Expand Energy (EXE) deserves a closer inspection, if only because it represented one of the few names that have weathered the Greenland drama quite well. In the trailing five sessions, EXE stock is up almost 8%, a beneficiary of analyst support. A ‘Strong Buy’ candidate, the main fundamental thesis is that, while the underlying natural gas pricing may fluctuate, strong power generation demand could help lift the business.

Indeed, that’s what the options flow screener — which focuses exclusively on big block transactions — appears to be implying. During the midweek session, net trade sentiment was overwhelmingly bullish, landing at $951,000 (relative to total gross bullish volume of $988,500). Further, delta imbalance stood at $60,827, indicating that market makers’ books would rise in value if EXE stock also moves higher.

As confirmation, the biggest transactions in the options flow screener were for debit-based calls. Effectively, this means that the smart money is overall taking a directional bet on EXE stock.

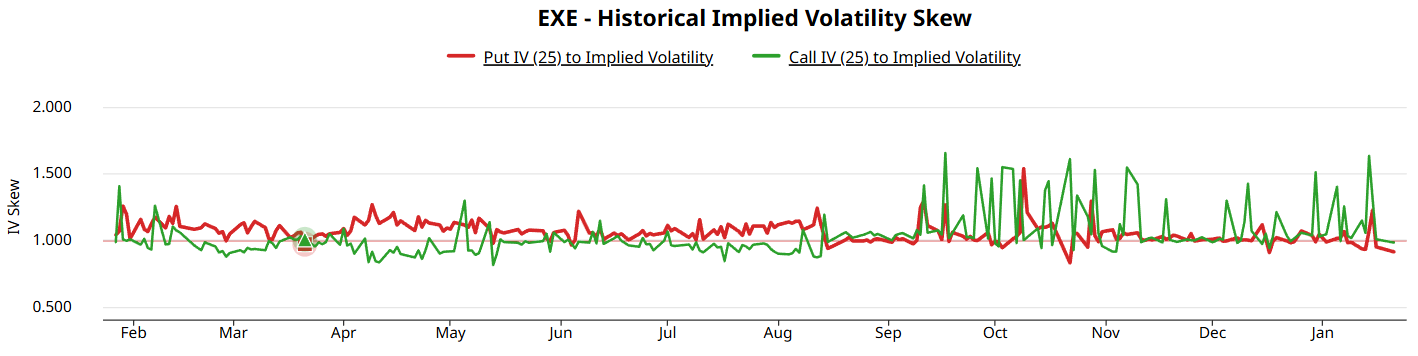

Here’s where circumstances get really interesting, though. Volatility skew — a readout that shows how implied volatility (IV) differs across strike prices and expiration dates on the same underlying asset — identified generally higher put IV relative to calls, especially for nearer-term expiration dates. Essentially, traders are paying a relatively higher premium for downside protection, which makes sense on some levels.

Natural gas isn’t exactly the most stable market and the current geopolitical environment adds complexity to the narrative. It’s also possible that traders are wary of EXE stock and its propensity for choppiness. For example, while it’s on a strong run right now, the security has only gained a little over 2% in the past 52 weeks, a consequence of its wild ebb and flow.

Still, there’s another reason to consider EXE stock beyond the options flow data — and that’s the potential mispricing.

