit@walshtrading.com

WALSH TRADING INC.

311 S. Wacker Suite 540

Chicago, IL 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)