1/20/26

.

.

.

.

If you don't like the customer service or lack of personal attention you are receiving from your broker, you have options, and you don't have to stay there. Account transfers are easy and so is opening a new account. Sign Up Now

.

.

If you would like to receive more information on the commodity markets, please use this link to join my email list Sign Up Now

.

.

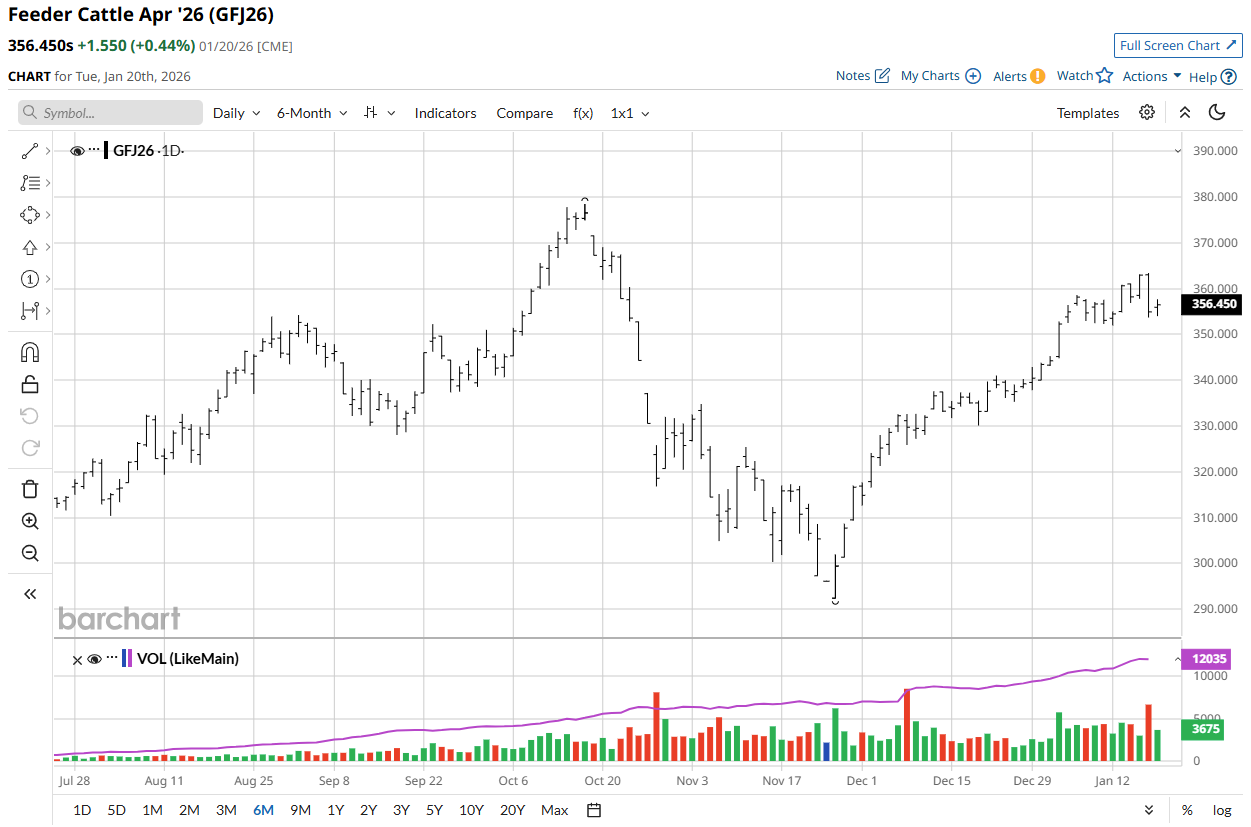

THE GAPS IN THE CHARTS FOR THE FATS AND FEEDERS BELOW

.

.