EXE Stock Could Offer a Solid Deal to the Upside

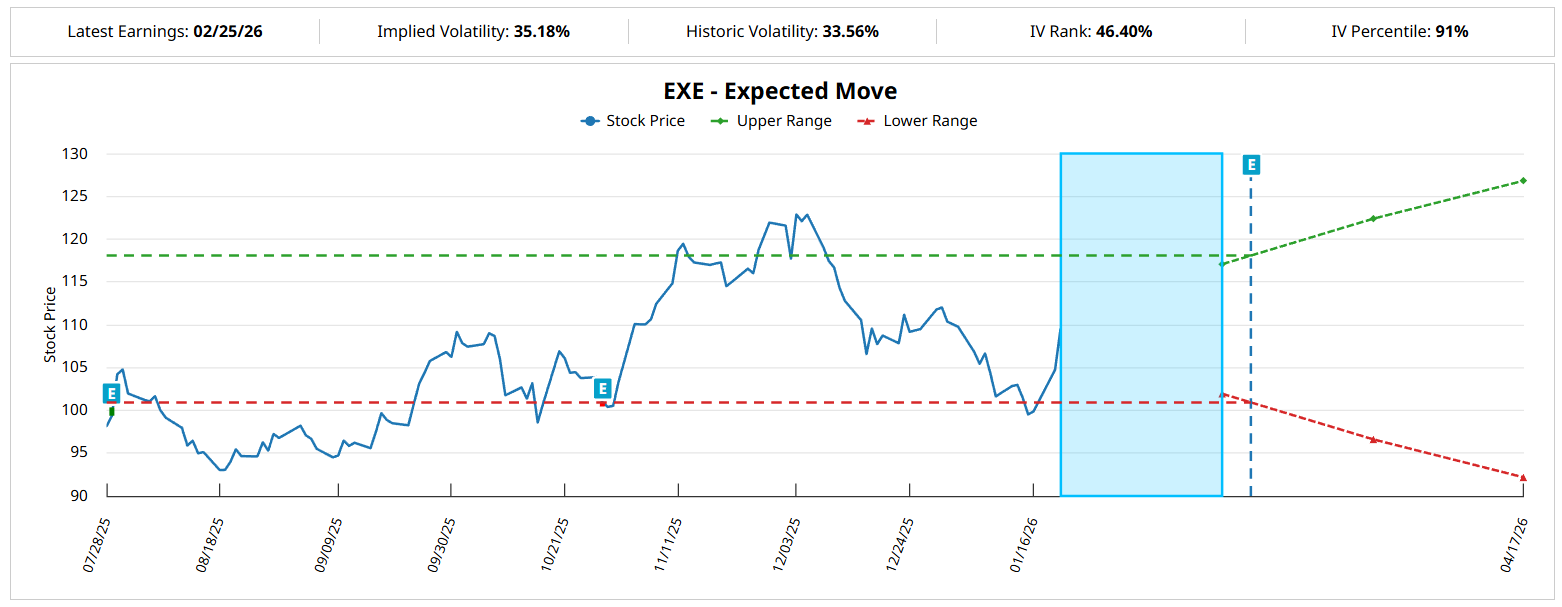

Under the Black-Scholes-derived Expected Move calculator, EXE stock would be expected to range between $101.94 and $117.07. Essentially, these price parameters fall inside one standard deviation of price relative to volatility and time (days to expiration). Given the downside protection referenced earlier, one might expect a negative target to have a higher probability of trading success.

What’s important to realize, though, is that no one has a claim to absolute truth prior to the forward event actually materializing. On the Black-Scholes side, the calculated probabilities are valid only if we assume that the model is perfectly representing reality. Regarding the options flow data, the smart money may be mechanically sophisticated — but they’re not always prescient.

What we do know is that, on a relative basis, since downside protection commands a premium, upside calls are cheap. If we have good reason to believe that EXE stock could swing higher on a given expiration date, the calls could be mispriced in our favor.

That’s where the Markov property becomes a powerful tool.

Generating a Second-Order Analysis

While we have good reason to believe that EXE stock may land between about $102 and $117, the gap between these two prices is almost 15%. We want to try to narrow this range down with a second-order analysis and we may do so using the Markov property.

Under Markov, the future state of a system depends solely on the current state. In other words, everything is contextual. For example, a 20-yard field goal attempt is practically a guaranteed three points. Add rain, crosswinds and playoff pressure and that surefire confidence may change in a hurry.

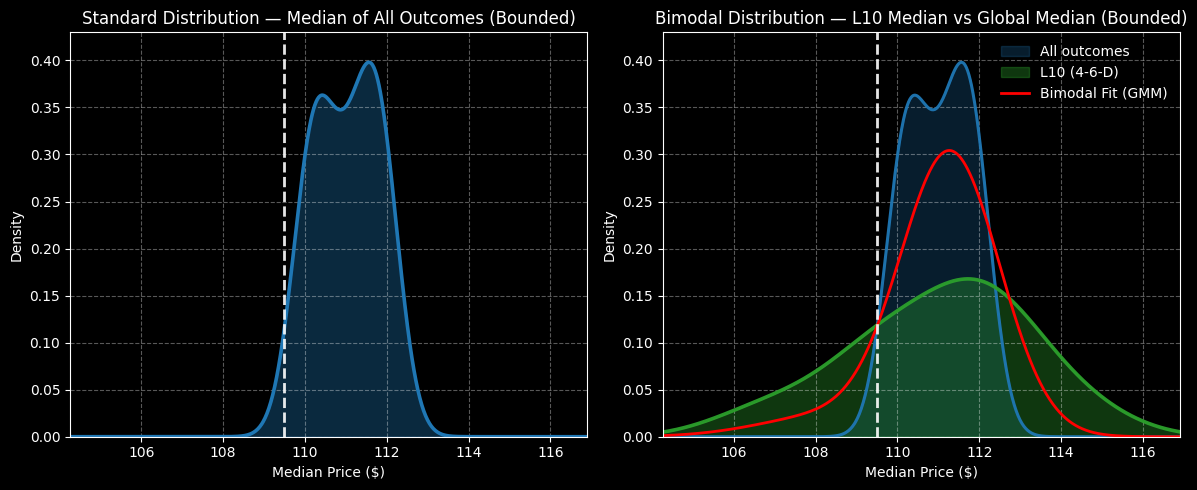

For EXE stock, the context is that in the trailing 10 weeks, the security printed only four up weeks, leading to an overall downward slope. Under this 4-6-D sequence, forward outcomes over the next 10 weeks would be expected to range between $105 and $117. Over the next five weeks, the outcome is actually wider, between $103 and $118.

