The iShares iBoxx $ Investment Grade Corporate Bond ETF (LQD) is a relatively popular exchange-traded fund that offers investors one-stop exposure to a broad range of U.S.-based, high-quality, dollar-denominated corporate bonds. With the Market iBoxx USD Liquid Investment Grade Index as its benchmark, LQD’s top holdings currently include bonds offered by top Wall Street banks – JPMorgan Chase (JPM), Goldman Sachs (GS), Bank of America (BAC), and more – as well as blue-chip telecoms AT&T (T) and Verizon (VZ), data center heavyweight Oracle (ORCL), and insurance giant UnitedHealth Group (UNH).

One deep-pocketed options trade on LQD caught my eye last Friday, when a trader bought the monthly June 18, 2026, $110-strike straddle on the corporate bond fund. A long straddle is a type of options trade that is neutral from a sentiment perspective, since it involves the purchase of both a call option and a put option at the same strike price – but it’s inherently bullish on volatility, since it typically requires a fairly large directional move to yield a profit.

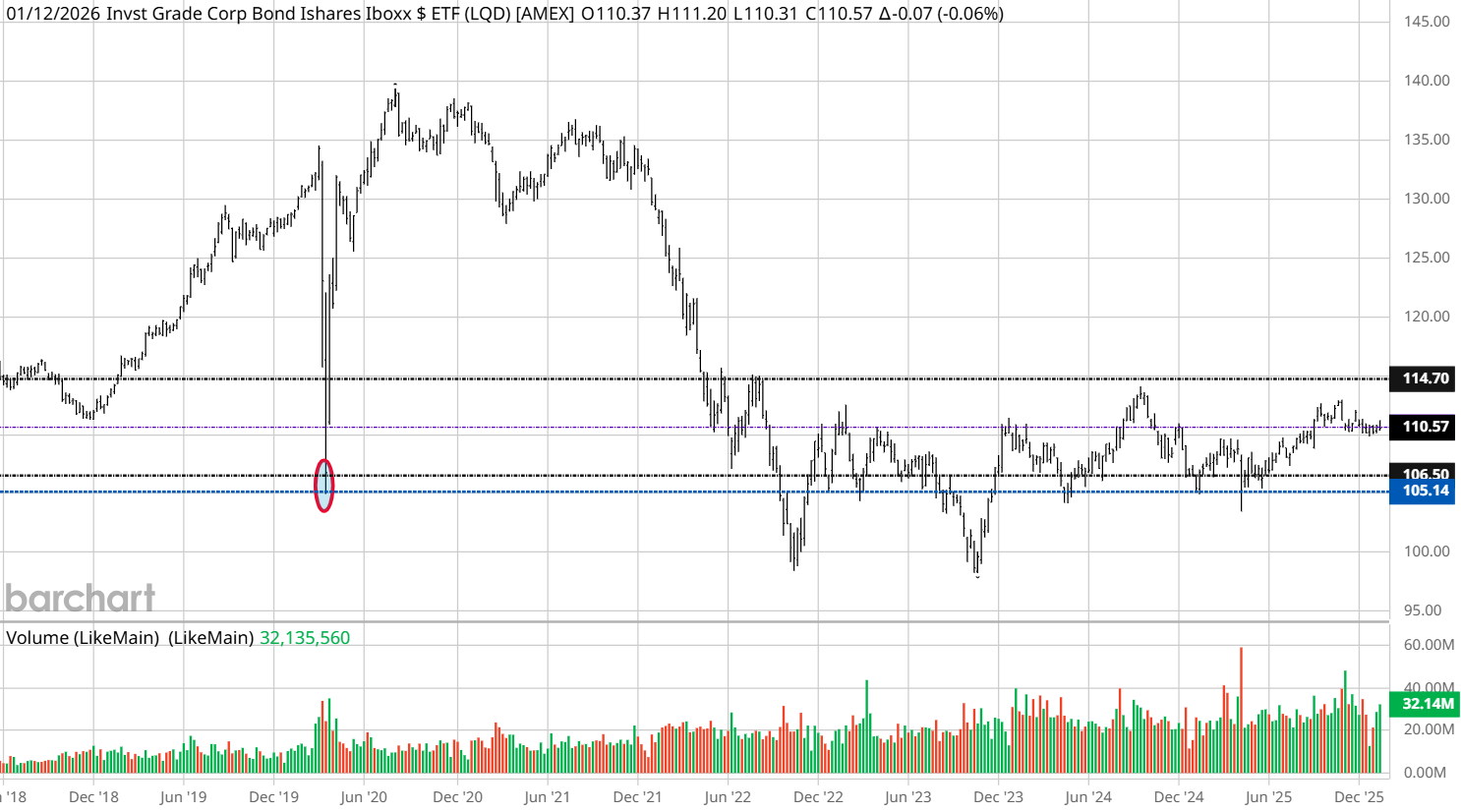

In this particular LQD straddle, the speculator paid a total premium of $4.07 on 6,500 contracts for a total dollar outlay of $2.645 million. This trader is likely expecting one of two events: either that the LQD ETF will make a move above the upper breakeven point at $114.07 or below the lower breakeven point at $105.93 by June 18; or that volatility in the yield curve will increase during the same time frame.

Historically, LQD tends to maintain an inverse relationship with the 10-year U.S. Treasury yield. That makes this straddle an interesting bet based on dollar cost, as well as the fact that LQD has been stuck in a trading range for the past two years – and hasn't seen this kind of volatility since August 2022.

Meanwhile, between August and October 2022, the 10-year Treasury yield experienced significant volatility, starting the month around 2.60% and climbing to approximately 3.13%. During this time, LQD experienced a 16-point directional move from peak to trough.

In other words, Friday’s LQD straddle buyer could believe that the yield curve will shift by 0.50% between now and June, and is using corporate bond options to express that view.

It seems to be an opportune time to do so via LQD options, which are priced very cheaply on a volatility basis. The current historical volatility (HV) is very low at 4.50%, while implied volatility (IV) is likewise at a muted 6.26%. That places the IV Rank at 9.70% and IV Percentile at 16%, creating attractive conditions to buy double premium – as with Friday’s straddle buyer, who is targeting either a large price movement or volatility expansion on this LQD trade.

– John Rowland, CMT, is Barchart’s Senior Market Strategist and host of Market on Close.

On the date of publication, Barchart Insights did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Alphabet%20(Google)%20Image%20by%20Piotr%20Swat%20via%20Shutterstock.jpg)