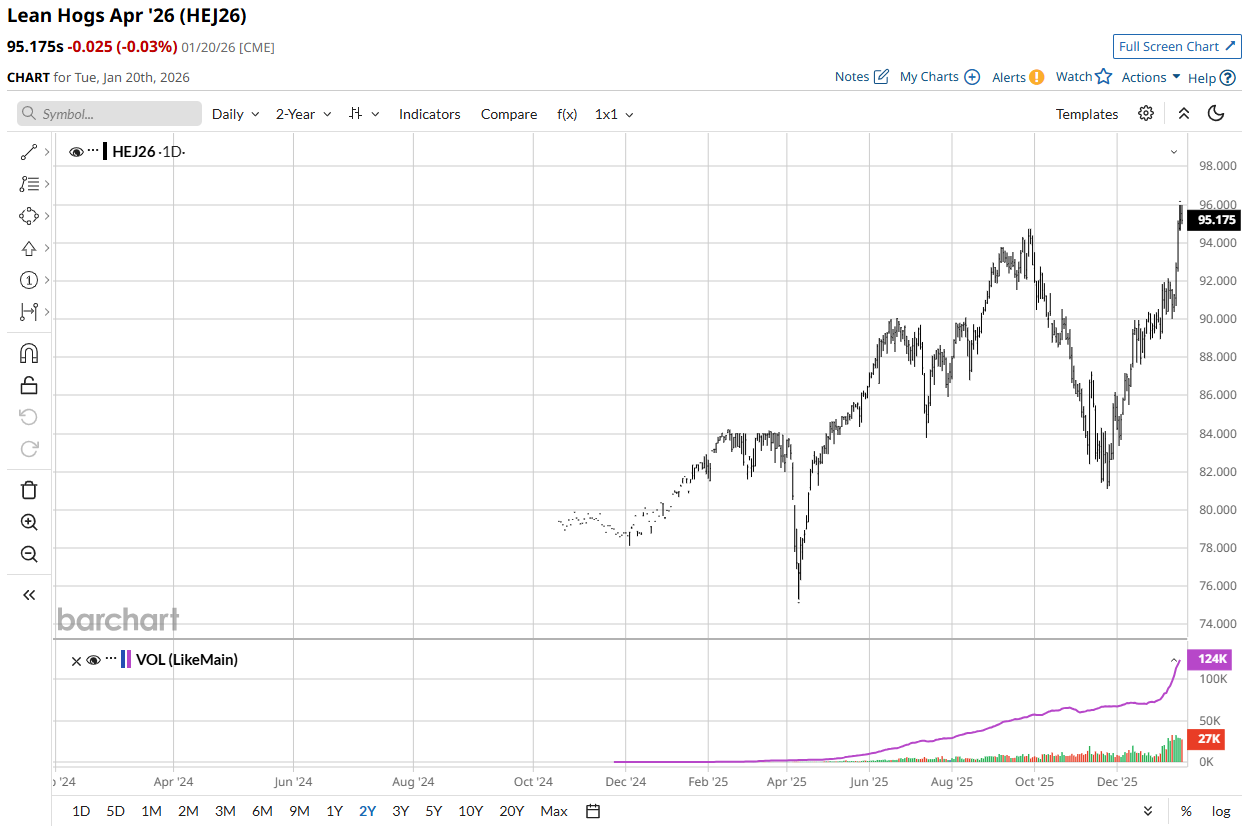

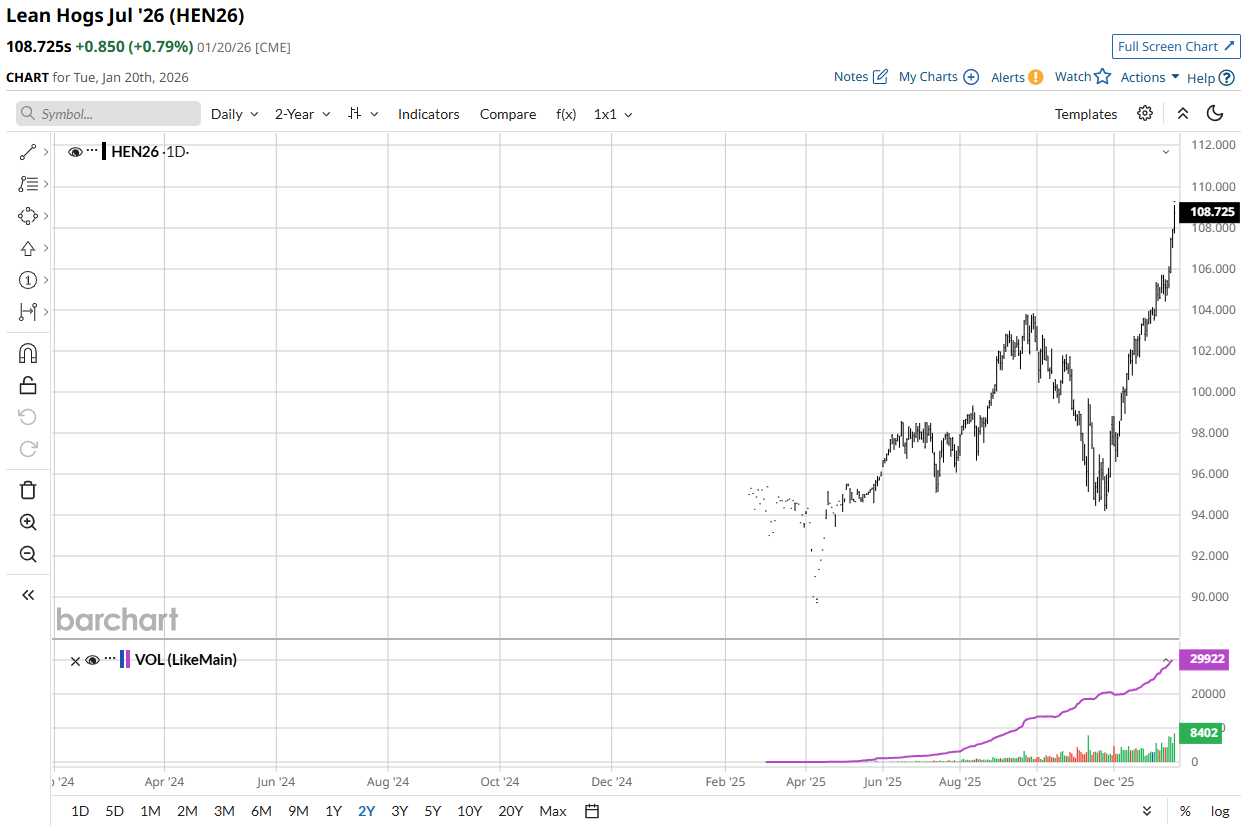

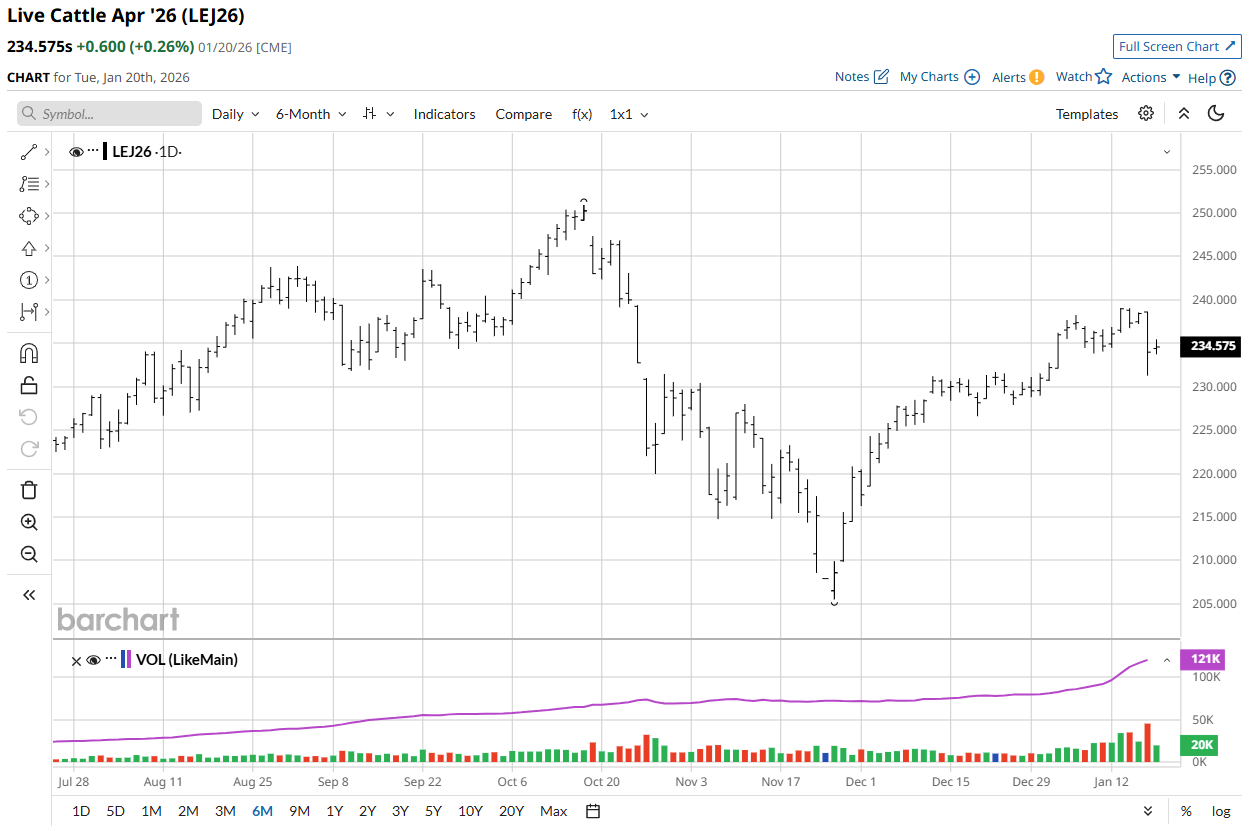

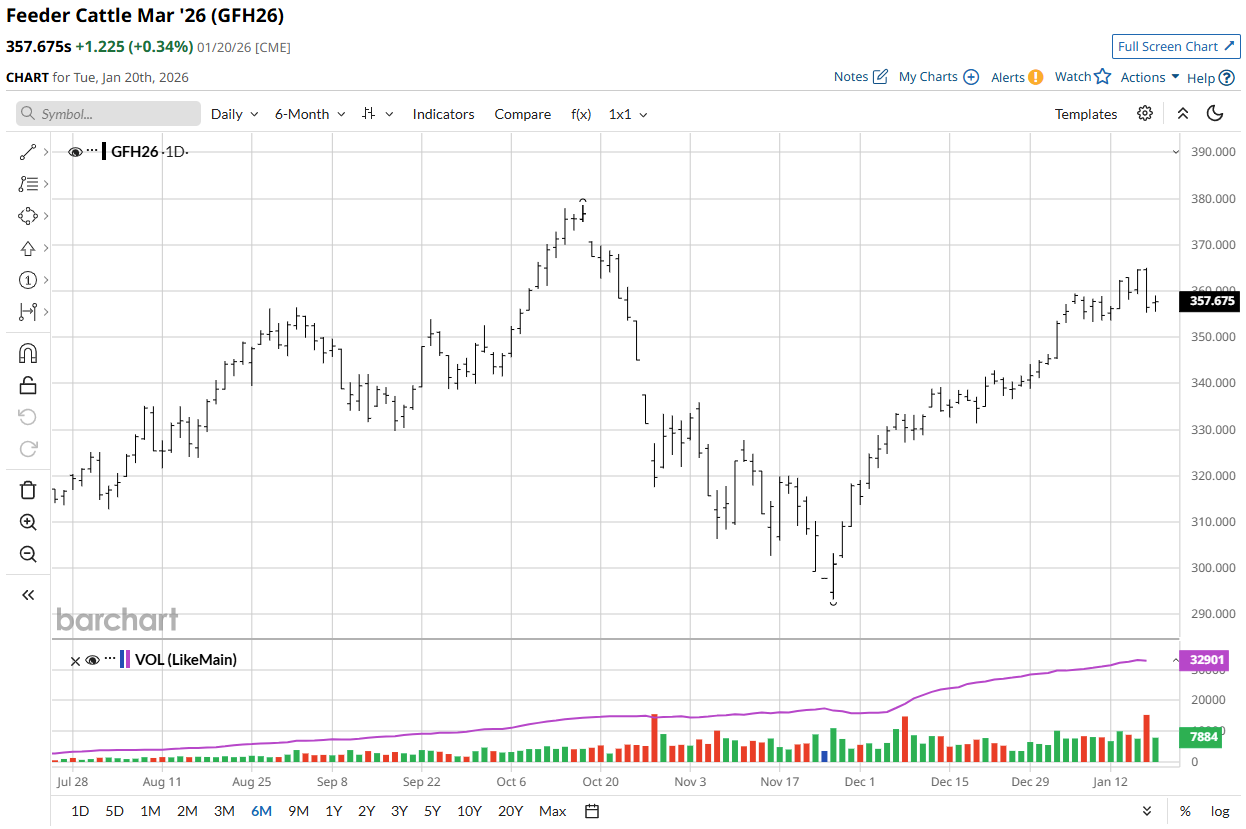

The Livestock Markets rebounded from Friday's ridiculous selloff on false information, and only the Stock Markets held the Cattle Markets back today. April'26 Live Cattle were 60 cents higher today and settled at 234.57 ½. Today's high was 235.45 and the 1-month high is 239.05. Today's low was 233.72 ½ and the 1-month low is 227.90. Since 12/19 April'26 Live Cattle are 4.57 ½ higher or almost 2%. The March'26 Feeders regained more than a dollar today. The March'26 Feeder Cattle were 1.22 ½ higher today and settled at 357.67 ½. Today's high was 359.02 ½ and the 1-month high is 365.00 Today's low was 355.50 and the 1-month low is 336.30. Since 12/19 March'26 Feeder Cattle are 18.27 ½ higher or more than 5%. The Hogs made new contract highs today. April'26 Lean Hogs were 2 ½ cents lower today and settled at 95.17 ½. Today's high was 95.95 and that is the new 1-month and contract high as well. Today's low was 94.97 ½ and the 1-month low is 88.92 ½. Since 12/19 April'26 Lean Hogs are 6.05 higher or almost 7%. False information once again