/Broadcom%20Inc%20logo%20on%20building-by%20Poetra_%20RH%20via%20Shutterstock.jpg)

Shares of the chipmaker Broadcom (AVGO) slipped 4.2% on Jan. 14 as investors digested a cluster of headwinds. Reports of a Chinese directive against U.S. software, a multibillion-dollar debt offering, and sizable insider stock sales converged, briefly denting sentiment and compressing near-term confidence.

Wells Fargo analysts view the pullback as an opening rather than a warning. Led by analyst Aaron Rakers, they argue that growing visibility into meaningful incremental catalysts through 2026 justifies a more constructive stance, especially as Broadcom deepens its strategic relevance through a high-profile partnership with Alphabet (GOOGL) on tensor processing units.

Acting on that view, analysts upgraded Broadcom to “Overweight” from “Equal-weight.” Wells Fargo also lifted its calendar 2026 and 2027 estimates meaningfully. For 2026, the firm raised projections from $97 billion and $10.36 per share to $100.3 billion and $10.80. For 2027, analysts hiked their projections from $130.5 billion and $13.90 to $143.8 billion and $15.35.

These upward revisions rest squarely on accelerating artificial intelligence (AI) momentum. Wells Fargo now expects Broadcom’s AI semiconductor revenue to reach $52.6 billion in 2026 and $93.4 billion in 2027. That implies 116% and 78% year-over-year (YOY) growth, respectively, as AI demand scales.

With AVGO stock down roughly 1% over the past three months, the setup invites investors to assess whether the current pullback offers an attractive entry point or whether optimism has already found its way into the share price. Let's take a closer look.

About Broadcom Stock

Headquartered in Palo Alto, California, Broadcom ranks among the world’s largest semiconductor companies. It designs, develops, and supplies semiconductors, enterprise software, and security solutions, positioning itself as both a hardware powerhouse and a software scale player.

With a market capitalization of $1.66 trillion, Broadcom delivers RF devices, wireless connectivity, custom touch controllers, and inductive charging for mobile applications. It also supplies cloud tools, application development platforms, edge networking, mainframe software, and cybersecurity offerings.

Performance trends underline the strength. AVGO stock has climbed 53% over the past year and advanced about 25% in the last six months. By comparison, the State Street Technology Select Sector SPDR ETF (XLK) has gained 26% over the last 52 weeks and 13% over six months, highlighting Broadcom’s relative outperformance.

AVGO stock currently trades at 40.8 times forward adjusted earnings and 25.5 times sales. Both exceed industry benchmarks and the company’s own five-year averages, signaling a hefty valuation.

Moreover, Broadcom has increased its dividend for 15 consecutive years and pays $2.60 annually per share, yielding 0.76%. Its most recent $0.65 per share dividend was paid on Dec. 31 to shareholders of record as of Dec. 22, reinforcing disciplined capital returns.

Broadcom Surpasses Q4 Earnings

On Dec. 11, Broadcom delivered a decisive fiscal 2025 fourth-quarter beat. Revenue grew 28% YOY to $18.02 billion, also beating Street forecasts of $17.5 billion. Adjusted EPS grew 37% from the year-ago value to $1.95, also surpassing Wall Street expectations of $1.87.

Profitability followed suit. Non-GAAP operating income increased 35% to $11.9 billion, while non-GAAP net income advanced 39% to $9.7 billion. AI semiconductor revenue surged 74%, far above the company’s guidance, underscoring demand strength and execution discipline across advanced workloads.

Infrastructure software also impressed. Sales in the segment housing VMware rose 19%, accelerating from the prior quarter. The momentum suggests that Broadcom continues to expand VMware successfully, even as some customers voice frustration, reinforcing confidence in the integration strategy.

Coming to the balance sheet, cash and cash equivalents reached $16.2 billion at quarter-end, up from $10.7 billion in the prior quarter.

Looking ahead, Broadcom expects AI semiconductor revenue to double YOY to $8.2 billion in Q1 fiscal 2026. Management is also guiding for total revenue of $19.1 billion and adjusted EBITDA margins of 67%, signaling confidence in both growth and profitability entering the new fiscal year.

Analysts model continued earnings acceleration. Consensus forecasts call for Q1 fiscal 2026 EPS of $1.66, up nearly 19% YOY. Full-year 2026 earnings are projected to climb 49% to $8.39, followed by another 46% increase to $12.23 in fiscal 2027.

