Dual Edge Research publishes two powerful newsletters that work great individually — and even better together. The Bull Strangle Newsletter focuses on stocks and options, combining stock ownership with premium-selling strategies to generate consistent income and market-beating returns. The Smart Spreads Newsletter specializes in seasonal commodity futures spreads, offering a diversified approach with low correlation to equities. Together, they deliver a complete investment perspective — one focused on income, the other on diversification — all under one simple subscription.

Introduction

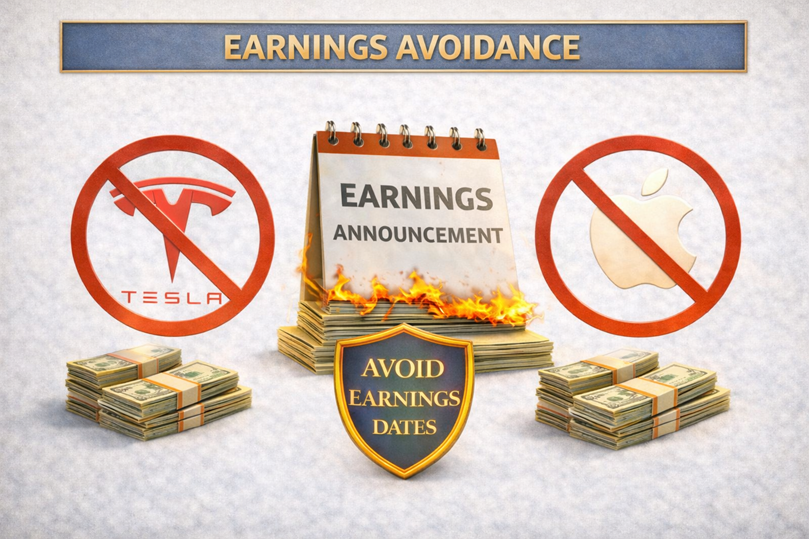

As earnings season begins to ramp up, option traders are once again entering the most dangerous period of the calendar. While earnings create opportunity, they also introduce a form of risk that is fundamentally different from normal market volatility—and one that many traders consistently underestimate. Unlike gradual price movement driven by supply, demand, or macro trends, earnings announcements introduce binary risk. Stocks do not drift into earnings results; they gap. And those gaps can instantly overwhelm even well-structured option positions.

Understanding why earnings pose such a unique threat—and how to systematically avoid it—is one of the most important skills in long-term options trading.

Why Earnings Are a Different Kind of Risk

Most option strategies rely on probabilities. Time decay, volatility contraction, and strike distance all assume that price movement will remain within a reasonably expected range. Earnings break that assumption. An earnings announcement compresses weeks or months of uncertainty into a single moment. Guidance changes, margin surprises, or one unexpected line item can send a stock sharply higher or lower before the market has time to adjust. For option sellers in particular, this creates a dangerous asymmetry:

- Limited upside from collected premium

- Potentially unlimited downside from a single overnight gap

No amount of strike selection or premium sizing can fully neutralize this risk.

Volatility Before vs. Volatility After

One of the most common misconceptions is that elevated implied volatility before earnings somehow “prices in” the risk. While implied volatility does rise ahead of earnings, that premium is compensation for uncertainty, not protection from magnitude. A stock can still gap far beyond the expected move, instantly invalidating probability-based assumptions. After earnings, implied volatility collapses—but by then the damage is already done. This is why earnings losses often feel shocking: the trade looked safe right up until it wasn’t.

The Cost of “Just One Earnings Trade”

Many traders justify holding through earnings by telling themselves it’s “just one position” or “a small size.” But earnings losses rarely stay small. A single earnings gap can:

- Overwhelm weeks or months of steady gains

- Force defensive adjustments that compound losses

- Introduce emotional decision-making that disrupts discipline

The long-term damage comes not just from the loss itself, but from the instability it introduces into the trading process.

The Professional Approach: Systematic Avoidance

Professional option income strategies treat earnings as a hard constraint, not a calculated risk. The logic is simple:

- Earnings outcomes are unpredictable

- The payoff structure is unfavorable

- The opportunity set outside earnings is vast

By consistently avoiding earnings windows—often using predefined time buffers before and after announcements—traders remove the single largest source of catastrophic loss from their strategy. This doesn’t reduce opportunity. It improves consistency.

A Season to Be Careful

With earnings season now beginning to unfold, the temptation to chase elevated premiums will increase. Volatility will rise, option prices will look attractive, and traders will convince themselves that this quarter will be different. It won’t be. Earnings will surprise, stocks will gap, and many otherwise sound strategies will suffer unnecessary damage—not because they were flawed, but because they ignored a known landmine.

Closing Thought

Avoiding earnings is not about being conservative—it’s about being professional. Successful option traders don’t win by predicting earnings reactions; they win by building structures that survive all market environments. That philosophy is a core principle behind the Bull Strangle Newsletter, which emphasizes disciplined option income strategies designed to sidestep earnings risk entirely rather than gamble through it. In options trading, the biggest edge often comes not from what you trade—but from what you refuse to trade.

More Information

Now you can get two powerful newsletters — for one simple price!

- For stocks and options, the Bull Strangle Newsletter shows you how to combine stock ownership with dual option selling — a disciplined strategy that has consistently outperformed the S&P 500.

- For commodity futures, the Smart Spreads Newsletter focuses on seasonal commodity spreads — a proven, low-correlation approach that thrives in all types of markets.

Each newsletter is designed to deliver consistent income on its own — but when used together, they create a complete, diversified trading approach that works in any market environment.

Visit BullStrangle.com to subscribe for just $1 for the first month.

For a video overview of the Bull Strangle Newsletter

For a video overview of the Smart Spreads Newsletter

Darren Carlat

Dual Edge Research

(214) 636-3133

DualEdgeResearch@gamil.com

Disclaimer

This information is for informational purposes only and should not be considered as investment advice. Past performance is not indicative of future results, and all investments carry inherent risk. Consult with a financial advisor before making any investment decisions.

/AI%20(artificial%20intelligence)/3D%20Graphics%20Concept%20Big%20Data%20Center%20by%20Gorodenkoff%20via%20Shutterstock.jpg)

/Cisco%20Systems%2C%20Inc_%20HQ-by%20Sundry%20Photography%20via%20iStock.jpg)