sent the Cattle markets lower on Friday. It was falsely reported Friday that the Screwworm was found in Texas, IT HAS NOT BEEN. That made the funds nervous, and they sold before a three-day weekend. Today I expected a big rally, but the Stock Markets were down big all day, with the Dow Jones Index losing more than 800 points. There is another fear of new tariffs, but the last time that was brought up the Feeders shot up $100, so that should not concern anyone, along with the same fact as before, the cattle numbers are tight. It did not look like the Funds were selling anything toady, so that is positive on its own. The demand for beef remains high, with no sign of slowing. Nothing has changed in my outlook, and the next 100-days could be very impressive in the Fats and Feeders, as I still feel we can see the gap above get filled, and continue higher. For the Gap to be filled in the April'26 Live Cattle it needs to trade 250.25. That price is 15.67 ½ above today's settlement price of 234.57 ½, and just 67 ½ cents below the contract high at 250.92 ½. In the March'26 Feeders for the gap to be filled, 376.70 needs to be traded, and that price is 19.02 ½ above today's settlement price of 357.67 ½ and is 1.90 below the contract high at 378.60. In the April'26 Feeders for the gap to be filled, 376.50 needs to be traded, and that price is 19.52 ½ above today's settlement price of 356.45 and is 1.95 below the contract high at 378.45. The US Southern Border remains closed, without any timeline to reopen to Cattle from Mexico, as 8 new cases of screwworms were reported in Northern Mexico late last week. Domestically our Cattle numbers are still tight, and Brazil is about to go through a 2-year cycle with much lower cattle numbers, with a 2% drop in production in 2026. I think we could see the Fats and Feeders both close over last week's highs by the end of this week. The April'26 Hogs made a new contract high today at 95.95 and settled at 95.17 ½. There could be more to the upside in the Hog Market, with the African Swine Fever spread across Europe, and especially in Spain, however Brazil is expanding their operations in the Hog Market as well, and today's prices are the highest we have seen in April'26 contract month in two years. Hedging soon might not be a bad idea. There is an April'26 Hog Chart below. I would like to speak with you about the markets, so when you have time, give me a call.

