/GE%20Aerospace%20jet%20engine%20facility-by%20jetcityimage%20via%20iStock.jpg)

GE Aerospace (GE) will release its fourth quarter 2025 financials on Thursday, Jan. 22. Despite a supportive industry backdrop and strong demand, GE Aerospace shares have been relatively subdued in recent months, gaining 3.3% over the past three months.

The company’s results through the first nine months of 2025 reflect solid growth. Adjusted revenue increased 21% year-over-year (YoY), while operating margins expanded by 140 basis points, reflecting both volume growth and operational efficiency. Adjusted earnings per share (EPS) surged nearly 46%, highlighting the strong operating leverage in the business. Free cash flow reached $5.9 billion, and GE Aerospace exited the third quarter with a $175 billion backlog, providing a strong base for future revenue growth.

The ongoing momentum in GE’s businesses will enable the company to report strong growth in Q4. Further, from a technical perspective, the stock does not appear overstretched. GE Aerospace’s 14-day Relative Strength Index (RSI) is 59.55, well below the 70 level typically associated with overbought conditions. This indicates that the shares have room to move higher if fourth-quarter results and forward guidance come in above expectations.

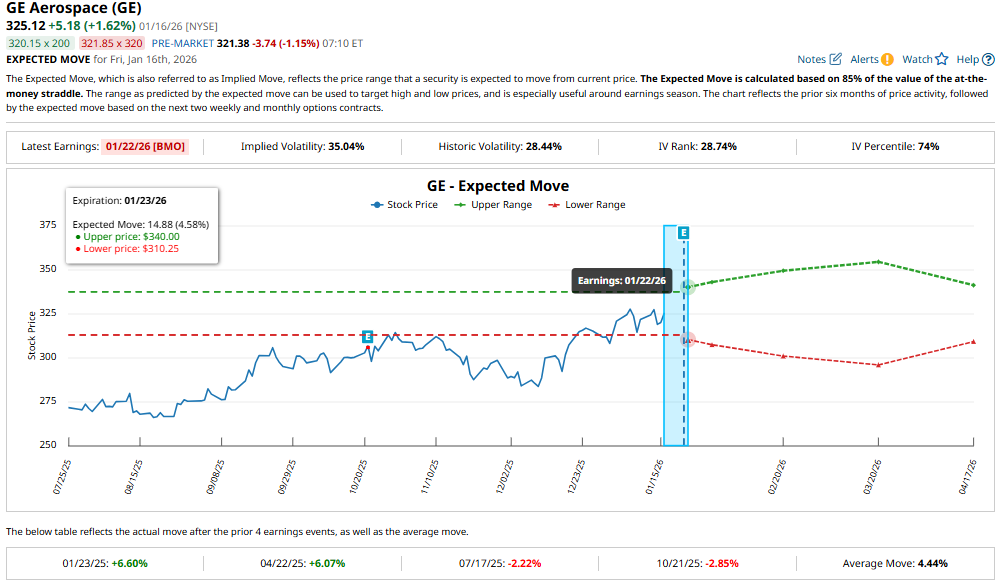

Derivatives markets are anticipating a moderate reaction to the earnings release. Options pricing implies a post-earnings move of approximately 4.6% in either direction for contracts expiring Jan. 23, broadly in line with the stock’s average earnings-related move over the past four quarters. Note that GE Aerospace shares declined 2.9% following the previous earnings announcement.

GE Q4: Here’s What to Expect

As GE Aerospace heads into its fourth-quarter earnings report, the company appears well-positioned to extend the momentum it has built throughout the year. Its business is benefiting from a large installed base of aircraft engines, strong demand for aftermarket services, and a steady recovery in engine deliveries. These factors will continue to support both revenue growth and profitability.

On the revenue side, strength is expected across GE Aerospace’s major operating segments. The Commercial Engines & Services business remains a key driver, supported by rising services revenue and improving equipment sales. As more engines cycle through Maintenance, Repair, and Overhaul facilities, demand for servicing and spare parts has increased meaningfully, allowing the company to capitalize on higher volumes and favorable pricing conditions. At the same time, increased engine deliveries are adding further lift.

The defense-focused operations will continue to play an important role in the quarter’s performance. Demand in Defense & Propulsion Technologies is supported by higher engine volumes and better pricing, providing a steady, reliable revenue stream. Within this segment, Propulsion & Additive Technologies is expected to maintain its growth trajectory.

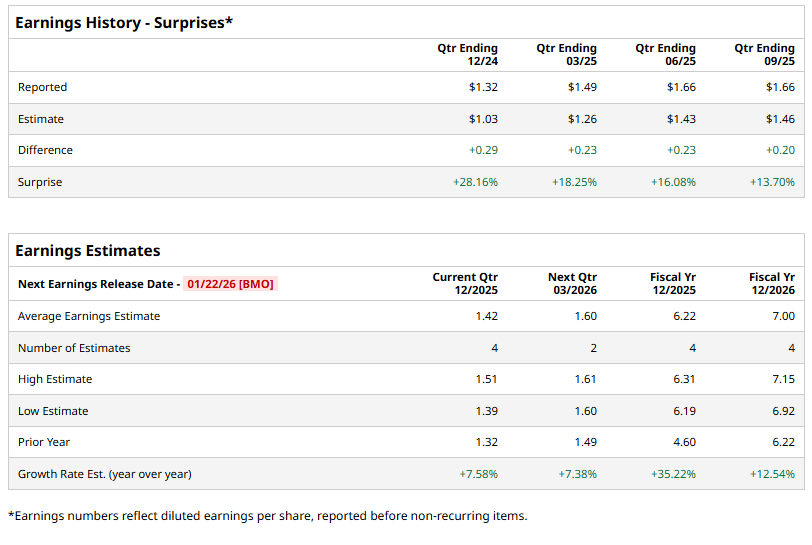

Profitability is expected to remain strong. GE Aerospace’s margins are benefiting from higher service volumes, increased pricing, and a favorable mix of spare-parts sales. This has enabled the company to consistently exceed earnings expectations, aided by operating leverage and the growing share of high-margin services in its revenue base. Notably, GE Aerospace has delivered earnings beats in each of the past four quarters, including a strong 13.7% upside surprise in the third quarter.

For the fourth quarter, Wall Street expects earnings of approximately $1.42 per share, a 7.6% increase from the prior year. With both commercial and defense businesses performing well and a reduced share count, GE Aerospace appears well-positioned to deliver another solid earnings report.

The Bottom Line for GE Aerospace Stock

GE Aerospace enters the fourth quarter on a solid footing, supported by strong underlying fundamentals and favorable industry trends. The company continues to benefit from its large installed base, which drives steady demand for high-margin aftermarket services. Further, a recovery in engine deliveries and higher pricing will support its financials.

However, the company’s forward price-earnings (P/E) ratio of 45.6 indicates that the positives are priced in GE stock.

Heading into the earnings announcement, analysts maintain a “Moderate Buy” consensus rating on the stock, signaling confidence in GE Aerospace’s operational performance while also acknowledging the premium valuation.

On the date of publication, Amit Singh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/A%20SoFi%20logo%20on%20an%20office%20building%20by%20Tada%20Images%20via%20Shutterstock.jpg)

/Stickers%20with%20AMD%20Radeon%20and%20Nvidia%20GeForce%20RTX%20graphics%20on%20new%20laptop%20computer%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/Broadcom%20Inc%20logo%20on%20phone%20and%20site-by%20Majahid%20Mottakin%20via%20Shutterstock.jpg)