What Do Analysts Expect for Broadcom Stock?

All that said, Wells Fargo analysts have edged up Broadcom’s price target to $430 from $410, reflecting growing confidence in execution and visibility. Meanwhile, Mizuho analyst Vijay Rakesh maintained an “Outperform” rating and raised his price target from $450 to $480, reinforcing bullish sentiment.

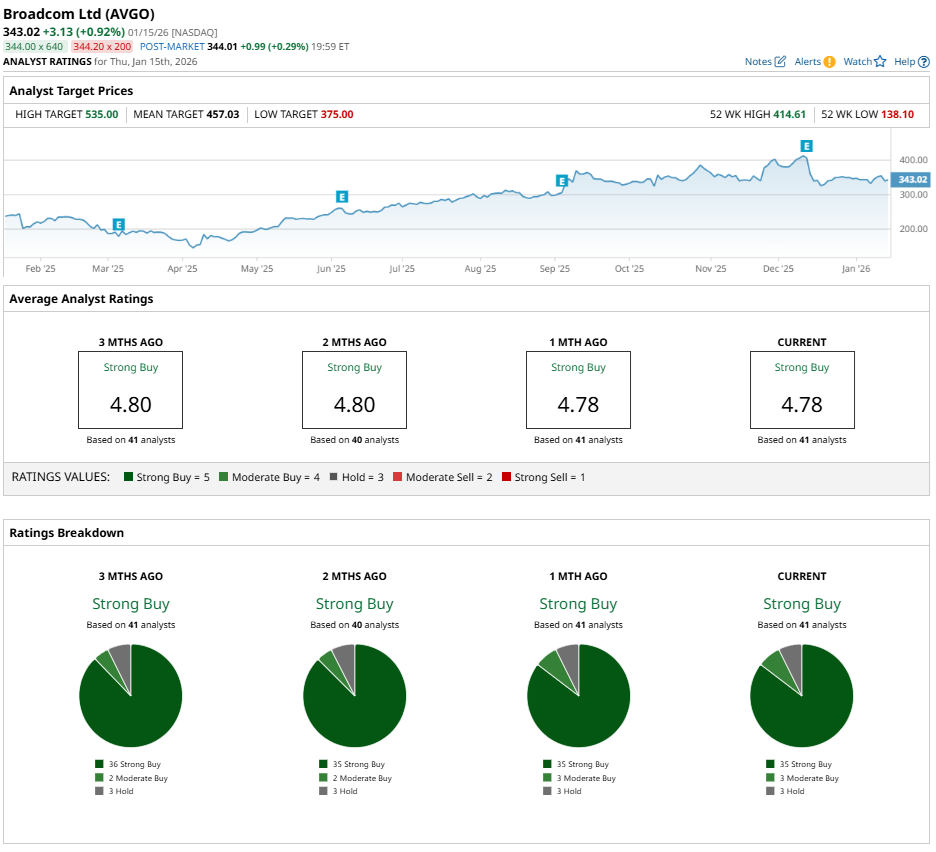

Overall, Wall Street has assigned AVGO stock a “Strong Buy” consensus rating. Out of 42 analysts covering the stock, 36 recommend a “Strong Buy,” three suggest “Moderate Buy,” and three advise a “Hold" rating.

AVGO stock’s mean price target of $455.22 implies potential upside of 29%. Meanwhile, the Street-high target of $535 represents a potential gain of 52% from current levels.

On the date of publication, Aanchal Sugandh did not have (either directly or indirectly) positions in any of the securities mentioned in this article. All information and data in this article is solely for informational purposes. For more information please view the Barchart Disclosure Policy here.

/Intel%20Corp_%20logo%20on%20mobile%20phone-by%20Piotr%20Swat%20via%20Shutterstock.jpg)

/An%20image%20of%20a%20Tesla%20humanoid%20robot%20in%20front%20of%20the%20company%20logo%20Around%20the%20World%20Photos%20via%20Shutterstock.jpg)

/Alphabet%20(Google)%20Image%20by%20Markus%20Mainka%20via%20Shutterstock.jpg)

/Nvidia%20logo%20by%20Konstantin%20Savusia%20via%20Shutterstock.jpg)