.

.

NOW IS THE TIME TO OPEN AN ACCOUNT BEFORE IT IS JULY AGAIN

.

.

BELOW IS A DIRECT LINK TO FILL OUT ACCOUNT PAPERWORK - PLEASE CALL ME IF YOU HAVE ANY QUESTIONS.

https://portal2.straitsfinancial.com/Identity/Account/Register?brokerId=978

.

.

Having a Trading or Hedging Account is essential for your business to be successful. Market volatility has increased across all commodities over the last 12 months, and I expect it to continue to increase over the next 12 months as well. Opening an account in the future, will not help you if you need access now. To be successful, you need to be able to manage risk in real time. If you are proactive now, you will have the ability to be reactive when you need to be. You can be Prepared and Patient at the same time. Call me or hit the direct link above.

.

.

Through Walsh Trading I have built the best 5-man team in the business. Give me a call and let me show you how the Pure Hedge Division can help your bottom line.

.

.

The Grain Markets were lower today, settling near the lows, with the Wheat leading the way down. March'26 Soybeans were 4 ¾ cents lower today and settled at 1053. Today's high was 1061 ¾ and the 1-month high is 1082 ½. Today's low was 1052 and the 1-month low is 1037 ¾. Since 12/19 March'26 Soybeans are 6 ½ cents lower or more then ½%. March'26 Corn closed a little lower again today. March'26 Corn was 1 cent lower today and settled at 423 ¾. Today's high was 425 ½ and the 1-month high is 453. Today's low was 422 and the 1-month low is 417 ¼. Since 12/19 March'26 Corn is 20 cents lower or about 4 ½%. The Wheat broke again and settled just above the lows. March'26 Wheat was 7 ¾ cents lower today and settled at 510 ¼. Today's high was 520 ¼ and the 1-month high is 528. Today's low was 509 ½ and the 1-month and contract low is 501 ½. Since 12/19 March'26 Wheat is ½ a cent higher or fractionally higher. The Grains did not look good again today, and unfortunately that could become a new theme, as Brazil has started its Soybean harvest, and China is done buying their 12mt of soybeans. The Corn demand remains strong, but there is a lot of it, and the Wheat is still nuts. The Soybean Oil continues to look like the one bright spot, with a story behind it to rally. The US has delayed its release of the new biofuel blending rates to March, but with the demand this strong, I still feel it could charge ahead anyway and possibly bring the Soybean contract slowly with it. I continued to buy Futures Spreads in the Soybean Oil today, along with spreads in the Option Market. I have new Trades in the Soybean Oil ready to go. Let me know if you are interested. There are Charts and New and Old Trades below. Give me a call and let's get that account open for you.

.

.

THE REST IS FROM LAST WEEK BELOW

.

.

