Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

Introduction

Commodity prices rarely move at random. Beneath the daily headlines and price fluctuations lies a structured physical system—one governed by production timing, storage economics, and transportation constraints. These forces create recurring supply cycles that directly shape futures curves and calendar spreads. While outright prices often capture attention, spreads frequently provide a clearer window into the true state of supply and demand. Understanding how harvest, storage, and transport interact helps explain why certain spreads widen, invert, or normalize with remarkable consistency across years.

- This article breaks down the mechanics behind those movements.

Harvest Timing: When Supply Floods the System

Most agricultural and soft commodities experience a concentrated production window. During harvest, supply enters the market rapidly, often overwhelming immediate demand. This surge tends to pressure nearby contracts as physical availability increases. Deferred contracts, however, reflect expectations beyond the harvest glut—factoring in future demand, weather risks, and inventory drawdowns. The result is a common seasonal pattern:

- Front-month weakness

- Deferred strength

- Widening carry spreads

These effects are not driven by speculation alone; they are rooted in the physical reality that newly harvested supply must be absorbed, stored, or transported elsewhere.

Storage Economics: The Cost of Time

Once supply is harvested, the next question becomes whether it is economical to hold it. Storage is never free. Warehousing, insurance, spoilage risk, and financing costs all influence whether physical inventory remains in place or moves quickly into consumption channels. Futures markets reflect these costs through carry—where deferred contracts trade at a premium to nearby ones.

When storage capacity is ample and costs are manageable, spreads tend to widen in carry. Conversely, when storage is scarce or expensive, the market discourages holding inventory, compressing spreads or even driving them into backwardation.

Spreads, in this sense, act as a pricing signal for inventory behavior.

Transportation Constraints: The Hidden Bottleneck

Transportation is often the least appreciated—but most disruptive—factor in supply cycles. Rail congestion, port delays, low river levels, shipping shortages, or regulatory bottlenecks can temporarily trap supply in one region while demand remains unmet elsewhere. These frictions can distort spreads even when total supply appears sufficient on paper.

In such cases:

- Nearby contracts may strengthen due to localized shortages

- Deferred contracts lag as future deliveries assume normal logistics

- Spreads tighten or invert unexpectedly

These moves are not anomalies—they are the market’s way of repricing delivery risk.

Why Spreads Reveal More Than Flat Price

Flat prices blend multiple forces into a single number. Spreads, by contrast, isolate time and availability. A widening carry often signals surplus and comfortable inventory. A tightening or inverted spread suggests urgency—whether from demand, logistical disruption, or constrained storage. Over time, these patterns tend to repeat because the underlying physical cycles repeat. This is why experienced commodity traders often monitor spreads first and price second. Spreads show where pressure exists in the supply chain, not just that pressure exists.

Repeating Rhythms, Not Random Moves

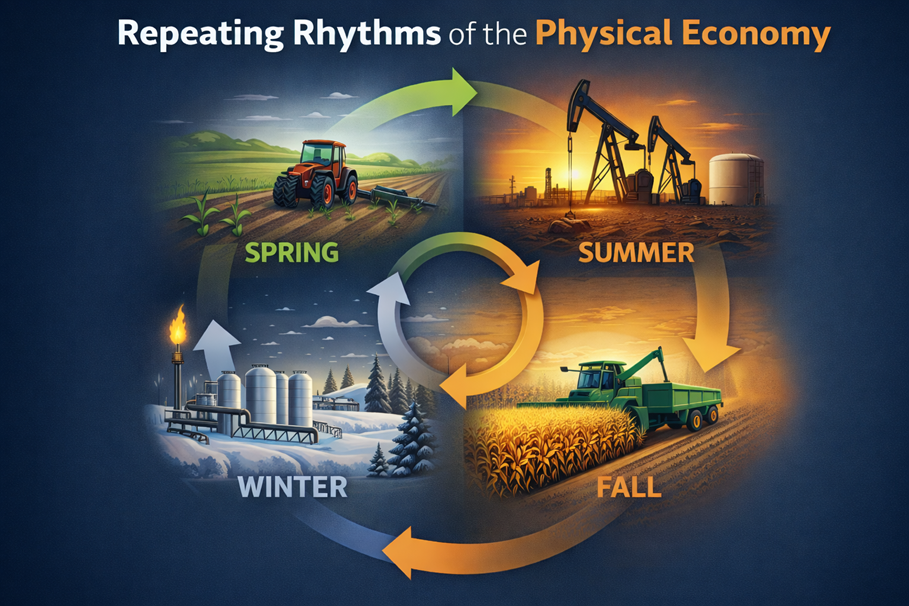

Harvest windows arrive each year. Storage costs fluctuate within known ranges. Transportation systems strain and recover in familiar ways. These repeating rhythms form the backbone of many seasonal and structural spread patterns. While no two years are identical, the framework remains remarkably stable. Markets may react differently depending on macro conditions, but the physical constraints never disappear. Understanding those constraints transforms spreads from abstract price relationships into interpretable signals.

Bringing Structure to Spread Trading

For traders seeking a systematic way to engage with these dynamics, a supply-cycle perspective provides clarity and discipline. Instead of reacting to short-term noise, it anchors decisions in the physical economy. That framework is the foundation of Smart Spreads, a research-driven newsletter focused on commodity calendar spreads shaped by seasonality, storage economics, and structural flows. The goal is not prediction, but preparation—identifying repeatable environments where risk and reward can be defined before trades are placed.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gmail.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)