Earnings results often indicate what direction a company will take in the months ahead. With Q3 behind us, let’s have a look at Nutanix (NASDAQ:NTNX) and its peers.

Software is eating the world, increasing organizations’ reliance on digital-only solutions. As more workloads and applications move to the cloud, the reliability of the underlying cloud infrastructure becomes ever more critical and ever more complex. To solve this challenge, companies and their engineering teams have turned to a range of cloud monitoring tools that provide them with the visibility to troubleshoot issues in real-time.

The 4 cloud monitoring stocks we track reported a mixed Q3. As a group, revenues beat analysts’ consensus estimates by 1% while next quarter’s revenue guidance was in line.

Amidst this news, share prices of the companies have had a rough stretch. On average, they are down 25.2% since the latest earnings results.

Weakest Q3: Nutanix (NASDAQ:NTNX)

Originally pioneering hyperconverged infrastructure to break down traditional data center silos, Nutanix (NASDAQ:NTNX) provides a unified software platform that enables organizations to run applications and manage data across private, public, and hybrid cloud environments.

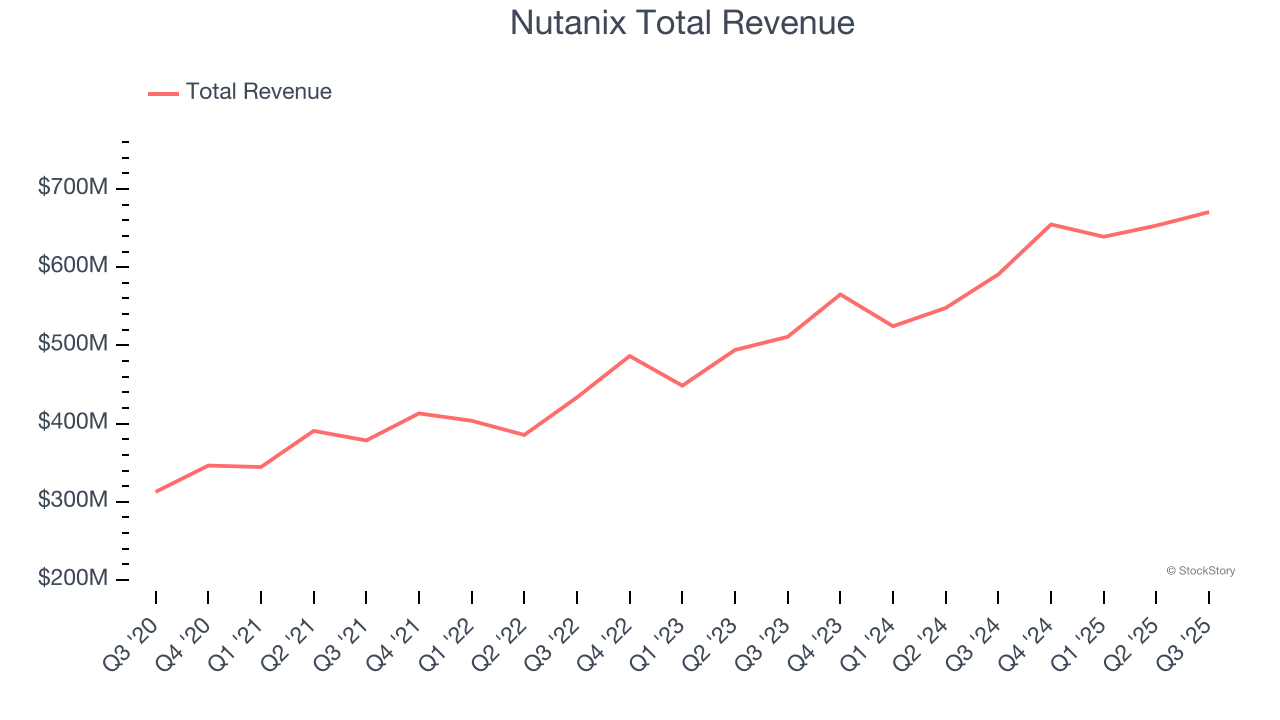

Nutanix reported revenues of $670.6 million, up 13.5% year on year. This print fell short of analysts’ expectations by 0.9%. Overall, it was a softer quarter for the company with full-year revenue guidance missing analysts’ expectations and revenue guidance for next quarter missing analysts’ expectations significantly.

Nutanix delivered the weakest performance against analyst estimates and weakest full-year guidance update of the whole group. Unsurprisingly, the stock is down 27.3% since reporting and currently trades at $43.25.

Is now the time to buy Nutanix? Access our full analysis of the earnings results here, it’s free.

Best Q3: Datadog (NASDAQ:DDOG)

Named after a database the founders had to painstakingly look after at their previous company, Datadog (NASDAQ:DDOG) provides a software platform that helps organizations monitor and secure their cloud applications, infrastructure, and services.