Not much new here, and I still feel the Soybeans can drift lower and the Corn could soon see 400. Soybean Oil stocks were released today, and they were below estimates… It could be a special year in the Soybean Oil. The Wheat is a wild card and settled just 9 cents above the contract low again. If the Wheat makes a new contract low, I recommend buying it. This is what I said last week 1/8/26 “The Bean Oil looks ready to charge ahead and could leave the rest of the Grains behind for a while. Indonesia, the world's largest producer of Palm Oil, has come out with a new plan to seize 4 or 5 million hectares of private plantations of Palm Oil. This is in addition to the more than 4 million hectares the Indonesia government seized and put under government control last year. Obviously, they must know they have a problem, and there might not be enough to go around. Indonesia also has a mandatory 40% Palm Oil biofuel blend rate and plans to increase that palm oil blend rate to 50% this year. Export taxes on Palm Oil have also increased and are currently 10%. This alone could make all vegetable oils much more expensive, and if they have a possible export ban, then Soybean Oil and Canola Oil could shoot to the moon. More Palm Oil plantation seizures just ahead of a blend rate increase sends the signal that stocks could drop quickly, and they could inevitably be short of what they need. Malaysia also plans on increasing its Palm Oil biofuel blend rate this year, and Brazil is increasing its Soybean Oil Biofuel blend rate this year as well. It is all setting up what could be a dramatic price increase in the vegetable oil markets. The US government is supposed to release their blend rate later this month, and I feel we could see an increase here as well. Today's weekly export sales for Soybean Oil were above the highest estimates, and for the 2025/2026 marketing year sales have reached over 70% of the USDA forecast, and the 5-year average for this time of year is just over 40%. It looks like the buying has begun. Today, May'26 Soybean Oil closed at 49.97 and I feel it could trade into the mid to high 50's, with the September'26 contract month in the 60's. May'26 Soybean Oil Options Expire 4/24/26 (106 Days).” It was reported today that Palm Oil production in Malaysia last month was down 5 ½% from the prior month. This has already tightened the Palm Oil supply. In the same time frame, shipments rose over 8%. It was also reported that exports of Palm Oil products rose a staggering 17%-29% over the first 10-days of this year when compared to December. India is expected to start buying Palm Oil this month, as their purchases were low in December. In addition to this, it looks like China and Indonesia could start buying Palm Oil as well this month. With a low supply, and a high demand, the price of Palm Oil looks like it could soon be out of reach, making other vegetable much more attractive, especially the Soybean Oil and the Canola Oil. I will say it again, this could be a very special year for the Soybean Oil Market, as prices have already started to rise, and the May'26 Soybean Oil was almost 2% higher today alone. I have new trades with incredible risk/reward ratios. Give me a call if you would like to know more. Have a great night.

.

.

REASONS WHY I AM STILL BULLISH SOYBEAN OIL - I FEEL RIGHT NOW IS A BUYING OPPORTUNITY

Here is why I like the Soybean Oil. The Palm Oil supply is getting tight, and export controls seem very possible later this year. The Indonesian Government must be worried about their supply, as they seized land in Palm Oil producing regions and placed them under State Owned Control. At the same time, the production and export supplies of Sunflower Oil are expected to decline, as the price continues to climb and make cheaper Soybean Oil more attractive. Sunflower Oil supplies are already tight, as production estimates have decreased throughout Europe, Russia, and Ukraine, which will limit the amount of Sunflower seed crushing, again making the cheaper Soybean Oil more attractive. Biofuel percentages are set to increase in Brazil, Indonesia, and Malaysia, and I would not be surprised if the Biofuel blend rates were raised domestically as well. Argentina has already sold most of their Soybeans to China, so their crushing will be limited as well. The Russia/Ukraine war has intensified and the Ports in Odesa, and their grain terminals have been hit, along with the railroads and a Soybean shipment at sea. I also learned a Sunflower Oil terminal was bombed as well. all of this puts a tighter squeeze on the vegetable Oil Markets, as demand is already very strong, with Soybean Oil sales almost hitting 50% of the USDA's forecast for 2025-2026. The 5-year average this time of year is under 32%. It all points to what could be a very dramatic price increase in the Soybean Oil Market, along with all the other reasons. I have continued to buy Soybean Oil Future Spreads and Options Spreads, with a new target level of 64.00-66.00. The market breaking this week was another unexpected opportunity, and I took advantage of it, and will continue to do so, with Spreads in the Futures and Options. I have 3-month, 6–month, and 12-month strategies completed, and ready to go. Give me a call if you would like to know more.

.

.