Now, that doesn’t really help us in terms of narrowing the expected dispersion. However, probability density is highest between $110 and $113. Basically, under multiple trials of the 4-6-D sequence, we would expect EXE stock to terminate between $110 and $113 at the end of the next five weeks.

Running the Numbers

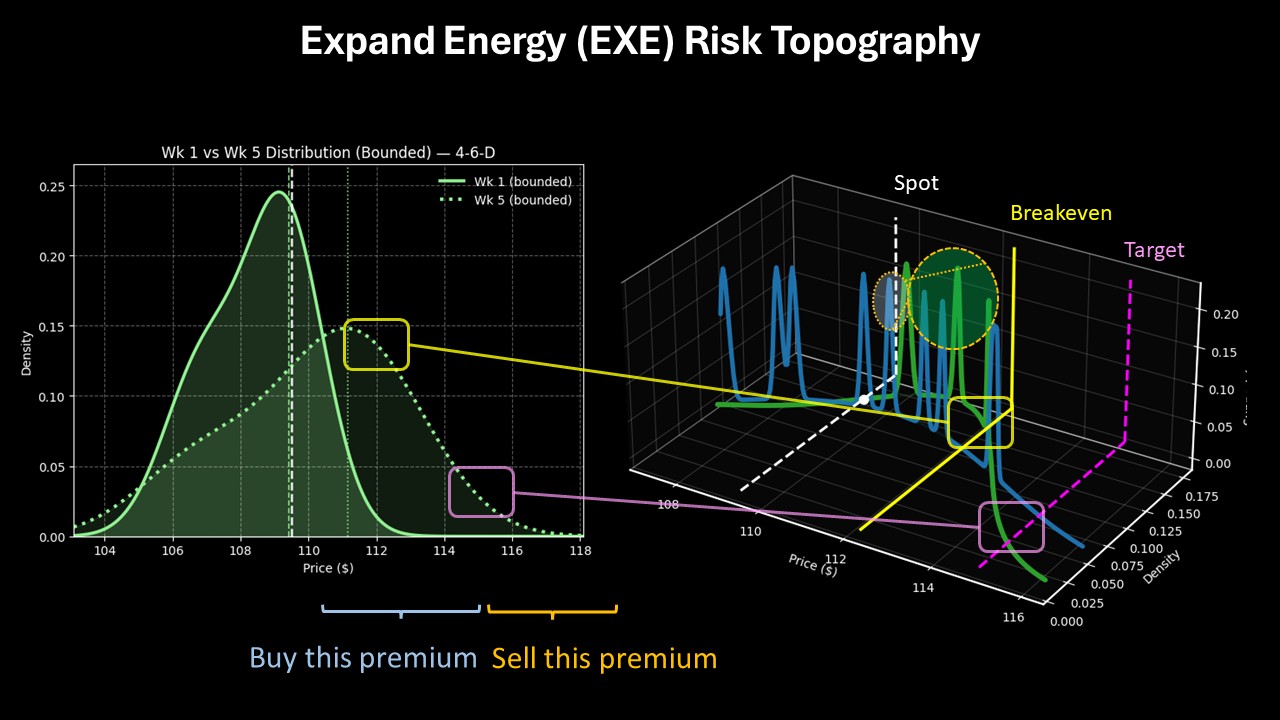

Based on the market intelligence above, arguably the most tempting trade to consider is the 110/115 bull call spread expiring Feb. 20, 2026. This trade requires EXE stock to rise through the $115 strike at expiration to trigger the maximum payout of 114.59%.

Granted, $115 falls on the upper realm of the distributional curve, which makes it a less-probable trade. However, what’s appealing here is the breakeven price of $112.33. Essentially, it falls close to peak probability density under 4-6-D conditions, thereby enhancing the trade’s credibility.

On the date of publication, Josh Enomoto did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/AI%20(artificial%20intelligence)/AI%20software%20engineering%20by%20Tapati%20Rinchumrus%20via%20Shutterstock.jpg)

/Netflix%20on%20tv%20with%20remote%20by%20freestocks%20via%20Unsplash.jpg)

/Apple%20Inc%20phone%20and%20data-by%20Anderson%20Reis%20via%20Shutterstock.jpg)