I am Stephen Davis, senior market strategist at Walsh Trading, Inc., Chicago, Illinois. You can reach me at 312-878-2391.

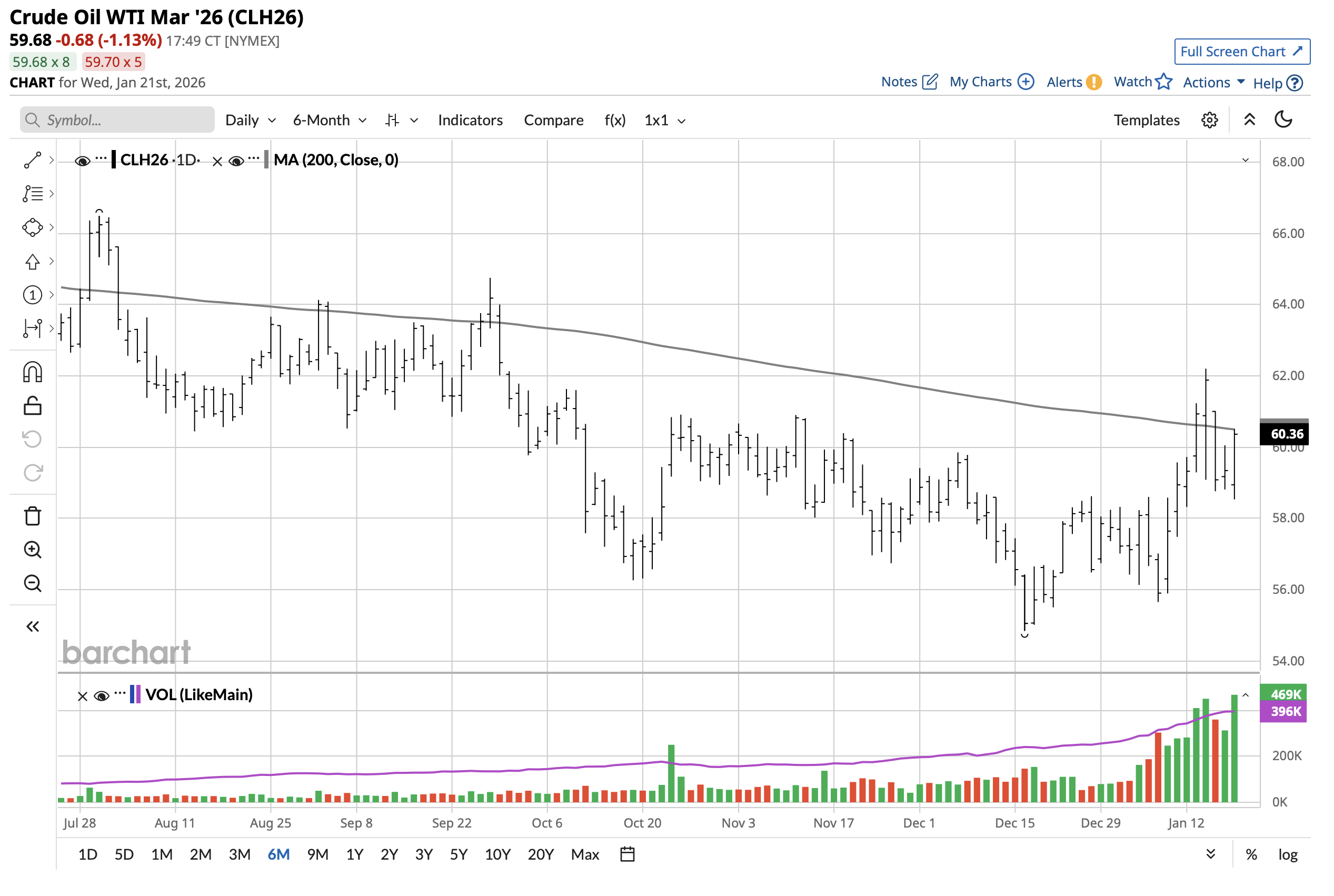

Crude oil futures closed up today, Jan. 20, pushing above the 200-day moving average. Demand for crude oil is growing. In China, refinery throughput for oil rose 4.1% in 2025, averaging a record-high 14.75 million barrels per day. China's economy is growing. Its Gross Domestic Product (GDP) will hit the target of 5%, said Chinese President Xi Jinping in his 2026 New Year message. Geopolitical tensions in the world may have an effect as well.

This chart pattern, which pushes above the 200-day average, is interesting because, in my opinion it's a bellwether for all markets and crude oil is going to trade higher. The fundamentals and technicals are coming together.

An option strategy is to sell March 2026 crude oil 59 put for 1.80 ($1,800). These options expire February 17, 2026. Notice the strong support at 59 and 58 on the chart below. In my opinion, If crude oil went down to those levels, it will bounce back higher.

To discuss trading strategies, contact me anytime. Have an excellent day and healthy, prosperous new year.

Stephen Davis

Senior Market Strategist

Walsh Trading

Direct 312 878 2391

Toll Free 800 556 9411

sdavis@walshtrading.com

www.walshtrading.com

Use this link to join my email list: SIGN UP NOW

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS. All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)