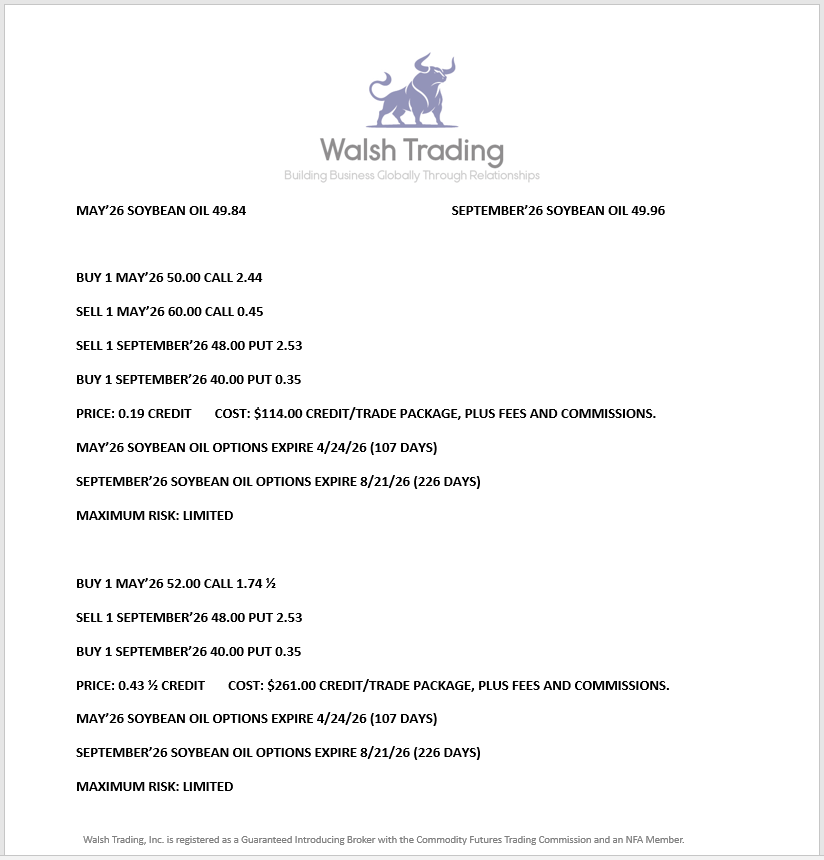

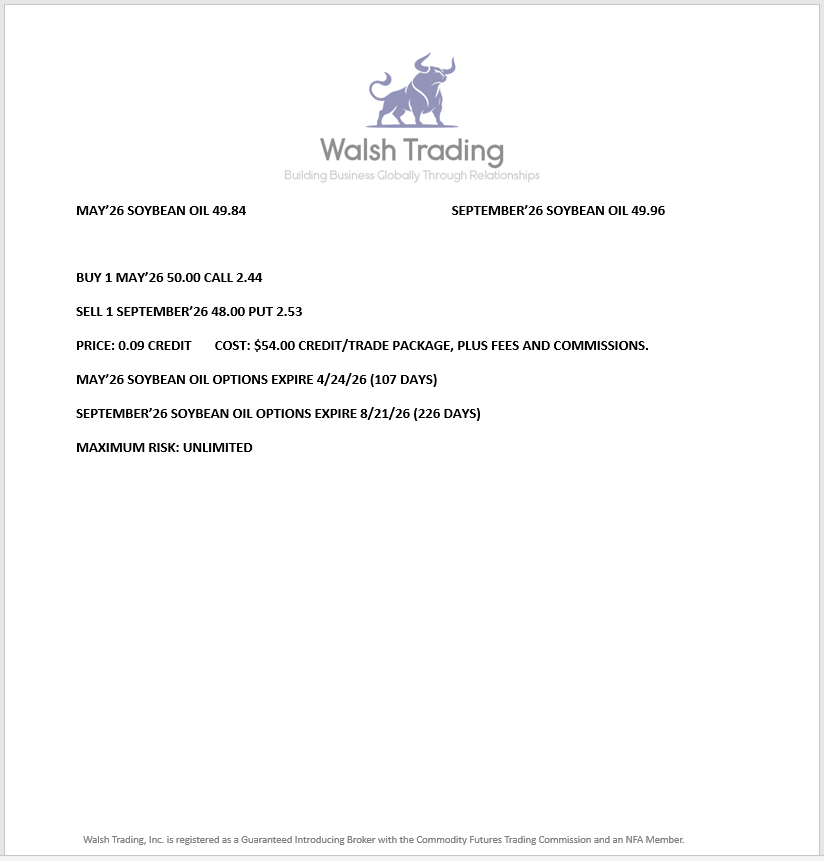

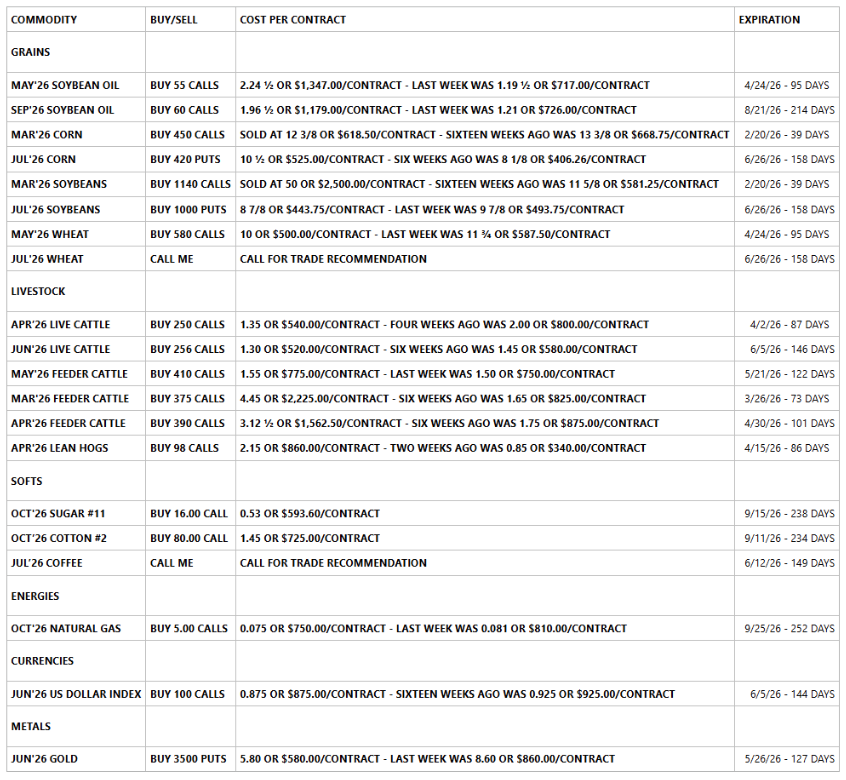

THE TRADE BELOW WAS STRUCTURED AND SENT OUT TODAY 1/20/26

.

.

.

.

THE TRADE BELOW WAS STRUCTURED AND SENT OUT 1/7/26

.

.

.

.

2-YEAR APRIL'26 LEAN HOG CHART BELOW - CONTRACT HIGH MADE TODAY AT 95.95

.

.

.

.

2-YEAR JULY'26 LEAN HOG CHART BELOW - CONTRACT HIGH MADE TODAY AT 109.10

.

.

.

.

CALL ME

.

.

WATCH IF THE NEXT GAP WILL BE FILLED IN THE APRIL'26 LIVE CATTLE @ 250.25 - CONTRACT HIGH IS 250.92 ½

.

.

.

.

WATCH IF THE NEXT GAP WILL BE FILLED IN THE MARCH'26 FEEDER CATTLE @ 376.70 - CONTRACT HIGH IS 378.60

.

.

.

.

WATCH IF THE NEXT GAP WILL BE FILLED IN THE APRIL'26 FEEDER CATTLE @ 376.50 - CONTRACT HIGH IS 378.45

.

.

.

.

THIS WEEKS WALSH GAMMA TRADER FROM TODAY 1/20/26 BELOW.

.

.

.

.

If you don't like the customer service or personal attention you are receiving from your broker, you have options, and you don't have to stay there. I can have your new account open in 1-2 days. Call me anytime 312-957-8079 BALLEN@WALSHTRADING.COM Sign Up Now

.

.

.

.

If you would like to open an account, please use this direct link https://portal2.straitsfinancial.com/Identity/Account/Register?brokerId=978

.

.

Having a Trading or Hedging Account is essential for your business to be successful. Market volatility has increased across all commodities over the last 12 months, and I expect it to continue to increase over the next 12 months as well. Opening an account in the future, will not help you if you need access now. To be successful, you need to be able to manage risk in real time. If you are proactive now, you will have the ability to be reactive when you need to be. You can be Prepared and Patient at the same time. Call me or hit the direct link above.

.

USE THE QR CODE BELOW TO SIGNUP FOR TRADE ALERTS

.

.

.

.

If you would like to receive more information on the commodity markets, please use the link to join my email list Sign Up Now

.

.