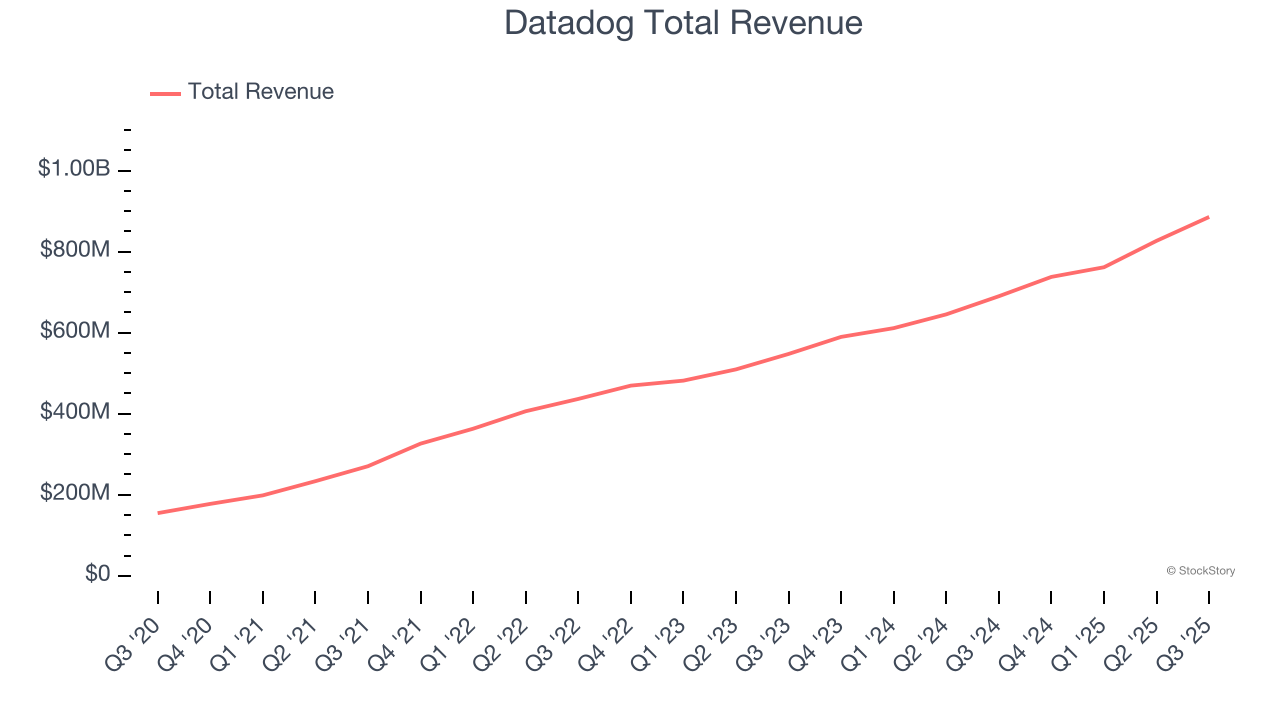

Datadog reported revenues of $885.7 million, up 28.4% year on year, outperforming analysts’ expectations by 3.9%. The business had an exceptional quarter with an impressive beat of analysts’ annual recurring revenue estimates and EPS guidance for next quarter exceeding analysts’ expectations.

Datadog scored the biggest analyst estimates beat and fastest revenue growth among its peers. The company added 210 enterprise customers paying more than $100,000 annually to reach a total of 4,060. Although it had a fine quarter compared its peers, the market seems unhappy with the results as the stock is down 24.5% since reporting. It currently trades at $117.44.

Is now the time to buy Datadog? Access our full analysis of the earnings results here, it’s free.

PagerDuty (NYSE:PD)

Born from the frustration of developers being woken up by unprioritized alerts, PagerDuty (NYSE:PD) is a digital operations management platform that helps organizations detect and respond to IT incidents, outages, and other critical issues in real-time.

PagerDuty reported revenues of $124.5 million, up 4.7% year on year, in line with analysts’ expectations. It was a slower quarter as it posted full-year revenue guidance missing analysts’ expectations significantly and revenue guidance for next quarter missing analysts’ expectations significantly.

PagerDuty delivered the highest full-year guidance raise but had the slowest revenue growth in the group. The company added 76 customers to reach a total of 15,398. As expected, the stock is down 27.5% since the results and currently trades at $11.01.

Read our full analysis of PagerDuty’s results here.

Dynatrace (NYSE:DT)

With its platform processing over 30 trillion pieces of IT performance data daily, Dynatrace (NYSE:DT) provides an AI-powered platform that helps organizations monitor, secure, and optimize their applications and IT infrastructure across cloud environments.

Dynatrace reported revenues of $493.8 million, up 18.1% year on year. This number surpassed analysts’ expectations by 1.3%. Taking a step back, it was a satisfactory quarter as it also recorded a solid beat of analysts’ EBITDA estimates but a significant miss of analysts’ billings estimates.

The stock is down 21.3% since reporting and currently trades at $39.05.

Read our full, actionable report on Dynatrace here, it’s free.

Want to invest in winners with rock-solid fundamentals? Check out our 9 Best Market-Beating Stocks and add them to your watchlist. These companies are poised for growth regardless of the political or macroeconomic climate.

StockStory’s analyst team — all seasoned professional investors — uses quantitative analysis and automation to deliver market-beating insights faster and with higher quality.

/Amazon%20-%20Image%20by%20bluestork%20via%20Shutterstock.jpg)

/Micron%20Technology%20Inc_logo%20and%20website-by%20Mojahid%20Mottakin%20via%20Shutterstock.jpg)

/Salesforce%20Inc%20HQ%20building-by%20JHVEPhoto%20via%20Shutterstock.jpg)