Thank you to all of my Canadian Customers. If you live in Alberta or Ontario, you are able to open an account in the USA. Hopefully we can work with the Province of Saskatchewan, and all Canadian Provinces soon. Your ability to open an account in the US is blocked by your Provincial Governments, not by the United States.

.

.

Thank you to all of my old and new Customers. I appreciate your business. To those of you that are close to opening an account, please call me if you have any questions, and I look forward to working with you soon. To anyone thinking about opening a Hedge or Trading account, give me a call and we can talk about it.

.

.

Most Recent Walsh Gamma Trader Link - Walsh Gamma Trader

.

.

GOD BLESS AMERICA

.

.

.

.

.

.

.

.

Give me a call if you have any questions.

.

.

Bill Allen

Vice President

Pure Hedge Division

Direct: 312-957-8079

WALSH TRADING INC.

311 South Wacker Drive

Suite 540 Chicago, Illinois 60606

Walsh Trading, Inc. is registered as a Guaranteed Introducing Broker with the Commodity Futures Trading Commission and an NFA Member.

Futures and options trading involves substantial risk and is not suitable for all investors. Therefore, individuals should carefully consider their financial condition in deciding whether to trade. Option traders should be aware that the exercise of a long option will result in a futures position. The valuation of futures and options may fluctuate, and as a result, clients may lose more than their original investment. The information contained on this site is the opinion of the writer or was obtained from sources cited within the commentary. The impact on market prices due to seasonal or market cycles and current news events may already be reflected in market prices. PAST PERFORMANCE IS NOT NECESSARILY INDICATIVE OF FUTURE RESULTS.

All information, communications, publications, and reports, including this specific material, used and distributed by Walsh Trading, Inc. (“WTI”) shall be construed as a solicitation for entering into a derivatives transaction. WTI does not distribute research reports, employ research analysts, or maintain a research department as defined in CFTC Regulation 1.71.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)